Scalper1 News

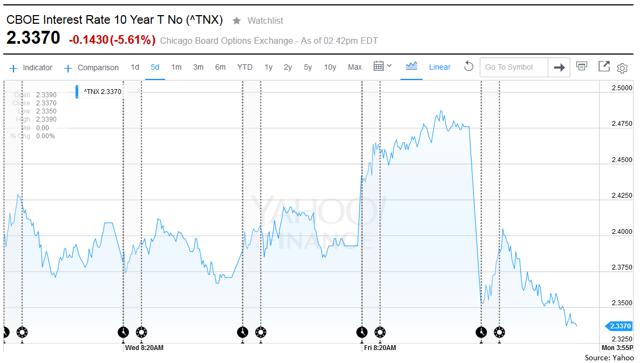

Summary The Vanguard REIT Index ETF appears to be on sale. Despite falling treasury yields and rising prices for utilities, equity REITs are showing weakness. I believe we are seeing a flight to quality as investors angle for more conservative assets. For investors that believe the markets are reasonably efficient, it makes sense to hold a large position in a low fee ETF like the Vanguard REIT Index ETF (NYSEARCA: VNQ ). I believe the markets are reasonably efficient, but I also believe that fear and greed occasionally overpower rational analysis and we see movements that fail to make adequate sense. On June 29th, it appears that fear was the emotion of the day and VNQ was becoming even more attractive. The Fear If you haven’t heard already, there are some issues in Greece. The Greek banks and their stock market are closed for the day and there are expectations of a payment due to the IMF to be missed. There was a nice little piece on it in the SA news feed earlier in the day . The piece there contains a little more information for readers that are interested. Rather than repeat the issues with Greece, I want to focus on the irony in the interest rate market. Let us begin with a look at a yield chart I pulled from Yahoo: (click to enlarge) The yields fell sharply lower today. If an investor is simply interested in what level of yield they can get on their investment, this should indicate that too many people are buying bonds and that they should be less attractive. By comparison, other sources of income should be more attractive. They should see prices increases and yields fall. However, that is precisely not what we saw with the Vanguard REIT Index ETF. I put together a quick chart from Google showing the price movements for VNQ and the Utilities Select Sector SPDR ETF (NYSEARCA: XLU ). (click to enlarge) As you can see, the movements previously were relatively similar and this morning they both jumped higher, but since then VNQ has been trading down while XLU has maintained part of the gain. My Take I’m seeing yields falling on treasury securities as investors have a “flight to quality”. Since the treasury securities are seen as the most reliable investment available, that is where the money is being placed. We see the same logic over the course of the day as investors are picking XLU over VNQ. The theory may be that if economic conditions worsen, the utilities will still have safe profit margins. Renters can move in with their parents and stop renting an apartment, but they won’t stop consuming electricity. The logic makes sense in the context of a flight to quality, but it ignores everything else about the business. I’d Rather Have REITs Owning a piece of the utility companies is a reasonable choice for portfolio diversification and very reasonable for investors focused on dividend yields. However, REITs remain an extremely attractive investment for the tax advantaged accounts. In my opinion, VNQ is a screaming buy relative to the 10 year treasury. The yield on VNQ just broke 4%. It is offering investors substantially higher levels of income than the Treasury, though I will grant it is also a significantly riskier security. The reason the risk is worth it can be viewed in the long term context. When we focus on investing and buying yield rather than on short term price movements, it is reasonable to say that an investor buying a bond should expect to achieve roughly the yield to maturity if they hold the security to maturity. In the event of a zero coupon bond (no reinvestment risk), we would expect precisely that yield absent any brokerage costs. When it comes to income, the investor in VNQ would need to see future dividends fall by over 40% before they would receive less in their yield on VNQ than they would on investing in the treasury security. It could happen, at least theoretically equity REITs could find themselves forced to reduce dividends if the economic environment worsens and revenues decline, however I have yet to see any plausible argument for a 40% reduction across the industry. The worst year for VNQ when measured in dividends paid out was 2010. The total dividend payment was $1.89. Compared to the current share price, that would still result in a 2.52% yield. Acceptable Capital Losses If we assume that dividends will average roughly the same level they are at now over the next ten years, then we have superior performance by about 1.7% per year. Using simple math, the premium in yield would compound to just over 18% in ten years. So long as VNQ ended the period with the share price falling by less than 18%, the shares would have delivered a superior total return. The most logical case for VNQ to underperform treasury investments would be a substantial cut in dividends that matches a substantial decline in share price as investors would continue to expect a reasonable yield on new investments. In that manner, if dividends were cut to less than $2.00 per share, I would expect capital losses to easily surpass the acceptable levels. I find that scenario to be very improbable. On the other hand, since late 2004 through early June VNQ delivered a CAGR (compound annual growth rate) counting reinvested dividends of 8.75% per year. Over the next decade I’m expecting the dividends to grow on average by 4% to 5% per year and I’m expecting share price to grow at a slightly slower rate as higher interest rates on bonds will require higher yields from other income securities. Conclusion I’m long VNQ and I have a buy-limit order to add to my REIT holdings. I’m hoping to see the major REIT index funds decline more over the next year so I can keep adding to my positions at prices I consider attractive. I’m not just rebalancing into more REIT investments; I’m increasing my exposure to equity REITs because I see attractive long term investment opportunities. The situation right now resembles a falling knife, but I see it as a falling knife of gold. I may get cut several times as I keep buying into the REIT sector, but the long term expected returns at these yield levels are enough to keep me happily buying more. Disclosure: I am/we are long VNQ. (More…) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. Additional disclosure: Information in this article represents the opinion of the analyst. All statements are represented as opinions, rather than facts, and should not be construed as advice to buy or sell a security. Ratings of “outperform” and “underperform” reflect the analyst’s estimation of a divergence between the market value for a security and the price that would be appropriate given the potential for risks and returns relative to other securities. The analyst does not know your particular objectives for returns or constraints upon investing. All investors are encouraged to do their own research before making any investment decision. Information is regularly obtained from Yahoo Finance, Google Finance, and SEC Database. If Yahoo, Google, or the SEC database contained faulty or old information it could be incorporated into my analysis. Scalper1 News

Summary The Vanguard REIT Index ETF appears to be on sale. Despite falling treasury yields and rising prices for utilities, equity REITs are showing weakness. I believe we are seeing a flight to quality as investors angle for more conservative assets. For investors that believe the markets are reasonably efficient, it makes sense to hold a large position in a low fee ETF like the Vanguard REIT Index ETF (NYSEARCA: VNQ ). I believe the markets are reasonably efficient, but I also believe that fear and greed occasionally overpower rational analysis and we see movements that fail to make adequate sense. On June 29th, it appears that fear was the emotion of the day and VNQ was becoming even more attractive. The Fear If you haven’t heard already, there are some issues in Greece. The Greek banks and their stock market are closed for the day and there are expectations of a payment due to the IMF to be missed. There was a nice little piece on it in the SA news feed earlier in the day . The piece there contains a little more information for readers that are interested. Rather than repeat the issues with Greece, I want to focus on the irony in the interest rate market. Let us begin with a look at a yield chart I pulled from Yahoo: (click to enlarge) The yields fell sharply lower today. If an investor is simply interested in what level of yield they can get on their investment, this should indicate that too many people are buying bonds and that they should be less attractive. By comparison, other sources of income should be more attractive. They should see prices increases and yields fall. However, that is precisely not what we saw with the Vanguard REIT Index ETF. I put together a quick chart from Google showing the price movements for VNQ and the Utilities Select Sector SPDR ETF (NYSEARCA: XLU ). (click to enlarge) As you can see, the movements previously were relatively similar and this morning they both jumped higher, but since then VNQ has been trading down while XLU has maintained part of the gain. My Take I’m seeing yields falling on treasury securities as investors have a “flight to quality”. Since the treasury securities are seen as the most reliable investment available, that is where the money is being placed. We see the same logic over the course of the day as investors are picking XLU over VNQ. The theory may be that if economic conditions worsen, the utilities will still have safe profit margins. Renters can move in with their parents and stop renting an apartment, but they won’t stop consuming electricity. The logic makes sense in the context of a flight to quality, but it ignores everything else about the business. I’d Rather Have REITs Owning a piece of the utility companies is a reasonable choice for portfolio diversification and very reasonable for investors focused on dividend yields. However, REITs remain an extremely attractive investment for the tax advantaged accounts. In my opinion, VNQ is a screaming buy relative to the 10 year treasury. The yield on VNQ just broke 4%. It is offering investors substantially higher levels of income than the Treasury, though I will grant it is also a significantly riskier security. The reason the risk is worth it can be viewed in the long term context. When we focus on investing and buying yield rather than on short term price movements, it is reasonable to say that an investor buying a bond should expect to achieve roughly the yield to maturity if they hold the security to maturity. In the event of a zero coupon bond (no reinvestment risk), we would expect precisely that yield absent any brokerage costs. When it comes to income, the investor in VNQ would need to see future dividends fall by over 40% before they would receive less in their yield on VNQ than they would on investing in the treasury security. It could happen, at least theoretically equity REITs could find themselves forced to reduce dividends if the economic environment worsens and revenues decline, however I have yet to see any plausible argument for a 40% reduction across the industry. The worst year for VNQ when measured in dividends paid out was 2010. The total dividend payment was $1.89. Compared to the current share price, that would still result in a 2.52% yield. Acceptable Capital Losses If we assume that dividends will average roughly the same level they are at now over the next ten years, then we have superior performance by about 1.7% per year. Using simple math, the premium in yield would compound to just over 18% in ten years. So long as VNQ ended the period with the share price falling by less than 18%, the shares would have delivered a superior total return. The most logical case for VNQ to underperform treasury investments would be a substantial cut in dividends that matches a substantial decline in share price as investors would continue to expect a reasonable yield on new investments. In that manner, if dividends were cut to less than $2.00 per share, I would expect capital losses to easily surpass the acceptable levels. I find that scenario to be very improbable. On the other hand, since late 2004 through early June VNQ delivered a CAGR (compound annual growth rate) counting reinvested dividends of 8.75% per year. Over the next decade I’m expecting the dividends to grow on average by 4% to 5% per year and I’m expecting share price to grow at a slightly slower rate as higher interest rates on bonds will require higher yields from other income securities. Conclusion I’m long VNQ and I have a buy-limit order to add to my REIT holdings. I’m hoping to see the major REIT index funds decline more over the next year so I can keep adding to my positions at prices I consider attractive. I’m not just rebalancing into more REIT investments; I’m increasing my exposure to equity REITs because I see attractive long term investment opportunities. The situation right now resembles a falling knife, but I see it as a falling knife of gold. I may get cut several times as I keep buying into the REIT sector, but the long term expected returns at these yield levels are enough to keep me happily buying more. Disclosure: I am/we are long VNQ. (More…) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. Additional disclosure: Information in this article represents the opinion of the analyst. All statements are represented as opinions, rather than facts, and should not be construed as advice to buy or sell a security. Ratings of “outperform” and “underperform” reflect the analyst’s estimation of a divergence between the market value for a security and the price that would be appropriate given the potential for risks and returns relative to other securities. The analyst does not know your particular objectives for returns or constraints upon investing. All investors are encouraged to do their own research before making any investment decision. Information is regularly obtained from Yahoo Finance, Google Finance, and SEC Database. If Yahoo, Google, or the SEC database contained faulty or old information it could be incorporated into my analysis. Scalper1 News

Scalper1 News