The Industrial Products sector, is currently positively placed at 3 out of a total 16 sectors we cover (top 19%). Last year, the industrial machinery sector was one of the most adversely impacted industries in the U.S, reeling from the uncertainties in the global arena.

This scenario can primarily be attributed to weak commodity prices, reduced investment in the energy sector as an aftermath of lower oil prices , poor economic conditions in some developed and developing nations, and Brexit. However, sentiment steadily improved thereafter, particularly following the victory of Donald Trump as investors anticipate his plans of big spending in infrastructure, and easing regulations for oil and coal exploration to help boost the industry.

The sector delivered a 6.7% increase in earnings in the fourth quarter. As per our projections , the sector will log a growth of 5.4% in first-quarter 2017. In the quarters ahead, governmental policies encouraging better trade relations, increase in infrastructural investments, job creation and high consumer-end demand will sustain growth for industrial machinery stocks. Until such improvements materialize, stocks with high investment rankings might interest investors seeking exposure in the machinery industry.

In the sector, two heavyweights that hog the limelight are Caterpillar, Inc. CAT and Deere & Company DE with market capitalizations of $ 54.21 billion and $ 33.5 billion, respectively. Caterpillar is the world’s largest manufacturer of construction and mining equipment and also dabbles in agricultural equipment. It falls under the Zacks categorized Manufacturing-Construction and Mining sub industry which is currently carrying a Rank of #59 (out of 265 industries we cover), being in the top 23%.

Deere is the one world’s foremost producers of agricultural equipment as well as a leading manufacturer of construction, forestry, and commercial and consumer equipment. It falls under the Zacks Categorized Manufacturing-Farm Equipment sub industry which is currently carrying a Rank of #105 (out of 265 industries we cover), being in the top 41%.

Investors keen on this sector would be inquisitive about which one has the more attractive prospects. Let’s look more closely at how Caterpillar and Deere fare on some key metrics to see which stock deserves to be a part of your portfolio.

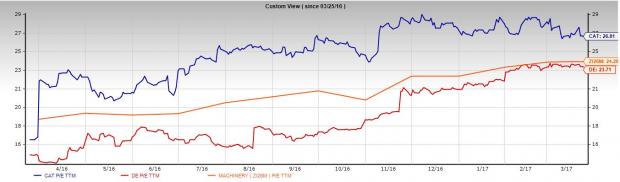

Stock Performance

Deere has gained 36.5% in the past one year, outperforming Caterpillar’s gain of 22.5% in the same time frame. While Deere has outpaced the Zacks categorized Machinery industry’s gain of 24.9%, Caterpillar has lagged the same. However, both have performed better than the Industrial Product sector’s rise of 19.8%.

Valuation

From a valuation perspective, the Caterpillar stock , which is trading at a forward P/E multiple of 26.81, is more expensive than the Deere stock which is trading a multiple of 23.71. Caterpillar is also expensive when compared with the industry multiple of 24.28, while the Deere Stock is cheaper.

Zacks Rank

Caterpillar currently carries a Zacks Rank #3 (Hold). While, Deere sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Long-Term Growth Expectations

In terms of long-term earnings growth expectations, Caterpillar scores above Deere with a projection of 9.50% compared with the latter’s 7.58%.

Dividend Yield

For income investors, Caterpillar has a higher dividend yield (3.33%) than Deere (2.19%).

Earnings Beat

Despite weak demand, both the companies have managed to beat estimates of late owing to cost cutting efforts. Caterpillar beat the Zacks Consensus Estimate in three the trailing four quarters, while coming in line in one quarter, with average earnings beat of 13.65%. Deere also has an impressive track record, beating the Zacks Consensus Estimate in all the four quarters, with an average earnings surprise of 60.50%.

Estimate Revisions Trend

For fiscal 2017, Caterpillar has witnessed, four downward estimate revisions with five upward movements in the last 60 days. For fiscal 2018, there have been three downward and three upward revisions in the same time frame. The Zacks Consensus Estimate for fiscal 2017 has edged up 1% to $ 3.24 while the estimate for fiscal 2017 has remained at $ 4.20 over the last 60 days.

While Deere has observed eleven estimates move north for fiscal 2017 in the last 60 days with no downward movement. For fiscal 2018, seven estimates have been revised upward. Over the said timeframe, the Zacks Consensus Estimate for Deere has moved up 4% to $ 4.76 for fiscal 2017 and for fiscal 2018, the estimate has moved up 4% to $ 5.47.

Results & Growth Prospects

Caterpillar’s continues to be affected by lower end-user demand. While commodity prices have improved from recent lows, it is not clear whether it is sufficient to drive increased demand for mining equipment. Meanwhile, despite a weak global agricultural sector, Deere continues to perform well driven by ongoing success of developing a more durable business model and wider range of revenue sources.

For both companies, improvement in construction and cost cutting are the keys to stay profitable. The construction industry has now entered a more mature phase of expansion, and construction spending can be anticipated to see moderate gains through 2017 and beyond.

Lately, both the companies’ share price has benefited from the victory of Donald Trump as investors expect his plans of big spending in infrastructure to help boost revenues. Further, investors appreciate the companies determined efforts to cut costs that will lead to margin expansion as revenues improve under President Trump.

However, Caterpillar is currently facing a federal probe regarding export filings related to its Swiss subsidiary CSARL. If the allegations are proved true, it will negatively impact the company. Thus it remains an overhang on the stock.

In Conclusion

Going by the above discussion, it can be said that Deere stands out as a better investment proposition compared with Caterpillar at this moment. With a favorable Zacks Rank and positive estimate revisions, the scale is tipped in Deere’s favor. Further, solid price movement ahead of the industry and cheaper valuation also make Deere a better bet.

Other Stocks to Consider

Apart from Deere, investors interested in the industrial products sector may also consider ACCO Brands Corp. ACCO and II-VI Inc. IIVI . ACCO Brands has delivered an average positive earnings surprise of 24.74% in the trailing four quarters. Both the companies sport the same rank as Deere. II-VI Incorporated has an average positive earnings surprise of 59.23% in the preceding four quarters.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $ 1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don’t buy now, you may kick yourself in 2020. Click here for the 6 trades >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

II-VI Incorporated (IIVI): Free Stock Analysis Report

Caterpillar, Inc. (CAT): Free Stock Analysis Report

Deere & Company (DE): Free Stock Analysis Report

Acco Brands Corporation (ACCO): Free Stock Analysis Report

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

Plantations International