Scalper1 News

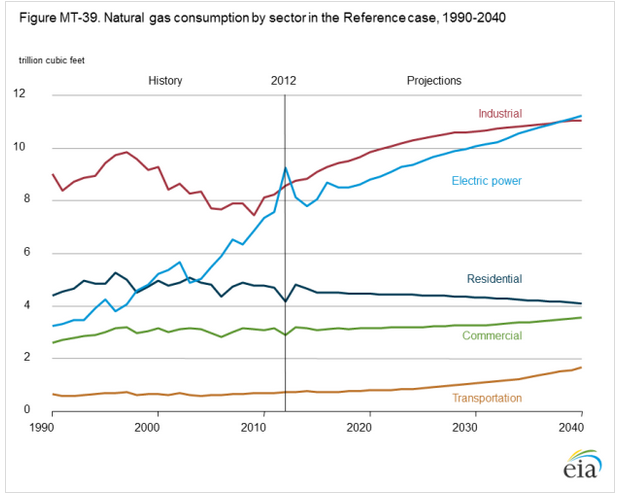

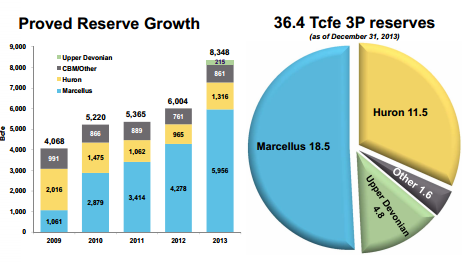

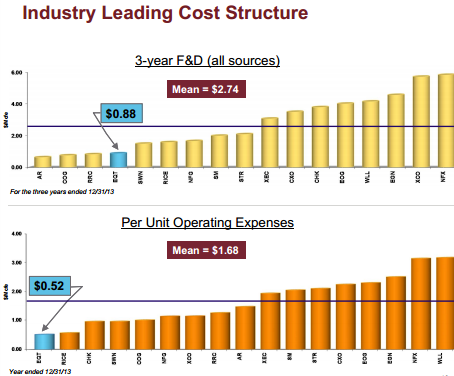

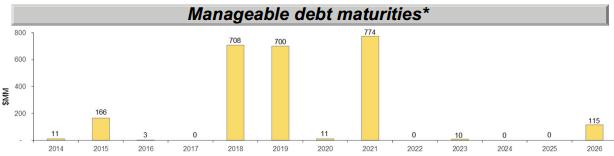

Summary EQT’s strong and well-diversified asset base will successfully support its ability to cater to the growing market. Moreover, the company plans to drill about 181 wells this year, which will further expand its production capacity. EQT’s leading cost structure and financial flexibility further aid its future growth. Based in Pittsburgh, Penn., EQT Corporation (NYSE: EQT ) is one of the largest natural gas producers in the Appalachian Basin and has been reporting healthy financial results for over a decade. Its improving financial performance year over year is indicative of the company’s strong business model. In my opinion, the company enjoys a strong competitive position in the market because of factors that not only support its future profitability, but also make it a worthy investment in the long term. Let’s analyze a few of these factors. Strong Asset Base Supports Its Ability to Successfully Cater to the Growing Market According to the U.S. Energy Information Administration (EIA), the demand for natural gas is expected to sharply rise in the coming years. Consumption is expected to increase from 25.6 trillion cubic feet (Tcf) in 2012 to about 31.6 Tcf in 2040, reflecting a compounded annual growth rate of nearly 0.7%. Except for residential, the use of natural gas is expected to rise in every end-use sector. The demand for gas in the residential sector has declined as a result of many U.S. citizens moving to warmer areas of the country. Source: EIA . I believe EQT can successfully accommodate the growing demand for natural gas as it owns a diversified and strong asset base. The company has been a major player in the Appalachian Basin for more than 120 years and seems to be taking full benefit of the Marcellus play, which is one of the most productive natural gas plays in North America. EQT owns about 3.6 million gross acres, which includes nearly 580,000 gross acres in the Marcellus play. It has total reserves of about 36.4 trillion cubic feet equivalent (Tcfe) of which half (18.5 Tcfe) are located in the Marcellus play, which has registered an annual growth rate of about 32% during the past few years. The company has over 14,500 gross productive wells, and has been witnessing a strong growth in its natural gas and oil reserves over the past few years. The total proved reserves grew from only 4,068 billion cubic feet equivalent (Bcfe) in 2009 to about 8,348 Bcfe in 2013. That reflects an annual increase of about 15%. Source: Investor Presentation . Moreover, the company plans to drill about 181 wells this year, which will further expand its production capacity — thus strengthening its ability to successfully cater to the growing market. Industry Leading Cost Structure and Financial Flexibility Accelerate Future Earnings EQT has an attractive cost structure that would definitely help it generate attractive profits, compared to those in its peer group. The company incurs nearly $0.88 per Mcfe of finding and development costs compared to the industry average of $2.74 Mcfe. The operating expenses per unit of $0.52 incurred by EQT is also much lower than the industry average of $1.68. Source: Investor Presentation . Furthermore, the company has ample liquidity to successfully execute its business plan. The total cash and cash equivalents and restricted cash increased from $845 million at the beginning of 2014 to nearly $1,355 million at the end of the third quarter of 2014, reflecting an attractive rise of about 60%. The company’s current net debt to total capital ratio is 21% and looks quite reasonable. Moreover, except for $166 million of debt maturing this year, no major debts/liabilities are payable earlier than 2018. The manageable debt maturities have raised EQT’s ability to appropriately finance future drilling operations and important projects, thus increasing its profitability. Source: Investor Presentation . A Risk to Consider Natural gas is a commodity and therefore the company receives market-based pricing. The market for natural gas is quite volatile and any fluctuation in its price can significantly affect EQT’s future revenues and profits. The current market scenario does not seem to favor EQT as natural gas prices continue to fall. During December 2014, the U.S. natural gas price declined below $3 per million British thermal units for the first time since 2012. The rapidly rising production of natural gas along with comparatively stable demand will put downward pressure on its price. According to some estimates, increasing natural gas production will leave inventories at a level of more than 4 trillion cubic feet by the end of October 2015. Analysts have lowered their estimates for average natural gas price in 2015 from $3.75 per million Btu to $3.60. Although EQT exercised a few hedging activities to protect its cash flows from exposure to the risk of changing commodity prices, it still cannot fully immunize itself from the any fluctuation in natural gas market. The company utilizes several derivatives commodity instruments, including NYMEX swaps, collars and futures where it enters into fixed price natural gas sales agreements. However, these agreements involve contracts that fix only the NYMEX portion of the price and contracts that fix the NYMEX and basis. In this way, the full price still cannot be hedged, thus putting the company’s future profitability at risk. Conclusion The sum and substance of my analysis is that EQT is well-positioned to cater to the growing natural gas market. EQT’s diversified and strong asset base and industry-leading cost structure give it an edge over its industry peers. Moreover, EQT’s financial flexibility further supports the successful execution of its business plan. Based on my analysis, I give the stock a buy rating. Disclosure: The author has no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More…) The author wrote this article themselves, and it expresses their own opinions. The author is not receiving compensation for it (other than from Seeking Alpha). The author has no business relationship with any company whose stock is mentioned in this article. Scalper1 News

Summary EQT’s strong and well-diversified asset base will successfully support its ability to cater to the growing market. Moreover, the company plans to drill about 181 wells this year, which will further expand its production capacity. EQT’s leading cost structure and financial flexibility further aid its future growth. Based in Pittsburgh, Penn., EQT Corporation (NYSE: EQT ) is one of the largest natural gas producers in the Appalachian Basin and has been reporting healthy financial results for over a decade. Its improving financial performance year over year is indicative of the company’s strong business model. In my opinion, the company enjoys a strong competitive position in the market because of factors that not only support its future profitability, but also make it a worthy investment in the long term. Let’s analyze a few of these factors. Strong Asset Base Supports Its Ability to Successfully Cater to the Growing Market According to the U.S. Energy Information Administration (EIA), the demand for natural gas is expected to sharply rise in the coming years. Consumption is expected to increase from 25.6 trillion cubic feet (Tcf) in 2012 to about 31.6 Tcf in 2040, reflecting a compounded annual growth rate of nearly 0.7%. Except for residential, the use of natural gas is expected to rise in every end-use sector. The demand for gas in the residential sector has declined as a result of many U.S. citizens moving to warmer areas of the country. Source: EIA . I believe EQT can successfully accommodate the growing demand for natural gas as it owns a diversified and strong asset base. The company has been a major player in the Appalachian Basin for more than 120 years and seems to be taking full benefit of the Marcellus play, which is one of the most productive natural gas plays in North America. EQT owns about 3.6 million gross acres, which includes nearly 580,000 gross acres in the Marcellus play. It has total reserves of about 36.4 trillion cubic feet equivalent (Tcfe) of which half (18.5 Tcfe) are located in the Marcellus play, which has registered an annual growth rate of about 32% during the past few years. The company has over 14,500 gross productive wells, and has been witnessing a strong growth in its natural gas and oil reserves over the past few years. The total proved reserves grew from only 4,068 billion cubic feet equivalent (Bcfe) in 2009 to about 8,348 Bcfe in 2013. That reflects an annual increase of about 15%. Source: Investor Presentation . Moreover, the company plans to drill about 181 wells this year, which will further expand its production capacity — thus strengthening its ability to successfully cater to the growing market. Industry Leading Cost Structure and Financial Flexibility Accelerate Future Earnings EQT has an attractive cost structure that would definitely help it generate attractive profits, compared to those in its peer group. The company incurs nearly $0.88 per Mcfe of finding and development costs compared to the industry average of $2.74 Mcfe. The operating expenses per unit of $0.52 incurred by EQT is also much lower than the industry average of $1.68. Source: Investor Presentation . Furthermore, the company has ample liquidity to successfully execute its business plan. The total cash and cash equivalents and restricted cash increased from $845 million at the beginning of 2014 to nearly $1,355 million at the end of the third quarter of 2014, reflecting an attractive rise of about 60%. The company’s current net debt to total capital ratio is 21% and looks quite reasonable. Moreover, except for $166 million of debt maturing this year, no major debts/liabilities are payable earlier than 2018. The manageable debt maturities have raised EQT’s ability to appropriately finance future drilling operations and important projects, thus increasing its profitability. Source: Investor Presentation . A Risk to Consider Natural gas is a commodity and therefore the company receives market-based pricing. The market for natural gas is quite volatile and any fluctuation in its price can significantly affect EQT’s future revenues and profits. The current market scenario does not seem to favor EQT as natural gas prices continue to fall. During December 2014, the U.S. natural gas price declined below $3 per million British thermal units for the first time since 2012. The rapidly rising production of natural gas along with comparatively stable demand will put downward pressure on its price. According to some estimates, increasing natural gas production will leave inventories at a level of more than 4 trillion cubic feet by the end of October 2015. Analysts have lowered their estimates for average natural gas price in 2015 from $3.75 per million Btu to $3.60. Although EQT exercised a few hedging activities to protect its cash flows from exposure to the risk of changing commodity prices, it still cannot fully immunize itself from the any fluctuation in natural gas market. The company utilizes several derivatives commodity instruments, including NYMEX swaps, collars and futures where it enters into fixed price natural gas sales agreements. However, these agreements involve contracts that fix only the NYMEX portion of the price and contracts that fix the NYMEX and basis. In this way, the full price still cannot be hedged, thus putting the company’s future profitability at risk. Conclusion The sum and substance of my analysis is that EQT is well-positioned to cater to the growing natural gas market. EQT’s diversified and strong asset base and industry-leading cost structure give it an edge over its industry peers. Moreover, EQT’s financial flexibility further supports the successful execution of its business plan. Based on my analysis, I give the stock a buy rating. Disclosure: The author has no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More…) The author wrote this article themselves, and it expresses their own opinions. The author is not receiving compensation for it (other than from Seeking Alpha). The author has no business relationship with any company whose stock is mentioned in this article. Scalper1 News

Scalper1 News