Scalper1 News

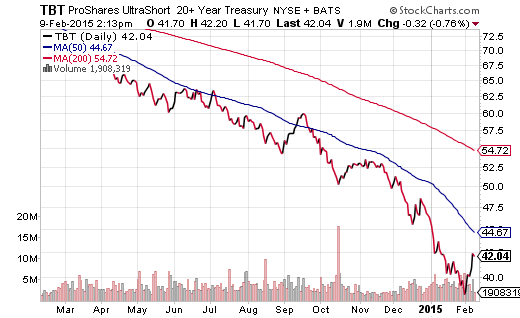

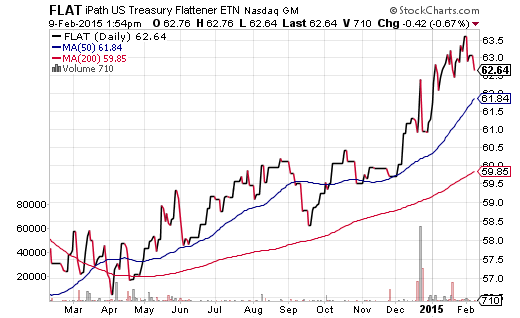

As much as economists, Wall Street and the White House cheered the upwardly revised labor data, few dared to ask if the job growth gains are as good as they will get. With the labor force participation rate still mired in the 1970s, the need for safer haven assets like long-dated U.S. Treasuries will not disappear. Waning labor force participation, international uncertainty and poor earnings leading to pricey P/E ratios are just some of the reasons why I am bullish on treasuries. When Jack Nicholson won his third Best Actor award in 1997’s “As Good As It Gets,” he may have chuckled at the knowledge that he’d never have it so good again. Who wins four Academy Awards for Best Actor in a motion picture? Nobody. (Yes, I checked… and Katherine Hepburn won four Oscars for Best Actress.) The problem with reaching a pinnacle, of course, is that your options are limited. You might be able to hang out on top of the world for a while. Or more likely, you’re going to fall down the mountain. As much as economists, Wall Street and the White House cheered the upwardly revised labor data, few dared to ask if the job growth gains are as good as they will get. Perhaps ironically, the CEO of Gallup questioned the veracity of the Bureau of Labor Statistics data itself, expressing that the “…suffering of the long-term and often permanently unemployed as well as the depressingly underemployed, amounts to a Big Lie.” Yet I could not find anyone who wondered if employers might not sit on those wallets in the months ahead. Here are three reasons why employers may not be as excited about hiring going forward: Small business creation remains well below small business conclusion . Throughout U.S. history, small employers have been responsible for the lion’s share of new jobs. In every year since 2008, however, more small businesses have called it quits than have opened shop. How can the largest employers make up for this trend, particularly when energy firms are laying off personnel and the strong U.S. dollar encourages large multinational corporations to hire cheaper labor abroad? Earnings across most sectors are already in trouble . How unattractive has the latest earnings season been for the S&P 500? Earnings growth for Q4 2014 may come in a 1.5%, far below the 7%-10% that analysts have come to expect. Yes, we can blame the energy sector for most of the damage, but truthfully, most economic segments underperformed. Worse yet, as recent as 9/30, analysts expected Q1 2015 to see earnings growth near 10%. Now the average for Q1 and Q2 has turned negative. Large companies may find it more appealing to use exceptionally low bond yields to issue more debt and buy back shares to boost the bottom line, rather than hire domestically at a time when the dollar is strong and foreign economies are decelerating. International Uncertainty . The Middle East is battling lost oil revenue as well as ISIS. Russia is battling lost oil revenue as well as Ukraine. And QE-euphoria is already fading. In particular, the new leadership in Greece may be taking a hard line on renegotiating the terms of its bailout. Meanwhile, Spanish and Italian bond yields have rocketed higher than they have in more than four months. Can you spell contagion? Even if you cannot spell it, does this sound like a global environment that is conducive to a “ramping up” of hiring? While I have been wrong on headline jobs numbers over the past year, I maintain that the size of the labor force and the percentage of those people working within in it more accurately reflect the state of employment in the U.S. With the labor force participation rate still mired in the 1970s, the need for safer haven assets like long-dated U.S. Treasuries will not disappear. Waning labor force participation, international uncertainty and poor earnings leading to pricey P/E ratios are just some of the reasons why I am bullish on treasuries. The other reasons? Roughly 1/6 of the world’s sovereign debt have negative yields, including the German 5-year and the Swiss 10-year. It follows that any liquidity/money that can get its hands on perceived safety (U.S. treasuries) for a better yield (10-year 1.9%) and price appreciation potential… who wouldn’t want that? ETFs like the ProShares UltraShort 7-10 Year Treasury ETF (NYSEARCA: PST ) and the ProShares UltraShort 20+ Year Treasury ETF (NYSEARCA: TBT ) simply do not stand a chance. Readers are well acquainted with my 14-month guidance on why rates would fall, the yield curve would flatten and how investors could profit from it. Some ETF enthusiasts might like the iPath U.S. Treasury Flattener ETN (NASDAQ: FLAT ). Most readers already recognize that my clients at Pacific Park Financial, Inc. own funds like the Vanguard Extended Duration Treasury ETF (NYSEARCA: EDV ). Use recent weakness in long-dated treasuries, as well as the 50-day trendline, to acquire positions. Click here for Gary’s latest podcast. Disclosure: Gary Gordon, MS, CFP is the president of Pacific Park Financial, Inc., a Registered Investment Adviser with the SEC. Gary Gordon, Pacific Park Financial, Inc, and/or its clients may hold positions in the ETFs, mutual funds, and/or any investment asset mentioned above. The commentary does not constitute individualized investment advice. The opinions offered herein are not personalized recommendations to buy, sell or hold securities. At times, issuers of exchange-traded products compensate Pacific Park Financial, Inc. or its subsidiaries for advertising at the ETF Expert web site. ETF Expert content is created independently of any advertising relationships. Scalper1 News

As much as economists, Wall Street and the White House cheered the upwardly revised labor data, few dared to ask if the job growth gains are as good as they will get. With the labor force participation rate still mired in the 1970s, the need for safer haven assets like long-dated U.S. Treasuries will not disappear. Waning labor force participation, international uncertainty and poor earnings leading to pricey P/E ratios are just some of the reasons why I am bullish on treasuries. When Jack Nicholson won his third Best Actor award in 1997’s “As Good As It Gets,” he may have chuckled at the knowledge that he’d never have it so good again. Who wins four Academy Awards for Best Actor in a motion picture? Nobody. (Yes, I checked… and Katherine Hepburn won four Oscars for Best Actress.) The problem with reaching a pinnacle, of course, is that your options are limited. You might be able to hang out on top of the world for a while. Or more likely, you’re going to fall down the mountain. As much as economists, Wall Street and the White House cheered the upwardly revised labor data, few dared to ask if the job growth gains are as good as they will get. Perhaps ironically, the CEO of Gallup questioned the veracity of the Bureau of Labor Statistics data itself, expressing that the “…suffering of the long-term and often permanently unemployed as well as the depressingly underemployed, amounts to a Big Lie.” Yet I could not find anyone who wondered if employers might not sit on those wallets in the months ahead. Here are three reasons why employers may not be as excited about hiring going forward: Small business creation remains well below small business conclusion . Throughout U.S. history, small employers have been responsible for the lion’s share of new jobs. In every year since 2008, however, more small businesses have called it quits than have opened shop. How can the largest employers make up for this trend, particularly when energy firms are laying off personnel and the strong U.S. dollar encourages large multinational corporations to hire cheaper labor abroad? Earnings across most sectors are already in trouble . How unattractive has the latest earnings season been for the S&P 500? Earnings growth for Q4 2014 may come in a 1.5%, far below the 7%-10% that analysts have come to expect. Yes, we can blame the energy sector for most of the damage, but truthfully, most economic segments underperformed. Worse yet, as recent as 9/30, analysts expected Q1 2015 to see earnings growth near 10%. Now the average for Q1 and Q2 has turned negative. Large companies may find it more appealing to use exceptionally low bond yields to issue more debt and buy back shares to boost the bottom line, rather than hire domestically at a time when the dollar is strong and foreign economies are decelerating. International Uncertainty . The Middle East is battling lost oil revenue as well as ISIS. Russia is battling lost oil revenue as well as Ukraine. And QE-euphoria is already fading. In particular, the new leadership in Greece may be taking a hard line on renegotiating the terms of its bailout. Meanwhile, Spanish and Italian bond yields have rocketed higher than they have in more than four months. Can you spell contagion? Even if you cannot spell it, does this sound like a global environment that is conducive to a “ramping up” of hiring? While I have been wrong on headline jobs numbers over the past year, I maintain that the size of the labor force and the percentage of those people working within in it more accurately reflect the state of employment in the U.S. With the labor force participation rate still mired in the 1970s, the need for safer haven assets like long-dated U.S. Treasuries will not disappear. Waning labor force participation, international uncertainty and poor earnings leading to pricey P/E ratios are just some of the reasons why I am bullish on treasuries. The other reasons? Roughly 1/6 of the world’s sovereign debt have negative yields, including the German 5-year and the Swiss 10-year. It follows that any liquidity/money that can get its hands on perceived safety (U.S. treasuries) for a better yield (10-year 1.9%) and price appreciation potential… who wouldn’t want that? ETFs like the ProShares UltraShort 7-10 Year Treasury ETF (NYSEARCA: PST ) and the ProShares UltraShort 20+ Year Treasury ETF (NYSEARCA: TBT ) simply do not stand a chance. Readers are well acquainted with my 14-month guidance on why rates would fall, the yield curve would flatten and how investors could profit from it. Some ETF enthusiasts might like the iPath U.S. Treasury Flattener ETN (NASDAQ: FLAT ). Most readers already recognize that my clients at Pacific Park Financial, Inc. own funds like the Vanguard Extended Duration Treasury ETF (NYSEARCA: EDV ). Use recent weakness in long-dated treasuries, as well as the 50-day trendline, to acquire positions. Click here for Gary’s latest podcast. Disclosure: Gary Gordon, MS, CFP is the president of Pacific Park Financial, Inc., a Registered Investment Adviser with the SEC. Gary Gordon, Pacific Park Financial, Inc, and/or its clients may hold positions in the ETFs, mutual funds, and/or any investment asset mentioned above. The commentary does not constitute individualized investment advice. The opinions offered herein are not personalized recommendations to buy, sell or hold securities. At times, issuers of exchange-traded products compensate Pacific Park Financial, Inc. or its subsidiaries for advertising at the ETF Expert web site. ETF Expert content is created independently of any advertising relationships. Scalper1 News

Scalper1 News