Scalper1 News

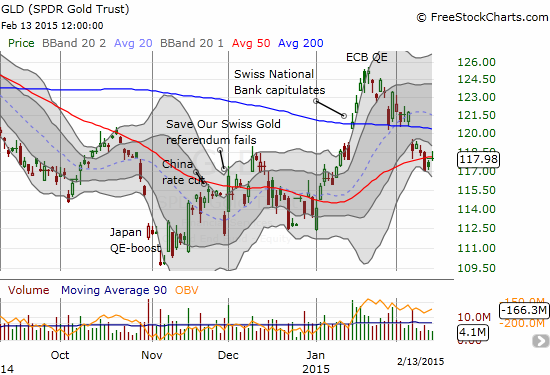

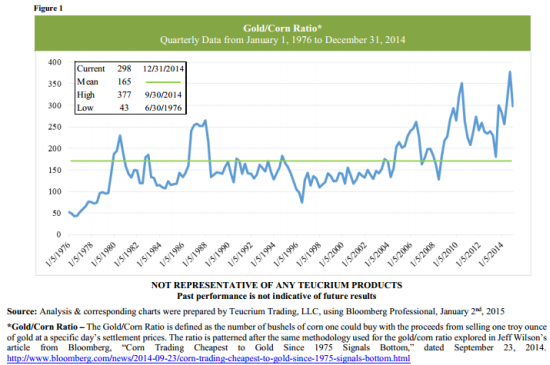

Summary The gold/corn ratio is extremely high relative to recent history. The bounce in CORN since a 40-year high (at least) in the gold/corn ratio seems to confirm a mean reversion is underway. Given corn’s strong underlying demand and a likely trading range for gold, I am betting on higher corn prices to drive most of the on-going mean reversion. I am finally starting to look over the rich agriculture-related resources provided by Teucrium Trading LLC , the financial firm that runs several agricultural ETFs: Teucrium Corn ETF (NYSEARCA: CORN ), Teucrium Soybean ETF (NYSEARCA: SOYB ), Teucrium Sugar ETF (NYSEARCA: CANE ), Teucrium Wheat ETF (NYSEARCA: WEAT ), and Teucrium Agricultural ETF (NYSEARCA: TAGS ) (TAGS invests the other four Teucrium ETFs). As an investor in CORN, I am particularly interested in understanding the supply and demand dynamics of the corn industry. What has my attention right now is an apparent trading signal provided by the amount of gold (NYSEARCA: GLD ) it takes to buy a bushel of corn. It is common to quantify the price of goods using gold as a frame of reference independent of a given paper currency. I have done this with oil and the S&P 500, but I have never thought to do it with agricultural products. In ” Portfolio Rebalancing – a Potentially Golden Opportunity ,” Teucrium references a Bloomberg article from September 24 titled ” Corn Trading Cheapest to Gold Since 1975 Signals Bottom ” to describe the opportunity for exchanging relatively “expensive” gold for relatively “cheap” corn. While I argued last month that it was time to end short-term trades going long gold , I did not think of gold being expensive (more like overbought relative to bets against path to monetary tightening). As expected, SPDR Gold Shares has fallen from the peak defined by QE in the eurozone…Yet, trading just above 5-year lows, it hardly “seems” expensive CORN is also trading near levels last seen five years ago, but it has dropped by 50% and more from recent highs. Since reaching its peak in 2012, CORN has traded ever downward with only two respites The current respite for CORN started, you guessed it, right after the Bloomberg article appeared noting corn’s cheapness relative to gold. Here is a telling chart reproduced by Teucrium. Corn is as cheap as ever relative to gold When I have argued for buying CORN off the lows , I have mainly relied upon a contrary argument that plays on an assumed cyclic nature of the prices for agricultural commodities. I have also noted strong underlying long-term demand dynamics confirmed by Deere’s CEO and soaring demand in China . However, the supply side has been volatile – corn has enjoyed several bumper crops after massive droughts in the U.S. last sent corn prices soaring in 2012. The February, 2015 U.S. Department of Agriculture (USDA) report reproduced by Teucrium along with other worldwide data shows U.S. corn inventory projected at 1.8B bushels, levels last seen in the 2005-2006 crop year. Current inventories are 13.4% of projected total usage. Similar percentages were last seen between the 2008-2009 and 2009-2010 crop years. This five-year high for corn inventory relative to total usage is an important benchmark because it turns out that worldwide demand for gold hit a five-year low at the end of 2014 . These 5-year spans for corn and gold could of course be pure coincidence, but they put current dynamics in good longer-term perspective: current conditions are pushing toward extremes. Assuming that gold is going into a new trading range roughly between the 2014 low and the 2015 high, my bet is on higher corn prices to move the gold/corn ratio closer to a mean reversion. Be careful out there! Disclosure: The author is long CORN, GLD. (More…) The author wrote this article themselves, and it expresses their own opinions. The author is not receiving compensation for it (other than from Seeking Alpha). The author has no business relationship with any company whose stock is mentioned in this article. Are you Bullish or Bearish on ? Bullish Bearish Neutral Results for ( ) Thanks for sharing your thoughts. Submit & View Results Skip to results » Share this article with a colleague Scalper1 News

Summary The gold/corn ratio is extremely high relative to recent history. The bounce in CORN since a 40-year high (at least) in the gold/corn ratio seems to confirm a mean reversion is underway. Given corn’s strong underlying demand and a likely trading range for gold, I am betting on higher corn prices to drive most of the on-going mean reversion. I am finally starting to look over the rich agriculture-related resources provided by Teucrium Trading LLC , the financial firm that runs several agricultural ETFs: Teucrium Corn ETF (NYSEARCA: CORN ), Teucrium Soybean ETF (NYSEARCA: SOYB ), Teucrium Sugar ETF (NYSEARCA: CANE ), Teucrium Wheat ETF (NYSEARCA: WEAT ), and Teucrium Agricultural ETF (NYSEARCA: TAGS ) (TAGS invests the other four Teucrium ETFs). As an investor in CORN, I am particularly interested in understanding the supply and demand dynamics of the corn industry. What has my attention right now is an apparent trading signal provided by the amount of gold (NYSEARCA: GLD ) it takes to buy a bushel of corn. It is common to quantify the price of goods using gold as a frame of reference independent of a given paper currency. I have done this with oil and the S&P 500, but I have never thought to do it with agricultural products. In ” Portfolio Rebalancing – a Potentially Golden Opportunity ,” Teucrium references a Bloomberg article from September 24 titled ” Corn Trading Cheapest to Gold Since 1975 Signals Bottom ” to describe the opportunity for exchanging relatively “expensive” gold for relatively “cheap” corn. While I argued last month that it was time to end short-term trades going long gold , I did not think of gold being expensive (more like overbought relative to bets against path to monetary tightening). As expected, SPDR Gold Shares has fallen from the peak defined by QE in the eurozone…Yet, trading just above 5-year lows, it hardly “seems” expensive CORN is also trading near levels last seen five years ago, but it has dropped by 50% and more from recent highs. Since reaching its peak in 2012, CORN has traded ever downward with only two respites The current respite for CORN started, you guessed it, right after the Bloomberg article appeared noting corn’s cheapness relative to gold. Here is a telling chart reproduced by Teucrium. Corn is as cheap as ever relative to gold When I have argued for buying CORN off the lows , I have mainly relied upon a contrary argument that plays on an assumed cyclic nature of the prices for agricultural commodities. I have also noted strong underlying long-term demand dynamics confirmed by Deere’s CEO and soaring demand in China . However, the supply side has been volatile – corn has enjoyed several bumper crops after massive droughts in the U.S. last sent corn prices soaring in 2012. The February, 2015 U.S. Department of Agriculture (USDA) report reproduced by Teucrium along with other worldwide data shows U.S. corn inventory projected at 1.8B bushels, levels last seen in the 2005-2006 crop year. Current inventories are 13.4% of projected total usage. Similar percentages were last seen between the 2008-2009 and 2009-2010 crop years. This five-year high for corn inventory relative to total usage is an important benchmark because it turns out that worldwide demand for gold hit a five-year low at the end of 2014 . These 5-year spans for corn and gold could of course be pure coincidence, but they put current dynamics in good longer-term perspective: current conditions are pushing toward extremes. Assuming that gold is going into a new trading range roughly between the 2014 low and the 2015 high, my bet is on higher corn prices to move the gold/corn ratio closer to a mean reversion. Be careful out there! Disclosure: The author is long CORN, GLD. (More…) The author wrote this article themselves, and it expresses their own opinions. The author is not receiving compensation for it (other than from Seeking Alpha). The author has no business relationship with any company whose stock is mentioned in this article. Are you Bullish or Bearish on ? Bullish Bearish Neutral Results for ( ) Thanks for sharing your thoughts. Submit & View Results Skip to results » Share this article with a colleague Scalper1 News

Scalper1 News