Scalper1 News

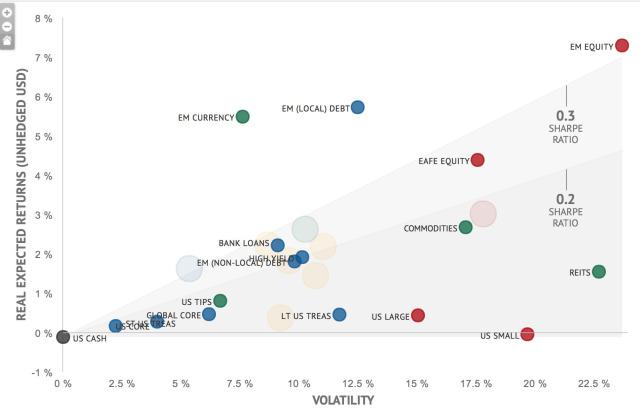

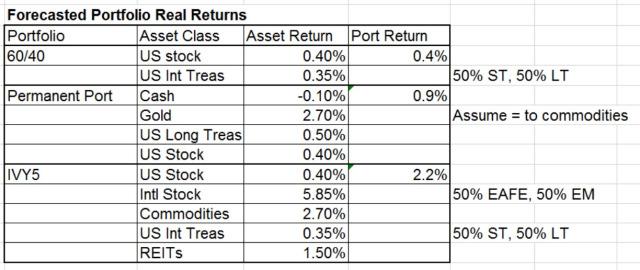

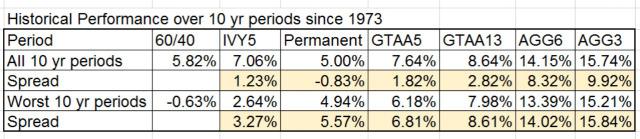

There’s been a lot of chatter recently about asset valuations, in particular U.S. stocks and U.S. bonds, and their impact of future returns. This is nothing new. It just seems to get louder at the start of every new year. I’ve discussed this topic before on the blog. Last time here . Basically, my point was that we may indeed, in fact it’s probable, be facing poor future returns – a least for the next 10 years, but that doesn’t mean that the 4% SWR rule is dead. In fact the 4% SWR implies even worse returns than people are forecasting now. For those building towards retirement it probably means a longer time to hit one’s goals And maybe that’s the worst part of it. In this post I wanted to discuss what the options are for investors if we take the forecasts of poor future returns as a fait accompli. First, some discussion of definitions is in order. Most of the the time when you hear forecasts of poor future returns you hear about the potential for poor U.S. stock returns, and poor U.S. government bonds returns, and the predominant 60% U.S. stock 40% U.S. bond allocation. The 60/40 portfolio is the dominant benchmark used in the U.S. by the finance industry partially due to the fact that they are the asset classes with the best and longest historical data. That is why you hear about it so much. Part of the problem with this of course is that today there are far more assets classes than just these basic two. But for this type of analysis it serves the purpose well enough. Just something to be aware of. Let’s move on. In this post, I’m going to use a recent forecast analysis done by Research Affiliates at the beginning of the year that forecasts future 10yr real asset class returns and the 60/40 portfolio return. You can find that analysis here . They also maintain an updated forecast of 10 yr expected real returns at their asset allocation website . A must visit in my view. Here is a graphical view of their current 10 yr real return forecasts and risk. The classic 60/40 portfolio is way down there. Almost at the bottom left corner with a 10 yr projected real return of 0.4% annualized. Not so great. They forecast U.S. large stocks at 0.4% as well, so that basically leaves 0.4% for bond returns, the benefits of re-balancing, etc. Not exactly outstanding. Just for reference, over the last 10 year period from 2005 to 2014, the 60/40 portfolio has returned 4.8% per year on a real basis, not too far from it’s historical average of 5.2% per year. Let’s take these forecasts as a given and discuss what options an investor has going forward. The most obvious option is to do nothing. If these forecasted returns do come to represent reality then, at least for those withdrawing from their portfolios, the historical 4% SWR will probably be just fine. As the Kitces blog post I linked to in the first paragraph discusses in detail these forecasts of poor future returns would turn out to be an upside surprise to the 4% SWR. In fact, for the worst case retiree in history, starting in 1966, the first 10 year return for a 60/40 portfolio was -1.85% real per year! That’s a lot lower than what is currently being forecasted. In the modern portfolio era, since 1973, there have been four 10 yr periods where the real return was less than 1% per year. Those were the 10 yr periods beginning in 1973, 1999, 2000, and 2001. Sometimes you get the impression that the realization of these poor forecasted returns would be some unprecedented event. Not even close. We’ve been there before and in not the too distant past either. A slight variation to the do nothing option is just to change the allocation between stocks and bonds. If stocks are not offering any higher real returns than bonds then why allocate to them. For example, an investor could go to a 40% stock 60% bond allocation (or 50/50, 30/70, etc…), that has the same forecasted real return but with a lot lower volatility and lower drawdowns. The lower volatility and drawdowns in and of themselves will lead to higher SWRs. The next option is to allocate to assets classes with higher forecasted returns. Obvious, right? The tough part is deciding how to break up that allocation and to into what asset classes. It is much better to simply choose a long standing portfolio allocation that has stood the test of time. I’ll use two examples here that I talk about often on the blog; the Permanent Portfolio, and the IVY 5 asset class buy and hold portfolio. Taking the asset allocations for the portfolios and plugging in the forecasted returns from the Research Affiliates forecast you get the forecasted 10yr returns for the strategies shown below. The Permanent Portfolio’s forecasted 10 yr real return is 0.9%. That’s much better than 60/40 but still a lot less than it’s average 10yr real return since 1973 of 5%. However the Permanent Portfolio comes with a lot less volatility (30% less) than 60/40 and a lot lower drawdowns which leads to a higher SWR than implied just by the return alone. The IVY5 Portfolio’s forecasted 10 yr real return is 2.2%, compared with it’s 7% average since 1973. I didn’t forecast the IVY13 portfolio because there were no forecasts for certain key factors, like value and momentum, but assuming historical relationships, lets say the IVY13 forecasted 10yr real returns are in the 2.5% to 3% per year. As you can see, going global and diversifying more enhances the projected returns. Now, lets see how some of the tactical asset allocation models may perform in the future under these poor future return forecasts. For this part of the discussion, I’ll be comparing the GTAA5, GTAA13, GTAA AGG3, and GTAA AGG6 portfolios to the buy and hold portfolios discussed above. The first thing I’ll do is compare the performance of the tactical asset allocation portfolios over all 10 yr periods to the buy and hold portfolios; 60/40, IVY5, and Permanent. Then we’ll compare the performance over only the worst 10 yr periods. That will give us a gauge of their relative performance during these bad return periods we are interested in. Below is the key table. The first line in the table shows the average real 10 yr period performance for each of the portfolios for all 10 yr periods since 1973 (1973 to 1982, 1974 to 1983…through 2005 to 2014). The 60/40 portfolio returned on average 5.82% real per year, the IVY5 7.06%, the AGG6 portfolio 14.15%, etc… The next row shows the spread between the particular portfolio and the 60/40 classic buy and hold portfolio. For example, GTAA5 outperforms 60/40 on average about 1.82% per year. Now it gets interesting. The next row shows the average 10 yr period performance only for those 10 yr periods where the 60/40 return was less than 1% per year real. The performance for all the portfolios is lower as one would expect but look at the next row, the spreads to the 60/40 portfolio during these poor return periods. The outperformance of all the portfolios is better during bad periods. For example, GTAA5 only outperforms 60/40 by 1.82% per year during all periods but during bad periods it outperforms by 6.8% per year! That is pretty astonishing. The TAA portfolios have risk reduction built in automatically and keep the investor out of long down markets, exactly what is being forecasted for the buy and hold portfolios. Sounds like a pretty good portfolio approach to me especially if the forecast of poor returns comes to be. If similar spreads hold true in the future the TAA portfolios would be looking at 10 yr real performance ranges of 6-8% per year for the GTAA5 and GTAA13 portfolios and 13-15% per year for the GTAA AGG3 and AGG6 portfolios. Sounds to good to be true but even if the performance ranges are half of what they’ve been an investor will be a lot better off than in a traditional 60/40 portfolio. The structure of the portfolios stacks the odds in the investor’s favor during bad markets. In summary, I’ve shown that if forecasts of poor returns come true the portfolio outcomes for investors are no worse than the past. An investor doesn’t need to do anything different. But there are better options that stack the odds in the investor’s favor in poor return environments. The most basic option is better diversification as exhibited in the IVY5 and the Permanent Portfolio as examples. And then there are even better options by using tactical allocation models that protect to the downside and in aggressive versions tilt the portfolio toward the best performing asset classes. While all returns for all portfolios will be lower in a low return environment the outperformance of better constructed portfolios will still allow investors and especially retirees to outperform and meet their long term goals. Scalper1 News

There’s been a lot of chatter recently about asset valuations, in particular U.S. stocks and U.S. bonds, and their impact of future returns. This is nothing new. It just seems to get louder at the start of every new year. I’ve discussed this topic before on the blog. Last time here . Basically, my point was that we may indeed, in fact it’s probable, be facing poor future returns – a least for the next 10 years, but that doesn’t mean that the 4% SWR rule is dead. In fact the 4% SWR implies even worse returns than people are forecasting now. For those building towards retirement it probably means a longer time to hit one’s goals And maybe that’s the worst part of it. In this post I wanted to discuss what the options are for investors if we take the forecasts of poor future returns as a fait accompli. First, some discussion of definitions is in order. Most of the the time when you hear forecasts of poor future returns you hear about the potential for poor U.S. stock returns, and poor U.S. government bonds returns, and the predominant 60% U.S. stock 40% U.S. bond allocation. The 60/40 portfolio is the dominant benchmark used in the U.S. by the finance industry partially due to the fact that they are the asset classes with the best and longest historical data. That is why you hear about it so much. Part of the problem with this of course is that today there are far more assets classes than just these basic two. But for this type of analysis it serves the purpose well enough. Just something to be aware of. Let’s move on. In this post, I’m going to use a recent forecast analysis done by Research Affiliates at the beginning of the year that forecasts future 10yr real asset class returns and the 60/40 portfolio return. You can find that analysis here . They also maintain an updated forecast of 10 yr expected real returns at their asset allocation website . A must visit in my view. Here is a graphical view of their current 10 yr real return forecasts and risk. The classic 60/40 portfolio is way down there. Almost at the bottom left corner with a 10 yr projected real return of 0.4% annualized. Not so great. They forecast U.S. large stocks at 0.4% as well, so that basically leaves 0.4% for bond returns, the benefits of re-balancing, etc. Not exactly outstanding. Just for reference, over the last 10 year period from 2005 to 2014, the 60/40 portfolio has returned 4.8% per year on a real basis, not too far from it’s historical average of 5.2% per year. Let’s take these forecasts as a given and discuss what options an investor has going forward. The most obvious option is to do nothing. If these forecasted returns do come to represent reality then, at least for those withdrawing from their portfolios, the historical 4% SWR will probably be just fine. As the Kitces blog post I linked to in the first paragraph discusses in detail these forecasts of poor future returns would turn out to be an upside surprise to the 4% SWR. In fact, for the worst case retiree in history, starting in 1966, the first 10 year return for a 60/40 portfolio was -1.85% real per year! That’s a lot lower than what is currently being forecasted. In the modern portfolio era, since 1973, there have been four 10 yr periods where the real return was less than 1% per year. Those were the 10 yr periods beginning in 1973, 1999, 2000, and 2001. Sometimes you get the impression that the realization of these poor forecasted returns would be some unprecedented event. Not even close. We’ve been there before and in not the too distant past either. A slight variation to the do nothing option is just to change the allocation between stocks and bonds. If stocks are not offering any higher real returns than bonds then why allocate to them. For example, an investor could go to a 40% stock 60% bond allocation (or 50/50, 30/70, etc…), that has the same forecasted real return but with a lot lower volatility and lower drawdowns. The lower volatility and drawdowns in and of themselves will lead to higher SWRs. The next option is to allocate to assets classes with higher forecasted returns. Obvious, right? The tough part is deciding how to break up that allocation and to into what asset classes. It is much better to simply choose a long standing portfolio allocation that has stood the test of time. I’ll use two examples here that I talk about often on the blog; the Permanent Portfolio, and the IVY 5 asset class buy and hold portfolio. Taking the asset allocations for the portfolios and plugging in the forecasted returns from the Research Affiliates forecast you get the forecasted 10yr returns for the strategies shown below. The Permanent Portfolio’s forecasted 10 yr real return is 0.9%. That’s much better than 60/40 but still a lot less than it’s average 10yr real return since 1973 of 5%. However the Permanent Portfolio comes with a lot less volatility (30% less) than 60/40 and a lot lower drawdowns which leads to a higher SWR than implied just by the return alone. The IVY5 Portfolio’s forecasted 10 yr real return is 2.2%, compared with it’s 7% average since 1973. I didn’t forecast the IVY13 portfolio because there were no forecasts for certain key factors, like value and momentum, but assuming historical relationships, lets say the IVY13 forecasted 10yr real returns are in the 2.5% to 3% per year. As you can see, going global and diversifying more enhances the projected returns. Now, lets see how some of the tactical asset allocation models may perform in the future under these poor future return forecasts. For this part of the discussion, I’ll be comparing the GTAA5, GTAA13, GTAA AGG3, and GTAA AGG6 portfolios to the buy and hold portfolios discussed above. The first thing I’ll do is compare the performance of the tactical asset allocation portfolios over all 10 yr periods to the buy and hold portfolios; 60/40, IVY5, and Permanent. Then we’ll compare the performance over only the worst 10 yr periods. That will give us a gauge of their relative performance during these bad return periods we are interested in. Below is the key table. The first line in the table shows the average real 10 yr period performance for each of the portfolios for all 10 yr periods since 1973 (1973 to 1982, 1974 to 1983…through 2005 to 2014). The 60/40 portfolio returned on average 5.82% real per year, the IVY5 7.06%, the AGG6 portfolio 14.15%, etc… The next row shows the spread between the particular portfolio and the 60/40 classic buy and hold portfolio. For example, GTAA5 outperforms 60/40 on average about 1.82% per year. Now it gets interesting. The next row shows the average 10 yr period performance only for those 10 yr periods where the 60/40 return was less than 1% per year real. The performance for all the portfolios is lower as one would expect but look at the next row, the spreads to the 60/40 portfolio during these poor return periods. The outperformance of all the portfolios is better during bad periods. For example, GTAA5 only outperforms 60/40 by 1.82% per year during all periods but during bad periods it outperforms by 6.8% per year! That is pretty astonishing. The TAA portfolios have risk reduction built in automatically and keep the investor out of long down markets, exactly what is being forecasted for the buy and hold portfolios. Sounds like a pretty good portfolio approach to me especially if the forecast of poor returns comes to be. If similar spreads hold true in the future the TAA portfolios would be looking at 10 yr real performance ranges of 6-8% per year for the GTAA5 and GTAA13 portfolios and 13-15% per year for the GTAA AGG3 and AGG6 portfolios. Sounds to good to be true but even if the performance ranges are half of what they’ve been an investor will be a lot better off than in a traditional 60/40 portfolio. The structure of the portfolios stacks the odds in the investor’s favor during bad markets. In summary, I’ve shown that if forecasts of poor returns come true the portfolio outcomes for investors are no worse than the past. An investor doesn’t need to do anything different. But there are better options that stack the odds in the investor’s favor in poor return environments. The most basic option is better diversification as exhibited in the IVY5 and the Permanent Portfolio as examples. And then there are even better options by using tactical allocation models that protect to the downside and in aggressive versions tilt the portfolio toward the best performing asset classes. While all returns for all portfolios will be lower in a low return environment the outperformance of better constructed portfolios will still allow investors and especially retirees to outperform and meet their long term goals. Scalper1 News

Scalper1 News