Scalper1 News

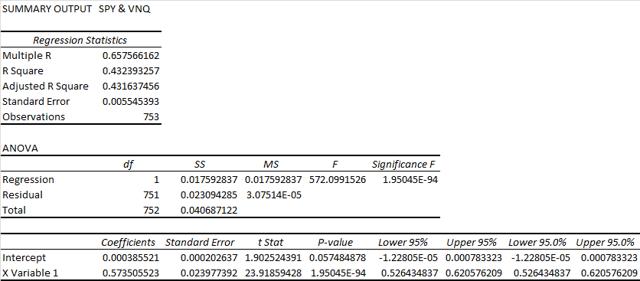

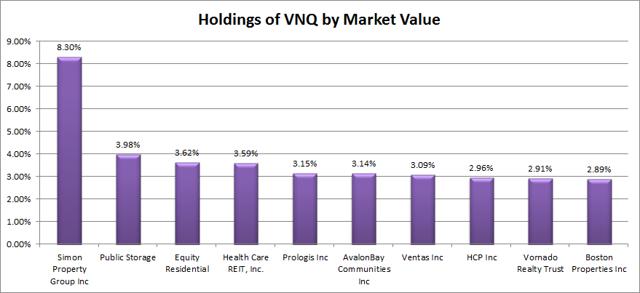

Summary VNQ offers investors the full package of benefits I’m looking for. The ETF is offering excellent correlation benefits to SPY, low expense ratios, and great liquidity. REIT ETF’s generally offer very strong dividend yields. I’m not seeing any reason not to use VNQ. Investors should be seeking to improve their risk adjusted returns. I’m a big fan of using ETFs to achieve the risk adjusted returns relative to the portfolios that a normal investor can generate for themselves after trading costs. I’m working on building a new portfolio and I’m going to be analyzing several of the ETFs that I am considering for my personal portfolio. One of the funds that I’m considering is the Vanguard REIT Index Fund ETF (NYSEARCA: VNQ ). I’ll be performing a substantial portion of my analysis along the lines of modern portfolio theory, so my goal is to find ways to minimize costs while achieving diversification to reduce my risk level. What does VNQ do? VNQ attempts to track the total return (before fees and expenses) of the MSCI U.S. REIT Index. Substantially all of the assets are invested in funds included in this index. VNQ falls under the category of “Real Estate”. Does VNQ provide diversification benefits to a portfolio? Each investor may hold a different portfolio, but I use the SPDR S&P 500 Trust ETF (NYSEARCA: SPY ) as the basis for my analysis. I believe SPY, or another large cap U.S. fund with similar properties, represents the reasonable first step for many investors designing an ETF portfolio. Therefore, I start my diversification analysis by seeing how it works with SPY. I start with an ANOVA table: (click to enlarge) The correlation is just under 66%. That’s a very solid level of correlation and not unusual for comparing a REIT index to SPY. As an investor using modern portfolio theory, I’m happy with seeing that level of correlation. Of course, the value low correlation wouldn’t mean much if the values were being distorted by poor liquidity. The average volume of nearly 5 million shares per day suggests that liquidity shouldn’t be a concern. That’s a good sign for investors wanting verification of the statistics or wanting to know that they can exit the position with less concern about it deviating from NAV. Standard deviation of daily returns (dividend adjusted, measured since November 2013) The standard deviation is fairly reasonable. For VNQ it is .843%. For SPY, it is 0.736% for the same period. The ETF is definitely showing more volatility than SPY by a noticeable margin when we compare returns on a daily basis. Given the low correlation, it should still improve the risk profile of the portfolio. Mixing it with SPY I run comparisons on the standard deviation of daily returns for the portfolio assuming that the portfolio is combined with the S&P 500. For research, I assume daily rebalancing because it dramatically simplifies the math. With a 50/50 weighting in a portfolio holding only SPY and VNQ, the standard deviation of daily returns across the entire portfolio is 0.719%. With 80% in SPY and 20% in VNQ, the standard deviation of the portfolio would have been .711%. If an investor wanted to use VNQ as a supplement to their portfolio, the standard deviation across the portfolio with 95% in SPY and 5% in VNQ would have been .727%. In each scenario, the overall portfolio has less volatility than SPY. I am leaning towards running REITs in my portfolio as 10 to 20% of the total portfolio. Why I use standard deviation of daily returns I don’t believe historical returns have predictive power for future returns, but I do believe historical values for standard deviations of returns relative to other ETFs have some predictive power on future risks and correlations. Yield & Taxes The distribution yield is 3.60%. I like to see strong yields for retiring portfolios because I don’t want to touch the principal. By investing in ETFs I’m removing some of the human emotions, such as panic. Higher yields imply lower growth rates (without reinvestment) over the long term, but that is an acceptable trade off in my opinion. The ETF is composed of REITs, so investors concerned about the taxation impacts of investing in a REIT ETF should seek tax advice from a qualified professional. Expense Ratio The ETF is posting an expense ratio of .10%. I want diversification, I want stability, and I don’t want to pay for them. An expense ratio of .10% is absolutely beautiful and extremely attractive for an ETF that is also offering low correlation to SPY, strong yields, and great liquidity. Market to NAV The ETF is at a .05% discount to NAV currently. Premiums or discounts to NAV can change very quickly so investors should check prior to putting in an order. Generally speaking, that discount to NAV isn’t big enough to be a big deal. However, even a small discount to NAV is fairly attractive when we are talking about a high quality ETF. In my opinion, this is easily one of the most attractive ETFs I have examined. Largest Holdings The diversification in the holdings isn’t going to be a strong selling point. Nothing against Simon Property Group (NYSE: SPG ), but over 8% in the position is pretty big. Given that the expense ratio is .10%, I think that offsets the relatively mediocre level of diversification within the positions. The other individual companies that are making up the top several sections all have different exposures, such as self-storage, multi-family housing, and health care. (click to enlarge) Conclusion The combination of correlation, liquidity, and yield makes a great investment for investors that want to reduce the overall volatility of their portfolio without having their capital tied up in investments that can be difficult to exit. For investors looking at the very long term picture, the extremely low expense ratio is beautiful. Vanguard and Schwab have provided some ETFs with very low expense ratios. I don’t think an ETF should be chosen purely for the expense ratio, but I do believe investors should be very aware of it. When I’m putting together hypothetical portfolio positions, one of the things I include is the expense ratio of the ETFs to track the overall expense ratio on the portfolio. In trying to find anything wrong with the ETF, the biggest weaknesses would probably be the size of the position in SPG and the fact that it is market weighted. However, most ETFs are market weighted. Most ETFs also have enough weaknesses that I can easily spot at least something wrong. In the case of VNQ, the market cap issue is offset by the fund having a turnover ratio of only 11%. I’ve had a preference for Schwab funds because I have an account that can trade them for free. However, I also have some significant tax exempt accounts with other brokerages. I’m strongly considering VNQ for a position in my IRA. Got a different opinion? An argument for why I shouldn’t invest in VNQ? Let’s hear it in the comments. Additional disclosure: Information in this article represents the opinion of the analyst. All statements are represented as opinions, rather than facts, and should not be construed as advice to buy or sell a security. Ratings of “outperform” and “underperform” reflect the analyst’s estimation of a divergence between the market value for a security and the price that would be appropriate given the potential for risks and returns relative to other securities. The analyst does not know your particular objectives for returns or constraints upon investing. All investors are encouraged to do their own research before making any investment decision. Information is regularly obtained from Yahoo Finance, Google Finance, and SEC Database. If Yahoo, Google, or the SEC database contained faulty or old information it could be incorporated into my analysis. The analyst holds a diversified portfolio including mutual funds or index funds which may include a small long exposure to the stock. Scalper1 News

Summary VNQ offers investors the full package of benefits I’m looking for. The ETF is offering excellent correlation benefits to SPY, low expense ratios, and great liquidity. REIT ETF’s generally offer very strong dividend yields. I’m not seeing any reason not to use VNQ. Investors should be seeking to improve their risk adjusted returns. I’m a big fan of using ETFs to achieve the risk adjusted returns relative to the portfolios that a normal investor can generate for themselves after trading costs. I’m working on building a new portfolio and I’m going to be analyzing several of the ETFs that I am considering for my personal portfolio. One of the funds that I’m considering is the Vanguard REIT Index Fund ETF (NYSEARCA: VNQ ). I’ll be performing a substantial portion of my analysis along the lines of modern portfolio theory, so my goal is to find ways to minimize costs while achieving diversification to reduce my risk level. What does VNQ do? VNQ attempts to track the total return (before fees and expenses) of the MSCI U.S. REIT Index. Substantially all of the assets are invested in funds included in this index. VNQ falls under the category of “Real Estate”. Does VNQ provide diversification benefits to a portfolio? Each investor may hold a different portfolio, but I use the SPDR S&P 500 Trust ETF (NYSEARCA: SPY ) as the basis for my analysis. I believe SPY, or another large cap U.S. fund with similar properties, represents the reasonable first step for many investors designing an ETF portfolio. Therefore, I start my diversification analysis by seeing how it works with SPY. I start with an ANOVA table: (click to enlarge) The correlation is just under 66%. That’s a very solid level of correlation and not unusual for comparing a REIT index to SPY. As an investor using modern portfolio theory, I’m happy with seeing that level of correlation. Of course, the value low correlation wouldn’t mean much if the values were being distorted by poor liquidity. The average volume of nearly 5 million shares per day suggests that liquidity shouldn’t be a concern. That’s a good sign for investors wanting verification of the statistics or wanting to know that they can exit the position with less concern about it deviating from NAV. Standard deviation of daily returns (dividend adjusted, measured since November 2013) The standard deviation is fairly reasonable. For VNQ it is .843%. For SPY, it is 0.736% for the same period. The ETF is definitely showing more volatility than SPY by a noticeable margin when we compare returns on a daily basis. Given the low correlation, it should still improve the risk profile of the portfolio. Mixing it with SPY I run comparisons on the standard deviation of daily returns for the portfolio assuming that the portfolio is combined with the S&P 500. For research, I assume daily rebalancing because it dramatically simplifies the math. With a 50/50 weighting in a portfolio holding only SPY and VNQ, the standard deviation of daily returns across the entire portfolio is 0.719%. With 80% in SPY and 20% in VNQ, the standard deviation of the portfolio would have been .711%. If an investor wanted to use VNQ as a supplement to their portfolio, the standard deviation across the portfolio with 95% in SPY and 5% in VNQ would have been .727%. In each scenario, the overall portfolio has less volatility than SPY. I am leaning towards running REITs in my portfolio as 10 to 20% of the total portfolio. Why I use standard deviation of daily returns I don’t believe historical returns have predictive power for future returns, but I do believe historical values for standard deviations of returns relative to other ETFs have some predictive power on future risks and correlations. Yield & Taxes The distribution yield is 3.60%. I like to see strong yields for retiring portfolios because I don’t want to touch the principal. By investing in ETFs I’m removing some of the human emotions, such as panic. Higher yields imply lower growth rates (without reinvestment) over the long term, but that is an acceptable trade off in my opinion. The ETF is composed of REITs, so investors concerned about the taxation impacts of investing in a REIT ETF should seek tax advice from a qualified professional. Expense Ratio The ETF is posting an expense ratio of .10%. I want diversification, I want stability, and I don’t want to pay for them. An expense ratio of .10% is absolutely beautiful and extremely attractive for an ETF that is also offering low correlation to SPY, strong yields, and great liquidity. Market to NAV The ETF is at a .05% discount to NAV currently. Premiums or discounts to NAV can change very quickly so investors should check prior to putting in an order. Generally speaking, that discount to NAV isn’t big enough to be a big deal. However, even a small discount to NAV is fairly attractive when we are talking about a high quality ETF. In my opinion, this is easily one of the most attractive ETFs I have examined. Largest Holdings The diversification in the holdings isn’t going to be a strong selling point. Nothing against Simon Property Group (NYSE: SPG ), but over 8% in the position is pretty big. Given that the expense ratio is .10%, I think that offsets the relatively mediocre level of diversification within the positions. The other individual companies that are making up the top several sections all have different exposures, such as self-storage, multi-family housing, and health care. (click to enlarge) Conclusion The combination of correlation, liquidity, and yield makes a great investment for investors that want to reduce the overall volatility of their portfolio without having their capital tied up in investments that can be difficult to exit. For investors looking at the very long term picture, the extremely low expense ratio is beautiful. Vanguard and Schwab have provided some ETFs with very low expense ratios. I don’t think an ETF should be chosen purely for the expense ratio, but I do believe investors should be very aware of it. When I’m putting together hypothetical portfolio positions, one of the things I include is the expense ratio of the ETFs to track the overall expense ratio on the portfolio. In trying to find anything wrong with the ETF, the biggest weaknesses would probably be the size of the position in SPG and the fact that it is market weighted. However, most ETFs are market weighted. Most ETFs also have enough weaknesses that I can easily spot at least something wrong. In the case of VNQ, the market cap issue is offset by the fund having a turnover ratio of only 11%. I’ve had a preference for Schwab funds because I have an account that can trade them for free. However, I also have some significant tax exempt accounts with other brokerages. I’m strongly considering VNQ for a position in my IRA. Got a different opinion? An argument for why I shouldn’t invest in VNQ? Let’s hear it in the comments. Additional disclosure: Information in this article represents the opinion of the analyst. All statements are represented as opinions, rather than facts, and should not be construed as advice to buy or sell a security. Ratings of “outperform” and “underperform” reflect the analyst’s estimation of a divergence between the market value for a security and the price that would be appropriate given the potential for risks and returns relative to other securities. The analyst does not know your particular objectives for returns or constraints upon investing. All investors are encouraged to do their own research before making any investment decision. Information is regularly obtained from Yahoo Finance, Google Finance, and SEC Database. If Yahoo, Google, or the SEC database contained faulty or old information it could be incorporated into my analysis. The analyst holds a diversified portfolio including mutual funds or index funds which may include a small long exposure to the stock. Scalper1 News

Scalper1 News