Scalper1 News

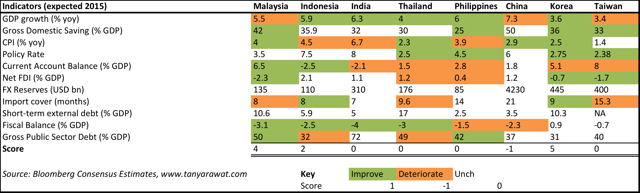

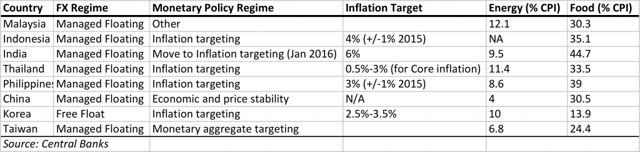

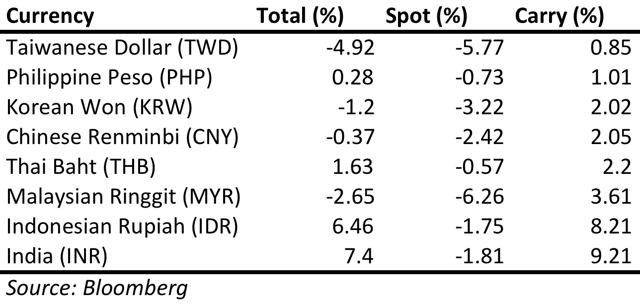

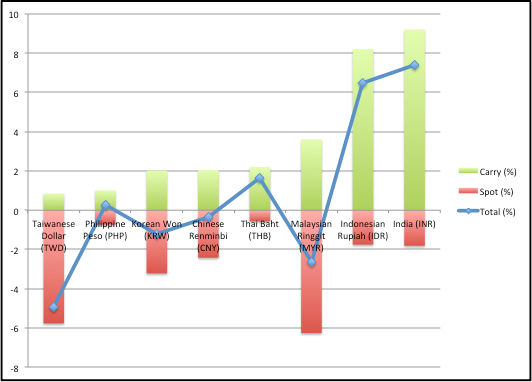

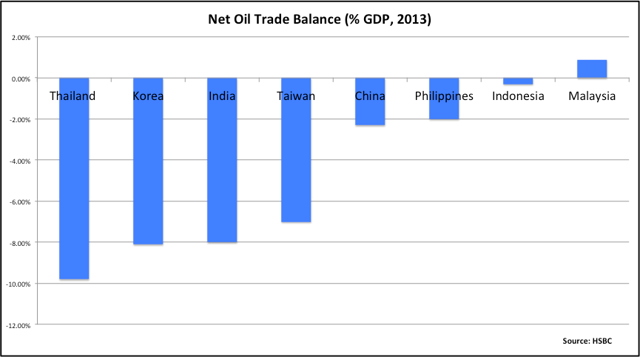

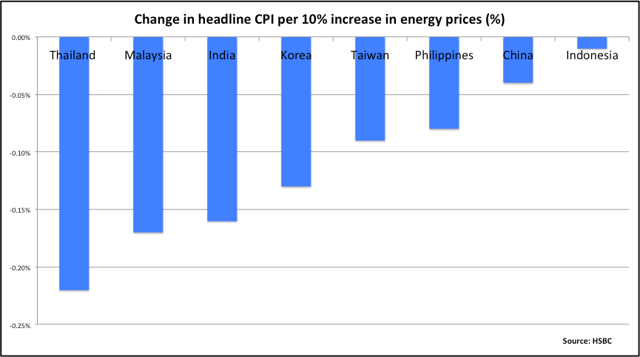

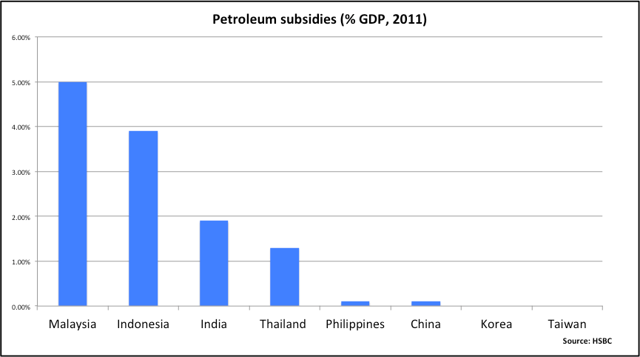

We are at crossroads of diverging monetary policies. GRI’s analyst Tanya Rawat breaks down what this means for investment in emerging markets (EM) in Asia. The U.S. gets ready to tighten policy rates whereas the Eurozone and Japan have adopted easing measures to invigorate economies at a risk of falling into a disinflationary cycle if not deflationary. Taking account of this paradigm shift, the lure of high carry, which some of the high yielding Asian currencies offer will no longer suffice, especially if U.S. Treasury yields were to rise quickly as well. The differentiating factor then in choosing the right investment destination in emerging market (EM) Asia will be domestic stability, external fundamental factors viz. current account balances, FX reserves, percentage of short-term liabilities backed by these reserves, robustness of FX policy and the credibility of the central banks. We use a rather simple scorecard methodology to choose probable winner and losers: (click to enlarge) Korea is the only the country with a positive fiscal balance and as a function of it, the lowest gross public sector debt. Add to this the layer of currency sensitivity to rising US interest rates, in 2014, the Korean Won performed the best with high core balance (current account balance + net FDI, both as a % of GDP), low real interest rates, REER undervaluation when compared to historical levels, a low leverage economy, high fiscal balance (% GDP), low gross public sector debt (% GDP) i.e. less susceptible to inflation and lastly sufficient FX cover. However, it does remain receptive to competitiveness from a weaker Yen and China’s growth uncertainty (largest export partners are China and the U.S.). Taiwan has the highest current account surplus, large FX Reserves and the highest import cover in the EM Asia universe. This makes it extremely robust to external shocks and there still remains room for inflation to catch up with the rest of the countries. While Malaysia scores well, investors should be sceptical as external FX vulnerability (exposure to changes in US rates) remains its Achilles’ heel and the country is also highly leveraged (household debt 86% of GDP). The Central bank has been sluggish in raising interest rates to curb this activity; the first hike of 25 bps since 2011 took place in the latter of 2014. Malaysia is a net oil exporter and thus remains to benefit the least from lower oil prices. Indonesia with the lowest current account balances (% GDP), import cover and highest short-term external debt (% of FX reserves), also remains quite vulnerable to US rate hikes. Also, it is one of only two countries on the planet with twin deficits; the other being India. However, the fiscal balance looks set to improve as the government stands to save highly due to elimination of fuel subsidy supported by lower oil prices, which now renders the current price cheaper than the subsidized rates. While India is neutral due to low core balance, low import cover and short-term external debt cover, it is positive that falling oil renders an improving current account balance, government savings on energy subsidies and ‘Modinomics’ that ensures momentum in economic reforms. Currently, all three rating agencies have India on a ‘Stable’ rating. Apart from offering the highest carry, inflation is trending lower as commodity prices continue to fall (CPI has a high sensitivity to energy prices) and monetary policy remains robust and supportive. Also, the Indian Central bank is keen to shift to inflation targeting from 2016 onwards (4% with deviation +/-2%). Thus far it has been enhancing credibility, largely by following prudent FX policy – absorbing portfolio inflows when they are strong and selling dollars when sentiment weakens. Reforms in the food market, rising investment in agriculture and a boost to rural productivity are necessary steps in the flight against persistently high inflation in India. Philippines and Thailand both have one of the lowest FX reserves in the world and food constitutes a high percentage of their CPI. Additionally, they do not fare well compared to other regions due to rising leverage and/or fiscal deficit, high portfolio liabilities and weaker core balances. Finally, while China offers the highest GDP growth (y-o-y) and has the largest FX reserves, it has one of the lowest current account balances (% GDP). Although signs of a fundamental slowdown in the economy became evident last year, the market was still one of the best performers in the world. This disconnect is worrying as the rapid increase in momentum came close in the heels of the opening the Chinese market to international investors via Stock-Connect. Recently, stimulus ‘steps’ are a case in point that the government is aware of this slowdown and is taking appropriate steps to alleviate the same. Investors should be skeptical of the China story simply on the basis that this time the stock market is lagging economic indicators, which maybe seen acting as a precedent to a deeper fundamental problem. Spending by the government may turn China into only the third region in the EM Asia universe with a twin deficit. (click to enlarge) (click to enlarge) 1-year (2013-14) performance of Asian EM currencies. Spot returns were trivial, while yield chasing was the norm given the rather benign carry environment. On such a playing field, the Indian Rupee was the prime victor (1M NDF Implied Yields). (Source: Bloomberg) (click to enlarge) With lower oil prices, Thailand, Indonesia, Taiwan and India standing to be relative gainers with Malaysia standing to lose as it is the only net exporter. (click to enlarge) Sensitivity of headline CPI changes to changes in energy costs. (click to enlarge) Even if the pass-through to consumer inflation is muted (as corporations will prefer to remain sluggish in lowering oil prices to maintain profitability), governments will eventually save on subsidies. Scalper1 News

We are at crossroads of diverging monetary policies. GRI’s analyst Tanya Rawat breaks down what this means for investment in emerging markets (EM) in Asia. The U.S. gets ready to tighten policy rates whereas the Eurozone and Japan have adopted easing measures to invigorate economies at a risk of falling into a disinflationary cycle if not deflationary. Taking account of this paradigm shift, the lure of high carry, which some of the high yielding Asian currencies offer will no longer suffice, especially if U.S. Treasury yields were to rise quickly as well. The differentiating factor then in choosing the right investment destination in emerging market (EM) Asia will be domestic stability, external fundamental factors viz. current account balances, FX reserves, percentage of short-term liabilities backed by these reserves, robustness of FX policy and the credibility of the central banks. We use a rather simple scorecard methodology to choose probable winner and losers: (click to enlarge) Korea is the only the country with a positive fiscal balance and as a function of it, the lowest gross public sector debt. Add to this the layer of currency sensitivity to rising US interest rates, in 2014, the Korean Won performed the best with high core balance (current account balance + net FDI, both as a % of GDP), low real interest rates, REER undervaluation when compared to historical levels, a low leverage economy, high fiscal balance (% GDP), low gross public sector debt (% GDP) i.e. less susceptible to inflation and lastly sufficient FX cover. However, it does remain receptive to competitiveness from a weaker Yen and China’s growth uncertainty (largest export partners are China and the U.S.). Taiwan has the highest current account surplus, large FX Reserves and the highest import cover in the EM Asia universe. This makes it extremely robust to external shocks and there still remains room for inflation to catch up with the rest of the countries. While Malaysia scores well, investors should be sceptical as external FX vulnerability (exposure to changes in US rates) remains its Achilles’ heel and the country is also highly leveraged (household debt 86% of GDP). The Central bank has been sluggish in raising interest rates to curb this activity; the first hike of 25 bps since 2011 took place in the latter of 2014. Malaysia is a net oil exporter and thus remains to benefit the least from lower oil prices. Indonesia with the lowest current account balances (% GDP), import cover and highest short-term external debt (% of FX reserves), also remains quite vulnerable to US rate hikes. Also, it is one of only two countries on the planet with twin deficits; the other being India. However, the fiscal balance looks set to improve as the government stands to save highly due to elimination of fuel subsidy supported by lower oil prices, which now renders the current price cheaper than the subsidized rates. While India is neutral due to low core balance, low import cover and short-term external debt cover, it is positive that falling oil renders an improving current account balance, government savings on energy subsidies and ‘Modinomics’ that ensures momentum in economic reforms. Currently, all three rating agencies have India on a ‘Stable’ rating. Apart from offering the highest carry, inflation is trending lower as commodity prices continue to fall (CPI has a high sensitivity to energy prices) and monetary policy remains robust and supportive. Also, the Indian Central bank is keen to shift to inflation targeting from 2016 onwards (4% with deviation +/-2%). Thus far it has been enhancing credibility, largely by following prudent FX policy – absorbing portfolio inflows when they are strong and selling dollars when sentiment weakens. Reforms in the food market, rising investment in agriculture and a boost to rural productivity are necessary steps in the flight against persistently high inflation in India. Philippines and Thailand both have one of the lowest FX reserves in the world and food constitutes a high percentage of their CPI. Additionally, they do not fare well compared to other regions due to rising leverage and/or fiscal deficit, high portfolio liabilities and weaker core balances. Finally, while China offers the highest GDP growth (y-o-y) and has the largest FX reserves, it has one of the lowest current account balances (% GDP). Although signs of a fundamental slowdown in the economy became evident last year, the market was still one of the best performers in the world. This disconnect is worrying as the rapid increase in momentum came close in the heels of the opening the Chinese market to international investors via Stock-Connect. Recently, stimulus ‘steps’ are a case in point that the government is aware of this slowdown and is taking appropriate steps to alleviate the same. Investors should be skeptical of the China story simply on the basis that this time the stock market is lagging economic indicators, which maybe seen acting as a precedent to a deeper fundamental problem. Spending by the government may turn China into only the third region in the EM Asia universe with a twin deficit. (click to enlarge) (click to enlarge) 1-year (2013-14) performance of Asian EM currencies. Spot returns were trivial, while yield chasing was the norm given the rather benign carry environment. On such a playing field, the Indian Rupee was the prime victor (1M NDF Implied Yields). (Source: Bloomberg) (click to enlarge) With lower oil prices, Thailand, Indonesia, Taiwan and India standing to be relative gainers with Malaysia standing to lose as it is the only net exporter. (click to enlarge) Sensitivity of headline CPI changes to changes in energy costs. (click to enlarge) Even if the pass-through to consumer inflation is muted (as corporations will prefer to remain sluggish in lowering oil prices to maintain profitability), governments will eventually save on subsidies. Scalper1 News

Scalper1 News