Scalper1 News

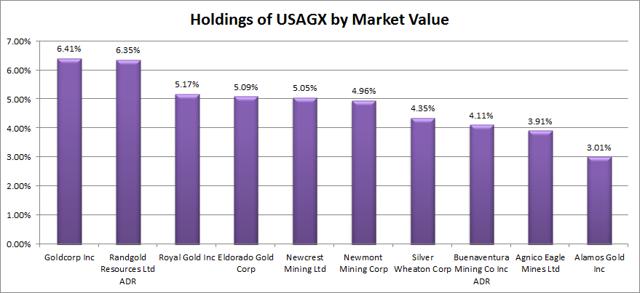

Summary USAGX offers investors a 1.24% expense ratio to go with a very undesirable batch of companies. The fund holds only 55 companies so investors seeking to diversify can get enough diversification without the mutual fund. The mining industry (including precious metals) is currently in a terribly bearish cycle because of the industry dynamics. Individual companies are choosing to expand production to lower average cost per unit. Expanded production is driving global supply higher and prices lower. One of my picks for least attractive investment is the USAA Precious Metals and Minerals Fund No Load (MUTF: USAGX ). This isn’t a slam on USAA; I believe their banking services and insurance products are excellent. Unfortunately, this mutual fund doesn’t resemble the rest of the sponsor’s company. Terrible Sector The first issue with USAGX is that it is simply positioned in a terrible sector. The mutual fund is investing heavily in mining companies and precious metals which has been a very ugly sector for years. To be fair, I have one mining company in my portfolio and it is a trading investment, not a long term holding. The mutual fund suffers from a few things but one major factor impacting returns has been that mining sector has been terrible. I regularly tell investors to ensure their holdings are adequately diversified, but I can’t bring that same argument to the mining sector. The problem with the mining sector is that the status quo is destroying the industry. Major mining companies are working desperately to expand production as prices crash seeking safety through having lower average costs of production than their competitors. The primary method for reducing their costs is to constantly drive their volume upwards which allows the fixed costs to be spread over a larger volume of production. In a vacuum, that strategy would make perfect sense. Under perfect competition we assume that companies are unable to produce enough of any commodity or product to influence the market price. In reality, we see that this competitive cycle has resulted in too much capacity being built and more being on the way. The only way to get a real broad based recovery for the entire sector, the kind of recovery that would be great for diversified investors, would be for the industry to see dramatically lower levels of competition. Since the biggest companies have been very clear about their intentions to continue driving up capacity rather than worry about the state of the industry, the most likely scenario for capacity to go offline is for smaller firms to fail. Holding a diversified portfolio means holding companies that will go bankrupt as well those that will survive. Diversified with Cost To be fair, it is possible that the investments within USAGX will be picked carefully to avoid holding the ones that will go bankrupt. That is a viable argument, for using an actively managed fund over a passive fund. However, there isn’t a great deal of turnover in the portfolio. The last reported statistic for portfolio turnover showed only 10%. Despite the relatively low turnover, the expense ratio is a mind blowing 1.24%. This is remarkably better than the category average of 1.5%, but this is really a sign to investors that creating a mutual fund for this sector may be a profitable investment. Except it is not that Diversified Despite the high expense ratio, the mutual fund isn’t actually that diversified even within the mining sector. The fund holds only 55 companies and is focused on precious metals rather than being spread across all metals. Easier to replicate For investors that want exposure to the holdings, they may want to seriously consider buying the individual companies or using one of the services that will assist the investor in investing in their own customized fund. For instance, Motif offers investors the ability to create their own custom investment and buy shares in it. Motif would limit those investors to 30 stocks in their customized investment, but the difference from a diversification standpoint between 30 stocks in one sector and 55 stocks in the same sector is not that large. I like broad market ETFs that investing in several segments of the economy for diversification. I also like expense ratios under .10%. If an investor is willing to eat substantial annual costs, they would be better off dealing with the trading fees than paying the expense ratios to use mutual funds for this sector. Holdings The chart below shows the top ten holdings of USAGX. (click to enlarge) Precisely as described, the holdings are focused on mining precious metals. I have no problem with the individual holdings as companies, but I find the industry very unattractive because excessive competition is driving down prices, which in turn is hurting margins, and each individual company is aiming to fix the problem for themselves by creating more the commodity. When the behaviors are looked at individually, they make perfect sense. When they are seen collectively, this is the tragedy of the commons playing out on a global level. Conclusion The only thing I can find to like about the mutual fund is the lack of a load fee. Overall, I see inefficient segment of the market where the mutual funds are offering investors terrible returns and sponsors high income from expense ratios. Investors confident that they should invest in this sector would be better off doing the due diligence on each company they want to buy rather than buying a group of companies that are rapidly working to destroy each other and accidentally destroying themselves in the process. Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More…) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. Additional disclosure: Information in this article represents the opinion of the analyst. All statements are represented as opinions, rather than facts, and should not be construed as advice to buy or sell a security. Ratings of “outperform” and “underperform” reflect the analyst’s estimation of a divergence between the market value for a security and the price that would be appropriate given the potential for risks and returns relative to other securities. The analyst does not know your particular objectives for returns or constraints upon investing. All investors are encouraged to do their own research before making any investment decision. Information is regularly obtained from Yahoo Finance, Google Finance, and SEC Database. If Yahoo, Google, or the SEC database contained faulty or old information it could be incorporated into my analysis. Scalper1 News

Summary USAGX offers investors a 1.24% expense ratio to go with a very undesirable batch of companies. The fund holds only 55 companies so investors seeking to diversify can get enough diversification without the mutual fund. The mining industry (including precious metals) is currently in a terribly bearish cycle because of the industry dynamics. Individual companies are choosing to expand production to lower average cost per unit. Expanded production is driving global supply higher and prices lower. One of my picks for least attractive investment is the USAA Precious Metals and Minerals Fund No Load (MUTF: USAGX ). This isn’t a slam on USAA; I believe their banking services and insurance products are excellent. Unfortunately, this mutual fund doesn’t resemble the rest of the sponsor’s company. Terrible Sector The first issue with USAGX is that it is simply positioned in a terrible sector. The mutual fund is investing heavily in mining companies and precious metals which has been a very ugly sector for years. To be fair, I have one mining company in my portfolio and it is a trading investment, not a long term holding. The mutual fund suffers from a few things but one major factor impacting returns has been that mining sector has been terrible. I regularly tell investors to ensure their holdings are adequately diversified, but I can’t bring that same argument to the mining sector. The problem with the mining sector is that the status quo is destroying the industry. Major mining companies are working desperately to expand production as prices crash seeking safety through having lower average costs of production than their competitors. The primary method for reducing their costs is to constantly drive their volume upwards which allows the fixed costs to be spread over a larger volume of production. In a vacuum, that strategy would make perfect sense. Under perfect competition we assume that companies are unable to produce enough of any commodity or product to influence the market price. In reality, we see that this competitive cycle has resulted in too much capacity being built and more being on the way. The only way to get a real broad based recovery for the entire sector, the kind of recovery that would be great for diversified investors, would be for the industry to see dramatically lower levels of competition. Since the biggest companies have been very clear about their intentions to continue driving up capacity rather than worry about the state of the industry, the most likely scenario for capacity to go offline is for smaller firms to fail. Holding a diversified portfolio means holding companies that will go bankrupt as well those that will survive. Diversified with Cost To be fair, it is possible that the investments within USAGX will be picked carefully to avoid holding the ones that will go bankrupt. That is a viable argument, for using an actively managed fund over a passive fund. However, there isn’t a great deal of turnover in the portfolio. The last reported statistic for portfolio turnover showed only 10%. Despite the relatively low turnover, the expense ratio is a mind blowing 1.24%. This is remarkably better than the category average of 1.5%, but this is really a sign to investors that creating a mutual fund for this sector may be a profitable investment. Except it is not that Diversified Despite the high expense ratio, the mutual fund isn’t actually that diversified even within the mining sector. The fund holds only 55 companies and is focused on precious metals rather than being spread across all metals. Easier to replicate For investors that want exposure to the holdings, they may want to seriously consider buying the individual companies or using one of the services that will assist the investor in investing in their own customized fund. For instance, Motif offers investors the ability to create their own custom investment and buy shares in it. Motif would limit those investors to 30 stocks in their customized investment, but the difference from a diversification standpoint between 30 stocks in one sector and 55 stocks in the same sector is not that large. I like broad market ETFs that investing in several segments of the economy for diversification. I also like expense ratios under .10%. If an investor is willing to eat substantial annual costs, they would be better off dealing with the trading fees than paying the expense ratios to use mutual funds for this sector. Holdings The chart below shows the top ten holdings of USAGX. (click to enlarge) Precisely as described, the holdings are focused on mining precious metals. I have no problem with the individual holdings as companies, but I find the industry very unattractive because excessive competition is driving down prices, which in turn is hurting margins, and each individual company is aiming to fix the problem for themselves by creating more the commodity. When the behaviors are looked at individually, they make perfect sense. When they are seen collectively, this is the tragedy of the commons playing out on a global level. Conclusion The only thing I can find to like about the mutual fund is the lack of a load fee. Overall, I see inefficient segment of the market where the mutual funds are offering investors terrible returns and sponsors high income from expense ratios. Investors confident that they should invest in this sector would be better off doing the due diligence on each company they want to buy rather than buying a group of companies that are rapidly working to destroy each other and accidentally destroying themselves in the process. Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More…) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. Additional disclosure: Information in this article represents the opinion of the analyst. All statements are represented as opinions, rather than facts, and should not be construed as advice to buy or sell a security. Ratings of “outperform” and “underperform” reflect the analyst’s estimation of a divergence between the market value for a security and the price that would be appropriate given the potential for risks and returns relative to other securities. The analyst does not know your particular objectives for returns or constraints upon investing. All investors are encouraged to do their own research before making any investment decision. Information is regularly obtained from Yahoo Finance, Google Finance, and SEC Database. If Yahoo, Google, or the SEC database contained faulty or old information it could be incorporated into my analysis. Scalper1 News

Scalper1 News