On Jan 6, we issued an updated research report on leading global producer of industrial packaging products, Greif, Inc. GEF . The company will benefit from fundamental operational improvements, sale of non-core assets, consolidation of facilities, cost cuts but the sluggish global industrial economy may play spoilsport.

Greif’s top-line and bottom-line both declined on a year-over-year basis in fiscal fourth-quarter 2016. While revenues beat the Zacks Consensus Estimate, earnings fell short. Greif projects fiscal 2017 EPS to range between $ 2.78 and $ 3.08. Compared with the adjusted EPS of $ 2.44 in fiscal 2016, the year-over-year guidance range depicts growth in the range of 14-26%. Further, the company initiated a free cash flow guidance of $ 180-$ 210 million. It also expects to gain from the ongoing benefits of its Transformation plan, contribution from the $ 40 per ton containerboard increase and lower interest expense owing to recent refinance efforts as well as a lower effective tax rate.

Greif’s margins in the fourth quarter were driven by strong pricing, improved sourcing, and a more favorable product mix in the Rigid Industrial Packaging & Services business. This momentum will continue in the coming years and gross margin improvement will be above the company’s target of 20%. This will be driven by ongoing sourcing and supply chain initiatives, improving plant operating efficiencies; and consolidating/divesting underperforming operations. Further, the recent price increase of $ 40/ton in kraft linerboard will help counter increased input costs.

The company is executing process improvements in all commercial sourcing supply chain and operations. Further, Greif continues to rationalize operations, accelerate headcount reductions, and slash entertainment and travel budget by increasing video conferencing usage and eliminating all non-sales related travel. These actions will be accretive to earnings.

Further, Greif has implemented a strategy to improve its business portfolio, address underperforming assets and generate additional cash. This strategy includes selling, general and administrative (“SG&A”) reductions throughout the company and rationalization of manufacturing facilities. Greif has been successful in fixing under-performing businesses and divested non-core assets as well as closed facilities, which will drive long-term performance. During 2016, the company completed four divestitures. The divestitures were of non-strategic businesses, three in the Rigid Industrial Packaging & Services segment and one in the Flexible Products & Services segment.

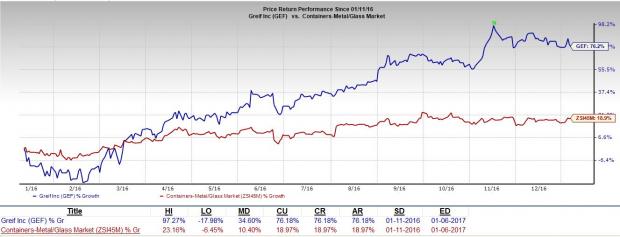

Given these positives, Greif’s share price performance has outperformed the Zacks categorized containers-metal glass industry in the past one year. The stock has grown 76.2%, way ahead of the industry’s gain of 18.9% over the same time frame.

However, even though Greif will gain from its strategic transformation plans in the future, it has resulted in significant impairment and restructuring charges. During fiscal 2016, Greif recorded restructuring charges of $ 26.9 million, consisting of $ 16.7 million in employee separation costs and $ 10.2 million in other restructuring costs, primarily comprising of professional fees incurred for services specifically associated with employee separation and relocation.

Moreover, both steel and Old Corrugated Container (OCC) prices continue to rise through calendar fourth-quarter 2016, two months of which fall in Greif’s fiscal first-quarter 2017. If the effect of price increase is not realized in the quarter, increased raw material costs will have a negative impact on margins. Further, results will be affected by sluggish global industrial economy, continued strength of the U.S. dollar, weaker containerboard prices and weaker-than-expected seasonal agricultural sales.

The Zacks Consensus Estimate for first-quarter fiscal 2017 is 50 cents, reflecting a 23.75% year-over-year growth. The estimate for fiscal 2017 is currently at $ 2.97, depicting a 21.89% year-over-year climb.

Grief currently carries a Zacks Rank #3 (Hold).

Stocks to Consider

Some better-ranked stocks in the same space include Altra Industrial Motion Corp. AIMC , Actuant Corporation ATU and Deere & Company DE . All three of these stocks sport a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here .

Altra Industrial Motion has a positive average earnings surprise of 8.06% in the last four quarters. Actuant generated a positive average earnings surprise of 11.47% in the trailing four quarters. Deere has delivered an average positive earnings surprise of 58.17% in the last four quarters.

Now See Our Private Investment Ideas

While the above ideas are being shared with the public, other trades are hidden from everyone but selected members. Would you like to peek behind the curtain and view them? Starting today, for the next month, you can follow all Zacks’ private buys and sells in real time from value to momentum . . . from stocks under $ 10 to ETF and option moves . . . from insider trades to companies that are about to report positive earnings surprises (we’ve called them with 80%+ accuracy). You can even look inside portfolios so exclusive that they are normally closed to new investors. Click here for Zacks’ secret trades >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Greif Bros. Corporation (GEF): Free Stock Analysis Report

Actuant Corporation (ATU): Free Stock Analysis Report

Deere & Company (DE): Free Stock Analysis Report

Altra Industrial Motion Corp. (AIMC): Free Stock Analysis Report

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

Plantations International