Scalper1 News

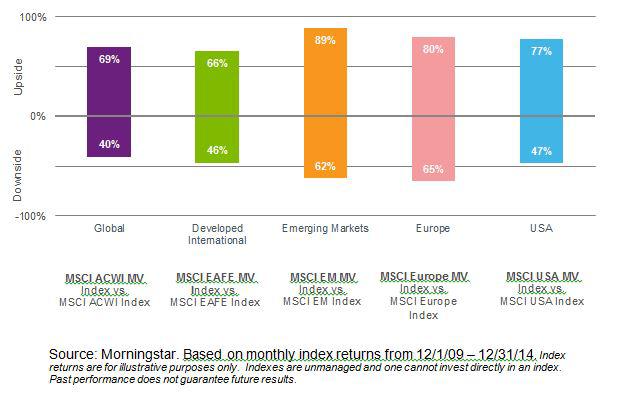

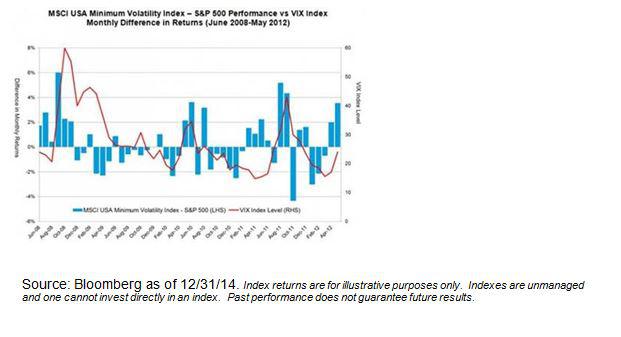

In my post on smart beta predictions for the year , I suggested that a minimum volatility (min vol) strategy would be top of mind for investors. It hasn’t taken long for that trend to materialize, as this segment posted strong returns and enjoyed inflows of $1.9 billion in the first month of 2015 (Source: Bloomberg; BlackRock ETP Landscape Report). In today’s market climate – where volatility has moved from historical lows to above long-term averages in just a few short months – the case for min vol is particularly timely. A strategy for market ups and downs Like all smart beta strategies, min vol blends aspects of traditional active and passive investing: active in that the strategies attempt to improve risk-adjusted return; passive in that portfolio construction is generally objective and based on pre-set rules. The chart below illustrates this asymmetrical behavior: for example, over the last five years, the MSCI US Minimum Volatility Index has experienced only 47% of the downside return of the standard MSCI USA Index, but captured 77% of the upside. This potential for downside protection and upside participation is how min vol portfolios have delivered strong risk adjusted returns over the long term, with smaller bumps in the road. Upside Vs. Downside Capture for MSCI Minimum Volatility Indices I like to think of min vol as being similar to windbreaker. It can help provide some protection against the sun without being too hot. And when it rains, you have something to help keep you dry. It’s an item you keep with you all year to help guard against different kinds of weather. Weathering the storm My colleague Russ Koesterich points out that volatility is back, and likely here to stay awhile . That’s a change from last year: The VIX fell well below its long-term average of 13.6 in the first half of the year before spiking above 25 in October and has remained elevated since (Source: Thomson Reuters, BlackRock Investment Institute). Against that backdrop, the MSCI U.S. Minimum Volatility Index slightly lagged the S&P 500 for the first three quarters of the year before roaring ahead to end 2015 at 16.5%, compared to the S&P’s 13.7%. But if you take away any stats from this story, here’s the most important one: The MSCI U.S. Minimum Volatility Index was 34% less volatile than the S&P 500 over that same one-year period. Min vol strategies have historically performed well in volatile times. The chart below plots the VIX Index in red – a commonly used metric of market volatility. The blue bars represent the monthly performance difference between the MSCI USA Minimum Volatility Index and the S&P 500 Index. Historically the min vol index has generally out-performed the S&P 500 in months when volatility was rising. What about when volatility abates? By limiting the downside during the deepest troughs, the min vol index was better able to capitalize on a rebound. . . In today’s more turbulent market environment, the lower volatility sought by min vol strategies is particularly appealing to many investors. In January alone, the S&P 500 has experienced a daily change of over 1% in 8 out of 20 trading days, or 40% of the time. As my colleague Nelli Oster explores in her posts on investor behavior, it can be difficult to tune out that degree of volatility and stay focused on your long-term investment goals: paying for college, saving for retirement or planning to expand your family. Where we go from here Volatility is born from uncertainty: the heightened level of risk we see in capital markets is driven by the divergence across today’s global economy. The catalysts for that divergence – conflicting central bank actions, disparate levels of economic growth across the globe and a long list of geopolitical risks – are unlikely to dissipate any time soon. This means that market volatility will likely remain elevated. I like minimum volatility for the long haul. It’s a way to participate in equity markets with the potential for less volatility and allows you to stay focused on your investment goals even in turbulent times. As market bumps are a daily reality, min vol may be an appealing investment solution, and can help keep both you and your investment strategy on track. Original Post Scalper1 News

In my post on smart beta predictions for the year , I suggested that a minimum volatility (min vol) strategy would be top of mind for investors. It hasn’t taken long for that trend to materialize, as this segment posted strong returns and enjoyed inflows of $1.9 billion in the first month of 2015 (Source: Bloomberg; BlackRock ETP Landscape Report). In today’s market climate – where volatility has moved from historical lows to above long-term averages in just a few short months – the case for min vol is particularly timely. A strategy for market ups and downs Like all smart beta strategies, min vol blends aspects of traditional active and passive investing: active in that the strategies attempt to improve risk-adjusted return; passive in that portfolio construction is generally objective and based on pre-set rules. The chart below illustrates this asymmetrical behavior: for example, over the last five years, the MSCI US Minimum Volatility Index has experienced only 47% of the downside return of the standard MSCI USA Index, but captured 77% of the upside. This potential for downside protection and upside participation is how min vol portfolios have delivered strong risk adjusted returns over the long term, with smaller bumps in the road. Upside Vs. Downside Capture for MSCI Minimum Volatility Indices I like to think of min vol as being similar to windbreaker. It can help provide some protection against the sun without being too hot. And when it rains, you have something to help keep you dry. It’s an item you keep with you all year to help guard against different kinds of weather. Weathering the storm My colleague Russ Koesterich points out that volatility is back, and likely here to stay awhile . That’s a change from last year: The VIX fell well below its long-term average of 13.6 in the first half of the year before spiking above 25 in October and has remained elevated since (Source: Thomson Reuters, BlackRock Investment Institute). Against that backdrop, the MSCI U.S. Minimum Volatility Index slightly lagged the S&P 500 for the first three quarters of the year before roaring ahead to end 2015 at 16.5%, compared to the S&P’s 13.7%. But if you take away any stats from this story, here’s the most important one: The MSCI U.S. Minimum Volatility Index was 34% less volatile than the S&P 500 over that same one-year period. Min vol strategies have historically performed well in volatile times. The chart below plots the VIX Index in red – a commonly used metric of market volatility. The blue bars represent the monthly performance difference between the MSCI USA Minimum Volatility Index and the S&P 500 Index. Historically the min vol index has generally out-performed the S&P 500 in months when volatility was rising. What about when volatility abates? By limiting the downside during the deepest troughs, the min vol index was better able to capitalize on a rebound. . . In today’s more turbulent market environment, the lower volatility sought by min vol strategies is particularly appealing to many investors. In January alone, the S&P 500 has experienced a daily change of over 1% in 8 out of 20 trading days, or 40% of the time. As my colleague Nelli Oster explores in her posts on investor behavior, it can be difficult to tune out that degree of volatility and stay focused on your long-term investment goals: paying for college, saving for retirement or planning to expand your family. Where we go from here Volatility is born from uncertainty: the heightened level of risk we see in capital markets is driven by the divergence across today’s global economy. The catalysts for that divergence – conflicting central bank actions, disparate levels of economic growth across the globe and a long list of geopolitical risks – are unlikely to dissipate any time soon. This means that market volatility will likely remain elevated. I like minimum volatility for the long haul. It’s a way to participate in equity markets with the potential for less volatility and allows you to stay focused on your investment goals even in turbulent times. As market bumps are a daily reality, min vol may be an appealing investment solution, and can help keep both you and your investment strategy on track. Original Post Scalper1 News

Scalper1 News