Scalper1 News

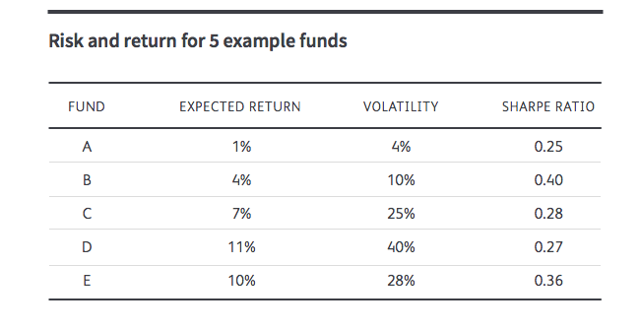

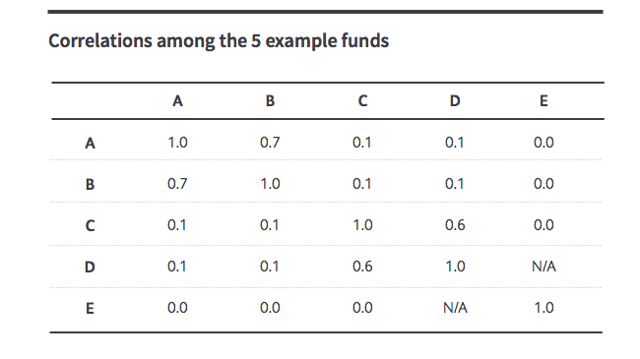

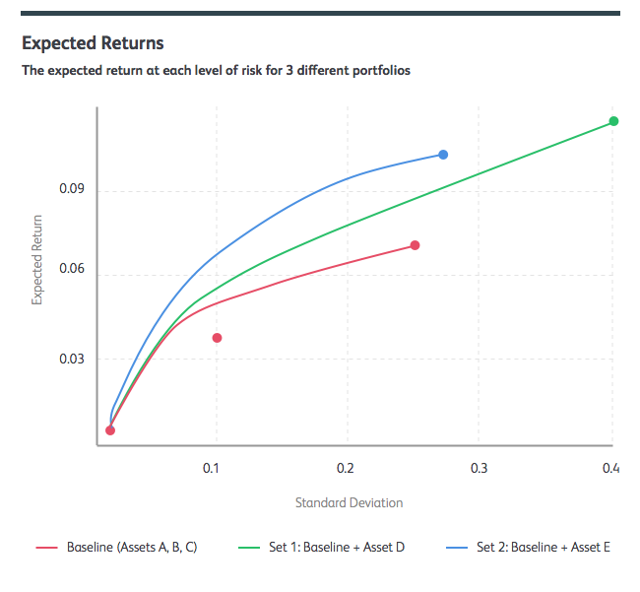

By Andy Rachleff We get a lot of questions about why we choose certain exchange-traded funds in our portfolios and not others. Often, readers of our blog will point out that this or that ETF has outperformed one of the ETFs we recommend for our portfolios. We love getting feedback, but in this case, our readers are failing to see the forest for the trees. Specifically, they’re evaluating things in isolation, when what matters is how a particular ETF works in a portfolio. Sports fans know this idea well. Teams will sign players with superstar statistics, only to see their overall team performance suffer, as the player doesn’t mesh well with others. Conversely, teams may add role players, only to see their team overall performance soar. The same is true in portfolios: What matters is not just the returns of an individual ETF, but its relationship to the other funds in the portfolio. When Is A Hot Performing Fund A Bad Idea? When you construct a portfolio using Modern Portfolio Theory, you’re required to estimate three things: The expected returns of each asset class in the portfolio. The expected volatility of each asset class in the portfolio. The correlations between each asset class in the portfolio. Let’s imagine you have two portfolios, each of which owns 4 funds. Portfolio 1 holds funds A, B, C and D, while Portfolio 2 holds funds A, B, C and E. Over a one-year time period, we expect to see the following returns and volatility for each fund. (click to enlarge) As a stand-alone investment for a risk-tolerant investor, fund D appears very attractive: It has the highest expected return. But you also have to consider volatility and correlations when determining which ETFs will maximize the risk adjusted return for the overall portfolio. In this case fund D is reasonably correlated to the other funds, whereas fund E is entirely uncorrelated. It marches to its own drummer. (click to enlarge) If you run these portfolios through an optimizer, it will spit out the mix of assets that maximizes the portfolio’s return for every level of risk/volatility. The graph below displays the expected return at every level of risk for three different portfolios: One with just funds A, B and C (red line), one with A, B, C and Fund D (green line) and one with A, B, C and Fund E (blue line). In every case, the portfolio containing Fund E delivers more return per unit of risk than the competing portfolios – despite the fact that Fund D has a higher expected return than Fund E. (click to enlarge) The only case that can be made for the portfolio containing fund D is for investors that are extraordinarily risk-tolerant and searching out the highest absolute return. But even portfolios that are nearly 100% concentrated in fund D barely outperform our A/B/C/E portfolio (and certainly fail on a risk-adjusted basis). At Wealthfront, we evaluate ETFs in the context of their position in a portfolio. That places extra emphasis on funds with low correlations to other funds, and funds that can deliver consistent strong risk-adjusted returns. In a future post, we’ll discuss why we generally favor Vanguard ETFs over their competitors. But even with our overall predilection for Vanguard products, the important thing is the same: All selections must be made in the context of an overall portfolio. Even if that means you leave a hot-performer by the wayside. Disclosure The information provided here is for educational purposes only. Nothing in this article should be construed as a tax advice, solicitation or offer, or recommendation, to buy or sell any security. There is a potential for loss as well as gain. Actual investors on Wealthfront may experience different results from the results shown. Past performance is no guarantee of future results. Andy is Wealthfront’s co-founder and its first CEO. He is now serving as Chairman of Wealthfront’s board and company Ambassador. A co-founder and former General Partner of venture capital firm Benchmark Capital, Andy is on the faculty of the Stanford Graduate School of Business, where he teaches a variety of courses on technology entrepreneurship. He also serves on the Board of Trustees of the University of Pennsylvania and is the Vice Chairman of their endowment investment committee. Andy earned his BS from the University of Pennsylvania and his M.B.A. from Stanford Graduate School of Business. Scalper1 News

By Andy Rachleff We get a lot of questions about why we choose certain exchange-traded funds in our portfolios and not others. Often, readers of our blog will point out that this or that ETF has outperformed one of the ETFs we recommend for our portfolios. We love getting feedback, but in this case, our readers are failing to see the forest for the trees. Specifically, they’re evaluating things in isolation, when what matters is how a particular ETF works in a portfolio. Sports fans know this idea well. Teams will sign players with superstar statistics, only to see their overall team performance suffer, as the player doesn’t mesh well with others. Conversely, teams may add role players, only to see their team overall performance soar. The same is true in portfolios: What matters is not just the returns of an individual ETF, but its relationship to the other funds in the portfolio. When Is A Hot Performing Fund A Bad Idea? When you construct a portfolio using Modern Portfolio Theory, you’re required to estimate three things: The expected returns of each asset class in the portfolio. The expected volatility of each asset class in the portfolio. The correlations between each asset class in the portfolio. Let’s imagine you have two portfolios, each of which owns 4 funds. Portfolio 1 holds funds A, B, C and D, while Portfolio 2 holds funds A, B, C and E. Over a one-year time period, we expect to see the following returns and volatility for each fund. (click to enlarge) As a stand-alone investment for a risk-tolerant investor, fund D appears very attractive: It has the highest expected return. But you also have to consider volatility and correlations when determining which ETFs will maximize the risk adjusted return for the overall portfolio. In this case fund D is reasonably correlated to the other funds, whereas fund E is entirely uncorrelated. It marches to its own drummer. (click to enlarge) If you run these portfolios through an optimizer, it will spit out the mix of assets that maximizes the portfolio’s return for every level of risk/volatility. The graph below displays the expected return at every level of risk for three different portfolios: One with just funds A, B and C (red line), one with A, B, C and Fund D (green line) and one with A, B, C and Fund E (blue line). In every case, the portfolio containing Fund E delivers more return per unit of risk than the competing portfolios – despite the fact that Fund D has a higher expected return than Fund E. (click to enlarge) The only case that can be made for the portfolio containing fund D is for investors that are extraordinarily risk-tolerant and searching out the highest absolute return. But even portfolios that are nearly 100% concentrated in fund D barely outperform our A/B/C/E portfolio (and certainly fail on a risk-adjusted basis). At Wealthfront, we evaluate ETFs in the context of their position in a portfolio. That places extra emphasis on funds with low correlations to other funds, and funds that can deliver consistent strong risk-adjusted returns. In a future post, we’ll discuss why we generally favor Vanguard ETFs over their competitors. But even with our overall predilection for Vanguard products, the important thing is the same: All selections must be made in the context of an overall portfolio. Even if that means you leave a hot-performer by the wayside. Disclosure The information provided here is for educational purposes only. Nothing in this article should be construed as a tax advice, solicitation or offer, or recommendation, to buy or sell any security. There is a potential for loss as well as gain. Actual investors on Wealthfront may experience different results from the results shown. Past performance is no guarantee of future results. Andy is Wealthfront’s co-founder and its first CEO. He is now serving as Chairman of Wealthfront’s board and company Ambassador. A co-founder and former General Partner of venture capital firm Benchmark Capital, Andy is on the faculty of the Stanford Graduate School of Business, where he teaches a variety of courses on technology entrepreneurship. He also serves on the Board of Trustees of the University of Pennsylvania and is the Vice Chairman of their endowment investment committee. Andy earned his BS from the University of Pennsylvania and his M.B.A. from Stanford Graduate School of Business. Scalper1 News

Scalper1 News