Scalper1 News

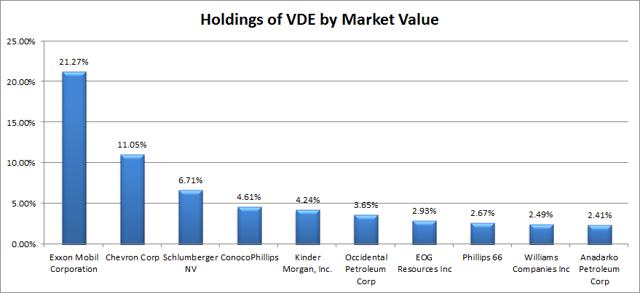

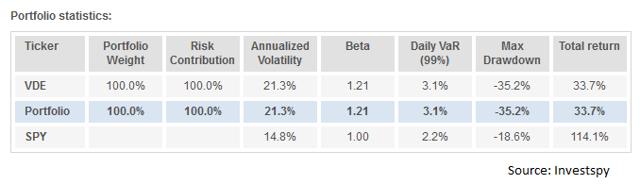

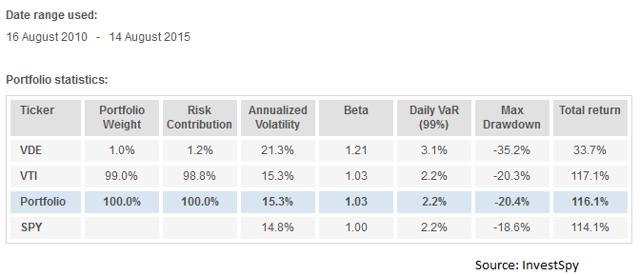

Summary Oil companies seem like a solid natural hedge against higher oil prices and the negative impacts oil prices can have on the economy. VDE has heavy concentration in one company, but I like that holding. The big surprise for me was that high correlation between VDE and the rest of the domestic market. Due to volatility and the high correlation, it appears very difficult to use VDE to reduce total portfolio risk. The low expense ratio is great, but that is not enough to get me to buy into an ETF. When I started looking at the Vanguard Energy ETF (NYSEARCA: VDE ), it looked like a natural fit for my portfolio. The fund is offering diversification while buying up the big oil companies. When it comes to oil, my theory is simple. Holding oil should be a natural hedge to some of the other risks in the economy. When oil prices are doing great, the rest of the economy should be hit by higher gas prices that reduce the amount of capital for consumers to spend at other businesses. The cost of doing business for corporations that rely on physically moving assets should be higher which would compress margins. It is reasonable to assume that VDE should be a great hedge for some of the portfolio risk. I have a bias towards buying high-quality ETFs when I see their prices “dip”. Lately that has been great for me as it has helped me acquire better prices on several of the ETFs I’m holding. On the other hand, if we were to have another major recession where the market fell by 40%, I would’ve been all in by the time the market was down to 5% to 10% and scrambling to get more dry powder to buy more shares when prices were even lower. Largest Holdings The diversification within the ETF is terrible. That sounds like a huge problem, but in this rare case it is not a major issue. If I was going to buy one company to try to hedge against higher oil prices, I would probably pick Exxon Mobil (NYSE: XOM ). That is running around 21% of the portfolio of VDE, as shown below: (click to enlarge) Since XOM is one of the first companies I would want to add to the portfolio, I see VDE as offering diversification for 79% of the investment. From that perspective, the diversification adds a fairly solid benefit relative to only holding one of the major oil producers. When I’m comparing the concentration to the other ETFs I choose, there is no way I would accept so much concentration in any of the other ETFs. Surprises When I ran the statistical analysis over the last 5 years, I was surprised to see the results. I expected oil to appear fairly volatile after the problems the oil market has seen in the last year. Despite expecting some volatility, I wasn’t expecting these results. (click to enlarge) When I ran the ETF through InvestSpy to check the statistics, the high beta stood out to me. I was expecting a lower beta for the ETF, because I thought the correlation would be lower. Instead, using the last 5 years, the correlation was running at 84%. To run some quick math, when the volatility is almost 50% higher than SPY and the correlation is greater than 80%, you’re not going to find any diversification benefits showing up in the statistical analysis relative to just holding SPY. Regardless of how small the weight was for VDE, it would hurt the total portfolio volatility unless the starting portfolio was very strange. To demonstrate that point, I ran a sample portfolio that was 99% Vanguard Total Stock Market ETF (NYSEARCA: VTI ). I use VTI for a substantial portion of my portfolio because I value the diversification. I’m not using it as 99%, but I think this demonstrates precisely the challenge in using VDE. (click to enlarge) When an ETF is only used for 1% of the portfolio, even high levels of volatility can be dealt with by simply diversifying away the risk. However, the high correlation between VDE and the domestic U.S. market is preventing it from gaining those benefits. Double Dipping on Exposure The simplest argument for VDE having such a high correlation with the total stock market ETF and with the S&P 500 would be that XOM is already an enormous company and thus it is influencing both ETFs. However, the problem with that argument is that XOM is only 1.53% of the VTI portfolio. Expense Ratio The expense ratio is only .12%, which is a good reasonable ratio. Unfortunately, a low expense ratio is not enough by itself to get me to invest in a fund. Conclusion I like the idea of increasing my oil exposure and regularly rebalancing the position after seeing how far some of the sector has fallen. Despite that desire, the combination of volatility and correlation makes it much harder for me to justify using a heavy exposure to the sector. Perhaps I need to measure the returns over longer sample periods such as quarters at a time to test for lower correlation levels. That might reduce the correlation of returns, and I’m more likely to assess the performance of my portfolio on a monthly or quarterly basis. I look for opportunities to invest more often than that, but I don’t want to sweat minor changes. Disclosure: I am/we are long VTI. (More…) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. Additional disclosure: Information in this article represents the opinion of the analyst. All statements are represented as opinions, rather than facts, and should not be construed as advice to buy or sell a security. Ratings of “outperform” and “underperform” reflect the analyst’s estimation of a divergence between the market value for a security and the price that would be appropriate given the potential for risks and returns relative to other securities. The analyst does not know your particular objectives for returns or constraints upon investing. All investors are encouraged to do their own research before making any investment decision. Information is regularly obtained from Yahoo Finance, Google Finance, and SEC Database. If Yahoo, Google, or the SEC database contained faulty or old information it could be incorporated into my analysis. Scalper1 News

Summary Oil companies seem like a solid natural hedge against higher oil prices and the negative impacts oil prices can have on the economy. VDE has heavy concentration in one company, but I like that holding. The big surprise for me was that high correlation between VDE and the rest of the domestic market. Due to volatility and the high correlation, it appears very difficult to use VDE to reduce total portfolio risk. The low expense ratio is great, but that is not enough to get me to buy into an ETF. When I started looking at the Vanguard Energy ETF (NYSEARCA: VDE ), it looked like a natural fit for my portfolio. The fund is offering diversification while buying up the big oil companies. When it comes to oil, my theory is simple. Holding oil should be a natural hedge to some of the other risks in the economy. When oil prices are doing great, the rest of the economy should be hit by higher gas prices that reduce the amount of capital for consumers to spend at other businesses. The cost of doing business for corporations that rely on physically moving assets should be higher which would compress margins. It is reasonable to assume that VDE should be a great hedge for some of the portfolio risk. I have a bias towards buying high-quality ETFs when I see their prices “dip”. Lately that has been great for me as it has helped me acquire better prices on several of the ETFs I’m holding. On the other hand, if we were to have another major recession where the market fell by 40%, I would’ve been all in by the time the market was down to 5% to 10% and scrambling to get more dry powder to buy more shares when prices were even lower. Largest Holdings The diversification within the ETF is terrible. That sounds like a huge problem, but in this rare case it is not a major issue. If I was going to buy one company to try to hedge against higher oil prices, I would probably pick Exxon Mobil (NYSE: XOM ). That is running around 21% of the portfolio of VDE, as shown below: (click to enlarge) Since XOM is one of the first companies I would want to add to the portfolio, I see VDE as offering diversification for 79% of the investment. From that perspective, the diversification adds a fairly solid benefit relative to only holding one of the major oil producers. When I’m comparing the concentration to the other ETFs I choose, there is no way I would accept so much concentration in any of the other ETFs. Surprises When I ran the statistical analysis over the last 5 years, I was surprised to see the results. I expected oil to appear fairly volatile after the problems the oil market has seen in the last year. Despite expecting some volatility, I wasn’t expecting these results. (click to enlarge) When I ran the ETF through InvestSpy to check the statistics, the high beta stood out to me. I was expecting a lower beta for the ETF, because I thought the correlation would be lower. Instead, using the last 5 years, the correlation was running at 84%. To run some quick math, when the volatility is almost 50% higher than SPY and the correlation is greater than 80%, you’re not going to find any diversification benefits showing up in the statistical analysis relative to just holding SPY. Regardless of how small the weight was for VDE, it would hurt the total portfolio volatility unless the starting portfolio was very strange. To demonstrate that point, I ran a sample portfolio that was 99% Vanguard Total Stock Market ETF (NYSEARCA: VTI ). I use VTI for a substantial portion of my portfolio because I value the diversification. I’m not using it as 99%, but I think this demonstrates precisely the challenge in using VDE. (click to enlarge) When an ETF is only used for 1% of the portfolio, even high levels of volatility can be dealt with by simply diversifying away the risk. However, the high correlation between VDE and the domestic U.S. market is preventing it from gaining those benefits. Double Dipping on Exposure The simplest argument for VDE having such a high correlation with the total stock market ETF and with the S&P 500 would be that XOM is already an enormous company and thus it is influencing both ETFs. However, the problem with that argument is that XOM is only 1.53% of the VTI portfolio. Expense Ratio The expense ratio is only .12%, which is a good reasonable ratio. Unfortunately, a low expense ratio is not enough by itself to get me to invest in a fund. Conclusion I like the idea of increasing my oil exposure and regularly rebalancing the position after seeing how far some of the sector has fallen. Despite that desire, the combination of volatility and correlation makes it much harder for me to justify using a heavy exposure to the sector. Perhaps I need to measure the returns over longer sample periods such as quarters at a time to test for lower correlation levels. That might reduce the correlation of returns, and I’m more likely to assess the performance of my portfolio on a monthly or quarterly basis. I look for opportunities to invest more often than that, but I don’t want to sweat minor changes. Disclosure: I am/we are long VTI. (More…) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. Additional disclosure: Information in this article represents the opinion of the analyst. All statements are represented as opinions, rather than facts, and should not be construed as advice to buy or sell a security. Ratings of “outperform” and “underperform” reflect the analyst’s estimation of a divergence between the market value for a security and the price that would be appropriate given the potential for risks and returns relative to other securities. The analyst does not know your particular objectives for returns or constraints upon investing. All investors are encouraged to do their own research before making any investment decision. Information is regularly obtained from Yahoo Finance, Google Finance, and SEC Database. If Yahoo, Google, or the SEC database contained faulty or old information it could be incorporated into my analysis. Scalper1 News

Scalper1 News