Scalper1 News

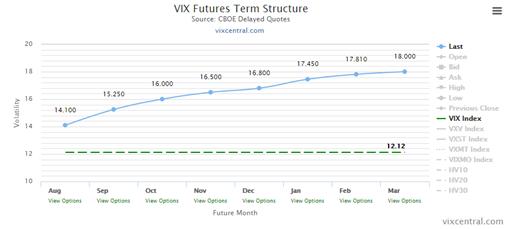

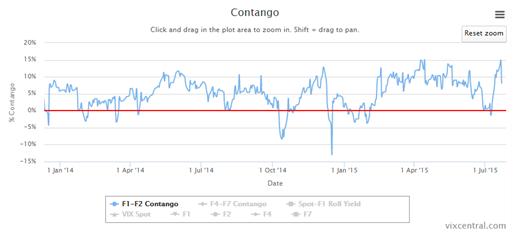

I recommended shorting VXX two weeks ago at the height of the Greece situation. That trade is up about 25% in two weeks as VXX is making new lows. Contango is still high so shorting VXX will still be profitable but I’m ringing the register here. A couple of weeks ago I wrote an article about the short term volatility ETF VXX (NYSEARCA: VXX ) during the height of the nonsense coming out of Greece. At the time panic levels were elevated and the VXX had climbed nicely from $17 to $21+ and the VIX term structure was nearly flat in the near months. That, combined with what I was quite sure was a situation that would be resolved peacefully by the EU, led me to believe VXX was expensive at $21.51 and I said investors should short it from that level. If we fast forward to today that proved to be the near exact top in VXX and we now see it making new lows once more. That trade worked out very nicely but what do we do now? (click to enlarge) The spike in VXX was pretty easy to call because the situation in Greece was blown way out of proportion. It is events like this that I love because people panic and provide us with very easy opportunities to make 20%+ gains in a matter of a few trading days by shorting VXX into these types of things. But now that it is over and the VIX has tanked once more, I think more caution is warranted in trading VXX. The easy spike in the VIX that allows us to take advantage of short opportunities in VXX is gone but contango in the VIX term structure is still very high as out months are elevated compared to the front month. This chart from vixcentral.com shows us that while the VIX spike premium is out of VXX there is still a lot of contango in the term structure so VXX will decay pretty quickly at these levels. This chart puts a magnitude on the contango as you can see the cost of holding VXX is very high right now. That means you’ll see sizable gains over time shorting VXX but the potential for huge short term gains is gone. I like to short VXX when it spikes and contango evaporates because that is a highly unsustainable position as you can see from this chart. At this point we just have negative roll yield and while that’s a powerful force in shorting VXX, it is a medium term story and not a matter of a couple of days. As a result, I’m ringing the register here. My short VXX trade is up ~25% in a couple of weeks and while contango is very high and there is still money to be made shorting VXX, I’m content to take my gains and move on. I’m not calling a bottom in VXX because the bottom continues to go lower but I am saying the easy money has been made. I’ll short VXX again at some point in the future but simply collecting the roll yield when the market looks like it might be topping is too risky for me. Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More…) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. Share this article with a colleague Scalper1 News

I recommended shorting VXX two weeks ago at the height of the Greece situation. That trade is up about 25% in two weeks as VXX is making new lows. Contango is still high so shorting VXX will still be profitable but I’m ringing the register here. A couple of weeks ago I wrote an article about the short term volatility ETF VXX (NYSEARCA: VXX ) during the height of the nonsense coming out of Greece. At the time panic levels were elevated and the VXX had climbed nicely from $17 to $21+ and the VIX term structure was nearly flat in the near months. That, combined with what I was quite sure was a situation that would be resolved peacefully by the EU, led me to believe VXX was expensive at $21.51 and I said investors should short it from that level. If we fast forward to today that proved to be the near exact top in VXX and we now see it making new lows once more. That trade worked out very nicely but what do we do now? (click to enlarge) The spike in VXX was pretty easy to call because the situation in Greece was blown way out of proportion. It is events like this that I love because people panic and provide us with very easy opportunities to make 20%+ gains in a matter of a few trading days by shorting VXX into these types of things. But now that it is over and the VIX has tanked once more, I think more caution is warranted in trading VXX. The easy spike in the VIX that allows us to take advantage of short opportunities in VXX is gone but contango in the VIX term structure is still very high as out months are elevated compared to the front month. This chart from vixcentral.com shows us that while the VIX spike premium is out of VXX there is still a lot of contango in the term structure so VXX will decay pretty quickly at these levels. This chart puts a magnitude on the contango as you can see the cost of holding VXX is very high right now. That means you’ll see sizable gains over time shorting VXX but the potential for huge short term gains is gone. I like to short VXX when it spikes and contango evaporates because that is a highly unsustainable position as you can see from this chart. At this point we just have negative roll yield and while that’s a powerful force in shorting VXX, it is a medium term story and not a matter of a couple of days. As a result, I’m ringing the register here. My short VXX trade is up ~25% in a couple of weeks and while contango is very high and there is still money to be made shorting VXX, I’m content to take my gains and move on. I’m not calling a bottom in VXX because the bottom continues to go lower but I am saying the easy money has been made. I’ll short VXX again at some point in the future but simply collecting the roll yield when the market looks like it might be topping is too risky for me. Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More…) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. Share this article with a colleague Scalper1 News

Scalper1 News