InvestorPlace InvestorPlace – Stock Market News, Stock Advice & Trading Tips

U.S. stock futures are in rally mode this morning, as corporate earnings continue to bolster sentiment on Wall Street. What’s more, the Dow Jones Industrial Average could be poised to challenge the 20,000 level today, especially if earnings from blue-chip members United Technologies Corporation (NYSE: UTX ) and Boeing Co (NYSE: BA ) come in strong this morning.

Against this backdrop, futures on the Dow Jones Industrial Average have added 0.33%, with S&P 500 futures up 0.32% and Nasdaq-100 futures rallying 0.43%.

Against this backdrop, futures on the Dow Jones Industrial Average have added 0.33%, with S&P 500 futures up 0.32% and Nasdaq-100 futures rallying 0.43%.

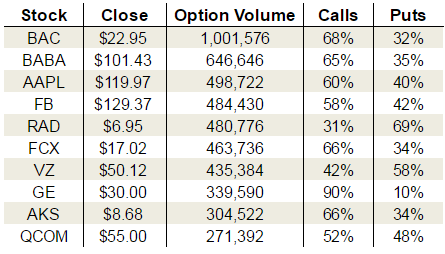

On the options front, Tuesday’s volume came back strong from Monday’s lackluster performance. Overall, the roughly 17.5 million calls and 14.8 million puts traded put a bullish spin on the day’s activity. Bullish activity wasn’t quite as pronounced on the CBOE, however, as the single-session equity put/call volume ratio dipped slightly to 0.65. The 10-day moving average banked its fifth session in a row at 0.65.

Turning to Tuesday’s volume leaders, Apple Inc. (NASDAQ: AAPL ) remained pinned to the $ 120 region after Barclays downgraded the shares on excessive hype surrounding the iPhone 8 “supercycle.” Meanwhile, Facebook Inc (NASDAQ: FB ) continues to see call volume come in light heading into next week’s earnings report, and Freeport-McMoRan Inc (NYSE: FCX ) and other miners attracted a sizable bullish bid after President Trump signed several executive orders to help increase infrastructure spending.

Apple Inc. (AAPL)

In a note to clients on Tuesday, Barclays said that it does not see any “meaningful upside potential” for AAPL stock. The brokerage firm also downgraded Apple to “overweight” from “equal weight” and cut its price target to $ 117 from $ 119.

Barclays noted that the so-called “supercycle” – where iPhone 6 and 7 users upgrade to the supposedly much improved iPhone 8 – has been overplayed and will not deliver the results many investors are hoping for as customers increasingly mix down to the iPhone 6S and 7S models.

AAPL options activity took a noticeable hit on Tuesday following the downgrade. Call option volume had been trending in the 66th to 67th percentile of daily total volume, but managed to only garner 60% of the more than 498,000 contracts traded yesterday.

Still, this one blip hasn’t been enough to shake overall sentiment on AAPL, with the 3 Feb put/call open interest ratio falling over the past couple of weeks to rest at 0.76. The current upside earnings target in the 3 Feb series remains $ 120 with 19,000 contracts, though the $ 125 has amassed more than 10,000 contracts, and OI is rising.

Facebook Inc (FB)

FB stock is also garnering quite the earnings bid from speculative options traders. Facebook stock saw option volume jump to 484,000 contracts on Tuesday, with calls making up a below-average 58% of the day’s take. Surprisingly, puts are in considerable demand for FB stock ahead of earnings, with the 3 Feb put/call OI ratio rising in recent weeks to 0.93 – placing puts and calls in near parity.

On the upside, FB stock options traders are eyeballing the $ 130 strike (6,500 contracts), though peak call OI for the series totals nearly 10,000 contracts at the in-the-money $ 123 strike. Implieds are pricing in a post-earnings move of about 5% for FB stock.

By the numbers, Wall Street is expecting a profit of $ 1.30 per share on revenue of $ 8.4 billion, though EarningsWhispers.com places the whisper number at $ 1.37 per share, hinting at elevated expectations that may be giving options traders pause.

Freeport-McMoRan Inc. (FCX)

FCX stock and a bevy of other mining concerns took off on Tuesday after President Donald Trump signed several executive orders designed to increase spending on infrastructure, including orders to streamline the permitting process and regulatory burden for domestic manufacturers. Mining stocks have been a hot topic for investors recently, and with Trump showing that he intends to follow through on his infrastructure promises, investors appear to finally be diving in.

As for FCX, the stock saw heavy call volume on Tuesday, with these typically bullish bets snapping up 66% of the more than 463,000 contracts traded yesterday. Options traders were already heavily bullish on FCX, with the stock’s Feb put/call OI ratio arriving at 0.48, indicating that calls more than double puts among options set to expire within the next month.

That said, FCX stock is selling off premarket this morning – down nearly 3% at last check – after the company missed fourth-quarter earnings expectations, posting a profit of 25 cents per share on revenue of $ 4.37 billion, versus the consensus of 32 cents per share on revenue of $ 4.44 billion.

As of this writing, Joseph Hargett did not hold a position in any of the aforementioned securities.

More From InvestorPlace

The post Wednesday’s Vital Data: Apple Inc. (AAPL), Facebook Inc (FB) and Freeport-McMoRan Inc (FCX) appeared first on InvestorPlace .

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

Plantations International