Scalper1 News

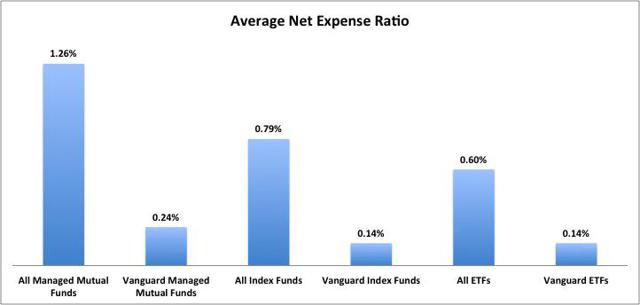

The best no-load ETFs and index funds will help you create a diversified portfolio. Vanguard Funds is the place to start when it comes to finding the best no-load ETFs and index funds. When you are replicating an index, cost and portfolio drift are two of the main issues. Vanguard Funds started the first index fund back in the 1970s, and their ability to limit portfolio drift is well documented. How the best no-load ETFs and index funds do on cost We did some research, which you can see in this chart: (click to enlarge) Source: Morningstar Looks like Vanguard Funds are leading the way in cost no matter which type of investment you wish to purchase. In this article, we focus on the best no-load ETFs and index funds from Vanguard. Which should you buy to make your globally-balanced portfolio – the best no-load ETFs or index funds? We have done a lot of comparison shopping, and our preference is the Vanguard Admiral Shares Index Funds. However, they are not available everywhere; they have a $10,000 minimum purchase, and they do not trade during the day like an ETF. If any of these are issues for you, then we recommend you purchase the Vanguard ETF shares. Want to make a five Vanguard fund portfolio that will cover the planet? Here is what you should buy: Vanguard S&P 500 ETF (NYSEARCA: VOO ) or (MUTF: VFIAX ) – This fund buys the 500 stocks selected by S&P to represent the U.S. large cap stock universe. It has the advantage of being an index that is recognized and purchased around the world. A limited number of stocks with growing global demand and an incredibly low 0.05% expense ratio make this a good core holding for your portfolio. Vanguard Extended Markets ETF (NYSEARCA: VXF ) or (MUTF: VEXAX ) – This fund contains all of the U.S. common stocks regularly traded on the New York Stock Exchange and the Nasdaq over-the-counter market, except those stocks included in the S&P 500 Index. This fund fills in the blanks that are missing from the S&P 500 Index. It holds a total of 3,078 US stocks, mostly mid and small caps, which gives you fantastic coverage of the U.S. stock market. Vanguard Total Bond Market ETF (NYSEARCA: BND ) or (MUTF: VBTLX ) – This ETF tracks the Barclays U.S. Aggregate Float Adjusted Index. It covers a wide range of public, investment-grade, taxable bonds in the United States-including government, corporate, and international dollar-denominated bonds, as well as mortgage-backed and asset-backed securities-all with maturities of more than one year. The ETF invests by sampling the index and currently holds 6,166 bonds. Vanguard Total International Stock ETF (NASDAQ: VXUS ) or (MUTF: VTIAX ) – This ETF tracks the market-cap weighted FTSE Global All Cap ex US Index, which covers 99% of the world’s global market capitalization outside the US. The ETF holds 5,512 stocks from 46 developed and emerging markets. Vanguard Total International Bond ETF (NASDAQ: BNDX ) or (MUTF: VTABX ) – This fund tracks the Barclays Global Aggregate ex-USD Float Adjusted RIC Capped Index (USD Hedged). The index includes government, government agency, corporate, and securitized non-U.S. investment-grade fixed income investments. They are all issued in currencies other than the U.S. dollar, with maturities of more than one year. To minimize the currency risk, the ETF will attempt to hedge its currency exposures. The ETF currently holds 2,246 bonds. With just five Vanguard ETFs or index funds you get exposure to 9,090 stocks and 8,412 bonds. This is incredible diversification! There are pros and cons to every portfolio. You may want to read “Vanguard’s Best ETF Index Funds for Building a Global Portfolio” to get a better understanding of the strengths and weaknesses of each portfolio type. Originally published 2/6/14. Updated on 7/20/15. Share this article with a colleague Scalper1 News

The best no-load ETFs and index funds will help you create a diversified portfolio. Vanguard Funds is the place to start when it comes to finding the best no-load ETFs and index funds. When you are replicating an index, cost and portfolio drift are two of the main issues. Vanguard Funds started the first index fund back in the 1970s, and their ability to limit portfolio drift is well documented. How the best no-load ETFs and index funds do on cost We did some research, which you can see in this chart: (click to enlarge) Source: Morningstar Looks like Vanguard Funds are leading the way in cost no matter which type of investment you wish to purchase. In this article, we focus on the best no-load ETFs and index funds from Vanguard. Which should you buy to make your globally-balanced portfolio – the best no-load ETFs or index funds? We have done a lot of comparison shopping, and our preference is the Vanguard Admiral Shares Index Funds. However, they are not available everywhere; they have a $10,000 minimum purchase, and they do not trade during the day like an ETF. If any of these are issues for you, then we recommend you purchase the Vanguard ETF shares. Want to make a five Vanguard fund portfolio that will cover the planet? Here is what you should buy: Vanguard S&P 500 ETF (NYSEARCA: VOO ) or (MUTF: VFIAX ) – This fund buys the 500 stocks selected by S&P to represent the U.S. large cap stock universe. It has the advantage of being an index that is recognized and purchased around the world. A limited number of stocks with growing global demand and an incredibly low 0.05% expense ratio make this a good core holding for your portfolio. Vanguard Extended Markets ETF (NYSEARCA: VXF ) or (MUTF: VEXAX ) – This fund contains all of the U.S. common stocks regularly traded on the New York Stock Exchange and the Nasdaq over-the-counter market, except those stocks included in the S&P 500 Index. This fund fills in the blanks that are missing from the S&P 500 Index. It holds a total of 3,078 US stocks, mostly mid and small caps, which gives you fantastic coverage of the U.S. stock market. Vanguard Total Bond Market ETF (NYSEARCA: BND ) or (MUTF: VBTLX ) – This ETF tracks the Barclays U.S. Aggregate Float Adjusted Index. It covers a wide range of public, investment-grade, taxable bonds in the United States-including government, corporate, and international dollar-denominated bonds, as well as mortgage-backed and asset-backed securities-all with maturities of more than one year. The ETF invests by sampling the index and currently holds 6,166 bonds. Vanguard Total International Stock ETF (NASDAQ: VXUS ) or (MUTF: VTIAX ) – This ETF tracks the market-cap weighted FTSE Global All Cap ex US Index, which covers 99% of the world’s global market capitalization outside the US. The ETF holds 5,512 stocks from 46 developed and emerging markets. Vanguard Total International Bond ETF (NASDAQ: BNDX ) or (MUTF: VTABX ) – This fund tracks the Barclays Global Aggregate ex-USD Float Adjusted RIC Capped Index (USD Hedged). The index includes government, government agency, corporate, and securitized non-U.S. investment-grade fixed income investments. They are all issued in currencies other than the U.S. dollar, with maturities of more than one year. To minimize the currency risk, the ETF will attempt to hedge its currency exposures. The ETF currently holds 2,246 bonds. With just five Vanguard ETFs or index funds you get exposure to 9,090 stocks and 8,412 bonds. This is incredible diversification! There are pros and cons to every portfolio. You may want to read “Vanguard’s Best ETF Index Funds for Building a Global Portfolio” to get a better understanding of the strengths and weaknesses of each portfolio type. Originally published 2/6/14. Updated on 7/20/15. Share this article with a colleague Scalper1 News

Scalper1 News