Scalper1 News

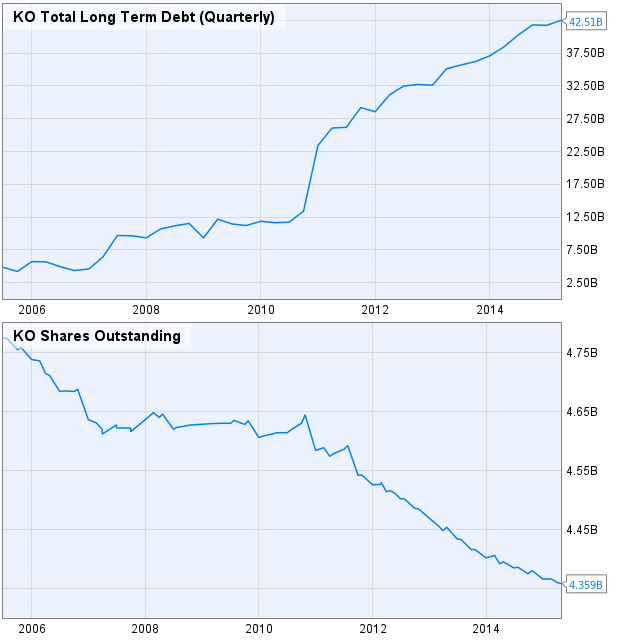

The Fed’s zero interest rate policy has led to a number of unnatural distortions in today’s market. More importantly, the end of the Fed’s zero interest rate policy will likely halt or reverse these distortions, causing many investors to sustain significant losses. We’ve already discussed the “reach for yield trend” in which conservative income investors have bought dividend stocks to replace income previously generated from bonds and deposit accounts. When the Fed allows rates to rise again, this trend will likely reverse sending “safe” stocks lower . Today, we’re going to look at another distortion caused by the Fed’s low rate policy, using one of the world’s most popular consumer staples stocks as an example. What happens when a profitable company can borrow massive amounts of capital at an extremely low interest rate? More specifically, what strategy should an executive team adopt to take advantage of cheap available capital? Executives at many blue chip companies – have been forced to wrestle with these questions as borrowing costs have dropped to historically low levels. The Fed’s zero interest rate policy has made it possible for blue chip companies in good financial shape to borrow huge amounts of capital at very attractive interest rates. The Fed did this intentionally, in an attempt to cause companies to invest in growth opportunities – and thus stimulate the economy. For many large companies, it made perfect sense to issue long-term bonds with very low yields. Even if the companies didn’t have immediate projects to spend the cash on, they simply couldn’t responsibly pass up the opportunity to borrow so cheaply. The availability of cheap cash led many publicly-traded companies to “engineer growth” by borrowing capital and using the funds to buy back shares of stock. Here’s how the practice works: Let’s say a company has 1 billion shares outstanding, trading at a price of $25 per share. This gives our company a market cap of $25 billion. Over the next year, our company is expected to earn $1.2 billion, or $1.20 per share. Our company’s executive team decides to borrow $5 billion at a rate of 2.5% and use that money to buy back shares of stock. Purchasing the shares at an average cost of $25, the company buys back 200 million shares of stock, leaving 800 million shares outstanding. During the year, our company then earns the $1.2 billion it expected to earn, less $125 million in interest paid on the $5 billion borrowed. So the net earnings come out to $1,075 million after counting for the interest expense. If you divide the $1,075 million in earnings by the new share count of 800 million shares of stock, the company’s earnings add up to $1.34 per share. This is 11.7% higher than the company would have earned without borrowing capital at a low interest rate. So in this example, borrowing cheap money and buying back shares of stock resulted in 11.7% in “engineered growth.” The company’s actual business didn’t grow. But the earnings per share was significantly higher. With interest rates pegged at extremely low levels for an extended period of time, companies have had an irresistible incentive to borrow capital and use the money to buy back shares of stock. The result has been widespread “engineered growth” in earnings per share for U.S. blue chip stocks. Now is this a bad thing? Not necessarily. The demand for shares of stock (as companies have spent billions to buy back their own shares) has helped to push stock prices higher. Meanwhile, more cash has been made available for dividend payments. This is true both because the companies have ample cash from selling bonds and also because there are fewer shares outstanding (so dividend payments can be bigger for each of the remaining shares). The Coca-Cola Company (NYSE: KO ) is a great example of this, as the company has issued nearly $40 billion in new debt over the last ten years, while reducing its share count by more than 400 million shares. Strong demand for the company’s shares – both from buyback programs as well as from the reach for yield trend – has led to a premium valuation for shares of KO. Today, shares of KO are trading near the high end of its valuation range as investors are paying roughly $18.50 for every dollar that KO is expected to earn over the next year. It is important to note that this metric measures KO’s price compared to next year’s expected earnings. So the valuation is affected not only by the share price of KO, but also by shifting expectations for the company’s earnings over the next year. Observant investors will note that KO has already declined significantly from its high in the fourth quarter of 2014. But even though the stock has pulled back 12% from its high of $45, KO could have further to drop as the distortions from the Fed’s zero interest rate policy unwind. (click to enlarge) Once the Fed begins hiking rates later this year (or at the very latest in Q1 2016), borrowing costs for blue chip stocks will increase. The trend of buying back shares to increase earnings will no longer be a viable growth strategy, and these companies will need to generate actual revenue and profit growth to please investors. An unwinding of the reach for yield will ad selling pressure for blue-chip dividend stocks, and this should cause forward valuations to drop to a more reasonable levels. Meanwhile, currency headwinds are likely to continue to pummel U.S. companies who generate the majority of their revenue overseas. We’ll discuss these currency pressures in the next installment of our consumer staples series. Note: This is part three of our series on consumer staples stocks. See also: – Part I: The Monsters Under the Bed are Real for Consumer Staples Stocks – Part II: Don’t Get Caught Holding This “Safe” Stock When the Fed Hikes Rates Scalper1 News

The Fed’s zero interest rate policy has led to a number of unnatural distortions in today’s market. More importantly, the end of the Fed’s zero interest rate policy will likely halt or reverse these distortions, causing many investors to sustain significant losses. We’ve already discussed the “reach for yield trend” in which conservative income investors have bought dividend stocks to replace income previously generated from bonds and deposit accounts. When the Fed allows rates to rise again, this trend will likely reverse sending “safe” stocks lower . Today, we’re going to look at another distortion caused by the Fed’s low rate policy, using one of the world’s most popular consumer staples stocks as an example. What happens when a profitable company can borrow massive amounts of capital at an extremely low interest rate? More specifically, what strategy should an executive team adopt to take advantage of cheap available capital? Executives at many blue chip companies – have been forced to wrestle with these questions as borrowing costs have dropped to historically low levels. The Fed’s zero interest rate policy has made it possible for blue chip companies in good financial shape to borrow huge amounts of capital at very attractive interest rates. The Fed did this intentionally, in an attempt to cause companies to invest in growth opportunities – and thus stimulate the economy. For many large companies, it made perfect sense to issue long-term bonds with very low yields. Even if the companies didn’t have immediate projects to spend the cash on, they simply couldn’t responsibly pass up the opportunity to borrow so cheaply. The availability of cheap cash led many publicly-traded companies to “engineer growth” by borrowing capital and using the funds to buy back shares of stock. Here’s how the practice works: Let’s say a company has 1 billion shares outstanding, trading at a price of $25 per share. This gives our company a market cap of $25 billion. Over the next year, our company is expected to earn $1.2 billion, or $1.20 per share. Our company’s executive team decides to borrow $5 billion at a rate of 2.5% and use that money to buy back shares of stock. Purchasing the shares at an average cost of $25, the company buys back 200 million shares of stock, leaving 800 million shares outstanding. During the year, our company then earns the $1.2 billion it expected to earn, less $125 million in interest paid on the $5 billion borrowed. So the net earnings come out to $1,075 million after counting for the interest expense. If you divide the $1,075 million in earnings by the new share count of 800 million shares of stock, the company’s earnings add up to $1.34 per share. This is 11.7% higher than the company would have earned without borrowing capital at a low interest rate. So in this example, borrowing cheap money and buying back shares of stock resulted in 11.7% in “engineered growth.” The company’s actual business didn’t grow. But the earnings per share was significantly higher. With interest rates pegged at extremely low levels for an extended period of time, companies have had an irresistible incentive to borrow capital and use the money to buy back shares of stock. The result has been widespread “engineered growth” in earnings per share for U.S. blue chip stocks. Now is this a bad thing? Not necessarily. The demand for shares of stock (as companies have spent billions to buy back their own shares) has helped to push stock prices higher. Meanwhile, more cash has been made available for dividend payments. This is true both because the companies have ample cash from selling bonds and also because there are fewer shares outstanding (so dividend payments can be bigger for each of the remaining shares). The Coca-Cola Company (NYSE: KO ) is a great example of this, as the company has issued nearly $40 billion in new debt over the last ten years, while reducing its share count by more than 400 million shares. Strong demand for the company’s shares – both from buyback programs as well as from the reach for yield trend – has led to a premium valuation for shares of KO. Today, shares of KO are trading near the high end of its valuation range as investors are paying roughly $18.50 for every dollar that KO is expected to earn over the next year. It is important to note that this metric measures KO’s price compared to next year’s expected earnings. So the valuation is affected not only by the share price of KO, but also by shifting expectations for the company’s earnings over the next year. Observant investors will note that KO has already declined significantly from its high in the fourth quarter of 2014. But even though the stock has pulled back 12% from its high of $45, KO could have further to drop as the distortions from the Fed’s zero interest rate policy unwind. (click to enlarge) Once the Fed begins hiking rates later this year (or at the very latest in Q1 2016), borrowing costs for blue chip stocks will increase. The trend of buying back shares to increase earnings will no longer be a viable growth strategy, and these companies will need to generate actual revenue and profit growth to please investors. An unwinding of the reach for yield will ad selling pressure for blue-chip dividend stocks, and this should cause forward valuations to drop to a more reasonable levels. Meanwhile, currency headwinds are likely to continue to pummel U.S. companies who generate the majority of their revenue overseas. We’ll discuss these currency pressures in the next installment of our consumer staples series. Note: This is part three of our series on consumer staples stocks. See also: – Part I: The Monsters Under the Bed are Real for Consumer Staples Stocks – Part II: Don’t Get Caught Holding This “Safe” Stock When the Fed Hikes Rates Scalper1 News

Scalper1 News