Scalper1 News

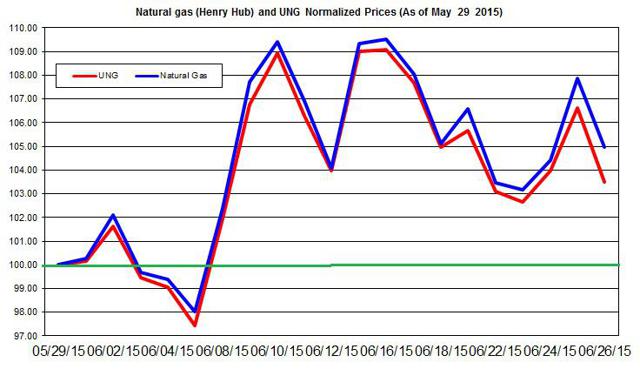

The price of UNG is up for the month on account of stronger demand in the power sector. Despite warmer weather, the cooling degree days are expected to reach normal levels this week. The normal cooling degree days could suggest the demand for natural gas in the power sector will cool down. The recent natural gas report showed the injection to storage was 75 Bcf, which was slightly lower than market expectations. Moreover, the latest buildup was below the 5-year average and last year’s injection. This news has provided a short-term boost for the shares of the United States Natural Gas ETF (NYSEARCA: UNG ) during last week. The price of UNG is slightly up for the month, but it will require a stronger demand for natural gas to bring UNG further up. For now, this scenario doesn’t seem likely. Before reviewing the latest developments in the natural gas market, shares of UNG continue to underperform natural gas prices: The impact of the roll decay on the price of UNG is demonstrated in the chart below (the prices are normalized to the end of last month). As you can see, the price of UNG rose by only 3.5% during June, while the Henry Hub by nearly 5%, i.e. a 1.5 percentage point difference. (click to enlarge) Source of data taken from EIA and Google finance According to the weekly EIA report , this week’s injection was the first time for this season to be below the 5-year average buildup. As of last week, the storage was 38% higher than the level recorded last year and 1.4% above the 5-year average. (click to enlarge) Source of data taken from EIA From the supply side, production picked up – it rose by 1%, week over week. And it’s up by 5.5% compared to last year. Based on the latest update by Baker Hughes , the number of gas rigs slightly rose by 5 to 228 rigs. Nonetheless, U.S. consumption also grew by 2.4% last week and was up by 8.5% for the year. Most of the growth in demand came in the power sector – 6.1%. This gain was partly offset by lower consumption in the industrial and residential/commercial sectors. Looking forward towards the next two weeks, the weather is expected to heat up mostly in the coastal line, including West, Northeast and South Atlantic, but the temperatures are projected to be lower than normal for this time of the year in parts of the Midwest. Despite the expected higher than normal temperatures in parts of the U.S., the cooling degree days are estimated to be only slightly higher than normal – this could suggest the rise in consumption in the power sector will slowdown. This could explain why the markets estimate this week’s injection will be close to the 5-year average buildup of 75 Bcf. The natural gas market slightly heated up in the past few weeks, but over the short run the power sector isn’t expected to heat up. Thus, the demand isn’t likely to pressure up the price of natural gas. For UNG, this could mean another pullback in its price. For more see: On the Contango in Natural Gas Market Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More…) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. Scalper1 News

The price of UNG is up for the month on account of stronger demand in the power sector. Despite warmer weather, the cooling degree days are expected to reach normal levels this week. The normal cooling degree days could suggest the demand for natural gas in the power sector will cool down. The recent natural gas report showed the injection to storage was 75 Bcf, which was slightly lower than market expectations. Moreover, the latest buildup was below the 5-year average and last year’s injection. This news has provided a short-term boost for the shares of the United States Natural Gas ETF (NYSEARCA: UNG ) during last week. The price of UNG is slightly up for the month, but it will require a stronger demand for natural gas to bring UNG further up. For now, this scenario doesn’t seem likely. Before reviewing the latest developments in the natural gas market, shares of UNG continue to underperform natural gas prices: The impact of the roll decay on the price of UNG is demonstrated in the chart below (the prices are normalized to the end of last month). As you can see, the price of UNG rose by only 3.5% during June, while the Henry Hub by nearly 5%, i.e. a 1.5 percentage point difference. (click to enlarge) Source of data taken from EIA and Google finance According to the weekly EIA report , this week’s injection was the first time for this season to be below the 5-year average buildup. As of last week, the storage was 38% higher than the level recorded last year and 1.4% above the 5-year average. (click to enlarge) Source of data taken from EIA From the supply side, production picked up – it rose by 1%, week over week. And it’s up by 5.5% compared to last year. Based on the latest update by Baker Hughes , the number of gas rigs slightly rose by 5 to 228 rigs. Nonetheless, U.S. consumption also grew by 2.4% last week and was up by 8.5% for the year. Most of the growth in demand came in the power sector – 6.1%. This gain was partly offset by lower consumption in the industrial and residential/commercial sectors. Looking forward towards the next two weeks, the weather is expected to heat up mostly in the coastal line, including West, Northeast and South Atlantic, but the temperatures are projected to be lower than normal for this time of the year in parts of the Midwest. Despite the expected higher than normal temperatures in parts of the U.S., the cooling degree days are estimated to be only slightly higher than normal – this could suggest the rise in consumption in the power sector will slowdown. This could explain why the markets estimate this week’s injection will be close to the 5-year average buildup of 75 Bcf. The natural gas market slightly heated up in the past few weeks, but over the short run the power sector isn’t expected to heat up. Thus, the demand isn’t likely to pressure up the price of natural gas. For UNG, this could mean another pullback in its price. For more see: On the Contango in Natural Gas Market Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More…) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. Scalper1 News

Scalper1 News