We issued an updated research report on Vale S.A. VALE on Jan 6, 2017.

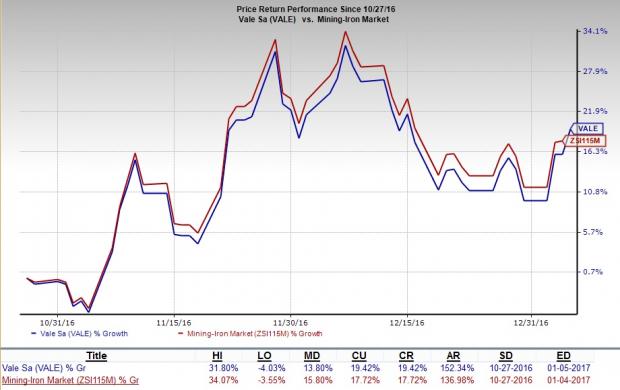

This Zacks Rank #1 (Strong Buy) stock looks bullish at the moment. Post third-quarter 2016 earnings release (Oct 27, 2016), Vale’s shares recorded a return of 19.42% – outperforming 17.72% return provided by the Zacks categorized Mining-Iron industry.

Why Should You Pick this Stock?

Vale is currently boosting its competency on the back of environmental licenses, lower expenses & costs, strategic portfolio management and productive project implementation.

The company is bolstering its revenues on higher selling prices of certain core metals and rising demand for fertilizers and ferrous minerals in the market. Profitability has been improving on the back of a robust top line and lower costs.

Vale has been trying to curb its exploration and mining expenses by maximizing the productivity of major mines. Notably, the company is aimed at fortifying its production capacity by investing in new projects. Its major ferrous mineral and coal projects have just commenced operations or are on the verge of completion.

For instance, the company’s new iron ore mine and processing plant, build under the Carajás Serra Sul S11D project, began its operations in the third quarter. Successful ramp-up and stable productivity of these projects would likely augment Vale’s production capability. This, in turn, would equip its business to capture the growing demand for core metals in the near term.

In addition, the company implements a progressive dividend policy, which highlights its commitment to raise shareholders’ wealth. By investing in high-return growth opportunities, Vale intends to strengthen its cash position for offering attractive share buyback and dividend distribution programs for its shareholders. Moreover, efficient disinvestment programs and suitable capital-deployment strategies are likely to stabilize the company’s debt level in the quarters ahead.

Over the last 60 days, the Zacks Consensus Estimate for the stock moved north for 2017, reflecting positive sentiments.

Other Stocks that Warrant a Look

The Chemours Company CC has a whopping average earnings surprise of 153.83% for the last four quarters and currently sports a Zacks Rank #1. You can see the complete list of today’s Zacks #1 Rank stocks here .

Daqo New Energy Corp. DQ also flaunts a Zacks Rank #1 and has an average earnings surprise of 112.94% for the trailing four quarters.

Monsanto Company MON , which currently carries a Zacks Rank #2 (Buy), has an average earnings surprise of 124.52% for the last four quarters.

The Best Place to Start Your Stock Search

Today, you are invited to download the full list of 220 Zacks Rank #1 “Strong Buy” stocks – absolutely free of charge. Since 1988, Zacks Rank #1 stocks have nearly tripled the market, with average gains of +26% per year. Plus, you can access the list of portfolio-killing Zacks Rank #5 “Strong Sells” and other private research. See these stocks free >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

DAQO New Energy Corp. (DQ): Free Stock Analysis Report

VALE S.A. (VALE): Free Stock Analysis Report

Monsanto Company (MON): Free Stock Analysis Report

Chemours Company (The) (CC): Free Stock Analysis Report

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

Plantations International