Scalper1 News

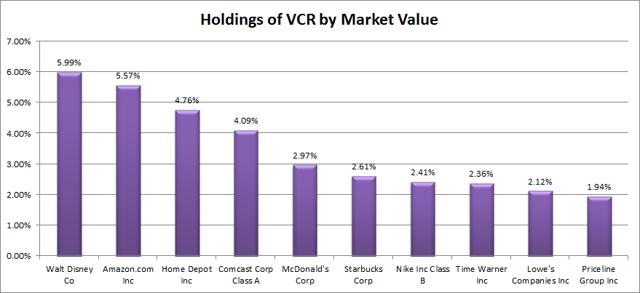

Summary The sector specific exposure makes the ETF a reasonable pick for investors who expect the sector to outperform. The low expense ratio makes it a viable long-term holding for the buy and hold investor. The biggest weakness for a buy and hold strategy here is that the dividend yield would be insufficient to provide retirement income without an enormous portfolio. Investors should be seeking to improve their risk adjusted returns. I’m a big fan of using ETFs to achieve risk-adjusted returns relative to the portfolios that a normal investor can generate for themselves after trading costs. I’m working on building a new portfolio and I’m going to be analyzing several of the ETFs that I am considering for my personal portfolio. A substantial portion of my analysis will use modern portfolio theory, so my goal is to find ways to minimize costs while achieving diversification to reduce my risk level. In this article, I’m reviewing the Vanguard Consumer Discretionary ETF (NYSEARCA: VCR ). Does VCR provide diversification benefits to a portfolio? Each investor may hold a different portfolio, but I use the SPDR S&P 500 Trust ETF (NYSEARCA: SPY ) as the basis for my analysis. I believe SPY, or another large cap U.S. fund with similar properties, represents the reasonable first step for many investors designing an ETF portfolio. The correlation is about 88%, which is low enough that I’m expecting some diversification benefits, but I would not expect it to be dramatic. Standard Deviation The standard deviation of annualized returns for VCR was 12.8% compared to SPY at 12.1%. So VCR is slightly more volatile but using it as a small part of a portfolio would get past even that problem. For instance, using VCR at 10% would have brought the annualized volatility down to 12.0%. Yield and Taxes The distribution yield is 1.11%. Simply put, the ETF doesn’t make much sense for retiring investors who want to use portfolio yields as a large part of their retirement income. Sure, they could sell shares to generate income, but that may create a temptation to change the portfolio strategy at the wrong time. Expense Ratio The ETF is posting 0.12% for an expense ratio. That is not bad compared to other ETFs, though it is slightly higher than SPY at 0.09% and higher than a few of the other more popular Vanguard ETFs. Market to NAV The ETF is trading at a 0.02% premium to NAV currently. I don’t see that as being a big enough issue to matter. A few very small ETFs may see their values deviating from NAV but this Vanguard fund should be staying very close to NAV. Largest Holdings The diversification within the ETF would be weak compared to a whole market ETF, but given that this is a specific sector allocation for consumer discretionary stocks, the diversification is better than many investors might expect. (click to enlarge) Through diversification it may be possible (just barely) to lower portfolio risk by adding the ETF due to the correlation. However, the most logical argument for adding the ETF to the portfolio is an investor believing that this sector is set to outperform based on analysis of macroeconomic factors. A belief that the sector is likely to do well would be a great rationale for holding the ETF; however, it would imply more of a short to intermediate term trading mentality rather than a long-term core holding. Does That Make it Bad for Retail Investors? I would not go that far. The volatility is reasonable and the expense ratio is low. So long as the expected returns are keeping up with the market, there is no reason to say the portfolio is unsuitable for a long-term buy and hold investor. I think it makes an ideal fit for a trader who is moving their assets based on macroeconomic analysis, but it is still a reasonable option for the buy and hold investor as well. The thing those investors should remember is to take advantage of the benefits of lower correlation by rebalancing their portfolio. If it is tax exempt, that could be accomplished easily by buying and selling. If the portfolio is not tax exempt, it may be better to adjust exposure by simply adding cash and buying the fund that has fallen below the ideal weighting. Conclusion This is a solid all-round ETF for any investor who wants to add an emphasis on the “consumer discretionary” sector to their asset allocations. As a sector ETF, it would work well for traders, but the low expense ratio and reasonable level of volatility make it a fine choice for the long-term buy and hold investor as well. The one concern for the buy and hold investor may be the weak dividend yields which would be insufficient for retirement income. Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More…) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. Additional disclosure: Information in this article represents the opinion of the analyst. All statements are represented as opinions, rather than facts, and should not be construed as advice to buy or sell a security. Ratings of “outperform” and “underperform” reflect the analyst’s estimation of a divergence between the market value for a security and the price that would be appropriate given the potential for risks and returns relative to other securities. The analyst does not know your particular objectives for returns or constraints upon investing. All investors are encouraged to do their own research before making any investment decision. Information is regularly obtained from Yahoo Finance, Google Finance, and SEC Database. If Yahoo, Google, or the SEC database contained faulty or old information it could be incorporated into my analysis. Scalper1 News

Summary The sector specific exposure makes the ETF a reasonable pick for investors who expect the sector to outperform. The low expense ratio makes it a viable long-term holding for the buy and hold investor. The biggest weakness for a buy and hold strategy here is that the dividend yield would be insufficient to provide retirement income without an enormous portfolio. Investors should be seeking to improve their risk adjusted returns. I’m a big fan of using ETFs to achieve risk-adjusted returns relative to the portfolios that a normal investor can generate for themselves after trading costs. I’m working on building a new portfolio and I’m going to be analyzing several of the ETFs that I am considering for my personal portfolio. A substantial portion of my analysis will use modern portfolio theory, so my goal is to find ways to minimize costs while achieving diversification to reduce my risk level. In this article, I’m reviewing the Vanguard Consumer Discretionary ETF (NYSEARCA: VCR ). Does VCR provide diversification benefits to a portfolio? Each investor may hold a different portfolio, but I use the SPDR S&P 500 Trust ETF (NYSEARCA: SPY ) as the basis for my analysis. I believe SPY, or another large cap U.S. fund with similar properties, represents the reasonable first step for many investors designing an ETF portfolio. The correlation is about 88%, which is low enough that I’m expecting some diversification benefits, but I would not expect it to be dramatic. Standard Deviation The standard deviation of annualized returns for VCR was 12.8% compared to SPY at 12.1%. So VCR is slightly more volatile but using it as a small part of a portfolio would get past even that problem. For instance, using VCR at 10% would have brought the annualized volatility down to 12.0%. Yield and Taxes The distribution yield is 1.11%. Simply put, the ETF doesn’t make much sense for retiring investors who want to use portfolio yields as a large part of their retirement income. Sure, they could sell shares to generate income, but that may create a temptation to change the portfolio strategy at the wrong time. Expense Ratio The ETF is posting 0.12% for an expense ratio. That is not bad compared to other ETFs, though it is slightly higher than SPY at 0.09% and higher than a few of the other more popular Vanguard ETFs. Market to NAV The ETF is trading at a 0.02% premium to NAV currently. I don’t see that as being a big enough issue to matter. A few very small ETFs may see their values deviating from NAV but this Vanguard fund should be staying very close to NAV. Largest Holdings The diversification within the ETF would be weak compared to a whole market ETF, but given that this is a specific sector allocation for consumer discretionary stocks, the diversification is better than many investors might expect. (click to enlarge) Through diversification it may be possible (just barely) to lower portfolio risk by adding the ETF due to the correlation. However, the most logical argument for adding the ETF to the portfolio is an investor believing that this sector is set to outperform based on analysis of macroeconomic factors. A belief that the sector is likely to do well would be a great rationale for holding the ETF; however, it would imply more of a short to intermediate term trading mentality rather than a long-term core holding. Does That Make it Bad for Retail Investors? I would not go that far. The volatility is reasonable and the expense ratio is low. So long as the expected returns are keeping up with the market, there is no reason to say the portfolio is unsuitable for a long-term buy and hold investor. I think it makes an ideal fit for a trader who is moving their assets based on macroeconomic analysis, but it is still a reasonable option for the buy and hold investor as well. The thing those investors should remember is to take advantage of the benefits of lower correlation by rebalancing their portfolio. If it is tax exempt, that could be accomplished easily by buying and selling. If the portfolio is not tax exempt, it may be better to adjust exposure by simply adding cash and buying the fund that has fallen below the ideal weighting. Conclusion This is a solid all-round ETF for any investor who wants to add an emphasis on the “consumer discretionary” sector to their asset allocations. As a sector ETF, it would work well for traders, but the low expense ratio and reasonable level of volatility make it a fine choice for the long-term buy and hold investor as well. The one concern for the buy and hold investor may be the weak dividend yields which would be insufficient for retirement income. Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More…) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. Additional disclosure: Information in this article represents the opinion of the analyst. All statements are represented as opinions, rather than facts, and should not be construed as advice to buy or sell a security. Ratings of “outperform” and “underperform” reflect the analyst’s estimation of a divergence between the market value for a security and the price that would be appropriate given the potential for risks and returns relative to other securities. The analyst does not know your particular objectives for returns or constraints upon investing. All investors are encouraged to do their own research before making any investment decision. Information is regularly obtained from Yahoo Finance, Google Finance, and SEC Database. If Yahoo, Google, or the SEC database contained faulty or old information it could be incorporated into my analysis. Scalper1 News

Scalper1 News