Scalper1 News

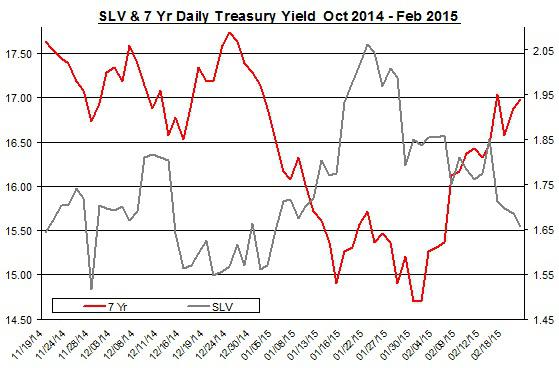

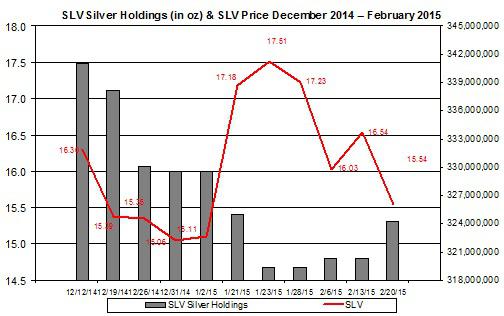

Summary The price of SLV fell down in the past week. Will Yellen’s testimony move the price of SLV? The rally in the U.S. treasury yields coincided with the drop in silver prices. The silver market cooled down in the past week as shares of the iShares Silver Trust ETF (NYSEARCA: SLV ) fell by 6%. For SLV, the upcoming testimony of Yellen and the latest developments in Europe could curb further down SLV. Yellen testifies Following the release of the minutes of the FOMC meeting, the upcoming testimony of FOMC Chair Yellen will take the center stage this week. Yellen will testify on Tuesday and Wednesday before the Senate Banking Committee and House Financial Services Committee, respectively. The latest minutes were perceived a bit dovish. After all, the probabilities of a rate hike have gone down a bit for both July and June compared to previous weeks. Because of the dovish tone in the minutes, some market analysts think that Yellen’s testimony will be a bit more hawkish – given the strong numbers presented in the latest non-farm payroll report, this scenario is plausible. But Yellen isn’t likely to rock the boat and reiterate that a decision on a rate hike will be data dependent. Since the FOMC is slowly adjusting the markets for a rate hike in the coming months, it’s unlikely that there will be a surprise or significant delay. This is true because central banks tend to “surprise the markets” and change the market expectations when it comes to stimulating the economy. When it comes to austerity and rate hikes, central banks tend to be much more cautious, prudent and give enough time for the market to adjust to the new policy. The biggest fear of a central bank is that its policy change will lead to an economic slowdown or even recession. Besides Yellen’s testimony, the second estimate of the U.S. GDP for the fourth quarter will be released on Friday. In the first estimate, the GDP growth rate was 2.6%, which was a bit lower than market expectations. If the GDP growth rate comes lower than current estimates, which are 2.1%, this news may bring back up the price of SLV. Another report worth considering is the U.S. CPI, which will be released this week. A drop in the core CPI could actually bring up SLV – this could revise down the FOMC’s inflation expectations. In the meantime, the recent developments in Europe may have also contributed to the weakness of SLV. Greece’s debt problem was defused, for now… One factor that could have had some indirect implications on the levels of risk in the financial markets, which may have benefited precious metals investments such as SLV, is the Greek debt problem and the possibility of a Greek exit from the European Union. The recent news from this front is that the Greeks have practically conceded to the Germans : The Greeks didn’t achieve too major goals to the austerity measures set in place. Greece received a four-month extension on its bailout. In exchange, on Monday, the Syriza-led government submitted its list of structural reforms that will need to be approved by the EU members. At least when it comes to the fiscal targets, the Greeks got a victory, and the budget surplus of 4.5% of GDP is on the table and the target could come down to 1.5% next year. These developments are likely to push away the whole Greek exit talk for the near term from the markets’ agenda. One of the main events of the week in Europe is the third tranche of the targeted LTRO. The last two auctions came short of market expectations. If this tranche also fails to reach high levels, then it could suggest the ECB may wish to expand its QE program. For SLV, lower risk in the financial markets could bring further down its price. One way is via the changes in the U.S. treasury yields. The sharp fall in U.S. long-term treasury yields at the beginning of the year changed course in recent weeks, as indicated in the chart below. Source: U.S. Department of Treasury and Bloomberg The linear correlation between SLV and U.S. long-term treasury yields isn’t strong at only -0.17 (for 7-year yields), but precious metals, especially gold, tend to have a strong relation with treasury yields. Nonetheless, the rise in U.S. interest rates, as the market expects a rise in the Fed’s cash rate in the middle of the year, could further contribute to the weakness of SLV. In the past week, the amount of silver ounces in SLV has picked up a bit albeit the silver ounces in this ETF are still down for the year. Source: iShares Silver Trust website It’s still unclear when, if at all, the FOMC starts to raise rates. For now, it seems that unless we will see a major change in the U.S. economic recovery, the FOMC will likely to raise rates in the middle of the year. Yellen’s upcoming testimony could provide some more insight about the next policy change, but I suspect this testimony, much like others in the past, won’t offer more than a general tone and “data dependency” policy. The recent diffusion of the Greek debt crisis is likely to curb down the demand for investments that are considered safe haven such as precious metals. For now, the possible upside for SLV is if the U.S. economy’s progress fails to meet market expectations (e.g. lower-than-anticipated growth in GDP or CPI). In such an event, SLV could rally, even if for a short term. For more see: Will Higher Physical Demand For Silver Drive Up SLV? Disclosure: The author has no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More…) The author wrote this article themselves, and it expresses their own opinions. The author is not receiving compensation for it (other than from Seeking Alpha). The author has no business relationship with any company whose stock is mentioned in this article. Scalper1 News

Summary The price of SLV fell down in the past week. Will Yellen’s testimony move the price of SLV? The rally in the U.S. treasury yields coincided with the drop in silver prices. The silver market cooled down in the past week as shares of the iShares Silver Trust ETF (NYSEARCA: SLV ) fell by 6%. For SLV, the upcoming testimony of Yellen and the latest developments in Europe could curb further down SLV. Yellen testifies Following the release of the minutes of the FOMC meeting, the upcoming testimony of FOMC Chair Yellen will take the center stage this week. Yellen will testify on Tuesday and Wednesday before the Senate Banking Committee and House Financial Services Committee, respectively. The latest minutes were perceived a bit dovish. After all, the probabilities of a rate hike have gone down a bit for both July and June compared to previous weeks. Because of the dovish tone in the minutes, some market analysts think that Yellen’s testimony will be a bit more hawkish – given the strong numbers presented in the latest non-farm payroll report, this scenario is plausible. But Yellen isn’t likely to rock the boat and reiterate that a decision on a rate hike will be data dependent. Since the FOMC is slowly adjusting the markets for a rate hike in the coming months, it’s unlikely that there will be a surprise or significant delay. This is true because central banks tend to “surprise the markets” and change the market expectations when it comes to stimulating the economy. When it comes to austerity and rate hikes, central banks tend to be much more cautious, prudent and give enough time for the market to adjust to the new policy. The biggest fear of a central bank is that its policy change will lead to an economic slowdown or even recession. Besides Yellen’s testimony, the second estimate of the U.S. GDP for the fourth quarter will be released on Friday. In the first estimate, the GDP growth rate was 2.6%, which was a bit lower than market expectations. If the GDP growth rate comes lower than current estimates, which are 2.1%, this news may bring back up the price of SLV. Another report worth considering is the U.S. CPI, which will be released this week. A drop in the core CPI could actually bring up SLV – this could revise down the FOMC’s inflation expectations. In the meantime, the recent developments in Europe may have also contributed to the weakness of SLV. Greece’s debt problem was defused, for now… One factor that could have had some indirect implications on the levels of risk in the financial markets, which may have benefited precious metals investments such as SLV, is the Greek debt problem and the possibility of a Greek exit from the European Union. The recent news from this front is that the Greeks have practically conceded to the Germans : The Greeks didn’t achieve too major goals to the austerity measures set in place. Greece received a four-month extension on its bailout. In exchange, on Monday, the Syriza-led government submitted its list of structural reforms that will need to be approved by the EU members. At least when it comes to the fiscal targets, the Greeks got a victory, and the budget surplus of 4.5% of GDP is on the table and the target could come down to 1.5% next year. These developments are likely to push away the whole Greek exit talk for the near term from the markets’ agenda. One of the main events of the week in Europe is the third tranche of the targeted LTRO. The last two auctions came short of market expectations. If this tranche also fails to reach high levels, then it could suggest the ECB may wish to expand its QE program. For SLV, lower risk in the financial markets could bring further down its price. One way is via the changes in the U.S. treasury yields. The sharp fall in U.S. long-term treasury yields at the beginning of the year changed course in recent weeks, as indicated in the chart below. Source: U.S. Department of Treasury and Bloomberg The linear correlation between SLV and U.S. long-term treasury yields isn’t strong at only -0.17 (for 7-year yields), but precious metals, especially gold, tend to have a strong relation with treasury yields. Nonetheless, the rise in U.S. interest rates, as the market expects a rise in the Fed’s cash rate in the middle of the year, could further contribute to the weakness of SLV. In the past week, the amount of silver ounces in SLV has picked up a bit albeit the silver ounces in this ETF are still down for the year. Source: iShares Silver Trust website It’s still unclear when, if at all, the FOMC starts to raise rates. For now, it seems that unless we will see a major change in the U.S. economic recovery, the FOMC will likely to raise rates in the middle of the year. Yellen’s upcoming testimony could provide some more insight about the next policy change, but I suspect this testimony, much like others in the past, won’t offer more than a general tone and “data dependency” policy. The recent diffusion of the Greek debt crisis is likely to curb down the demand for investments that are considered safe haven such as precious metals. For now, the possible upside for SLV is if the U.S. economy’s progress fails to meet market expectations (e.g. lower-than-anticipated growth in GDP or CPI). In such an event, SLV could rally, even if for a short term. For more see: Will Higher Physical Demand For Silver Drive Up SLV? Disclosure: The author has no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More…) The author wrote this article themselves, and it expresses their own opinions. The author is not receiving compensation for it (other than from Seeking Alpha). The author has no business relationship with any company whose stock is mentioned in this article. Scalper1 News

Scalper1 News