Dean Foods CompanyDF appears promising, backed by its robust brand portfolio, ongoing strategic initiatives and focus on improving core business activities. All these endeavors position the company well to generate higher returns, going forward.

Shares of Dean Foods have yielded a return of nearly 32% in the past three months against the Zacks categorized Consumer Staples sector’s fall of 4%. Also, this Zacks Rank #2 (Buy) stock exhibits a VGM Score of “A” with a long-term earnings growth rate of 12%, highlighting its growth potential. Moreover, the company’s share price is currently hovering close to its 52-week high of $ 22.31.

Growth Factors

Dean Foods’ strong portfolio of brands provides a competitive advantage, alongside fortifying its customer base. In addition, being one of the low-cost producers, the company is well positioned in the industry, on one hand; while it strives to extend this advantage through cost-reduction activities across its business, on the other.

Further, management remains committed toward taking strategic steps to optimize its capital allocation and concentrate on core business activities. The company’s strategic measures are primarily focused on three controllable factors – price realization, cost productivity and volumes at margins – which will aid in delivering appropriate returns.

With this respect, the company underwent a major transformation into core dairy products in 2013 and has since been concentrating to enhance its dairy business. This is evident from its buyout of Friendly’s Ice Cream manufacturing and retail operations and continued success of its previously introduced DairyPure and TruMoo brands.

Backed by these factors and a healthy financial status, Dean Foods’ bottom line has outperformed estimates, by an average of 5.4% in the trailing four quarters. In third-quarter 2016, its earnings were in line with the Zacks Consensus Estimate and surged year over year, driven by a decline in raw milk prices . Also, sales exceeded estimates, thus scoring a hat-trick of positive sales surprises.

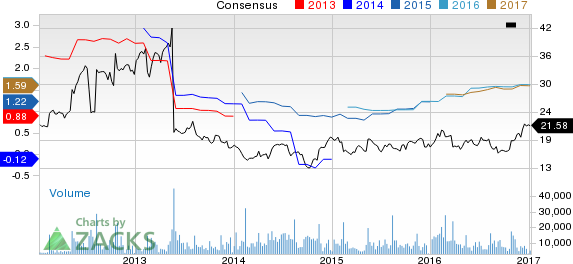

Dean Foods Company Price and Consensus

Dean Foods Company Price and Consensus | Dean Foods Company Quote

Stocks You May Consider

Other favorably placed stocks in the Consumer Staples sector include Archer-Daniels-Midland Company ADM , B&G Foods, Inc. BGS and Fresh Del Monte Produce Inc. FDP , all sporting a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here .

Archer Daniels, with a long-term earnings growth rate of 8.5%, has increased 30% in the past one year.

B&G Foods, with a long-term earnings growth rate of 8%, has gained roughly 25% in the past one year.

Fresh Del Monte Produce delivered a positive earnings surprise of 116.7% in the last reported quarter and has surged nearly 53.9% in the past one year.

Zacks’ Top Investment Ideas for Long-Term Profit

How would you like to see our best recommendations to help you find today’s most promising long-term stocks? Starting now, you can look inside our portfolios featuring stocks under $ 10, income stocks, value investments and more. These picks, which have double and triple-digit profit potential, are rarely available to the public. But you can see them now. Click here >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Fresh Del Monte Produce, Inc. (FDP): Free Stock Analysis Report

Dean Foods Company (DF): Free Stock Analysis Report

B&G Foods, Inc. (BGS): Free Stock Analysis Report

Archer-Daniels-Midland Company (ADM): Free Stock Analysis Report

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

Plantations International