Scalper1 News

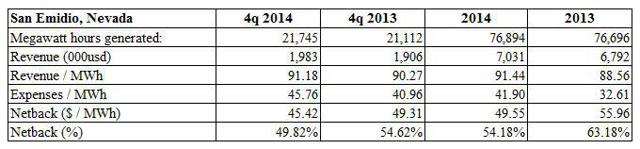

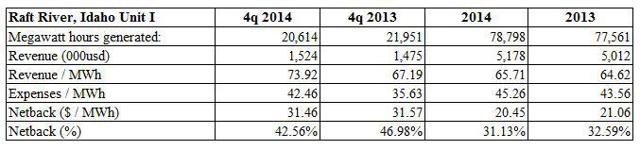

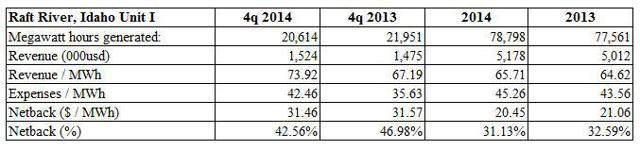

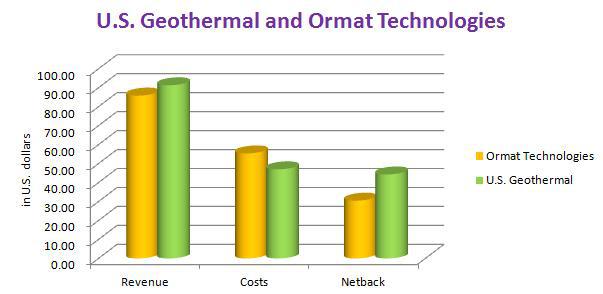

Summary U.S. Geothermal has entered its stable stage of development. To radically improve its financial results, the company has to put new projects into operation. In its 2014 Annual Report, U.S. Geothermal once again reports the delays in implementing a few projects under development. Investors should give serious consideration to these factors before investing in HTM shares. On March 17, U.S. Geothermal (NYSEMKT: HTM ) announced its 2014 results . The table below evidences a few basic measures recorded in three consecutive years: (in thousands of U.S. dollars) Source: HTM reports As the table shows, after a dramatic increase in revenues and financial results in 2013 (that year, two projects – San Emidio and Neal Hot Springs – reached their planned capacities), in 2014, the company leveled off. Two new and prospective geothermal projects were acquired, but no new geothermal plants went on-line. In my opinion, this situation will not change until 2018, when new plants should go on-line. Therefore, between 2015 and 2018, due to the fact that the company should grow only organically, no radical change in its financial results should be visible. Below, I am discussing some aspects of this organic growth; in the last section of this article, I will try to summarize the prospects of exploration projects. Organic growth The tables below summarize the results reported by three currently operating geothermal plants: San Emidio, Nevada (click to enlarge) Source: Simple Digressions and HTM reports In 2014, San Emidio’s operating costs increased much higher than its revenues. As the company explains (2014 Annual Report, page 79), the increase in costs is primarily a result of higher property tax expenses and related legal costs, which went up by $393,197. It seems this has been just a one-off. After excluding this one-off, the San Emidio’s netback for the whole 2014 should have been reported at $54.66 (instead of $49.55), which is still below the netback reported in 2013. Raft River (click to enlarge) Source: Simple Digressions and HTM reports Similarly to San Emidio, this plant’s netback decreased as compared to 2013. Neal Hot Springs (click to enlarge) Source: Simple Digressions and HTM reports Neal Hot Springs is the largest (net capacity of 22 megawatt) and the best plant in HTM’s portfolio. In 2014, its revenues were higher than those generated by the other plants combined. It also reported the best results – the highest revenue per megawatt-hour, the lowest expenses and the highest netback. Simply put, constituting nearly 75% of overall HTM EBITDA (the chart below), it is the jewel in HTM’s crown. In 2014, the company produced 339,086 megawatt hours of electricity (9.5% more than in the previous year). The chart below shows the number of megawatt hours generated by the operating plants since 2012. (click to enlarge) S ource : Simple Digressions and HTM reports As the chart shows, energy production at the San Emidio and Raft River plants reached a plateau in 2014. Looking at the guideline provided by the company in its last presentation, the future production at Neal Hot Springs should not go up much higher than that reported in 2014 (although the company plans to exchange an air cooling system at this plant into a wet cooling, which should increase its capacity). Summarizing, in my opinion, in 2014, U.S. Geothermal entered the stable phase of its business. Looking at the company’s cash flow statement, it seems that – excluding working capital issues and assuming that the company has only three currently operating plants – HTM should be providing around $13 million per year in cash flow from operations (in 2014, it was actually $12,763 thousand). At this point of the discussion, I would like to go back to the issue raised in my last article on HTM. I mean elements of ambiguity in the way in which the company presents its non-controlling interest. This time, I would like to focus on the company’s cash flows generated from its operations. If you are not interested in these rather technical digressions, please skip this section. The table below shows my calculations of the company’s free cash flow: (click to enlarge) Source: Simple Digressions and HTM reports A technical remark: Contributions and distributions to the non-controlling interest are reported in HTM’s cash flow statement as cash flow from financing activities, but due to the fact that they are strictly related to the company’s operations, I have classified them as cash flow from operations. As you see, in 2014, the company had $12,802 thousand in cash flow from operations. Of that amount, it paid $15,048 thousand to the non-controlling interest and got $7 thousand as a contribution from the non-controlling interest. At that point, U.S. Geothermal had a negative cash flow of $2,239 thousand. After spending $10,588 thousand for its investment needs, the company recorded a negative free cash flow of $12,897 thousand. But things are not as bad as they look. In the column titled “2014 Adjusted,” I have put the adjusted numbers for the last year. In 2014, the distribution allocated to Enbridge was bigger than it should have been, because it covered a longer period than just the year 2014. Taking into account the results registered by Neal Hot Springs in 2014, the “standard” distribution should have stood at $3,916 thousand (2014 Annual Report, page 85). After the necessary adjustments, in 2014, the company should have had a negative free cash flow of only $1,061 thousand. Now, let me make some comments on the statement of operations. In 2014, U.S. Geothermal registered a net income of $14,896 thousand. Of that amount, $3,283 thousand was attributable to the non-controlling interest. Therefore, $11,614 thousand was attributable to the company’s shareholders. Let me break down this number: $10,307 thousand – net deferred tax assets $1,307 thousand – a “clean” (not attributable to net deferred tax assets) net income Well, simply put, at the end of 2014, U.S. Geothermal recognized that it has the tax receivables of $10,307 thousand against the U.S. government and the States of Oregon, Idaho and Nevada. This assumption carries a potential risk. As U.S. Geothermal states in its report (page F-19): ” The Company may be assessed penalties and interest related to the underpayment of income taxes . Such assessments would be treated as a provision of income tax expense on the financial statements… The Company files income tax returns in the U.S. federal jurisdiction and in the States of Idaho, California and Oregon. These filings are subject to a three year statute of limitations . The Company’s evaluation of income tax positions included the year ended December 31, 2014 and 2013, and the nine months ended December 31, 2012. No filings are currently under examination. No adjustments due to tax uncertainties have been made to reduce the estimated income tax benefit at year end. Any valuations relating to these income tax provisions will comply with U.S. Generally Accepted Accounting Principles. Summarizing, the way the company reports its stake in the Neal Hot Springs joint venture is a little bit confusing. U.S. Geothermal prepares its reports in accordance with generally accepted accounting principles in the U.S. (U.S. GAAP). Under these rules, investments in joint ventures (the investment in Neal Hot Springs is regarded by the company as a joint venture) are generally accounted for “under the equity” method, unless a venture elects the fair value option or qualifies to apply proportionate consolidation (page 41 of the Comprehensive Guide to Joint Ventures reporting prepared by Ernst & Young). Proportionate consolidation is permitted in limited circumstances for investments in the extractive and construction industries. The geothermal industry, in my opinion, is excluded from these industries, so the right method for reporting the company’s stake in the Neal Hot Springs joint venture seems to be “under the equity method”. U.S. Geothermal has chosen a different approach. Therefore, to obtain a clear picture of the company’s financial performance, investors should dig a little bit deeper into its financial statements. I hope I have succeeded in explaining this matter. The company’s guidance U.S. Geothermal has very ambitious plans. By 2020, the company wants to become the largest pure-play geothermal producer in the U.S. The following three goals (the company’s presentation , page 3) present a major challenge to the management: Net capacity of 200 megawatt (presently, it is 45 megawatt) EBITDA of $100 million (in 2014, the company reported the EBITDA of around $15 million) Market capitalization of $1 billion (currently, the company’s market cap stands at around $50 million) To meet such a challenge, U.S. Geothermal plans to put a number of its geothermal projects into operations. The following projects are the most advanced ones at the moment: Geysers (California), El Ceibillo (Guatemala), San Emidio Phase II (Nevada) and Crescent Valley (Nevada). These plants have a projected total capacity of 91 megawatt, so together with the current capacity of 45 megawatt, HTM’s total capacity after putting four new projects into operation should stand at 136 megawatt. Therefore, there is a shortage of 64 megawatt of capacity to achieve the planned 200 megawatt. The company is not specific about what projects, apart from those most advanced, will be implemented in the coming 5 years. In its current exploration portfolio, there are projects with a projected capacity of 163 megawatt, so some of them may constitute the planned capacity. But it is also probable that U.S. Geothermal will acquire some totally new geothermal properties at various stages of their development. Unfortunately, in my opinion, there is a substantial risk that the company could face problems with putting even the most advanced projects into operation on time. Let me discuss some details: El Ceibillo In the third quarter of 2014, U.S. Geothermal reported that this project should have been on-line in the third quarter of 2017 (in first-quarter 2014, the reported deadline was fourth-quarter 2015). In its 2014 Annual Report, the company reports another delay – this time it says that El Ceibillo should be on-line in the second quarter 2018. As you see, it has become a rule to delay this project. The company acquired El Ceibillo in April 2010. Currently, U.S. Geothermal continues its exploration works at the project site, and tries to acquire a Power Purchase Agreement. The problem is that the last provisional agreement (Memorandum of Understanding) has expired, so the company has to start the whole process again from the very beginning. In my opinion, this is a serious negative setback to the company’s plans, so additional delays are very probable. San Emidio Phase II Similar to El Ceibillo, this project was postponed many times. In the third quarter of 2014, the company reported that this project should be on-line in the fourth quarter of 2016 (in first-quarter 2014, the reported deadline was fourth-quarter 2015). In its 2014 Annual Report, the company reports another delay – this time it says that San Emidio Phase II should be on-line in the third quarter of 2017. WGP Geysers In its 2014 Annual Report, the company stated that this project should go on-line in the second quarter 2017. U.S. Geothermal is still evaluating two development scenarios: building a power plant to sell electricity, or building a pipeline to sell steam. According to D.J. Glaspey (president and chief operating officer), the company should make a decision on that subject in the second half of 2015. But acquiring a PPA could be a problem. As the Geothermal Energy Association reports : ” U.S. growth in geothermal power has stalled due a lack of demand for new power, meaning a lack of new power purchase agreements, and mixed messages from Washington D.C. on tax incentives for geothermal investment and production “. U.S. Geothermal on page 33 of the 2014 Annual Report explains: ” A Production Tax Credit (PTC) provides project owners with a federal tax credit for the first ten years of plant operation. The PTC enhances the annual revenues of the projects by as much as 25 percent per year for the first 10 years. At present, unless extended, facilities that begin construction after December 31, 2014 will not be eligible to use this production tax credit. The federal production tax credit available for geothermal energy in 2014 was 2.3 cents per kilowatt-hour. Alternatively, certain projects under construction before the end of 2014, are eligible to elect to take a 30% Investment Tax Credit (ITC) in lieu of the PTC “. According to U.S. Geothermal, the WGP Geysers project, San Emidio II project, and the Crescent Valley project all began construction prior to December 31, 2014, and the company believes all three projects currently qualify for the 30% ITC in lieu of the PTC. If not, the company will be granted only the 10% Investment Tax Credit (but there is one condition: the plants must be in service before January 1, 2017). Summarizing, investors should keep their eyes on the company’s progress in implementing WGP Geysers. There are a few really serious risks, which can have a negative impact on this project. Crescent Valley In its 2014 Annual Report, U.S. Geothermal states that the first phase of Crescent Valley should go on-line in the first quarter of 2018. The construction of all these above mentioned projects under development will require around $500 million. Currently, we know no details of how the company plans to finance its investments. I realize that any serious talks concerning financial agreements cannot be made until the company signs the Power Purchase Agreements, but in my opinion, there is quite a long and risky way before we see new projects on-line. Valuation As usual, I will try to compare two geothermal energy producers – U.S. Geothermal and Ormat Technologies (NYSE: ORA ). Of course, I realize that Ormat is a behemoth in comparison to U.S. Geothermal. But please have in mind that the latter company aspires to be the largest pure geothermal power producer in the U.S. That is why I think that such a comparison is justified. In 2014, Ormat had a capacity of 647 megawatt and generated 4,451,000 megawatt hours of electricity. The average rate earned per megawatt hour stood at $85.89. To produce electricity, Ormat incurred operating costs of $55.41 per megawatt hour. Therefore, the netback (difference between revenue and cost) stood at $30.48. The chart below evidences these basic technical measures for both companies. Source: Simple Digressions and HTM and ORA reports As you can see, in 2014, U.S. Geothermal performed better than its large rival. It had higher revenue, lower costs of production and much higher netback. This is a big plus for the company. Nonetheless, currently, U.S. Geothermal is undervalued against Ormat. Take into assumption the Enterprise Value to adjusted EBITDA (EV / EBITDA) ratio: Ormat: 10.26 (at the price of $38 per share) U.S. Geothermal: 7.40 (at the price of $0.47 per share). What is more, having in mind that the average EV / EBITDA ratio calculated for U.S. utilities stands at 10.58 , the company is undervalued against its peers as well. Conclusion Although U.S. Geothermal looks undervalued against its peers operating in the utility sector, I would not perceive this situation as a very attractive investment opportunity. The company is facing some problems with putting new plants into operation, and the current level of financial performance seems to be leveling off. Therefore, in my opinion, with the company’s shares trading around $0.50, the market values U.S. Geothermal quite fairly. Final note HTM stocks are trading at relatively low volumes. For example, for the last 30 days, the average trading volume was standing at around 300 thousand shares per day, which makes HTM stocks relatively illiquid for big investors. Editor’s Note: This article covers one or more stocks trading at less than $1 per share and/or with less than a $100 million market cap. Please be aware of the risks associated with these stocks. Disclosure: The author has no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More…) The author wrote this article themselves, and it expresses their own opinions. The author is not receiving compensation for it (other than from Seeking Alpha). The author has no business relationship with any company whose stock is mentioned in this article. Scalper1 News

Summary U.S. Geothermal has entered its stable stage of development. To radically improve its financial results, the company has to put new projects into operation. In its 2014 Annual Report, U.S. Geothermal once again reports the delays in implementing a few projects under development. Investors should give serious consideration to these factors before investing in HTM shares. On March 17, U.S. Geothermal (NYSEMKT: HTM ) announced its 2014 results . The table below evidences a few basic measures recorded in three consecutive years: (in thousands of U.S. dollars) Source: HTM reports As the table shows, after a dramatic increase in revenues and financial results in 2013 (that year, two projects – San Emidio and Neal Hot Springs – reached their planned capacities), in 2014, the company leveled off. Two new and prospective geothermal projects were acquired, but no new geothermal plants went on-line. In my opinion, this situation will not change until 2018, when new plants should go on-line. Therefore, between 2015 and 2018, due to the fact that the company should grow only organically, no radical change in its financial results should be visible. Below, I am discussing some aspects of this organic growth; in the last section of this article, I will try to summarize the prospects of exploration projects. Organic growth The tables below summarize the results reported by three currently operating geothermal plants: San Emidio, Nevada (click to enlarge) Source: Simple Digressions and HTM reports In 2014, San Emidio’s operating costs increased much higher than its revenues. As the company explains (2014 Annual Report, page 79), the increase in costs is primarily a result of higher property tax expenses and related legal costs, which went up by $393,197. It seems this has been just a one-off. After excluding this one-off, the San Emidio’s netback for the whole 2014 should have been reported at $54.66 (instead of $49.55), which is still below the netback reported in 2013. Raft River (click to enlarge) Source: Simple Digressions and HTM reports Similarly to San Emidio, this plant’s netback decreased as compared to 2013. Neal Hot Springs (click to enlarge) Source: Simple Digressions and HTM reports Neal Hot Springs is the largest (net capacity of 22 megawatt) and the best plant in HTM’s portfolio. In 2014, its revenues were higher than those generated by the other plants combined. It also reported the best results – the highest revenue per megawatt-hour, the lowest expenses and the highest netback. Simply put, constituting nearly 75% of overall HTM EBITDA (the chart below), it is the jewel in HTM’s crown. In 2014, the company produced 339,086 megawatt hours of electricity (9.5% more than in the previous year). The chart below shows the number of megawatt hours generated by the operating plants since 2012. (click to enlarge) S ource : Simple Digressions and HTM reports As the chart shows, energy production at the San Emidio and Raft River plants reached a plateau in 2014. Looking at the guideline provided by the company in its last presentation, the future production at Neal Hot Springs should not go up much higher than that reported in 2014 (although the company plans to exchange an air cooling system at this plant into a wet cooling, which should increase its capacity). Summarizing, in my opinion, in 2014, U.S. Geothermal entered the stable phase of its business. Looking at the company’s cash flow statement, it seems that – excluding working capital issues and assuming that the company has only three currently operating plants – HTM should be providing around $13 million per year in cash flow from operations (in 2014, it was actually $12,763 thousand). At this point of the discussion, I would like to go back to the issue raised in my last article on HTM. I mean elements of ambiguity in the way in which the company presents its non-controlling interest. This time, I would like to focus on the company’s cash flows generated from its operations. If you are not interested in these rather technical digressions, please skip this section. The table below shows my calculations of the company’s free cash flow: (click to enlarge) Source: Simple Digressions and HTM reports A technical remark: Contributions and distributions to the non-controlling interest are reported in HTM’s cash flow statement as cash flow from financing activities, but due to the fact that they are strictly related to the company’s operations, I have classified them as cash flow from operations. As you see, in 2014, the company had $12,802 thousand in cash flow from operations. Of that amount, it paid $15,048 thousand to the non-controlling interest and got $7 thousand as a contribution from the non-controlling interest. At that point, U.S. Geothermal had a negative cash flow of $2,239 thousand. After spending $10,588 thousand for its investment needs, the company recorded a negative free cash flow of $12,897 thousand. But things are not as bad as they look. In the column titled “2014 Adjusted,” I have put the adjusted numbers for the last year. In 2014, the distribution allocated to Enbridge was bigger than it should have been, because it covered a longer period than just the year 2014. Taking into account the results registered by Neal Hot Springs in 2014, the “standard” distribution should have stood at $3,916 thousand (2014 Annual Report, page 85). After the necessary adjustments, in 2014, the company should have had a negative free cash flow of only $1,061 thousand. Now, let me make some comments on the statement of operations. In 2014, U.S. Geothermal registered a net income of $14,896 thousand. Of that amount, $3,283 thousand was attributable to the non-controlling interest. Therefore, $11,614 thousand was attributable to the company’s shareholders. Let me break down this number: $10,307 thousand – net deferred tax assets $1,307 thousand – a “clean” (not attributable to net deferred tax assets) net income Well, simply put, at the end of 2014, U.S. Geothermal recognized that it has the tax receivables of $10,307 thousand against the U.S. government and the States of Oregon, Idaho and Nevada. This assumption carries a potential risk. As U.S. Geothermal states in its report (page F-19): ” The Company may be assessed penalties and interest related to the underpayment of income taxes . Such assessments would be treated as a provision of income tax expense on the financial statements… The Company files income tax returns in the U.S. federal jurisdiction and in the States of Idaho, California and Oregon. These filings are subject to a three year statute of limitations . The Company’s evaluation of income tax positions included the year ended December 31, 2014 and 2013, and the nine months ended December 31, 2012. No filings are currently under examination. No adjustments due to tax uncertainties have been made to reduce the estimated income tax benefit at year end. Any valuations relating to these income tax provisions will comply with U.S. Generally Accepted Accounting Principles. Summarizing, the way the company reports its stake in the Neal Hot Springs joint venture is a little bit confusing. U.S. Geothermal prepares its reports in accordance with generally accepted accounting principles in the U.S. (U.S. GAAP). Under these rules, investments in joint ventures (the investment in Neal Hot Springs is regarded by the company as a joint venture) are generally accounted for “under the equity” method, unless a venture elects the fair value option or qualifies to apply proportionate consolidation (page 41 of the Comprehensive Guide to Joint Ventures reporting prepared by Ernst & Young). Proportionate consolidation is permitted in limited circumstances for investments in the extractive and construction industries. The geothermal industry, in my opinion, is excluded from these industries, so the right method for reporting the company’s stake in the Neal Hot Springs joint venture seems to be “under the equity method”. U.S. Geothermal has chosen a different approach. Therefore, to obtain a clear picture of the company’s financial performance, investors should dig a little bit deeper into its financial statements. I hope I have succeeded in explaining this matter. The company’s guidance U.S. Geothermal has very ambitious plans. By 2020, the company wants to become the largest pure-play geothermal producer in the U.S. The following three goals (the company’s presentation , page 3) present a major challenge to the management: Net capacity of 200 megawatt (presently, it is 45 megawatt) EBITDA of $100 million (in 2014, the company reported the EBITDA of around $15 million) Market capitalization of $1 billion (currently, the company’s market cap stands at around $50 million) To meet such a challenge, U.S. Geothermal plans to put a number of its geothermal projects into operations. The following projects are the most advanced ones at the moment: Geysers (California), El Ceibillo (Guatemala), San Emidio Phase II (Nevada) and Crescent Valley (Nevada). These plants have a projected total capacity of 91 megawatt, so together with the current capacity of 45 megawatt, HTM’s total capacity after putting four new projects into operation should stand at 136 megawatt. Therefore, there is a shortage of 64 megawatt of capacity to achieve the planned 200 megawatt. The company is not specific about what projects, apart from those most advanced, will be implemented in the coming 5 years. In its current exploration portfolio, there are projects with a projected capacity of 163 megawatt, so some of them may constitute the planned capacity. But it is also probable that U.S. Geothermal will acquire some totally new geothermal properties at various stages of their development. Unfortunately, in my opinion, there is a substantial risk that the company could face problems with putting even the most advanced projects into operation on time. Let me discuss some details: El Ceibillo In the third quarter of 2014, U.S. Geothermal reported that this project should have been on-line in the third quarter of 2017 (in first-quarter 2014, the reported deadline was fourth-quarter 2015). In its 2014 Annual Report, the company reports another delay – this time it says that El Ceibillo should be on-line in the second quarter 2018. As you see, it has become a rule to delay this project. The company acquired El Ceibillo in April 2010. Currently, U.S. Geothermal continues its exploration works at the project site, and tries to acquire a Power Purchase Agreement. The problem is that the last provisional agreement (Memorandum of Understanding) has expired, so the company has to start the whole process again from the very beginning. In my opinion, this is a serious negative setback to the company’s plans, so additional delays are very probable. San Emidio Phase II Similar to El Ceibillo, this project was postponed many times. In the third quarter of 2014, the company reported that this project should be on-line in the fourth quarter of 2016 (in first-quarter 2014, the reported deadline was fourth-quarter 2015). In its 2014 Annual Report, the company reports another delay – this time it says that San Emidio Phase II should be on-line in the third quarter of 2017. WGP Geysers In its 2014 Annual Report, the company stated that this project should go on-line in the second quarter 2017. U.S. Geothermal is still evaluating two development scenarios: building a power plant to sell electricity, or building a pipeline to sell steam. According to D.J. Glaspey (president and chief operating officer), the company should make a decision on that subject in the second half of 2015. But acquiring a PPA could be a problem. As the Geothermal Energy Association reports : ” U.S. growth in geothermal power has stalled due a lack of demand for new power, meaning a lack of new power purchase agreements, and mixed messages from Washington D.C. on tax incentives for geothermal investment and production “. U.S. Geothermal on page 33 of the 2014 Annual Report explains: ” A Production Tax Credit (PTC) provides project owners with a federal tax credit for the first ten years of plant operation. The PTC enhances the annual revenues of the projects by as much as 25 percent per year for the first 10 years. At present, unless extended, facilities that begin construction after December 31, 2014 will not be eligible to use this production tax credit. The federal production tax credit available for geothermal energy in 2014 was 2.3 cents per kilowatt-hour. Alternatively, certain projects under construction before the end of 2014, are eligible to elect to take a 30% Investment Tax Credit (ITC) in lieu of the PTC “. According to U.S. Geothermal, the WGP Geysers project, San Emidio II project, and the Crescent Valley project all began construction prior to December 31, 2014, and the company believes all three projects currently qualify for the 30% ITC in lieu of the PTC. If not, the company will be granted only the 10% Investment Tax Credit (but there is one condition: the plants must be in service before January 1, 2017). Summarizing, investors should keep their eyes on the company’s progress in implementing WGP Geysers. There are a few really serious risks, which can have a negative impact on this project. Crescent Valley In its 2014 Annual Report, U.S. Geothermal states that the first phase of Crescent Valley should go on-line in the first quarter of 2018. The construction of all these above mentioned projects under development will require around $500 million. Currently, we know no details of how the company plans to finance its investments. I realize that any serious talks concerning financial agreements cannot be made until the company signs the Power Purchase Agreements, but in my opinion, there is quite a long and risky way before we see new projects on-line. Valuation As usual, I will try to compare two geothermal energy producers – U.S. Geothermal and Ormat Technologies (NYSE: ORA ). Of course, I realize that Ormat is a behemoth in comparison to U.S. Geothermal. But please have in mind that the latter company aspires to be the largest pure geothermal power producer in the U.S. That is why I think that such a comparison is justified. In 2014, Ormat had a capacity of 647 megawatt and generated 4,451,000 megawatt hours of electricity. The average rate earned per megawatt hour stood at $85.89. To produce electricity, Ormat incurred operating costs of $55.41 per megawatt hour. Therefore, the netback (difference between revenue and cost) stood at $30.48. The chart below evidences these basic technical measures for both companies. Source: Simple Digressions and HTM and ORA reports As you can see, in 2014, U.S. Geothermal performed better than its large rival. It had higher revenue, lower costs of production and much higher netback. This is a big plus for the company. Nonetheless, currently, U.S. Geothermal is undervalued against Ormat. Take into assumption the Enterprise Value to adjusted EBITDA (EV / EBITDA) ratio: Ormat: 10.26 (at the price of $38 per share) U.S. Geothermal: 7.40 (at the price of $0.47 per share). What is more, having in mind that the average EV / EBITDA ratio calculated for U.S. utilities stands at 10.58 , the company is undervalued against its peers as well. Conclusion Although U.S. Geothermal looks undervalued against its peers operating in the utility sector, I would not perceive this situation as a very attractive investment opportunity. The company is facing some problems with putting new plants into operation, and the current level of financial performance seems to be leveling off. Therefore, in my opinion, with the company’s shares trading around $0.50, the market values U.S. Geothermal quite fairly. Final note HTM stocks are trading at relatively low volumes. For example, for the last 30 days, the average trading volume was standing at around 300 thousand shares per day, which makes HTM stocks relatively illiquid for big investors. Editor’s Note: This article covers one or more stocks trading at less than $1 per share and/or with less than a $100 million market cap. Please be aware of the risks associated with these stocks. Disclosure: The author has no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More…) The author wrote this article themselves, and it expresses their own opinions. The author is not receiving compensation for it (other than from Seeking Alpha). The author has no business relationship with any company whose stock is mentioned in this article. Scalper1 News

Scalper1 News