Scalper1 News

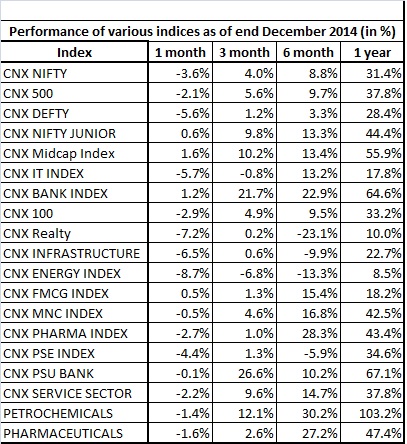

Summary The Indian finance ministry has allowed the issuance of sponsored and unsponsored Level 1 ADRs. DRs can be issued against any underlying permissible security such as equity, corporate debt, mutual funds, ETFs etc. Provides an exciting opportunity for overseas investors to invest in the Indian growth story. What are unsponsored ADRs? There are 4 types of American depository receipts, in increasing order of regulatory requirements: 1. Unsponsored ADRs 2. Sponsored Level 1 ADRs (OTC) 3. Sponsored Level 2 ADRs (listed) 4. Sponsored Level 3 ADRs (offering)… these were the only type of ADRs available for Indian companies. They have the most stringent regulatory requirements Level 1 and Level 2 ADRs have less stringent requirements than Level 3 ADRs, but all of them are sponsored (issued) by the issuer. In contrast, an unsponsored ADR is one in which there is no deposit agreement and no legal relationship between the depository bank and the issuer. There are no regulatory disclosure requirements for the issuer to comply with the Sarbanes-Oxley and no requirement to adhere to US GAAP requirements. In fact, an unsponsored ADR can be issued without the consent of the issuer. These instruments can be traded in the over-the-counter (OTC) markets in the United States. During the Union Budget of July 2014, Arun Jaitley, India’s Finance Minister, had accepted the Sahoo Committee’s recommendation for liberalization in ADR/GDR issues. As per the new Depository Receipts Scheme, a foreign depository bank is permitted to issue unsponsored ADRs for the first time. Since that announcement, BNY Mellon (NYSE: BK ) has confirmed that it has filed with the US SEC to establish several unsponsored depository receipts program from India. The proverbial home bias A US investor is more likely to invest a large proportion of his investments in domestic equities. This is mainly due to their familiarity with local regulations and settlement procedures. Also their investment mandate may force them to invest in only USD-denominated stocks. However, portfolio theory states that there are significant diversification benefits from investing in foreign equities as it lowers systemic risks from domestic factors. The credit crisis of 2007 and the various currency crisis that continue to occur over time shows that contagion spreads during a crisis. And the benefits of international diversification are considerably reduced during times of stress. But aside from these “Black swan events,” investment in foreign equities is likely to provide direct exposure to high-growth companies in emerging markets. What does it mean for investors in the US? Indian bourses have given returns in excess of 30% in the last one year. This has been on the back of positive sentiments arising due to the new business friendly prime minister. Also as per the latest economic indicators, it is likely that the economy is on a recovery path. This could lead to a multi-year bull run, similar to one seen in the US stock markets. In light of these very favorable circumstances, the announcement by the Indian finance minister to liberalize the ADR/GDR norms comes at a very appropriate time. I have listed below the sectoral returns from the Indian markets. A study by BNY Mellon notes that more than 50% of the Tier 2 and Tier 3 institutional investors ($1bn to $10bn in AUM) who wanted to invest in India did it through DRs as they couldn’t invest directly in India equities. These non capital-raising DRs will provide access to investors who can’t establish their Indian operations or who do not want to invest in equity derivatives or ETFs, but want to buy Indian equities in US-dollar denominated form. The Sahoo committee, which had proposed these policies, envisioned that there should be competitive neutrality, where all the economic agents (Indian or foreign investors and Indian or foreign firms) have the full freedom to invest/or issue DRs for permissible securities within the existing capital control regime. This freedom is given as long as the following two conditions are satisfied: 1) the permissible securities (as defined under the Securities Contracts Act), should be in dematerialized form and 2) DRs must be issued only in permissible jurisdictions. This is to make sure that interests of investors are protected and money is not laundered through these channels. Risks Before listing the key takeaways from the article, let’s first look at the risks involved in buying these securities. The biggest risk is if the depository banks are unable to attract sufficient liquidity in these OTC stocks. Volumes in unsponsored ADRs are far less than in sponsored ADRs. Hence the bid/ask spread is quite high. Low liquidity and high spreads make it difficult for investors to quickly enter or exit the stock. Investors who buy into these stocks also carry the risk of a fluctuating Indian rupee. Key Takeaways So here are the key takeaways: Unsponsored or sponsored Level 1 ADRs. DRs can be issued on any permissible security: equity, debt, MFs, ETFs, convertible debt etc. The DR can be issued for a listed or unlisted company. Conversion of DRs into underlying securities and vice versa is not taxable, since there is no change in beneficial ownership. Not regulated under Sarbanes-Oxley Act. No GAAP reconciliation requirement. No end restrictions on funds raised other than imposed under Foreign Exchange Management Act (FEMA). Shareholding under unsponsored ADR will be classified under the FDI cap. Voting rights to be retained by the investors. DRs to be listed on an exchange. Additional sources: IFR India Offshore Financing Roundtable 2014 , Neil Atkinson, BNY Mellon “The Depositary Receipt: Market Review” BNY Mellon, January 2015 CPI probably rose in Jan on base year shift , Reuters February 12, 2015 “Unsponsored ADRs: Evolution and opportunities” – Deutsche Bank Disclosure: The author has no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More…) The author wrote this article themselves, and it expresses their own opinions. The author is not receiving compensation for it (other than from Seeking Alpha). The author has no business relationship with any company whose stock is mentioned in this article. Scalper1 News

Summary The Indian finance ministry has allowed the issuance of sponsored and unsponsored Level 1 ADRs. DRs can be issued against any underlying permissible security such as equity, corporate debt, mutual funds, ETFs etc. Provides an exciting opportunity for overseas investors to invest in the Indian growth story. What are unsponsored ADRs? There are 4 types of American depository receipts, in increasing order of regulatory requirements: 1. Unsponsored ADRs 2. Sponsored Level 1 ADRs (OTC) 3. Sponsored Level 2 ADRs (listed) 4. Sponsored Level 3 ADRs (offering)… these were the only type of ADRs available for Indian companies. They have the most stringent regulatory requirements Level 1 and Level 2 ADRs have less stringent requirements than Level 3 ADRs, but all of them are sponsored (issued) by the issuer. In contrast, an unsponsored ADR is one in which there is no deposit agreement and no legal relationship between the depository bank and the issuer. There are no regulatory disclosure requirements for the issuer to comply with the Sarbanes-Oxley and no requirement to adhere to US GAAP requirements. In fact, an unsponsored ADR can be issued without the consent of the issuer. These instruments can be traded in the over-the-counter (OTC) markets in the United States. During the Union Budget of July 2014, Arun Jaitley, India’s Finance Minister, had accepted the Sahoo Committee’s recommendation for liberalization in ADR/GDR issues. As per the new Depository Receipts Scheme, a foreign depository bank is permitted to issue unsponsored ADRs for the first time. Since that announcement, BNY Mellon (NYSE: BK ) has confirmed that it has filed with the US SEC to establish several unsponsored depository receipts program from India. The proverbial home bias A US investor is more likely to invest a large proportion of his investments in domestic equities. This is mainly due to their familiarity with local regulations and settlement procedures. Also their investment mandate may force them to invest in only USD-denominated stocks. However, portfolio theory states that there are significant diversification benefits from investing in foreign equities as it lowers systemic risks from domestic factors. The credit crisis of 2007 and the various currency crisis that continue to occur over time shows that contagion spreads during a crisis. And the benefits of international diversification are considerably reduced during times of stress. But aside from these “Black swan events,” investment in foreign equities is likely to provide direct exposure to high-growth companies in emerging markets. What does it mean for investors in the US? Indian bourses have given returns in excess of 30% in the last one year. This has been on the back of positive sentiments arising due to the new business friendly prime minister. Also as per the latest economic indicators, it is likely that the economy is on a recovery path. This could lead to a multi-year bull run, similar to one seen in the US stock markets. In light of these very favorable circumstances, the announcement by the Indian finance minister to liberalize the ADR/GDR norms comes at a very appropriate time. I have listed below the sectoral returns from the Indian markets. A study by BNY Mellon notes that more than 50% of the Tier 2 and Tier 3 institutional investors ($1bn to $10bn in AUM) who wanted to invest in India did it through DRs as they couldn’t invest directly in India equities. These non capital-raising DRs will provide access to investors who can’t establish their Indian operations or who do not want to invest in equity derivatives or ETFs, but want to buy Indian equities in US-dollar denominated form. The Sahoo committee, which had proposed these policies, envisioned that there should be competitive neutrality, where all the economic agents (Indian or foreign investors and Indian or foreign firms) have the full freedom to invest/or issue DRs for permissible securities within the existing capital control regime. This freedom is given as long as the following two conditions are satisfied: 1) the permissible securities (as defined under the Securities Contracts Act), should be in dematerialized form and 2) DRs must be issued only in permissible jurisdictions. This is to make sure that interests of investors are protected and money is not laundered through these channels. Risks Before listing the key takeaways from the article, let’s first look at the risks involved in buying these securities. The biggest risk is if the depository banks are unable to attract sufficient liquidity in these OTC stocks. Volumes in unsponsored ADRs are far less than in sponsored ADRs. Hence the bid/ask spread is quite high. Low liquidity and high spreads make it difficult for investors to quickly enter or exit the stock. Investors who buy into these stocks also carry the risk of a fluctuating Indian rupee. Key Takeaways So here are the key takeaways: Unsponsored or sponsored Level 1 ADRs. DRs can be issued on any permissible security: equity, debt, MFs, ETFs, convertible debt etc. The DR can be issued for a listed or unlisted company. Conversion of DRs into underlying securities and vice versa is not taxable, since there is no change in beneficial ownership. Not regulated under Sarbanes-Oxley Act. No GAAP reconciliation requirement. No end restrictions on funds raised other than imposed under Foreign Exchange Management Act (FEMA). Shareholding under unsponsored ADR will be classified under the FDI cap. Voting rights to be retained by the investors. DRs to be listed on an exchange. Additional sources: IFR India Offshore Financing Roundtable 2014 , Neil Atkinson, BNY Mellon “The Depositary Receipt: Market Review” BNY Mellon, January 2015 CPI probably rose in Jan on base year shift , Reuters February 12, 2015 “Unsponsored ADRs: Evolution and opportunities” – Deutsche Bank Disclosure: The author has no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More…) The author wrote this article themselves, and it expresses their own opinions. The author is not receiving compensation for it (other than from Seeking Alpha). The author has no business relationship with any company whose stock is mentioned in this article. Scalper1 News

Scalper1 News