Scalper1 News

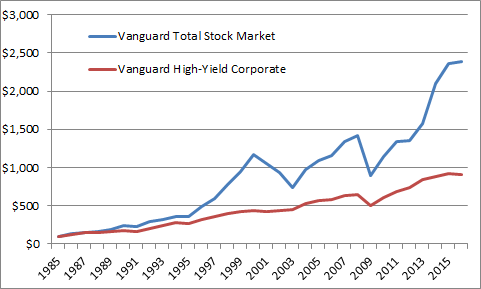

In my new paper on asset allocation I go into quite a bit of detail about why certain asset classes generate the returns they do. Understanding this is useful when thinking in a macro sense and trying to gauge why financial assets perform in certain ways in both the short-term and the long-term. It’s important to understand the fundamental drivers of these returns in order to avoid falling into the trap that these assets generate returns due to the way they’re traded in the markets. One of the more common misconceptions I see in the financial space is that credit traders are smarter than equity traders. This is usually presented with charts showing how credit “leads” equity performance or something like that. One of the more egregious offenders of this is a chart that has been going around in the last few days from Jeffrey Gundlach’s presentation showing credit relative to equity: One might look at this and conclude that these lines should necessarily converge at some point. As if the credit markets know something that the equity markets don’t. This is usually bandied about by bond traders who are convinced that stock traders are a bunch of dopes.¹ But this is silly when you think of things in aggregates because, in the long-run, the credit markets generate whatever the return is on the instruments that have been issued and not because bond traders are smarter or dumber than other people.² For instance, XYZ Corporate Bond paying 10% per year for 10 years doesn’t generate 10% for 10 years because bond traders are smart or stupid. It generates a 10% annualized return because the issuing entity pays that amount of income over the life of the bond. In fact, the more traders trade this bond the lower their real, real return will be. Trying to be overly clever about trading the bond, in the aggregate, only reduces the average return earned by its holders as taxes and fees chew into that 10% return. The “bond traders are smarter than stock traders” myth is hardly the most egregious myth at work here though. The bigger myth is the idea that equity must necessarily converge with credit over time. For instance, let’s change the time frame on our chart for a bit better perspective: If you’d bought into this notion that credit and equity converge starting in 1985 you would still be waiting for this great convergence. The reason for this is quite fundamental though. Corporate bonds only give owners access to a fixed rate of income expense paid by the issuing entity. Common stock, however, gives the owner access to the full potential profit in the long-term. If we think of common stock as a bond then common stock has essentially paid a 12% average annual coupon over the last 30 years while high yield bonds have only paid about a 8% coupon. In the most basic sense, credit and equity are different types of legal instruments giving the owner access to different potential streams of income. Equity, being the higher risk form of financing, will tend to reward its owners with higher returns over long periods of time. Why equity outperforms credit is hotly debated, but it makes sense that equity outperforms because the return on financing via equity must be higher than the potential return an investor will earn on otherwise safe assets. That is, if I am an entrepreneur who can earn 5% from a low risk bond it does not make sense for me to invest my capital in an instrument or entity that might not generate a greater return. In this sense, equity generates greater returns than credit because it’s not worth the extra risk to issue equity if the alternative is a relatively safe form of credit. Of course, it doesn’t always play out like this in the short-term, but if you think of equity as a sufficiently long-term instrument then it will tend to be true over the long-term because it’s the only rational reason for equity to be issued in the first place.³ ¹ – As an advocate of diversified indexing I can rightly be included as a “dope” about both asset classes. ² – This return could actually be lower due to defaults, callability, etc. ³ – “Long-term” in this instance has been calculated as at least a 25 year duration for equity. This is a sufficiently long period during which we should expect to see equity consistently earn a risk premium over credit. Scalper1 News

In my new paper on asset allocation I go into quite a bit of detail about why certain asset classes generate the returns they do. Understanding this is useful when thinking in a macro sense and trying to gauge why financial assets perform in certain ways in both the short-term and the long-term. It’s important to understand the fundamental drivers of these returns in order to avoid falling into the trap that these assets generate returns due to the way they’re traded in the markets. One of the more common misconceptions I see in the financial space is that credit traders are smarter than equity traders. This is usually presented with charts showing how credit “leads” equity performance or something like that. One of the more egregious offenders of this is a chart that has been going around in the last few days from Jeffrey Gundlach’s presentation showing credit relative to equity: One might look at this and conclude that these lines should necessarily converge at some point. As if the credit markets know something that the equity markets don’t. This is usually bandied about by bond traders who are convinced that stock traders are a bunch of dopes.¹ But this is silly when you think of things in aggregates because, in the long-run, the credit markets generate whatever the return is on the instruments that have been issued and not because bond traders are smarter or dumber than other people.² For instance, XYZ Corporate Bond paying 10% per year for 10 years doesn’t generate 10% for 10 years because bond traders are smart or stupid. It generates a 10% annualized return because the issuing entity pays that amount of income over the life of the bond. In fact, the more traders trade this bond the lower their real, real return will be. Trying to be overly clever about trading the bond, in the aggregate, only reduces the average return earned by its holders as taxes and fees chew into that 10% return. The “bond traders are smarter than stock traders” myth is hardly the most egregious myth at work here though. The bigger myth is the idea that equity must necessarily converge with credit over time. For instance, let’s change the time frame on our chart for a bit better perspective: If you’d bought into this notion that credit and equity converge starting in 1985 you would still be waiting for this great convergence. The reason for this is quite fundamental though. Corporate bonds only give owners access to a fixed rate of income expense paid by the issuing entity. Common stock, however, gives the owner access to the full potential profit in the long-term. If we think of common stock as a bond then common stock has essentially paid a 12% average annual coupon over the last 30 years while high yield bonds have only paid about a 8% coupon. In the most basic sense, credit and equity are different types of legal instruments giving the owner access to different potential streams of income. Equity, being the higher risk form of financing, will tend to reward its owners with higher returns over long periods of time. Why equity outperforms credit is hotly debated, but it makes sense that equity outperforms because the return on financing via equity must be higher than the potential return an investor will earn on otherwise safe assets. That is, if I am an entrepreneur who can earn 5% from a low risk bond it does not make sense for me to invest my capital in an instrument or entity that might not generate a greater return. In this sense, equity generates greater returns than credit because it’s not worth the extra risk to issue equity if the alternative is a relatively safe form of credit. Of course, it doesn’t always play out like this in the short-term, but if you think of equity as a sufficiently long-term instrument then it will tend to be true over the long-term because it’s the only rational reason for equity to be issued in the first place.³ ¹ – As an advocate of diversified indexing I can rightly be included as a “dope” about both asset classes. ² – This return could actually be lower due to defaults, callability, etc. ³ – “Long-term” in this instance has been calculated as at least a 25 year duration for equity. This is a sufficiently long period during which we should expect to see equity consistently earn a risk premium over credit. Scalper1 News

Scalper1 News