Scalper1 News

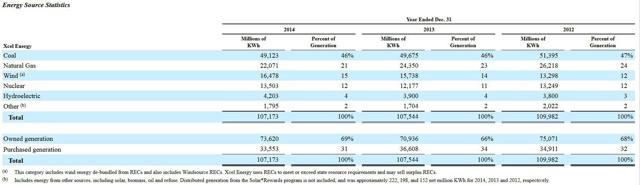

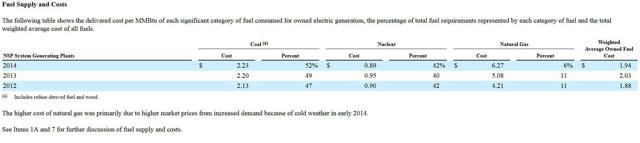

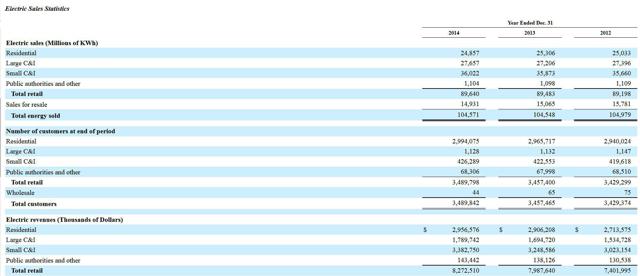

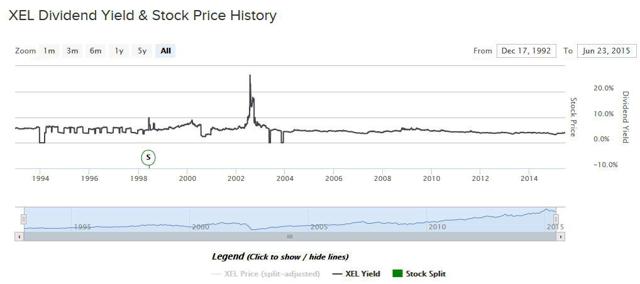

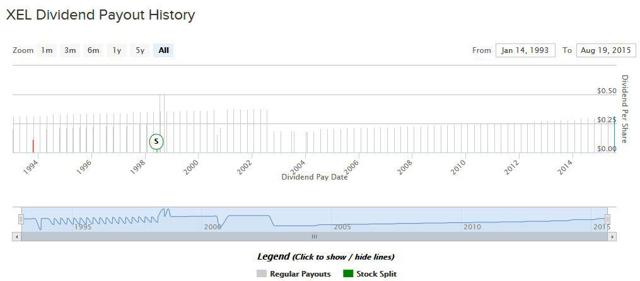

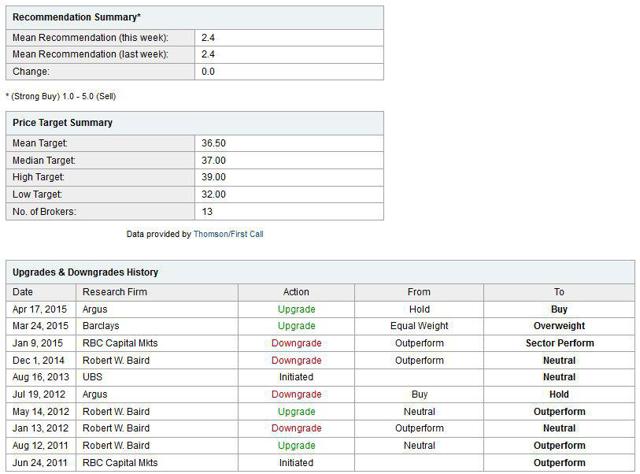

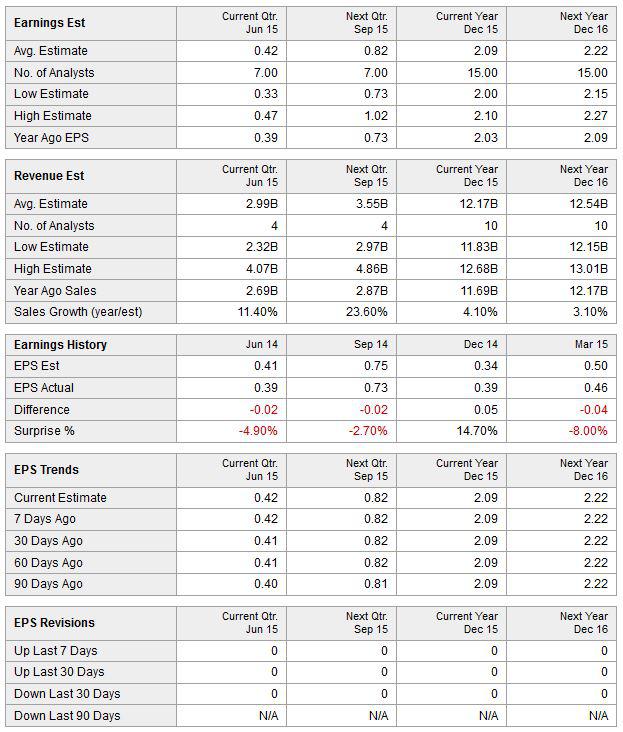

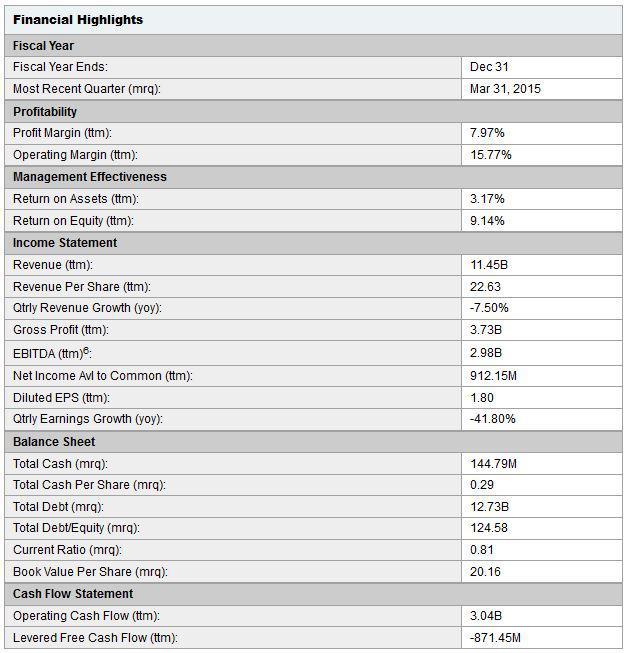

Summary EPA regulations are making coal generation facilities more costly to operate than ever before this is hurting XEL’s bottomline. Natural gas markets are fluctuating, and XEL’s stock price is inversely related. Summer is a seasonal low for natural gas prices, and as NG prices rise, XEL will fall. Xcel is a public utility company that is entering a bear cycle. While the Company pays a solid dividend which yields around 4% , its the revenues are stagnating. The Company has seen average residential electricity rates rise from 10.84 cents in 2012 to 11.89 cents in 2014. As these rates rise higher, solar and distributed generation become more economically attractive. Further, the price for Xcel’s energy is unlikely to decline in the near future, as the Company will have to upgrade its coal-fueled facilities to keep up with government regulation. Additionally Xcel’s stock price is inversely correlated to the natural gas market, when natural gas goes up, Xcel goes down. So if you believe as I do, that natural gas prices will increase over the next few years, Xcel is a sell. Company Positioning: from the 10-K Xcel Energy (NYSE: XEL ) is a holding company with subsidiaries engaged in the utility business. These subsidiaries are wholly owned public utilities that serve electric and natural gas customers in portions of Colorado, Michigan, Minnesota, New Mexico, North Dakota, South Dakota, Texas and Wisconsin. (click to enlarge) from the 10-K Coal is Xcel’s largest fuel input for electricity generation, it represents 46% of Xcel’s portfolio. Natural gas is the second largest with 21% of Xcel’s portfolio. The third largest is wind, with 15%. The Company has decreased its exposure to natural gas generation with approximately a -2% decrease from 23% of the portfolio in 2013 to 21% in 2014. (click to enlarge) from the 10-K As you can see from the table above, Xcel’s two major fuel sources , coal and nuclear, have low costs. Risk Management: from the 10-K (click to enlarge) from the 10-K Stagnating Electric Sales: If Xcel wants to make more revenue, it needs to increase electric sales across the board. It is a worry that there is a decline in growth of residential customers. Additionally Large C&I and Small C&I markets have stagnated. If this continues, Xcel will have difficulty growing. Environmental Regulations: The EPA is pursuing a regulatory path which will make it more costly to own and operate coal plants. These plants will have to be upgraded to stay inline with regulations. The Fluctuating Price for Natural Gas: The natural gas markets have finally leveled off after their long bear decline. Xcel has to effectively hedge against possible rising natural gas price levels to offset its fuel and supply costs. Dividends: (click to enlarge) from dividend.com (click to enlarge) from dividend.com XEL’s dividend historically ranges between $0.2 – $0.4 per share, however for three quarters of 2003 the dividend was not awarded at all. The period in 2003 is the only period which the stock has not paid dividends. The yield of the dividends are typically around 4%. Expert Opinions: (click to enlarge) from Yahoo Finance The median price estimate for XEL is $37 per share which gives the stock a 15.66% upside at its current price of $31.99. The stock has a beta of 0.34 which implies that the stock’s price is loosely related to the general market price. from Yahoo Finance XEL’s growth revenue is expected to slow down by 1% to 3.1% during 2016 year-over-year. Additionally, the Company’s EPS is expected to grow by 5.8% year-over-year. from Yahoo Finance The quarterly earnings growth for XEL was -41.8% year-over-year. Further quarterly revenue growth fell by -7.50% year-over-year. These are not good signs for a public utility company, whose revenues are dependent upon rate-making policy. Natural Gas Market: XEL has a negative correlation of -0.51 with United States Natural Gas Fund (NYSEARCA: UNG ) over a three year period. Summer is traditionally the season low pricing period for natural gas, as winter gets closer and closer we should begin to see the buyers enter to the market to hedge for winter exposures. Look for a seasonal up turn in natural gas markets as we near the end of summer. Recent News: White House recognizes Minneapolis and Xcel Energy for Web tool to help building owners track energy efficiency. Xcel Energy to begin inspecting transmission lines by helicopter Xcel Energy will use drone technology to protect and improve energy reliability and safety Xcel Energy named No. 1 utility wind provider for 11th consecutive year Conclusion: Xcel’s relationship with natural gas prices is really the major factor in recommending a sell of this stock. The natural gas market has been whip-sawing for the past year and considering we are currently near natural gas seasonal low, and with the adoption of LNG technology; natural gas seems poised for a climb. Xcel’s dividend is a healthy 4%, but they have cut the dividend in the past when the company hit hard times. There is little bright side to speak of, with quarterly revenue declines of -7.5% year-over-year and a total yearly revenue growth of only 3.1%. Further, the experts do not have a solid consensus regarding the future price of the stock. I recommend reducing exposure to XEL because of its risk associated with the natural gas market. Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More…) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. Scalper1 News

Summary EPA regulations are making coal generation facilities more costly to operate than ever before this is hurting XEL’s bottomline. Natural gas markets are fluctuating, and XEL’s stock price is inversely related. Summer is a seasonal low for natural gas prices, and as NG prices rise, XEL will fall. Xcel is a public utility company that is entering a bear cycle. While the Company pays a solid dividend which yields around 4% , its the revenues are stagnating. The Company has seen average residential electricity rates rise from 10.84 cents in 2012 to 11.89 cents in 2014. As these rates rise higher, solar and distributed generation become more economically attractive. Further, the price for Xcel’s energy is unlikely to decline in the near future, as the Company will have to upgrade its coal-fueled facilities to keep up with government regulation. Additionally Xcel’s stock price is inversely correlated to the natural gas market, when natural gas goes up, Xcel goes down. So if you believe as I do, that natural gas prices will increase over the next few years, Xcel is a sell. Company Positioning: from the 10-K Xcel Energy (NYSE: XEL ) is a holding company with subsidiaries engaged in the utility business. These subsidiaries are wholly owned public utilities that serve electric and natural gas customers in portions of Colorado, Michigan, Minnesota, New Mexico, North Dakota, South Dakota, Texas and Wisconsin. (click to enlarge) from the 10-K Coal is Xcel’s largest fuel input for electricity generation, it represents 46% of Xcel’s portfolio. Natural gas is the second largest with 21% of Xcel’s portfolio. The third largest is wind, with 15%. The Company has decreased its exposure to natural gas generation with approximately a -2% decrease from 23% of the portfolio in 2013 to 21% in 2014. (click to enlarge) from the 10-K As you can see from the table above, Xcel’s two major fuel sources , coal and nuclear, have low costs. Risk Management: from the 10-K (click to enlarge) from the 10-K Stagnating Electric Sales: If Xcel wants to make more revenue, it needs to increase electric sales across the board. It is a worry that there is a decline in growth of residential customers. Additionally Large C&I and Small C&I markets have stagnated. If this continues, Xcel will have difficulty growing. Environmental Regulations: The EPA is pursuing a regulatory path which will make it more costly to own and operate coal plants. These plants will have to be upgraded to stay inline with regulations. The Fluctuating Price for Natural Gas: The natural gas markets have finally leveled off after their long bear decline. Xcel has to effectively hedge against possible rising natural gas price levels to offset its fuel and supply costs. Dividends: (click to enlarge) from dividend.com (click to enlarge) from dividend.com XEL’s dividend historically ranges between $0.2 – $0.4 per share, however for three quarters of 2003 the dividend was not awarded at all. The period in 2003 is the only period which the stock has not paid dividends. The yield of the dividends are typically around 4%. Expert Opinions: (click to enlarge) from Yahoo Finance The median price estimate for XEL is $37 per share which gives the stock a 15.66% upside at its current price of $31.99. The stock has a beta of 0.34 which implies that the stock’s price is loosely related to the general market price. from Yahoo Finance XEL’s growth revenue is expected to slow down by 1% to 3.1% during 2016 year-over-year. Additionally, the Company’s EPS is expected to grow by 5.8% year-over-year. from Yahoo Finance The quarterly earnings growth for XEL was -41.8% year-over-year. Further quarterly revenue growth fell by -7.50% year-over-year. These are not good signs for a public utility company, whose revenues are dependent upon rate-making policy. Natural Gas Market: XEL has a negative correlation of -0.51 with United States Natural Gas Fund (NYSEARCA: UNG ) over a three year period. Summer is traditionally the season low pricing period for natural gas, as winter gets closer and closer we should begin to see the buyers enter to the market to hedge for winter exposures. Look for a seasonal up turn in natural gas markets as we near the end of summer. Recent News: White House recognizes Minneapolis and Xcel Energy for Web tool to help building owners track energy efficiency. Xcel Energy to begin inspecting transmission lines by helicopter Xcel Energy will use drone technology to protect and improve energy reliability and safety Xcel Energy named No. 1 utility wind provider for 11th consecutive year Conclusion: Xcel’s relationship with natural gas prices is really the major factor in recommending a sell of this stock. The natural gas market has been whip-sawing for the past year and considering we are currently near natural gas seasonal low, and with the adoption of LNG technology; natural gas seems poised for a climb. Xcel’s dividend is a healthy 4%, but they have cut the dividend in the past when the company hit hard times. There is little bright side to speak of, with quarterly revenue declines of -7.5% year-over-year and a total yearly revenue growth of only 3.1%. Further, the experts do not have a solid consensus regarding the future price of the stock. I recommend reducing exposure to XEL because of its risk associated with the natural gas market. Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More…) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. Scalper1 News

Scalper1 News