Scalper1 News

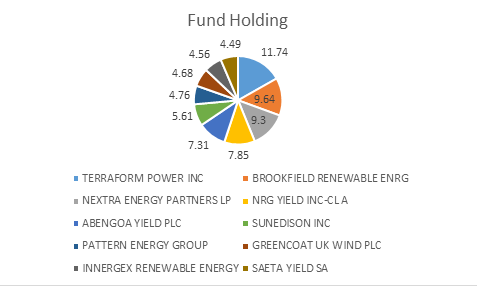

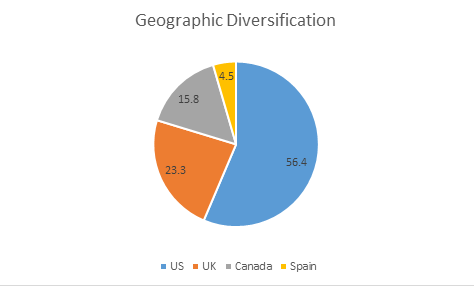

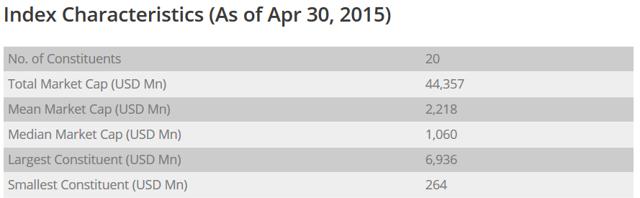

Summary YieldCos are an emerging asset class of yield vehicles, providing stable and growing dividend income from renewable energy assets. The ETF portfolio consists of high quality yieldco securities. The Global X YieldCo Index ETF is a low risk way to play the high growth renewable energy. The Global X YieldCo Index ETF (NASDAQ: YLCO ) is a new ETF investing in yieldcos as the underlying asset. It was formed by the Global X Funds, one of the largest issuers of ETFs providing investment opportunities across the global markets. This ETF provides a good opportunity for investors looking to invest in the renewable energy sector including solar and wind companies. YieldCos are becoming important especially in the solar industry. Many big solar companies have made plans to form a yieldco. YieldCos are dividend growth oriented public companies, providing stable cash flows and distributing the cash amongst its shareholders as dividends. YLCO will be the first YieldCo ETF available to U.S. investors. ETF Details The fund started on May 27, 2015 and has an expense ratio of 0.65%. The ETF follows the Indxx Global YieldCo Index, which is the underlying index. It will have to invest at least 80% of its total assets in the securities of the underlying index. It follows a replication strategy, where investment in securities will be done in the same proportion as the underlying asset; not trying to outperform or underperform. Since the Global YieldCo Index focuses on the energy sector, the new ETF will also concentrate on the energy sector. The Global YieldCo Index currently has a yield of over 3%. This fund is different from the rest as it seeks to invest in yieldcos. Why should you invest in a Renewable Energy YieldCo 1) Renewable Energy is growing rapidly Renewable energy usage has been scaling up in recent times. With solar energy reaching grid parity in a number of places, it is now becoming more economical to use solar power rather fossil fuels. Countries are focusing on reducing their carbon footprint by using more renewable energy. Developing countries like China and India have made aggressive plans to shift their energy mix from coal to more cleaner and efficient energy sources like wind and solar. Energy companies are bound to benefit in the future from these long term trends. According to Solar PV roadmap by IEA, solar energy capacity will grow to 3000 GW by 2050 up from 184 GW now. 2) YieldCos are becoming popular YieldCos are fast gaining traction in the renewable energy space. It is created by a parent company to lower the cost of capital, as renewable energy projects are capital intensive. Green energy does not require fuel and most of the cost is front loaded. The capital cost is the most crucial variable in determining the levelized cost of electricity (LCOE). The income from these yieldcos is considered reliable and some of the yieldcos are also growing rapidly e.g. Terraform Power (NASDAQ: TERP ). YieldCos distribute the cash amongst investors in the form of dividends. YieldCos have become extremely popular in this industry today. They enter into long term contracts and thus provide stable cash flows. This industry currently has a combined market capitalization value of $39 billion currently and 11 more IPOs are in the pipeline. 3) Top 10 Fund Holding The fund holds 20 securities with the top holding Terraform Power Inc. accounting for as much as 12%. TERP was the first yieldco formed by SunEdison (NYSE: SUNE ) in the solar energy space, which revolutionized the whole industry. The company’s portfolio has grown from 808 MW since its IPO in July 2014 to 1,675 MW. It has plans to diversify into natural gas, geothermal and hydro power. The CAFD guidance more than doubled to $225 million for 2015 . Another big holding is Brookfield Renewable Energy Partners which owns $20 billion in renewable power assets and is a leading operator of renewable projects across North America, Latin America and Europe. It has installed more than 7GW capacity predominantly in the hydroelectric space. The 3rd largest holding is NextEra Energy Partners (NYSE: NEP ) which owns clean energy projects particularly wind and solar energy in North America with stable, long-term cash flows. It declared $100-120 million as its CAFD guidance for 2015 and is expecting a 12-15% annual growth in dividend distribution over the next five years. Data from Global X Funds 4) Geographic Diversification Though the fund has a global footprint, the focus in mainly on the developed countries. The main reason for this concentration is the fact that yieldcos have been launched mainly in these regions. Emerging markets do not have major yieldcos as of now. As time passes, I expect yieldcos to emerge in the developing markets as well. Data from Global X Funds Index Characteristics (click to enlarge) Source: Indxx Risks One of the concerns of investing in this ETF could be the fact that the underlying assets are not fully under the control of its management. They are dependent on their sponsors. For example, if the sponsors do not have a healthy project pipeline, they will be unable to transfer the assets to their underlying yieldco which may adversely affect the yieldco’s performance and in turn the ETF’s. Other than this, it is a relatively new concept in the industry and like any other new venture there is this risk of whether it will be a success or a failure. But given the high quality stocks in the Global X YieldCo portfolio, I do not think it should be a major concern. Stock performance The Global X YieldCo Index ETF was launched on May 27, 2015 at $15.35 and is currently trading at ~$15. Conclusion Investing in renewable energy stocks is sometimes regarded as risky given the volatile nature of the sector. ETFs are a good way to diversify individual stock risks and are regarded as less risky. The Global X YieldCo Index ETF is a good and balanced way to stay invested in the green space, giving exposure to the growing yieldco market. It is a relatively new concept in the market now and has been launched by one of the fastest growing issuers of ETFs. I think it’s a smart way of investing in the renewable energy space as it is less risky and involves a portfolio of growing stocks. Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More…) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. Scalper1 News

Summary YieldCos are an emerging asset class of yield vehicles, providing stable and growing dividend income from renewable energy assets. The ETF portfolio consists of high quality yieldco securities. The Global X YieldCo Index ETF is a low risk way to play the high growth renewable energy. The Global X YieldCo Index ETF (NASDAQ: YLCO ) is a new ETF investing in yieldcos as the underlying asset. It was formed by the Global X Funds, one of the largest issuers of ETFs providing investment opportunities across the global markets. This ETF provides a good opportunity for investors looking to invest in the renewable energy sector including solar and wind companies. YieldCos are becoming important especially in the solar industry. Many big solar companies have made plans to form a yieldco. YieldCos are dividend growth oriented public companies, providing stable cash flows and distributing the cash amongst its shareholders as dividends. YLCO will be the first YieldCo ETF available to U.S. investors. ETF Details The fund started on May 27, 2015 and has an expense ratio of 0.65%. The ETF follows the Indxx Global YieldCo Index, which is the underlying index. It will have to invest at least 80% of its total assets in the securities of the underlying index. It follows a replication strategy, where investment in securities will be done in the same proportion as the underlying asset; not trying to outperform or underperform. Since the Global YieldCo Index focuses on the energy sector, the new ETF will also concentrate on the energy sector. The Global YieldCo Index currently has a yield of over 3%. This fund is different from the rest as it seeks to invest in yieldcos. Why should you invest in a Renewable Energy YieldCo 1) Renewable Energy is growing rapidly Renewable energy usage has been scaling up in recent times. With solar energy reaching grid parity in a number of places, it is now becoming more economical to use solar power rather fossil fuels. Countries are focusing on reducing their carbon footprint by using more renewable energy. Developing countries like China and India have made aggressive plans to shift their energy mix from coal to more cleaner and efficient energy sources like wind and solar. Energy companies are bound to benefit in the future from these long term trends. According to Solar PV roadmap by IEA, solar energy capacity will grow to 3000 GW by 2050 up from 184 GW now. 2) YieldCos are becoming popular YieldCos are fast gaining traction in the renewable energy space. It is created by a parent company to lower the cost of capital, as renewable energy projects are capital intensive. Green energy does not require fuel and most of the cost is front loaded. The capital cost is the most crucial variable in determining the levelized cost of electricity (LCOE). The income from these yieldcos is considered reliable and some of the yieldcos are also growing rapidly e.g. Terraform Power (NASDAQ: TERP ). YieldCos distribute the cash amongst investors in the form of dividends. YieldCos have become extremely popular in this industry today. They enter into long term contracts and thus provide stable cash flows. This industry currently has a combined market capitalization value of $39 billion currently and 11 more IPOs are in the pipeline. 3) Top 10 Fund Holding The fund holds 20 securities with the top holding Terraform Power Inc. accounting for as much as 12%. TERP was the first yieldco formed by SunEdison (NYSE: SUNE ) in the solar energy space, which revolutionized the whole industry. The company’s portfolio has grown from 808 MW since its IPO in July 2014 to 1,675 MW. It has plans to diversify into natural gas, geothermal and hydro power. The CAFD guidance more than doubled to $225 million for 2015 . Another big holding is Brookfield Renewable Energy Partners which owns $20 billion in renewable power assets and is a leading operator of renewable projects across North America, Latin America and Europe. It has installed more than 7GW capacity predominantly in the hydroelectric space. The 3rd largest holding is NextEra Energy Partners (NYSE: NEP ) which owns clean energy projects particularly wind and solar energy in North America with stable, long-term cash flows. It declared $100-120 million as its CAFD guidance for 2015 and is expecting a 12-15% annual growth in dividend distribution over the next five years. Data from Global X Funds 4) Geographic Diversification Though the fund has a global footprint, the focus in mainly on the developed countries. The main reason for this concentration is the fact that yieldcos have been launched mainly in these regions. Emerging markets do not have major yieldcos as of now. As time passes, I expect yieldcos to emerge in the developing markets as well. Data from Global X Funds Index Characteristics (click to enlarge) Source: Indxx Risks One of the concerns of investing in this ETF could be the fact that the underlying assets are not fully under the control of its management. They are dependent on their sponsors. For example, if the sponsors do not have a healthy project pipeline, they will be unable to transfer the assets to their underlying yieldco which may adversely affect the yieldco’s performance and in turn the ETF’s. Other than this, it is a relatively new concept in the industry and like any other new venture there is this risk of whether it will be a success or a failure. But given the high quality stocks in the Global X YieldCo portfolio, I do not think it should be a major concern. Stock performance The Global X YieldCo Index ETF was launched on May 27, 2015 at $15.35 and is currently trading at ~$15. Conclusion Investing in renewable energy stocks is sometimes regarded as risky given the volatile nature of the sector. ETFs are a good way to diversify individual stock risks and are regarded as less risky. The Global X YieldCo Index ETF is a good and balanced way to stay invested in the green space, giving exposure to the growing yieldco market. It is a relatively new concept in the market now and has been launched by one of the fastest growing issuers of ETFs. I think it’s a smart way of investing in the renewable energy space as it is less risky and involves a portfolio of growing stocks. Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More…) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. Scalper1 News

Scalper1 News