Scalper1 News

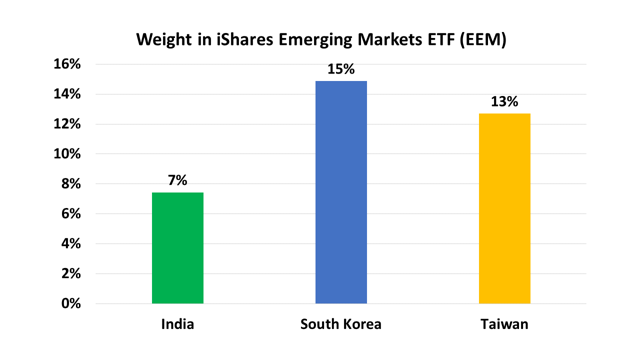

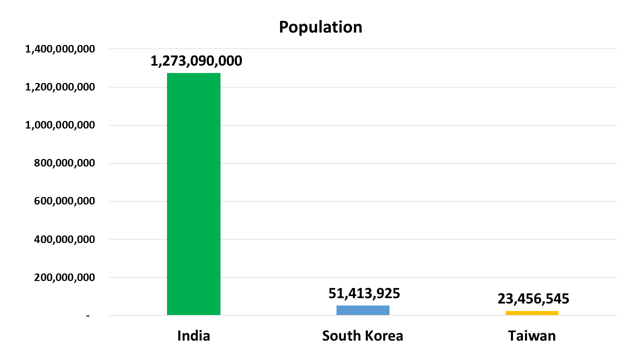

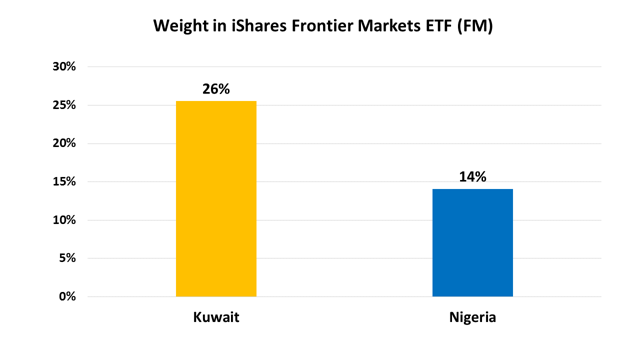

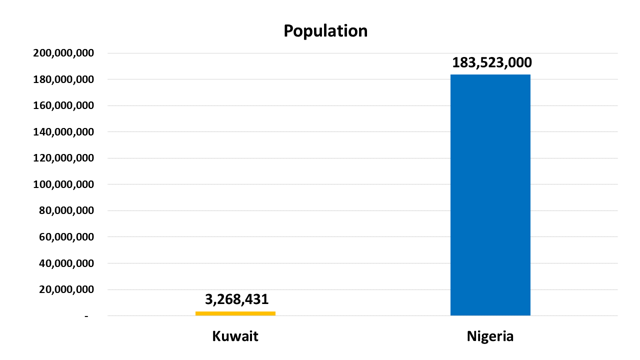

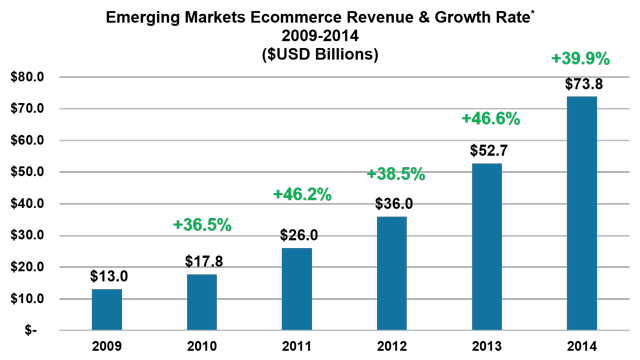

Summary Major Emerging Markets ETFs (EEM & VWO) are investing in the “legacy economy” and not in the “new economy”. Government owned Chinese banks, Brazilian oil companies and Russian resource companies dominate major ETFs. BABA, BIDU, MELI, YNDX and other US listed EM E-commerce companies are NOT in EEM & VWO. What’s wrong with Emerging Markets ETFs? After years of poor relative returns investors have become disinterested and disenchanted with the leading Emerging Markets ETFs ( EEM , VWO ). While the U.S. stock market has made new highs and posted double digit returns, Emerging Markets haven’t done much, leading many investors to question the value of their Emerging Markets allocations. Adding to the woes are headline risks that are really in the headlines as revolution, war, fraud and corruption have either happened in the recent past or are happening right now. But maybe there is a bigger problem. In spite of all the turmoil and risk, Emerging Markets are growing. In fact they are growing at twice the pace of the U.S. and the rest of the developing world. And some countries and sectors within Emerging Markets are growing at quite spectacular rates. But why then aren’t the indexes and ETFs that track Emerging Markets performing better? A closer look at the indexes reveals some major flaws in the largest Emerging Markets ETFs. SOEs are Not Seeking Alpha Weighing most heavily on the indexes is their enormous allocation to state-owned enterprises (SOEs) which account for nearly 30% of the weight of the largest Emerging Markets ETFs. These companies represent the past of Emerging Markets, but not the future. The largest of these SOEs are Chinese, Brazilian and Russian state owned banks and oil companies. Many adjectives describe SOEs including, monolithic, inefficient, conflicted and corrupt. You don’t need not look far to see the problems with investing in SOEs. Recent news has been filled with reports of the investigation of top Brazilian government officials suspected of plundering state-owned oil giant PetroBras of over $1 billion in kickbacks and bribes. The Chinese government has launched a campaign to return 150 “economic fugitives” living in the U.S. who have fled China after allegedly looting or defrauding state owned businesses. And in Russia, where do you even start? Is South Korea Twice as Big as India? Less widely recognized are some of the other factors that can distort the indexes. Traditional index construction methodology uses market capitalization to determine weightings, an approach that in Emerging Markets tends to overweight countries with large banks and financial companies and small populations. As a result, countries like South Korea and Taiwan end up with about twice the weight of India in the major Emerging Markets despite the fact that India has 25 times the population of Korea and 50 times that of Taiwan. Does that make sense? (click to enlarge) Source: Big Tree Capital LLC (click to enlarge) Source: Big Tree Capital LLC How are 3.4 million Rich People 26% of “the Next Emerging Markets”? Things get even worse in so-called Frontier Markets indexes and ETFs. While often dubbed as “the next Emerging Markets” by the fund companies, Kuwait, with a population of only 3.4 million and per capita GDP on par with the U.S. comprises 26% of the largest Frontier Markets ETF (NYSEARCA: FM ). How much room for growth is there with 3.4 million rich people? Meanwhile, Nigeria, with a population of 173 million gets only a 10% weighting. (click to enlarge) Source: Big Tree Capital LLC (click to enlarge) Source: Big Tree Capital LLC Where the Growth is in Emerging Markets Most Emerging Markets investors know that the real growth opportunity in Emerging Markets is the growth of the consumer class. There are dozens of studies and reports published by investment banks, consulting firms and fund companies describing how billions of humans are moving from subsistence income levels to levels where they begin to consume more and better food, clothing, appliances, cars, etc. It’s a very good story. It’s a big story. In a report titled “Going for Gold in Emerging Markets” McKinsey & Co concludes that the growth of consumption in Emerging Markets is “the biggest growth opportunity in the history of capitalism.” Yet, in the major Emerging Markets ETFs, the consumer sector gets a meager 16% weighting. EEM & VWO are Missing the Best Part Finally and importantly, the major indexes and ETFs are largely missing out on something big that is just starting. As the Emerging Markets consumer wave hits, another wave has formed and is gathering momentum. All over the developing world, consumers are getting internet access via wifi and mobile broadband. At the same time, a new breed of manufacturers is offering smartphones for as low as $40. And prices are going to keep dropping. Consider the case of Xiaomi – a Chinese manufacturer of entry level smartphones. The company – which is less than five years old – will sell about 100 mm smartphones this year, up from 60 million units sold in 2014. In the next 5 years a billion consumers will emerge with a $40 smartphone in their hands. The result of this trend is significant revenue growth and value creation. Estimates are that Ecommerce in Emerging Markets has grown at an average of 41.5% for the past five years. And, while this rate is sure to slow, it still clocked an impressive 39.9% growth in 2014. (click to enlarge) Source: EMQQ Index Yet, Alibaba (NYSE: BABA ), MercadoLibre (NASDAQ: MELI ), Baidu (NASDAQ: BIDU ), JD.com (NASDAQ: JD ), Yandex (NASDAQ: YNDX ), 58.com (NYSE: WUBA ) and most of the 50+ publicly traded Emerging Markets Ecommerce companies benefiting from this growth are not in EEM or VWO because they choose to list on U.S. exchanges. The companies are essentially being “punished” from an indexing perspective for listing on the exchanges that will give investors greater liquidity and transparency than their “home” markets. In short, the major ETFs and indexes are leaving out the future. Investors Should Move On Investors using ETFs to gain exposure to Emerging Markets should re-evaluate their allocations. Using legacy indexes and ETFs that provide exposure to the entire universe of Emerging Markets companies may not be the best way to benefit from the growth of Emerging Markets. Investors should concentrate on identifying the Emerging Markets ETFs that provide them with targeted exposure to sectors and companies that are both growing and seeking to maximize shareholder value. Disclosure: I am/we are long EMQQ, BABA, BIDU, YNDX, WUBA, JD, MELI. (More…) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article. Additional disclosure: I have created an Emerging Markets Internet & Ecommerce Index. The index has been licensed as the basis for EMQQ The Emerging Markets Internet & Ecommerce ETF (NYSE:EMQQ). I receive a licensing fee from the ETF. Scalper1 News

Summary Major Emerging Markets ETFs (EEM & VWO) are investing in the “legacy economy” and not in the “new economy”. Government owned Chinese banks, Brazilian oil companies and Russian resource companies dominate major ETFs. BABA, BIDU, MELI, YNDX and other US listed EM E-commerce companies are NOT in EEM & VWO. What’s wrong with Emerging Markets ETFs? After years of poor relative returns investors have become disinterested and disenchanted with the leading Emerging Markets ETFs ( EEM , VWO ). While the U.S. stock market has made new highs and posted double digit returns, Emerging Markets haven’t done much, leading many investors to question the value of their Emerging Markets allocations. Adding to the woes are headline risks that are really in the headlines as revolution, war, fraud and corruption have either happened in the recent past or are happening right now. But maybe there is a bigger problem. In spite of all the turmoil and risk, Emerging Markets are growing. In fact they are growing at twice the pace of the U.S. and the rest of the developing world. And some countries and sectors within Emerging Markets are growing at quite spectacular rates. But why then aren’t the indexes and ETFs that track Emerging Markets performing better? A closer look at the indexes reveals some major flaws in the largest Emerging Markets ETFs. SOEs are Not Seeking Alpha Weighing most heavily on the indexes is their enormous allocation to state-owned enterprises (SOEs) which account for nearly 30% of the weight of the largest Emerging Markets ETFs. These companies represent the past of Emerging Markets, but not the future. The largest of these SOEs are Chinese, Brazilian and Russian state owned banks and oil companies. Many adjectives describe SOEs including, monolithic, inefficient, conflicted and corrupt. You don’t need not look far to see the problems with investing in SOEs. Recent news has been filled with reports of the investigation of top Brazilian government officials suspected of plundering state-owned oil giant PetroBras of over $1 billion in kickbacks and bribes. The Chinese government has launched a campaign to return 150 “economic fugitives” living in the U.S. who have fled China after allegedly looting or defrauding state owned businesses. And in Russia, where do you even start? Is South Korea Twice as Big as India? Less widely recognized are some of the other factors that can distort the indexes. Traditional index construction methodology uses market capitalization to determine weightings, an approach that in Emerging Markets tends to overweight countries with large banks and financial companies and small populations. As a result, countries like South Korea and Taiwan end up with about twice the weight of India in the major Emerging Markets despite the fact that India has 25 times the population of Korea and 50 times that of Taiwan. Does that make sense? (click to enlarge) Source: Big Tree Capital LLC (click to enlarge) Source: Big Tree Capital LLC How are 3.4 million Rich People 26% of “the Next Emerging Markets”? Things get even worse in so-called Frontier Markets indexes and ETFs. While often dubbed as “the next Emerging Markets” by the fund companies, Kuwait, with a population of only 3.4 million and per capita GDP on par with the U.S. comprises 26% of the largest Frontier Markets ETF (NYSEARCA: FM ). How much room for growth is there with 3.4 million rich people? Meanwhile, Nigeria, with a population of 173 million gets only a 10% weighting. (click to enlarge) Source: Big Tree Capital LLC (click to enlarge) Source: Big Tree Capital LLC Where the Growth is in Emerging Markets Most Emerging Markets investors know that the real growth opportunity in Emerging Markets is the growth of the consumer class. There are dozens of studies and reports published by investment banks, consulting firms and fund companies describing how billions of humans are moving from subsistence income levels to levels where they begin to consume more and better food, clothing, appliances, cars, etc. It’s a very good story. It’s a big story. In a report titled “Going for Gold in Emerging Markets” McKinsey & Co concludes that the growth of consumption in Emerging Markets is “the biggest growth opportunity in the history of capitalism.” Yet, in the major Emerging Markets ETFs, the consumer sector gets a meager 16% weighting. EEM & VWO are Missing the Best Part Finally and importantly, the major indexes and ETFs are largely missing out on something big that is just starting. As the Emerging Markets consumer wave hits, another wave has formed and is gathering momentum. All over the developing world, consumers are getting internet access via wifi and mobile broadband. At the same time, a new breed of manufacturers is offering smartphones for as low as $40. And prices are going to keep dropping. Consider the case of Xiaomi – a Chinese manufacturer of entry level smartphones. The company – which is less than five years old – will sell about 100 mm smartphones this year, up from 60 million units sold in 2014. In the next 5 years a billion consumers will emerge with a $40 smartphone in their hands. The result of this trend is significant revenue growth and value creation. Estimates are that Ecommerce in Emerging Markets has grown at an average of 41.5% for the past five years. And, while this rate is sure to slow, it still clocked an impressive 39.9% growth in 2014. (click to enlarge) Source: EMQQ Index Yet, Alibaba (NYSE: BABA ), MercadoLibre (NASDAQ: MELI ), Baidu (NASDAQ: BIDU ), JD.com (NASDAQ: JD ), Yandex (NASDAQ: YNDX ), 58.com (NYSE: WUBA ) and most of the 50+ publicly traded Emerging Markets Ecommerce companies benefiting from this growth are not in EEM or VWO because they choose to list on U.S. exchanges. The companies are essentially being “punished” from an indexing perspective for listing on the exchanges that will give investors greater liquidity and transparency than their “home” markets. In short, the major ETFs and indexes are leaving out the future. Investors Should Move On Investors using ETFs to gain exposure to Emerging Markets should re-evaluate their allocations. Using legacy indexes and ETFs that provide exposure to the entire universe of Emerging Markets companies may not be the best way to benefit from the growth of Emerging Markets. Investors should concentrate on identifying the Emerging Markets ETFs that provide them with targeted exposure to sectors and companies that are both growing and seeking to maximize shareholder value. Disclosure: I am/we are long EMQQ, BABA, BIDU, YNDX, WUBA, JD, MELI. (More…) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article. Additional disclosure: I have created an Emerging Markets Internet & Ecommerce Index. The index has been licensed as the basis for EMQQ The Emerging Markets Internet & Ecommerce ETF (NYSE:EMQQ). I receive a licensing fee from the ETF. Scalper1 News

Scalper1 News