U.S. Silica Holdings, Inc. SLCA is set to release fourth-quarter 2016 results after the closing bell on Feb 22.

Last quarter, the company posted a loss of 13 cents per share compared to a net income of 4 cents in the third-quarter 2015. However, the loss was narrower than the Zacks Consensus Estimate of a loss of 19 cents.

The company’s net sales were $ 138 million, down 11% from the year ago quarter. Revenues missed the Zacks Consensus Estimate of $ 140 million.

Let’s take a look at how things are shaping up for this announcement.

Factors to Consider

U.S. Silica’s healthy balance sheet provides it with ample opportunities for making strategic investments that will ensure its long-term competitive position in the market. The company’s decision to raise capital enhanced its financial flexibility and reinforced its balance sheet.

U.S. Silica is actively pursuing many cost improvement projects throughout its supply chain. Moreover, the company remains focused on preserving capital by giving priority to critical maintenance projects and is also boosting its market position.

As part of its investment strategy, U.S. Silica purchased the NBR Sand unit of New Birmingham Inc., a privately-owned industrial minerals and logistics company which enables the company to expand its product offering and capacity in the regional sands market, and enhance customer satisfaction. The company is optimistic about the growth of the regional sand market and is looking to create a strong foothold in the same.

U.S. Silica has also acquired logistics solutions provider, Sandbox Enterprises LLC. This acquisition will allow the company to offer its customers improved transportation and operating efficiencies and meaningful cost savings relative to the existing delivery systems. The acquisition is also expected to deliver earnings accretion of between 20 cents and 30 cents per share in 2017.

U.S. Silica has outperformed the Zacks categorized Mining-Miscellaneous industry over the past three months. The company’s shares have rallied around 21.5% over this period, compared with roughly 13.4% gain recorded by the industry.

Earnings Whispers

Our proven model does not conclusively show that U.S. Silica is likely to beat estimates this quarter. This is because a stock needs to have both a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) for this to happen. This is not the case here, as you will see below:

Zacks ESP : Earnings ESP for U.S. Silica is currently pegged at -20%. This is because the Most Accurate estimate stands at a loss of 12 cents and the Zacks Consensus Estimate is pegged at a loss of 10 cents. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter .

Zacks Rank : U.S. Silica carries a Zacks Rank #2. Though a Zacks Rank #2 increases the predictive power of ESP, the company’s negative ESP of 20% makes surprise prediction difficult.

Concurrently, we caution against Sell-rated stocks (#4 or 5) going into the earnings announcement, especially when the company is seeing negative estimate revisions.

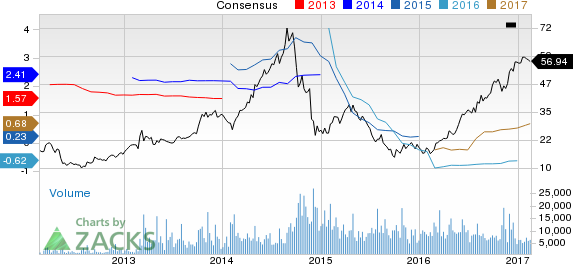

U.S. Silica Holdings, Inc. Price and Consensus

U.S. Silica Holdings, Inc. Price and Consensus | U.S. Silica Holdings, Inc. Quote

Stocks to Consider

Here are some companies in the basic materials space you may want to consider as our model shows that these have the right combination of elements to post an earnings beat this quarter:

Intrepid Potash, Inc. IPI has an Earnings ESP of +20% and a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank stocks here .

Koppers Holdings Inc. KOP has an Earnings ESP of +3.85% and a Zacks Rank #3.

IAMGOLD Corporation IAG has an Earnings ESP of +100% and a Zacks Rank #3.

Zacks’ Best Private Investment Ideas

In addition to the recommendations that are available to the public on our website, how would you like to follow all Zacks’ private buys and sells in real time?

Our experts cover all kinds of trades… from value to momentum . . . from stocks under $ 10 to ETF and option moves . . . from stocks that corporate insiders are buying up to companies that are about to report positive earnings surprises. You can even look inside exclusive portfolios that are normally closed to new investors. Starting today, for the next month, you can have unrestricted access. Click here for Zacks’ private trades >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Koppers Holdings Inc. (KOP): Free Stock Analysis Report

Intrepid Potash, Inc (IPI): Free Stock Analysis Report

Iamgold Corporation (IAG): Free Stock Analysis Report

U.S. Silica Holdings, Inc. (SLCA): Free Stock Analysis Report

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

Plantations International