The equity universe is bullish at the moment, recording post-election gains of 6.6%, 7.5% and 8.6% for the S&P 500, the Nasdaq and Dow Jones Industrial Average, respectively.

President Donald Trump’s market-friendly policies, steady U.S. economy, gradual economic recovery of China are all likely boost the degree of industrialization and thereby augment demand for core metal products offered by mining companies.

Among the numerous potential gainers, adding Vale S.A. VALE to your portfolio is likely to be a promising move.

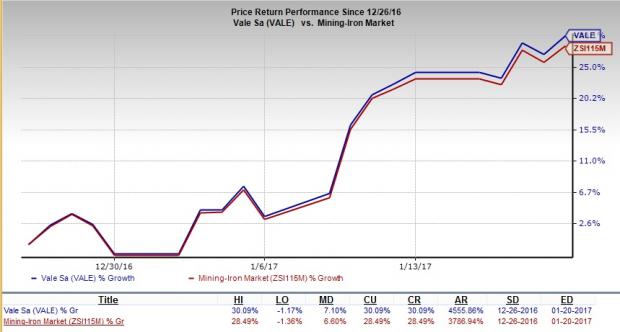

In the last one month, shares of this Zacks Rank #2 (Buy) stock recorded a gain of 30.09%, outperforming the Zacks categorized Mining-Iron industry’s return of 28.49%.

Notably, the attractiveness of this stock as a current investment choice is further accentuated by its favorable VGM Score of ‘B’.

Reasons for the Solid Run

Revenue Growth: In third-quarter 2016, Vale’s aggregate net operating revenues rose 13% year over year and 11% on a sequential basis.

The company anticipates that higher sales volume for fertilizers and ferrous minerals as well as increased prices of products like pellets and iron ore fines is likely to drive revenues in the upcoming quarters.

The stock’s Zacks Consensus Sales estimate for 2017 is currently pegged at 16.03%.

Margin Improvement: Vale is steadily improving its gross margin since the beginning of 2016.

In third-quarter 2016, the company’s gross margin improved by 980 basis points (bps) on a year-over-year basis and 470 bps on a sequential basis.

The company anticipates to accrue improved margins in the quarters ahead, on the back of lower costs and stronger operational performance.

Vale is currently optimizing its worldwide supply chain and ramping-up operations at the S11D mine. Through these measures, the company intends to boost its productivity for lowering costs and hence maximize near-term margins.

Earnings per Share Growth: Vale recorded an earnings surprise of 35.71% in third-quarter 2016. Notably, the stock carries a positive Earnings ESP of 104.76% for fourth-quarter 2016.

Please check our Earnings ESP Filter that enables you to find stocks that are expected to come out with earnings surprises.

Our proven model perceives that Vale would likely beat earnings in the upcoming quarter, as it carries the right combination of Zacks Rank and Earnings ESP.

Vale anticipates reporting higher near-term earnings on grounds of improved sales and stronger margins.

Upward Estimate Revisions: In the past 60 days, the Zacks Consensus Estimate for Vale moved up 42.9% to 90 cents for 2017. The positive earnings estimate revision indicates positive market sentiments and validates the Zacks Rank #2 for the stock.

Notably, the stock’s projected earnings per share (‘EPS’) growth for 2017 is currently pegged at 6.97%.

Investing in Lucrative Projects: Vale aims to widen its production capacity by investing in new projects. For instance, the company’s new iron ore mine and processing plant, build under the Carajás Serra Sul S11D project, has just initiated operations from the third quarter. Also, aggregate production of coal is expected to increase after the completion of the Moatize II project by the fall of this year. Successful ramp-up and stable productivity of these products is likely to boost Vale’s production capability and thereby equip its business to capitalize on increased mining market demand in the near term.

Commitment Toward Shareholders: Vale implements a progressive dividend policy in business, which reflects its commitment to increase shareholders’ wealth. By investing in high-return growth opportunities Vale aims to strengthen its cash position, which would enables the company to offer attractive share buyback and dividend return programs to its shareholders.

Other Key Picks

Some other favorably placed stocks within the industry are listed below:

BASF SE BASFY currently sports a Zacks Rank #1 (Strong Buy) and has an average earnings surprise of 34.34% in the last four quarters. You can see the complete list of today’s Zacks #1 Rank stocks here .

AK Steel Holding Corporation AKS also curently sports a Zacks Rank #1 and has an average earnings surprise of 170.80% in the last four quarters.

CF Industries Holdings, Inc. CF presently carries a Zacks Rank #2 and has an average earnings surprise of 18.83% in the trailing four quarters.

Zacks’ Top Investment Ideas for Long-Term Profit

How would you like to see our best recommendations to help you find today’s most promising long-term stocks? Starting now, you can look inside our portfolios featuring stocks under $ 10, income stocks, value investments and more. These picks, which have double and triple-digit profit potential, are rarely available to the public. But you can see them now. Click here >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

BASF SE (BASFY): Free Stock Analysis Report

CF Industries Holdings Inc. (CF): Free Stock Analysis Report

VALE SA (VALE): Free Stock Analysis Report

AK Steel Holding Corp. (AKS): Free Stock Analysis Report

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

Plantations International