Scalper1 News

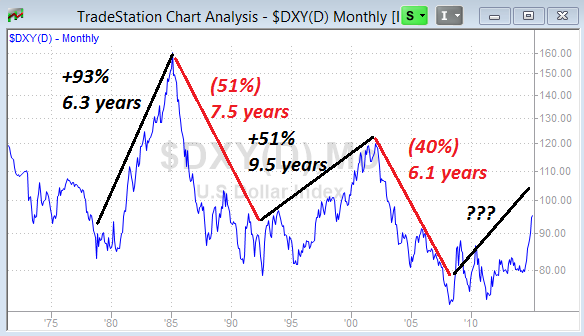

[Editor’s Note: This is the fourth and final installment in our series on consumer staples stocks. See also: – Part I : The Monsters Under the Bed are Real for Consumer Staples Stocks – Part II : Don’t Get Caught Holding This “Safe” Stock When the Fed Hikes Rates – Part III : What Happens When “Engineered Growth” is No Longer Viable Please let us know what you think of the series. Use the comment section below..] As we approach the end of the second quarter and enter earnings season, currency headwinds are likely to significantly cut into earnings for international consumer staples stocks. Investors in consumer staples stocks are already facing some serious challenges. We’ve discussed the high valuations as a result of income investors reaching for yield . These valuations are still well above average levels even after many of these stocks have sustained declines. As this reach for yield unwinds, valuations should contract, sending stock prices even lower. A second challenge comes from the end of an ” engineered growth ” phase. Companies have had an incentive to borrow money cheaply and buy shares of their own stock. This has reduced the share count, thereby artificially inflating earnings per share. But with valuations now inflated and with higher rates making it more expensive to borrow, the buyback fad will likely end. Investors who became accustomed to this engineered growth may be disappointed with lower growth rates in subsequent quarters. Today, we’re going to discuss the very real challenge of the strong U.S. dollar, as it relates to consumer staples companies who do business around the world. How the U.S. Dollar Affects Business Basic economics tells us that a weak currency helps to promote a country’s exports. This is because other countries’ currencies go farther towards purchasing goods and services, making the country with a weak currency more competitive. The opposite is true as well. When a country’s currency is strong, it becomes more challenging for that country to export products or services. The strong U.S. dollar has become a significant headwind for domestic companies who generate a significant amount of revenue overseas. Today, a U.S. company selling a product in international markets must choose between two options: Sell the product at a competitive price. In this scenario, the company may collect a steady amount of profit in euros (using just one currency as an example). But since each euro represents fewer U.S. dollars, the company’s profit margin will decline in dollar terms. Sell the product at a standard U.S. dollar price. In this scenario, the company can protect its profit margins by selling at a high enough price to keep profits per unit at a steady level. But since this price will be higher in euro terms, the product will be less competitive when compared to competing products. There is perhaps no better example of this problem for consumer staples stocks than Philip Morris International (NYSE: PM ). The company has the third largest position in the S&P Consumer Staples SPDR (NYSEARCA: XLP ) Philip Morris International is the international sister company of Altria Group (NYSE: MO ) following the company’s split. Philip Morris sells cigarettes and tobacco products outside the United States while Altria operates in the U.S. In the first quarter, PM reported 7.8% growth in sales when calculated on a “constant currency” basis. But when international sales were translated into dollar figures, revenue actually fell more than 4%. Adjusted earnings were also reported 2.5% lower than last year’s results, all a result of the strong U.S. dollar. We should note that when PM reported its results, shares traded higher. Investors chose to focus on the strength of PM’s international sales, hoping that the strong U.S. dollar would be a temporary factor, while expecting further international growth from PM. In addition to Philip Morris, many other international consumer staples companies have reported weakness due to the strong U.S. dollar. Here are just a few… Johnson & Johnson (NYSE: JNJ ) cut its guidance in April due to the strong U.S. dollar. The Coca-Cola Company (NYSE: KO ) reported a 6% cut to revenue as a result of the U.S. dollar Procter & Gamble (NYSE: PG ) reported a 5% negative impact to its sales due to the U.S. dollar Unfortunately, for international consumer staples stocks, it doesn’t look like this trend will reverse any time soon. It’s Still a Bullish Environment for the U.S. Dollar After advancing sharply in the second half of 2014 (and the first few months of 2015), the U.S. dollar has been trading in a more stable range the last several months. Many believe that the sharp rise in the dollar is complete and that while the trend may not reverse, the dollar is not likely to trade materially higher. Currencies have a reputation for long-term trends extending several years. Below is a long-term chart of the U.S. dollar index that we marked up to show the amount of time (and level of change) between peaks and troughs. Since the 1970s, the U.S. dollar has experienced five major trends lasting anywhere from 6 years to nearly 10 years. The average advance has been near 70% and the average decline near 45%. (Admittedly, this is a small sample size, but it is at the very least a rough gauge of the magnitude of typical U.S. dollar trends). While the current rally in the U.S. dollar has lasted seven years from its trough in 2008, the dollar has only advanced 38%. If the dollar were to continue to rally, it wouldn’t be outside the “normal” band for currency movements. Plus, one could argue that the true bottom didn’t occur until 2011 when the dollar bottomed against the yen and the Australian dollar. Fundamentally, there are compelling reasons why the dollar could continue to rally. The three biggest are: Continued uncertainty surrounding sovereign debt for Eurozone countries could cause institutions and individuals to gravitate away from euros and towards U.S. dollars. A weakening Chinese economy and lower oil prices are challenges for natural resource countries like Canada and Australia. This trend is just beginning and should continue to weigh on the Canadian and Australian dollars. Rising interest rates in the U.S. should make dollar-denominated deposits more attractive. As treasury yields rise, more international investors will convert savings to dollars and buy government bonds. While short-term movements in currencies are difficult to game, we believe that the bullish trend for the U.S. dollar is still intact, and that it will pressure earnings for international consumer staples companies. The U.S. Dollar Remains a Challenge for Q2 Results Despite a few weeks of sideways trading, the U.S. dollar remains significantly elevated from where it was last year. Today, the U.S. dollar is 21% stronger versus the euro than at this time last year. The U.S. dollar is 18% stronger versus the Australian dollar than at this time last year. The U.S. dollar is 13% stronger versus the Canadian dollar than at this time last year. When U.S. consumer staples companies with international sales report second quarter metrics next month, they will be up against a significant headwind. Last year during the second quarter, these companies did not face a strong dollar. This year, earnings will not compare favorably to last year’s numbers. At this point, it doesn’t matter what the U.S. dollar is going to do when it comes to second quarter results. Instead, it matters where the dollar is versus at this time last year. The key will be how investors respond to the reports. If they see the strong U.S. dollar as a temporary issue, investors may once again look the other way and the stocks may hold up. But if investors are worried about continued strength in the U.S. dollar, we believe that international consumer staples companies will trade lower in the days leading up to and following their second quarter announcements. With the Fed on tap to release its June statement tomorrow (this article is being penned after the close on Tuesday, June 16th), we could be in danger of seeing another spike in the U.S. dollar this week. Any hawkish rhetoric from the Fed, or any indication that the first rate hike will come in September could send the U.S. dollar higher. In an environment where the dollar is once again on the move, we don’t expect investors to give international consumer staples stocks the benefit of the doubt when it comes to the second quarter earnings announcements. Three Major Challenges So when it comes to consumer staples stocks, we’re decidedly cautious. We prefer to avoid these risky shares while waiting for three major challenges to pass. These challenges are: An unwinding of the “reach for yield” A curtailment of “engineered growth” A strong U.S. dollar headwind. Scalper1 News

[Editor’s Note: This is the fourth and final installment in our series on consumer staples stocks. See also: – Part I : The Monsters Under the Bed are Real for Consumer Staples Stocks – Part II : Don’t Get Caught Holding This “Safe” Stock When the Fed Hikes Rates – Part III : What Happens When “Engineered Growth” is No Longer Viable Please let us know what you think of the series. Use the comment section below..] As we approach the end of the second quarter and enter earnings season, currency headwinds are likely to significantly cut into earnings for international consumer staples stocks. Investors in consumer staples stocks are already facing some serious challenges. We’ve discussed the high valuations as a result of income investors reaching for yield . These valuations are still well above average levels even after many of these stocks have sustained declines. As this reach for yield unwinds, valuations should contract, sending stock prices even lower. A second challenge comes from the end of an ” engineered growth ” phase. Companies have had an incentive to borrow money cheaply and buy shares of their own stock. This has reduced the share count, thereby artificially inflating earnings per share. But with valuations now inflated and with higher rates making it more expensive to borrow, the buyback fad will likely end. Investors who became accustomed to this engineered growth may be disappointed with lower growth rates in subsequent quarters. Today, we’re going to discuss the very real challenge of the strong U.S. dollar, as it relates to consumer staples companies who do business around the world. How the U.S. Dollar Affects Business Basic economics tells us that a weak currency helps to promote a country’s exports. This is because other countries’ currencies go farther towards purchasing goods and services, making the country with a weak currency more competitive. The opposite is true as well. When a country’s currency is strong, it becomes more challenging for that country to export products or services. The strong U.S. dollar has become a significant headwind for domestic companies who generate a significant amount of revenue overseas. Today, a U.S. company selling a product in international markets must choose between two options: Sell the product at a competitive price. In this scenario, the company may collect a steady amount of profit in euros (using just one currency as an example). But since each euro represents fewer U.S. dollars, the company’s profit margin will decline in dollar terms. Sell the product at a standard U.S. dollar price. In this scenario, the company can protect its profit margins by selling at a high enough price to keep profits per unit at a steady level. But since this price will be higher in euro terms, the product will be less competitive when compared to competing products. There is perhaps no better example of this problem for consumer staples stocks than Philip Morris International (NYSE: PM ). The company has the third largest position in the S&P Consumer Staples SPDR (NYSEARCA: XLP ) Philip Morris International is the international sister company of Altria Group (NYSE: MO ) following the company’s split. Philip Morris sells cigarettes and tobacco products outside the United States while Altria operates in the U.S. In the first quarter, PM reported 7.8% growth in sales when calculated on a “constant currency” basis. But when international sales were translated into dollar figures, revenue actually fell more than 4%. Adjusted earnings were also reported 2.5% lower than last year’s results, all a result of the strong U.S. dollar. We should note that when PM reported its results, shares traded higher. Investors chose to focus on the strength of PM’s international sales, hoping that the strong U.S. dollar would be a temporary factor, while expecting further international growth from PM. In addition to Philip Morris, many other international consumer staples companies have reported weakness due to the strong U.S. dollar. Here are just a few… Johnson & Johnson (NYSE: JNJ ) cut its guidance in April due to the strong U.S. dollar. The Coca-Cola Company (NYSE: KO ) reported a 6% cut to revenue as a result of the U.S. dollar Procter & Gamble (NYSE: PG ) reported a 5% negative impact to its sales due to the U.S. dollar Unfortunately, for international consumer staples stocks, it doesn’t look like this trend will reverse any time soon. It’s Still a Bullish Environment for the U.S. Dollar After advancing sharply in the second half of 2014 (and the first few months of 2015), the U.S. dollar has been trading in a more stable range the last several months. Many believe that the sharp rise in the dollar is complete and that while the trend may not reverse, the dollar is not likely to trade materially higher. Currencies have a reputation for long-term trends extending several years. Below is a long-term chart of the U.S. dollar index that we marked up to show the amount of time (and level of change) between peaks and troughs. Since the 1970s, the U.S. dollar has experienced five major trends lasting anywhere from 6 years to nearly 10 years. The average advance has been near 70% and the average decline near 45%. (Admittedly, this is a small sample size, but it is at the very least a rough gauge of the magnitude of typical U.S. dollar trends). While the current rally in the U.S. dollar has lasted seven years from its trough in 2008, the dollar has only advanced 38%. If the dollar were to continue to rally, it wouldn’t be outside the “normal” band for currency movements. Plus, one could argue that the true bottom didn’t occur until 2011 when the dollar bottomed against the yen and the Australian dollar. Fundamentally, there are compelling reasons why the dollar could continue to rally. The three biggest are: Continued uncertainty surrounding sovereign debt for Eurozone countries could cause institutions and individuals to gravitate away from euros and towards U.S. dollars. A weakening Chinese economy and lower oil prices are challenges for natural resource countries like Canada and Australia. This trend is just beginning and should continue to weigh on the Canadian and Australian dollars. Rising interest rates in the U.S. should make dollar-denominated deposits more attractive. As treasury yields rise, more international investors will convert savings to dollars and buy government bonds. While short-term movements in currencies are difficult to game, we believe that the bullish trend for the U.S. dollar is still intact, and that it will pressure earnings for international consumer staples companies. The U.S. Dollar Remains a Challenge for Q2 Results Despite a few weeks of sideways trading, the U.S. dollar remains significantly elevated from where it was last year. Today, the U.S. dollar is 21% stronger versus the euro than at this time last year. The U.S. dollar is 18% stronger versus the Australian dollar than at this time last year. The U.S. dollar is 13% stronger versus the Canadian dollar than at this time last year. When U.S. consumer staples companies with international sales report second quarter metrics next month, they will be up against a significant headwind. Last year during the second quarter, these companies did not face a strong dollar. This year, earnings will not compare favorably to last year’s numbers. At this point, it doesn’t matter what the U.S. dollar is going to do when it comes to second quarter results. Instead, it matters where the dollar is versus at this time last year. The key will be how investors respond to the reports. If they see the strong U.S. dollar as a temporary issue, investors may once again look the other way and the stocks may hold up. But if investors are worried about continued strength in the U.S. dollar, we believe that international consumer staples companies will trade lower in the days leading up to and following their second quarter announcements. With the Fed on tap to release its June statement tomorrow (this article is being penned after the close on Tuesday, June 16th), we could be in danger of seeing another spike in the U.S. dollar this week. Any hawkish rhetoric from the Fed, or any indication that the first rate hike will come in September could send the U.S. dollar higher. In an environment where the dollar is once again on the move, we don’t expect investors to give international consumer staples stocks the benefit of the doubt when it comes to the second quarter earnings announcements. Three Major Challenges So when it comes to consumer staples stocks, we’re decidedly cautious. We prefer to avoid these risky shares while waiting for three major challenges to pass. These challenges are: An unwinding of the “reach for yield” A curtailment of “engineered growth” A strong U.S. dollar headwind. Scalper1 News

Scalper1 News