Scalper1 News

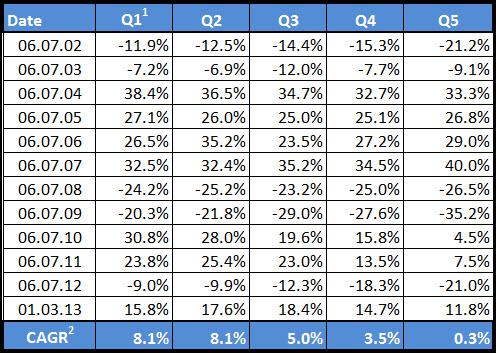

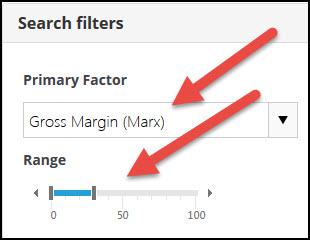

By Tim du Toit Do you think adding a company quality ratio to your investment strategy can make a difference to your returns? As you know we are skeptical, as our experience testing quality ratios in the research paper Quantitative Value Investing in Europe: What Works for Achieving Alpha was mixed. What doesn’t work We found that Return on invested capital (ROIC) and return on assets (ROA) weren’t good predictors of returns. Even though high-quality companies did do better than low-quality companies (low ROIC and ROA) returns did not increase in a linear way as you moved from low-quality to high-quality companies. And if you only invested in high-quality companies, it would not have helped you to consistently beat the market. A better quality ratio? Our thinking on quality ratios changed when we read a very interesting research paper called The Other Side of Value: The Gross Profitability Premium by Professor Robert Novy-Marx in which he defined a company quality ratio performed as well as a valuation ratio. How calculated Professor Novy-Marx defined a quality company as one that had a high gross income ratio (let’s call it Quality Novy-Marx ), which he calculated by dividing gross profits by total assets . He defined gross profit as sales minus cost of sales and assets simply total assets as shown in the company’s balance sheet (current assets + fixed assets). Does it work? In the paper Professor Novy-Marx shows that this simple ratio has about the same predictive return value as the price to book ratio in spite of companies with a high gross income ratio (Quality Novy-Marx) being a lot different if you compare them to undervalued companies with a low price to book ratio. Companies with a high Quality Novy-Marx ratio generated significantly higher average returns than less profitable companies in spite of them, on average, having a higher price to book ratio (more expensive) and higher market values. Because value (low price to book) and profitability (high Quality Novy-Marx ratio) strategies’ returns are negatively correlated (the one goes up when the other goes down), the two strategies work very well together. So much so that Professor Novy-Marx in the paper suggests that value investors can capture the full high-quality outperformance without taking on any additional risk by adding a high quality strategy to an existing value strategy. If you do this he found that this reduces overall portfolio volatility, in spite of it doubling your exposure to the stock market. We also tested it We of course also wanted to test if the Quality Novy-Marx ratio works on the European stock markets. Our back test (on European companies) over just less than 12 years from July 2001 to March 2013 came up with the following result: Source: Quant-Investing.com 1 Quintiles 2 Compound Annual Growth Rate ( OTCPK:CAGR ) As you can see the results are (apart from Q1 to Q2) linear, which means as you move from low-quality companies (Q5) to high-quality companies (Q1) returns increase every time. Also high quality companies (Q1) did substantially better than low-quality companies (Q5). This clearly shows that the Quality Novy-Marx ratio is a very good ratio to add to how you search for investment ideas. Substantially outperformed the market High-quality companies also substantially outperformed the index. The STOXX Europe 600 index over the same period had a compound annual growth rate of -0.82%, worse than even the worse quintile, most likely because of the banks being included in the index (not in the back test universe because you cannot calculate the Quality Novy-Marx ratio for them). In summary From these two back tests you can see that adding quality companies, defined as companies with high gross profits to total assets can definitely add to your investment returns. We have not tested it but Professor Novy-Marx mentions that if you are a value investor, quality companies have the ability to increase your returns and decrease the volatility of your portfolio. But if you add this quality ratio to your screens, you will find companies that are not undervalued, which is something that value investors will have to get used to. Where can you find it? In the screener you can select the gross income ratio (called Gross Margin (Marx)) as a ratio in one of the four sliders as shown below. Or you can select the Gross Margin (Marx) as a column in your screen which will allow you to filter and sort the Gross Margin (Marx) values. Scalper1 News

By Tim du Toit Do you think adding a company quality ratio to your investment strategy can make a difference to your returns? As you know we are skeptical, as our experience testing quality ratios in the research paper Quantitative Value Investing in Europe: What Works for Achieving Alpha was mixed. What doesn’t work We found that Return on invested capital (ROIC) and return on assets (ROA) weren’t good predictors of returns. Even though high-quality companies did do better than low-quality companies (low ROIC and ROA) returns did not increase in a linear way as you moved from low-quality to high-quality companies. And if you only invested in high-quality companies, it would not have helped you to consistently beat the market. A better quality ratio? Our thinking on quality ratios changed when we read a very interesting research paper called The Other Side of Value: The Gross Profitability Premium by Professor Robert Novy-Marx in which he defined a company quality ratio performed as well as a valuation ratio. How calculated Professor Novy-Marx defined a quality company as one that had a high gross income ratio (let’s call it Quality Novy-Marx ), which he calculated by dividing gross profits by total assets . He defined gross profit as sales minus cost of sales and assets simply total assets as shown in the company’s balance sheet (current assets + fixed assets). Does it work? In the paper Professor Novy-Marx shows that this simple ratio has about the same predictive return value as the price to book ratio in spite of companies with a high gross income ratio (Quality Novy-Marx) being a lot different if you compare them to undervalued companies with a low price to book ratio. Companies with a high Quality Novy-Marx ratio generated significantly higher average returns than less profitable companies in spite of them, on average, having a higher price to book ratio (more expensive) and higher market values. Because value (low price to book) and profitability (high Quality Novy-Marx ratio) strategies’ returns are negatively correlated (the one goes up when the other goes down), the two strategies work very well together. So much so that Professor Novy-Marx in the paper suggests that value investors can capture the full high-quality outperformance without taking on any additional risk by adding a high quality strategy to an existing value strategy. If you do this he found that this reduces overall portfolio volatility, in spite of it doubling your exposure to the stock market. We also tested it We of course also wanted to test if the Quality Novy-Marx ratio works on the European stock markets. Our back test (on European companies) over just less than 12 years from July 2001 to March 2013 came up with the following result: Source: Quant-Investing.com 1 Quintiles 2 Compound Annual Growth Rate ( OTCPK:CAGR ) As you can see the results are (apart from Q1 to Q2) linear, which means as you move from low-quality companies (Q5) to high-quality companies (Q1) returns increase every time. Also high quality companies (Q1) did substantially better than low-quality companies (Q5). This clearly shows that the Quality Novy-Marx ratio is a very good ratio to add to how you search for investment ideas. Substantially outperformed the market High-quality companies also substantially outperformed the index. The STOXX Europe 600 index over the same period had a compound annual growth rate of -0.82%, worse than even the worse quintile, most likely because of the banks being included in the index (not in the back test universe because you cannot calculate the Quality Novy-Marx ratio for them). In summary From these two back tests you can see that adding quality companies, defined as companies with high gross profits to total assets can definitely add to your investment returns. We have not tested it but Professor Novy-Marx mentions that if you are a value investor, quality companies have the ability to increase your returns and decrease the volatility of your portfolio. But if you add this quality ratio to your screens, you will find companies that are not undervalued, which is something that value investors will have to get used to. Where can you find it? In the screener you can select the gross income ratio (called Gross Margin (Marx)) as a ratio in one of the four sliders as shown below. Or you can select the Gross Margin (Marx) as a column in your screen which will allow you to filter and sort the Gross Margin (Marx) values. Scalper1 News

Scalper1 News