Scalper1 News

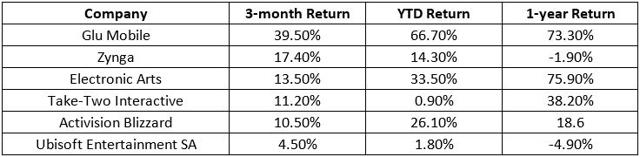

The video game’s annual interactive extravaganza event, Electronic Entertainment Expo, officially kicked off Monday at the Los Angeles Convention Center. Popularly called E3, the event showcases some exciting yet-to-be-launched game titles and consoles. What is interesting for mutual funds is that an American mutual fund firm has just became the largest shareholder in Nintendo ( OTCPK:NTDOY ). Apart from the craze for virtual reality systems, video streaming services and games specifically designed for PCs and mobile devices, many say the console games demand will prove its strength. That should again be good news for Nintendo and other console makers. According to DFC Intelligence estimates, sales of console systems including Xbox One, Nintendo’s Wii U and PlayStation 4, and their respective games may reach $15 billion in 2015. This is a 7% jump from last year. Also, there are a host of press conferences lined up from major companies, sparking further expectations for gamers and investors. Gaming industry giants like Sony (NYSE: SNE ), Microsoft Corp. (NASDAQ: MSFT ), Nintendo, UbiSoft Entertainment SA ( OTCPK:UBSFY ), and Bethesda Softworks, LLC are holding press conferences. Mutual funds having exposure to the video gaming industry are funds to watch out for now. U.S. Mutual Fund Now Top Nintendo Shareholder A filing with Japan’s Finance Ministry showed investment adviser to the American Funds family, Capital Research & Management, owned 16.4% stake in Nintendo. This is up from 15.3% in early March. This increased stake reflects the increasing amount of bets on the Japanese videogame company’s fortunes and revival efforts. Nintendo’s Wii U videogame console has lagged rivals like Sony’s PlayStation 4 and Microsoft’s Xbox One. However, Nintendo has been making efforts recently to gain momentum. Nintendo has made a move to expand its classic franchises into new areas. In March, Nintendo finally entered the mobile gaming business by collaborating with leading Japanese mobile game maker, DeNA. Under the deal, the two companies will develop gaming applications for smart devices based on Nintendo’s intellectual property. According to market research firm, NPD Group, the Nintendo 3DS video game console became the top selling video game hardware platform in the U.S. in February. Nintendo at E3 At E3, Nintendo will not have a traditional press conference. Instead, it will have the Nintendo Digital Event, a pre-recorded announcement. It will be streamed online on Jun 16. The company’s main highlights will be Fire Emblem X Shin Megami Tensei, Star Fox Wii U and Mario Maker. In the E3 event, Nintendo also had a Pre-E3 Super Smash Bros. video presentation on June 14. This had a lot of revelations about the Wii U and 3DS games’ futures and they are slated for major updates. Among other announcements, gamers are looking forward to the gameplay reveal for Star Fox (Wii U). It is the sequel to Nintendo Star Fox 64, which was announced after Nintendo’s E3 conference in 2014. Is E3 a Major Boost for Video Game Makers? The world’s biggest video game show definitely offers a major business opportunity for video game developers. These companies not only get to exhibit their upcoming titles and products but also create a certain hype, which helps drive sales, especially for titles/products launched after the E3 event. Of late, the video game industry hasn’t done too good financially. Last year, U.S. software sales of games declined 14% to $5.47 billion. However, hardware sales rose 20% to $5.07 billion, partly saving the industry with a 1% net increase in retail sales. Things went further downhill in the first half of 2015, with overall industry sales decreasing 13% to $507.6 million. Reportedly, software sales were down 25%, while hardware sales dropped 18% year over year. Video Game Industry Stock Performance The table below, presents the stock performance of some of the major players in the video game industry: (click to enlarge) Calculated via Google Finance Meanwhile, Sony has soared 87.7% over the 1-year period while its year-to-date return is 48.7%. However, Microsoft is down 1% so far this year and its 1-year return is 11.5%. US Mutual Funds’ Exposure to Gaming Industry E3 is a perfect platform for the video game industry with companies showcasing and promoting their upcoming products and experiences to boost demand. Since the event has kicked off, let’s look at the top mutual fund holders. Major fund houses like Fidelity and Vanguard have exposure to the video gaming industry. For example, Fidelity OTC Portfolio (MUTF: FOCPX ), carrying a Zacks Mutual Fund Rank #2 (Buy), holds 2.03% total shares in Activision. As of May 31, Vanguard Total Stock Market Index had 1.22% of total shares and as of Apr 30. According to Morningstar, Vanguard Mid-Cap Index (MUTF: VMCIX ) had 1.85% of total shares of Electronic Arts as of May 31. American Century Heritage Investor (MUTF: TWHIX ) and Prudential Jennison Mid Cap Growth A (MUTF: PEEAX ) are also major investors in Electronic Arts. While TWHIX carries a Zacks Mutual Fund Rank #3 (Hold), PEEAX holds a Zacks Mutual Fund Rank #4 (Sell). Coming to Nintendo, Fidelity Select Technology Portfolio (MUTF: FSPTX ), Fidelity Advisor Technology A (MUTF: FADTX ) and Praxis International Index A (MUTF: MPLAX ) own shares in the console maker. While FSPTX carries a Zacks Mutual Fund Rank #1 (Strong Buy), FADTX is Buy rated while MPLAX holds a Zacks Mutual Fund Rank #3. Original Post Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks. Scalper1 News

The video game’s annual interactive extravaganza event, Electronic Entertainment Expo, officially kicked off Monday at the Los Angeles Convention Center. Popularly called E3, the event showcases some exciting yet-to-be-launched game titles and consoles. What is interesting for mutual funds is that an American mutual fund firm has just became the largest shareholder in Nintendo ( OTCPK:NTDOY ). Apart from the craze for virtual reality systems, video streaming services and games specifically designed for PCs and mobile devices, many say the console games demand will prove its strength. That should again be good news for Nintendo and other console makers. According to DFC Intelligence estimates, sales of console systems including Xbox One, Nintendo’s Wii U and PlayStation 4, and their respective games may reach $15 billion in 2015. This is a 7% jump from last year. Also, there are a host of press conferences lined up from major companies, sparking further expectations for gamers and investors. Gaming industry giants like Sony (NYSE: SNE ), Microsoft Corp. (NASDAQ: MSFT ), Nintendo, UbiSoft Entertainment SA ( OTCPK:UBSFY ), and Bethesda Softworks, LLC are holding press conferences. Mutual funds having exposure to the video gaming industry are funds to watch out for now. U.S. Mutual Fund Now Top Nintendo Shareholder A filing with Japan’s Finance Ministry showed investment adviser to the American Funds family, Capital Research & Management, owned 16.4% stake in Nintendo. This is up from 15.3% in early March. This increased stake reflects the increasing amount of bets on the Japanese videogame company’s fortunes and revival efforts. Nintendo’s Wii U videogame console has lagged rivals like Sony’s PlayStation 4 and Microsoft’s Xbox One. However, Nintendo has been making efforts recently to gain momentum. Nintendo has made a move to expand its classic franchises into new areas. In March, Nintendo finally entered the mobile gaming business by collaborating with leading Japanese mobile game maker, DeNA. Under the deal, the two companies will develop gaming applications for smart devices based on Nintendo’s intellectual property. According to market research firm, NPD Group, the Nintendo 3DS video game console became the top selling video game hardware platform in the U.S. in February. Nintendo at E3 At E3, Nintendo will not have a traditional press conference. Instead, it will have the Nintendo Digital Event, a pre-recorded announcement. It will be streamed online on Jun 16. The company’s main highlights will be Fire Emblem X Shin Megami Tensei, Star Fox Wii U and Mario Maker. In the E3 event, Nintendo also had a Pre-E3 Super Smash Bros. video presentation on June 14. This had a lot of revelations about the Wii U and 3DS games’ futures and they are slated for major updates. Among other announcements, gamers are looking forward to the gameplay reveal for Star Fox (Wii U). It is the sequel to Nintendo Star Fox 64, which was announced after Nintendo’s E3 conference in 2014. Is E3 a Major Boost for Video Game Makers? The world’s biggest video game show definitely offers a major business opportunity for video game developers. These companies not only get to exhibit their upcoming titles and products but also create a certain hype, which helps drive sales, especially for titles/products launched after the E3 event. Of late, the video game industry hasn’t done too good financially. Last year, U.S. software sales of games declined 14% to $5.47 billion. However, hardware sales rose 20% to $5.07 billion, partly saving the industry with a 1% net increase in retail sales. Things went further downhill in the first half of 2015, with overall industry sales decreasing 13% to $507.6 million. Reportedly, software sales were down 25%, while hardware sales dropped 18% year over year. Video Game Industry Stock Performance The table below, presents the stock performance of some of the major players in the video game industry: (click to enlarge) Calculated via Google Finance Meanwhile, Sony has soared 87.7% over the 1-year period while its year-to-date return is 48.7%. However, Microsoft is down 1% so far this year and its 1-year return is 11.5%. US Mutual Funds’ Exposure to Gaming Industry E3 is a perfect platform for the video game industry with companies showcasing and promoting their upcoming products and experiences to boost demand. Since the event has kicked off, let’s look at the top mutual fund holders. Major fund houses like Fidelity and Vanguard have exposure to the video gaming industry. For example, Fidelity OTC Portfolio (MUTF: FOCPX ), carrying a Zacks Mutual Fund Rank #2 (Buy), holds 2.03% total shares in Activision. As of May 31, Vanguard Total Stock Market Index had 1.22% of total shares and as of Apr 30. According to Morningstar, Vanguard Mid-Cap Index (MUTF: VMCIX ) had 1.85% of total shares of Electronic Arts as of May 31. American Century Heritage Investor (MUTF: TWHIX ) and Prudential Jennison Mid Cap Growth A (MUTF: PEEAX ) are also major investors in Electronic Arts. While TWHIX carries a Zacks Mutual Fund Rank #3 (Hold), PEEAX holds a Zacks Mutual Fund Rank #4 (Sell). Coming to Nintendo, Fidelity Select Technology Portfolio (MUTF: FSPTX ), Fidelity Advisor Technology A (MUTF: FADTX ) and Praxis International Index A (MUTF: MPLAX ) own shares in the console maker. While FSPTX carries a Zacks Mutual Fund Rank #1 (Strong Buy), FADTX is Buy rated while MPLAX holds a Zacks Mutual Fund Rank #3. Original Post Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks. Scalper1 News

Scalper1 News