< div id= "articleText" readability =" 101.62382271468" > With the Q2 profits period industrious, capitalists are actually standing by to see exactly how the primary business do.

While determining the functionalities from farming supplies, our company keep in mind that headwinds like a cyclical slump of the farming market, weak agro product rates, growth of the united state unit of currency as well as economic stagnation in developing markets like China could limit development. Baseding on the Zacks Market distinction, the farming market is broadly assembled under Basic Materials, one from the 16 Zacks fields. Every our most current < a rel=" nofollow" > Earnings Preview write-up, this sector is most likely to underperform this revenues season.

Actually, our file dated Jul 22, 2016 indicates that overall profits for the field are anticipated to plunge 13.9% year over year in Q2, while incomes are actually assumed to drop 7.7%. Notably, the sector had actually watched a decrease from 15.7% and 8.6% in earnings and incomes, respectively, in Q1.

Recently, 2 of the leading firms coming from this market- Monsanto Firm < a href=http://” http://www.nasdaq.com/symbol/mon” > MON as well as Syngenta AG SYT – reported their quarterly end results. Monsanto’s watered down incomes in budgetary Q3 came in at $ 2.17 per portion. The firm’s income not merely overlooked the Zacks Agreement Estimation by 10% but additionally weakened 13.5% year over year. Syngenta, on the contrary, stated diluted profits from $ 12.69 per portion by the end from first-half 2016. The business’s profits likewise plunged 14% year over year.

Operating increasingly more providers slated to mention their results quickly, let’s take an appeal at how these two agricultural equities might make out.

http://What Waits for These Agricultural Bigwigs?

http://Potash Firm from Saskatchewan Inc. < a href =" http://www.nasdaq.com/symbol/pot" > FLOWERPOT is readied to release Q2 outcomes, just before the marketplace opens up on Jul 28. Our tried and tested model carries out certainly not effectively demonstrate to that Potash Corp. is very likely to beat estimates this quarter. This is since the company lugs a Zacks Ranking # 5 (Powerful Market) and possesses an < a href =" http://www.zacks.com/earnings/earnings-surprise-predictions/" rel= "nofollow" > Earnings ESP from -5.56%. Likewise, over the last 60 times, the Zacks Consensus Quote has been revised downward for the to-be-reported quarter. Unstable demand and crop costs are actually anticipated harmed the business’s profits as well as scopes in Q2. (Go through a lot more: < a href=" https://www.zacks.com/stock/news/224777/potash-corp-pot-will-its-earnings-disappoint-in-q2" rel=" nofollow" > Potash Corporation: Will its Revenues Let down in Q2? ).

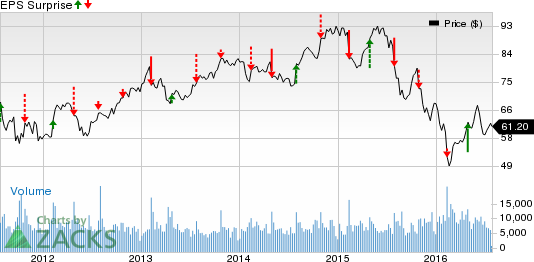

POTASH SASK Rate and also EPS Shock

POTASH SASK Cost and EPS Surprise |< a href=" https://www.zacks.com/stock/quote/POT" rel=" nofollow" > POTASH SASK Quote Bunge Limited< a href =" http://www.nasdaq.com/symbol/bg" > BG is actually explained to mention Q2 outcomes, just before the market place opens on Jul 28. In the final 4 fourths, the firm disclosed a negative common earnings unpleasant surprise from 3.55%. Our tried and tested version does certainly not conclusively demonstrate to that Bunge Limited is actually very likely to hammer on profits this quarter. This is considering that the business offers a Profits ESP of -36.96%. Though the business carries an advantageous Zacks Ranking # 2 (Buy), its damaging ESP makes shock forecasts inconclusive. Additionally, the Zacks Agreement Estimation for the stock has been revised downwards for Q2, over the final 60 times.

BUNGE LTD Rate and EPS Shock

< a href=" https://www.zacks.com/stock/chart/BG/price-eps-surprise "rel=" nofollow" > < a href=" https://www.zacks.com/stock/chart/BG/price-eps-surprise" rel=" nofollow" > BUNGE LTD Cost and also EPS Unpleasant surprise |< a href="

https://www.zacks.com/stock/quote/BG” rel= “nofollow” > BUNGE LTD Quote Do not skip on our complete profits release short articles for these 2 agricultural stocks, as the real results could keep some unpleasant surprises! Want the most recent suggestions from Zacks Financial investment Study? Today, you may download and install 7 Finest Shares for the Following 30 Times. < a href =" https://woas.zacks.com/adv/7stock_report.pdf?ADID=ZACKS_PFP_7BEST_analyst%20blog "rel =" nofollow "> Click >> in order to get this free of charge document > > Desired the most up to date suggestions from Zacks Investment Analysis? Today, you can easily download and install 7 Finest Assets for the Next One Month. < a href =" http://www.zacks.com/registration/pfp/?ALERT=RPT_7BST_LP194&ADID=NASDAQ_CONTENT_ZER_ARTCAT_ANALYST_BLOG&cid=CS-NASDAQ-FT-225157 "rel =" nofollow ">

The opinions and also viewpoints shown here are actually the beliefs as well as viewpoints of the author and carry out not necessarily show those from Nasdaq, Inc.

Most up-to-date Articles Plantations International