Scalper1 News

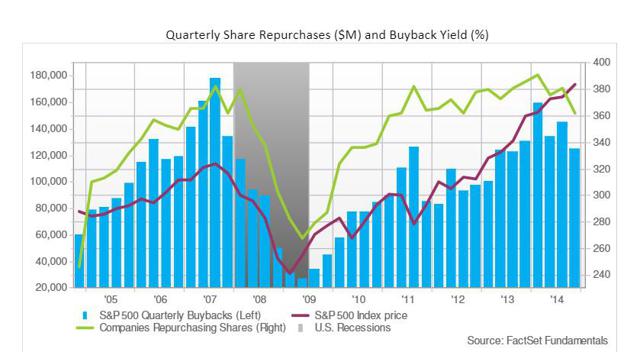

Summary Despite being a direct factor of long-term investor returns, few investors actually focus on identifying management teams that allocate capital well. Empirical studies suggest that even most management teams do not fully understand the importance of capital allocation on their business. The “holy grail” in investing is to find an excellent business, trading at a discount to fair value with a management team that allocates capital well. Introduction: Capital allocation is a topic of great importance to investors and management teams. At the core of any business is the simplistic NPV/IRR model which is used to answer a very simple question: Where should we invest? Whether a company invests in a new factory or an individual invests in a security, the concept is the same: If I outlay an amount today, how much will I expect to get in return in the future. Capital allocation in its simplest form is allocating capital from its various sources to its highest return. As author William Thorndike argued in his work, ” The Outsiders: Eight Unconventional CEOs and Their Radically Rational Blueprint for Success ,” the goal of a CEO is to properly allocate capital to its next highest return. The argument for such a quantitative measure of success is in stark contrast to the numerous more qualitative theories to excellent management. This article will focus on the goals of capital allocation and how an investor should logically assess the decisions management teams and Boards of Directors are making in regards to capital allocation decisions. As I previously mentioned in an older article, over long periods of time, compounding at higher rates creates exponential differences in ending values. Just like with investing, allocating capital in projects at high rates of return won’t matter as much in the short term but will matter tremendously in long term. Why Capital Allocation Matters: Capital allocation is the most critical aspect to generating long-term investment returns, yet despite many management teams making mention of the topic, their track record remains poor. A recent article posted in the HBR made a record of faults of current CEOs and their lack of focus on capital allocation. This is despite the fact that much of the financial theory regarding how value in a firm is created was first theorized in 1960s. So why do most CEOs perform poorly at what is arguably the most important for their position? A powerful argument, aptly discussed by legendary investor Warren Buffett in his 1987 Berkshire Hathaway (NYSE: BRK.A ) (NYSE: BRK.B ) Annual Letter, is that CEOs are more popularity contest than aptitude test. CEOs usually come up through the ranks of a company’s most important divisions such as sales, marketing, R&D or engineering. Their background and skill set is completely different as compared to what is actually required of them when they are promoted to CEO. This mismatch between a CEO’s background and the expectation for proper capital allocation by a firm’s investors has created the basis for typical activist investing. For all investors, the matter is still paramount when making investing decisions, especially those that are long term in nature. For the same exact business, excellent capital allocation will deliver excellent shareholder returns while poor capital allocation will do the opposite. How to Assess Capital Allocation Decisions: Management teams have a basic toolbox of decisions they can make to generate returns. The equation itself is relatively straightforward. First, capital can be obtained in four ways, the sale of debt, the sale of equity, the sale of assets and through internally generated operating cash flow. Next, the capital can be allocated in five different ways, either the issuance of dividends, the repurchase of stock, the retirement of debt, the purchase of other assets (M&A) or the reinvestment back into the business (i.e. Capex or net working capital additions.) Among each of these decisions, no specific one has precedence over the others. This is a critical concept that few investors or management teams truly appreciate. Whether capital is obtained through issuing debt or through operating cash flow, the capital is still finite and should be treated as such. A common misconception that many management teams and investors have is their view that operating cash flow is free and costless. This is not true as its real cost is the opportunity cost of other projects that could be done with the cash. Investors have been and should be upset when a management team uses operating cash flow to spend it on new internal projects with poor prospects of sufficient returns. Lastly, the question of capital allocation is not cut and dry. The best answer a management team could give investors regarding their view on capital allocation is: “it depends.” A common answer by some management teams might be to first spend on the business itself (new Capex or R&D) then pay a dividend and then use the rest of the excess capital for share repurchases. The graph below depicts this concept as share repurchases tend to peak during cyclical economic peaks, when operating cash flows are at their highest levels. (click to enlarge) This decision process is flawed, however, because capital should be allocated towards its next highest return. When a business is earning very high returns in its core business, reinvestment makes sense but if incremental returns are slowing, the company should not spend more despite the prospects of the business growing future revenues and profits. If the share price is substantially undervalued, the company should forego cash dividends and instead repurchase stock. If the share price is extremely expensive, M&A multiples far too high and all reinvestment opportunities exhausted, the last resort for management should be to pay a special cash dividend. This kind of flexibility in decision making may make investors nervous or less likely to buy a stock but it is the correct mindset for management teams who wish to drive attractive long-term shareholder returns. Finding Management Teams with Good Capital Allocation Skills: How does one find which management teams are apt at capital allocation? First, assess how a company’s management team discusses and presents its view on capital allocation. Does management think growth in the business should come at all costs? Are they beholden to a cash dividend no matter what other options for capital allocation exist? Do they not have an internal hurdle rate for returns when they do an M&A transaction? These types of viewpoints are indicative of a management team that does not have a solid grasp on proper capital allocation. Good management teams will describe the financial reasoning for their decisions. For example, for an M&A transaction, mentioning of the multiple to EBITDA or cash flow and how the deal is accretive to EPS and attractive on an ROIC basis are all needed to be sure the management team is doing due diligence. If a company is making share repurchases, they should make mention of their view on how undervalued the shares are. If the company is making share repurchases no matter what the multiple of the stock is to EPS or FCF, that is a telltale sign that management isn’t focused on capital allocation. Conclusion: Investors should be very wary of management teams and their capital allocation skills. Many CEOs move up through a company in divisions that don’t train them in proper capital allocation, leaving them less than apt at making investors above average shareholder returns. By staying focused on how management teams allocate capital, investors can figure out whether their investments’ management teams are making capital allocation decisions that maximize future shareholder returns. Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More…) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. Scalper1 News

Summary Despite being a direct factor of long-term investor returns, few investors actually focus on identifying management teams that allocate capital well. Empirical studies suggest that even most management teams do not fully understand the importance of capital allocation on their business. The “holy grail” in investing is to find an excellent business, trading at a discount to fair value with a management team that allocates capital well. Introduction: Capital allocation is a topic of great importance to investors and management teams. At the core of any business is the simplistic NPV/IRR model which is used to answer a very simple question: Where should we invest? Whether a company invests in a new factory or an individual invests in a security, the concept is the same: If I outlay an amount today, how much will I expect to get in return in the future. Capital allocation in its simplest form is allocating capital from its various sources to its highest return. As author William Thorndike argued in his work, ” The Outsiders: Eight Unconventional CEOs and Their Radically Rational Blueprint for Success ,” the goal of a CEO is to properly allocate capital to its next highest return. The argument for such a quantitative measure of success is in stark contrast to the numerous more qualitative theories to excellent management. This article will focus on the goals of capital allocation and how an investor should logically assess the decisions management teams and Boards of Directors are making in regards to capital allocation decisions. As I previously mentioned in an older article, over long periods of time, compounding at higher rates creates exponential differences in ending values. Just like with investing, allocating capital in projects at high rates of return won’t matter as much in the short term but will matter tremendously in long term. Why Capital Allocation Matters: Capital allocation is the most critical aspect to generating long-term investment returns, yet despite many management teams making mention of the topic, their track record remains poor. A recent article posted in the HBR made a record of faults of current CEOs and their lack of focus on capital allocation. This is despite the fact that much of the financial theory regarding how value in a firm is created was first theorized in 1960s. So why do most CEOs perform poorly at what is arguably the most important for their position? A powerful argument, aptly discussed by legendary investor Warren Buffett in his 1987 Berkshire Hathaway (NYSE: BRK.A ) (NYSE: BRK.B ) Annual Letter, is that CEOs are more popularity contest than aptitude test. CEOs usually come up through the ranks of a company’s most important divisions such as sales, marketing, R&D or engineering. Their background and skill set is completely different as compared to what is actually required of them when they are promoted to CEO. This mismatch between a CEO’s background and the expectation for proper capital allocation by a firm’s investors has created the basis for typical activist investing. For all investors, the matter is still paramount when making investing decisions, especially those that are long term in nature. For the same exact business, excellent capital allocation will deliver excellent shareholder returns while poor capital allocation will do the opposite. How to Assess Capital Allocation Decisions: Management teams have a basic toolbox of decisions they can make to generate returns. The equation itself is relatively straightforward. First, capital can be obtained in four ways, the sale of debt, the sale of equity, the sale of assets and through internally generated operating cash flow. Next, the capital can be allocated in five different ways, either the issuance of dividends, the repurchase of stock, the retirement of debt, the purchase of other assets (M&A) or the reinvestment back into the business (i.e. Capex or net working capital additions.) Among each of these decisions, no specific one has precedence over the others. This is a critical concept that few investors or management teams truly appreciate. Whether capital is obtained through issuing debt or through operating cash flow, the capital is still finite and should be treated as such. A common misconception that many management teams and investors have is their view that operating cash flow is free and costless. This is not true as its real cost is the opportunity cost of other projects that could be done with the cash. Investors have been and should be upset when a management team uses operating cash flow to spend it on new internal projects with poor prospects of sufficient returns. Lastly, the question of capital allocation is not cut and dry. The best answer a management team could give investors regarding their view on capital allocation is: “it depends.” A common answer by some management teams might be to first spend on the business itself (new Capex or R&D) then pay a dividend and then use the rest of the excess capital for share repurchases. The graph below depicts this concept as share repurchases tend to peak during cyclical economic peaks, when operating cash flows are at their highest levels. (click to enlarge) This decision process is flawed, however, because capital should be allocated towards its next highest return. When a business is earning very high returns in its core business, reinvestment makes sense but if incremental returns are slowing, the company should not spend more despite the prospects of the business growing future revenues and profits. If the share price is substantially undervalued, the company should forego cash dividends and instead repurchase stock. If the share price is extremely expensive, M&A multiples far too high and all reinvestment opportunities exhausted, the last resort for management should be to pay a special cash dividend. This kind of flexibility in decision making may make investors nervous or less likely to buy a stock but it is the correct mindset for management teams who wish to drive attractive long-term shareholder returns. Finding Management Teams with Good Capital Allocation Skills: How does one find which management teams are apt at capital allocation? First, assess how a company’s management team discusses and presents its view on capital allocation. Does management think growth in the business should come at all costs? Are they beholden to a cash dividend no matter what other options for capital allocation exist? Do they not have an internal hurdle rate for returns when they do an M&A transaction? These types of viewpoints are indicative of a management team that does not have a solid grasp on proper capital allocation. Good management teams will describe the financial reasoning for their decisions. For example, for an M&A transaction, mentioning of the multiple to EBITDA or cash flow and how the deal is accretive to EPS and attractive on an ROIC basis are all needed to be sure the management team is doing due diligence. If a company is making share repurchases, they should make mention of their view on how undervalued the shares are. If the company is making share repurchases no matter what the multiple of the stock is to EPS or FCF, that is a telltale sign that management isn’t focused on capital allocation. Conclusion: Investors should be very wary of management teams and their capital allocation skills. Many CEOs move up through a company in divisions that don’t train them in proper capital allocation, leaving them less than apt at making investors above average shareholder returns. By staying focused on how management teams allocate capital, investors can figure out whether their investments’ management teams are making capital allocation decisions that maximize future shareholder returns. Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More…) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. Scalper1 News

Scalper1 News