Scalper1 News

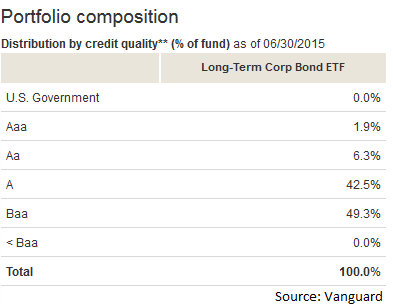

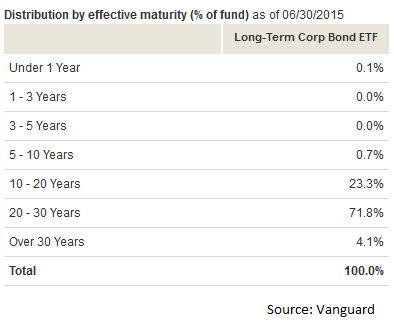

Summary The Vanguard Long-Term Corporate Bond Index ETF takes on some credit risk and quite a bit of duration risk to deliver better yields. The ideal exposure for bond investors would probably include other bond funds for more diversification on credit grades and durations. The low expense ratio is respectable. The Vanguard Long-Term Corporate Bond Index ETF (NASDAQ: VCLT ) is a solid bond fund. As I’ve been searching for appealing bond funds, I’ve found some of my favorites are from Vanguard. Given my distaste for high expense ratios, it should be no surprise that Vanguard products would be appealing. After looking through the portfolio, I think the holdings are fairly reasonable for an investor wanting to regularly keep part of their portfolio in a bond fund. With that said, I have to admit that the duration is fairly long and I’d really like to see stronger yields when taking on this level of duration risk. This would be a dangerous holding for an investor with a fairly short time horizon. For the investor with a long-term horizon, a small allocation here makes sense. Quick Introduction The Vanguard Long-Term Corporate Bond Index ETF is showing a yield to maturity of 4.9% and an average duration of 13.5 years. The yield gives investors a reason to take on the interest rate risk. Credit Quality When I first looked at the credit quality of the Vanguard Long-Term Corporate Bond Index ETF, my first impression was that the credit ratings were stacked pretty close together. The vast majority of the portfolio is rated A or Baa as shown below: It isn’t just the credit ratings that are stacked to a fairly small part of the curve, we also see the effective maturity is very long. Keep in mind that effective maturity is not the same as duration. The average effective maturity is 24 years. Maturities I grabbed another chart to show the effective maturity on the securities: Since we are getting a reasonable yield in a very low interest rate environment it shouldn’t be surprising to see that the maturities are fairly long. However, we are seeing quite a bit of concentration here as well. Because the credit risk and effective maturity are both heavily focused on specific parts of the curve, there is a meaningful amount of diversifiable risk left in the holdings. Risk The easiest way to control for the risk from the concentration of the holdings is simply to combine a few bond ETFs. In my estimate, VCLT is a very solid bond ETF that is at its best when it is combined with other bond ETFs to create the bond portion of a portfolio. Having so much concentration on the risk factors would be a problem if the investor only held VCLT, but very specific exposure can be a desirable factor when an investor is trying to figure out how to fit the bond ETF into their portfolio. Conclusion As far as bond ETFs go, the Vanguard Long-Term Corporate Bond Index ETF is a fairly solid option. For investors that get free trading on the ETF, it is even better because it would be easier to handle rebalancing to take advantage of the diversification benefits that the long-term bond portfolio can bring to a portfolio. The expense ratio is low which is an important selling point. With bond yields already being fairly low, having a high expense ratio is a quick way to get a real drag on any returns from interest payments. If an investor prefers to be a speculator and just wants to bet on rates going lower and getting price appreciation, then the expense ratio is less of an issue. For the long-term holder planning to keep high quality bond ETFs in their portfolio for the next few decades, the low expense ratios are an important factor. Due to the volatility created by having a fairly long duration, I would really favor a strategy with automatic rebalancing and a long time horizon. Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More…) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. Additional disclosure: Information in this article represents the opinion of the analyst. All statements are represented as opinions, rather than facts, and should not be construed as advice to buy or sell a security. Ratings of “outperform” and “underperform” reflect the analyst’s estimation of a divergence between the market value for a security and the price that would be appropriate given the potential for risks and returns relative to other securities. The analyst does not know your particular objectives for returns or constraints upon investing. All investors are encouraged to do their own research before making any investment decision. Information is regularly obtained from Yahoo Finance, Google Finance, and SEC Database. If Yahoo, Google, or the SEC database contained faulty or old information it could be incorporated into my analysis. Scalper1 News

Summary The Vanguard Long-Term Corporate Bond Index ETF takes on some credit risk and quite a bit of duration risk to deliver better yields. The ideal exposure for bond investors would probably include other bond funds for more diversification on credit grades and durations. The low expense ratio is respectable. The Vanguard Long-Term Corporate Bond Index ETF (NASDAQ: VCLT ) is a solid bond fund. As I’ve been searching for appealing bond funds, I’ve found some of my favorites are from Vanguard. Given my distaste for high expense ratios, it should be no surprise that Vanguard products would be appealing. After looking through the portfolio, I think the holdings are fairly reasonable for an investor wanting to regularly keep part of their portfolio in a bond fund. With that said, I have to admit that the duration is fairly long and I’d really like to see stronger yields when taking on this level of duration risk. This would be a dangerous holding for an investor with a fairly short time horizon. For the investor with a long-term horizon, a small allocation here makes sense. Quick Introduction The Vanguard Long-Term Corporate Bond Index ETF is showing a yield to maturity of 4.9% and an average duration of 13.5 years. The yield gives investors a reason to take on the interest rate risk. Credit Quality When I first looked at the credit quality of the Vanguard Long-Term Corporate Bond Index ETF, my first impression was that the credit ratings were stacked pretty close together. The vast majority of the portfolio is rated A or Baa as shown below: It isn’t just the credit ratings that are stacked to a fairly small part of the curve, we also see the effective maturity is very long. Keep in mind that effective maturity is not the same as duration. The average effective maturity is 24 years. Maturities I grabbed another chart to show the effective maturity on the securities: Since we are getting a reasonable yield in a very low interest rate environment it shouldn’t be surprising to see that the maturities are fairly long. However, we are seeing quite a bit of concentration here as well. Because the credit risk and effective maturity are both heavily focused on specific parts of the curve, there is a meaningful amount of diversifiable risk left in the holdings. Risk The easiest way to control for the risk from the concentration of the holdings is simply to combine a few bond ETFs. In my estimate, VCLT is a very solid bond ETF that is at its best when it is combined with other bond ETFs to create the bond portion of a portfolio. Having so much concentration on the risk factors would be a problem if the investor only held VCLT, but very specific exposure can be a desirable factor when an investor is trying to figure out how to fit the bond ETF into their portfolio. Conclusion As far as bond ETFs go, the Vanguard Long-Term Corporate Bond Index ETF is a fairly solid option. For investors that get free trading on the ETF, it is even better because it would be easier to handle rebalancing to take advantage of the diversification benefits that the long-term bond portfolio can bring to a portfolio. The expense ratio is low which is an important selling point. With bond yields already being fairly low, having a high expense ratio is a quick way to get a real drag on any returns from interest payments. If an investor prefers to be a speculator and just wants to bet on rates going lower and getting price appreciation, then the expense ratio is less of an issue. For the long-term holder planning to keep high quality bond ETFs in their portfolio for the next few decades, the low expense ratios are an important factor. Due to the volatility created by having a fairly long duration, I would really favor a strategy with automatic rebalancing and a long time horizon. Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More…) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. Additional disclosure: Information in this article represents the opinion of the analyst. All statements are represented as opinions, rather than facts, and should not be construed as advice to buy or sell a security. Ratings of “outperform” and “underperform” reflect the analyst’s estimation of a divergence between the market value for a security and the price that would be appropriate given the potential for risks and returns relative to other securities. The analyst does not know your particular objectives for returns or constraints upon investing. All investors are encouraged to do their own research before making any investment decision. Information is regularly obtained from Yahoo Finance, Google Finance, and SEC Database. If Yahoo, Google, or the SEC database contained faulty or old information it could be incorporated into my analysis. Scalper1 News

Scalper1 News