Scalper1 News

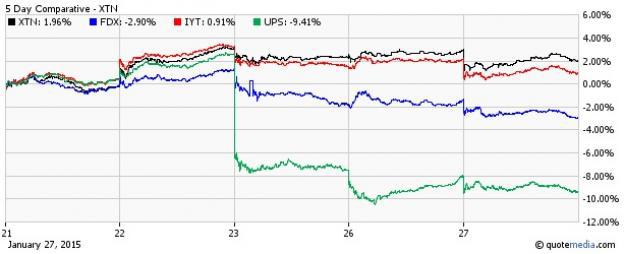

With the economy growing at the fastest clip in over a decade and the oil price at a five-year low, transportation was one of the best performing sectors of 2014. This trend continued in 2015 driven by solid retail, manufacturing, and labor data that created strong demand for the movement of goods across many economic sectors. Additionally, strong earnings from major players in the industry are fueling growth in the sector. However, the space was badly hit by the recent profit warning and sluggish outlook from the bellwether United Parcel Service (NYSE: UPS ) on January 23 that dampened investors’ mood making them cautious on the stock and the broad sector. UPS Warns of Soft Q4 Earnings The world’s largest package delivery company said that higher operating expenses and temporary hiring for the peak holiday season might take a toll on the earnings for the fourth quarter and full-year 2014. It is slated to release its fourth quarter earnings on February 3. The company now projects earnings for Q4 to come in at $1.25 per share, missing the Wall Street’s expectations of $1.47. Accordingly, the Zacks Consensus Estimate moved down to $1.25 from $1.47 over a period of seven days. United Parcel also slashed its full-year guidance to $4.75 per share, much below the previous expectation of $4.90-$5.00 a share and the current Zacks Consensus Estimate of $4.77. The Zacks Consensus Estimate has declined 21 cents over the past 7 days. Weak 2015 Guidance Further, the company expects 2015 earnings to grow slightly less than its long-term growth target of 9-13% due to increased pension costs and currency headwinds. The Zacks Consensus Estimate currently represents growth of 7.85% for this year. Market Impact The news has spread bearishness not only on this package delivery giant but also on the broad space. UPS shares dropped as much as 10% on Friday after this bearish announcement and are down nearly 11.7% over the past three days. Its major rival FedEx (NYSE: FDX ) fell 4.1% over the past three sessions. The sluggish trading has also been felt in the ETF world as both the transport ETFs – the iShares Dow Jones Transportation Average Fund (NYSEARCA: IYT ) and the SPDR S&P Transportation ETF (NYSEARCA: XTN ) – lost 2.3% and 1.2%, respectively, in the same period. What Lies Ahead? Despite the slide and UPS’ sluggish outlook, investors shouldn’t completely write off transportation ETFs from their holdings. This is because the funds have spread out exposure to a number of firms in various types of industries like railroads, airline and low cost trucking suggesting that the space can easily counter shocks from some of the industry’s biggest components. In fact, IYT puts about 47% in railroads while airfreight & logistics makes up for nearly 27% share. Meanwhile, XTN is heavily exposed to trucking and airlines as these make up roughly 62% of the total while air freight & logistics accounts for 21% share. In terms of individual holdings, the iShares product is heavily concentrated on the top firm – FedEx – at 11.65% while UPS takes the fourth spot at 6.71%. On the other hand, State Street fund uses an equal weight methodology for each security. While IYT is more popular and liquid among the two, XTN is cheap by 8 bps. Further, FedEx reaffirmed its EPS guidance of $8.50-$9.00 for fiscal 2015 on the heels of UPS’ warnings. The midpoint is well above the Zacks Consensus Estimate of $8.94, indicating sound business for the transport ETFs. If these were not enough, cheap fuel will provide a big-time boost to transport earnings growth. This has already started to reflect in the latest earnings results as earnings for the transport sector reported so far is up 20.6% with a beat ratio of 57.1% and median surprise of 3.3%. Scalper1 News

With the economy growing at the fastest clip in over a decade and the oil price at a five-year low, transportation was one of the best performing sectors of 2014. This trend continued in 2015 driven by solid retail, manufacturing, and labor data that created strong demand for the movement of goods across many economic sectors. Additionally, strong earnings from major players in the industry are fueling growth in the sector. However, the space was badly hit by the recent profit warning and sluggish outlook from the bellwether United Parcel Service (NYSE: UPS ) on January 23 that dampened investors’ mood making them cautious on the stock and the broad sector. UPS Warns of Soft Q4 Earnings The world’s largest package delivery company said that higher operating expenses and temporary hiring for the peak holiday season might take a toll on the earnings for the fourth quarter and full-year 2014. It is slated to release its fourth quarter earnings on February 3. The company now projects earnings for Q4 to come in at $1.25 per share, missing the Wall Street’s expectations of $1.47. Accordingly, the Zacks Consensus Estimate moved down to $1.25 from $1.47 over a period of seven days. United Parcel also slashed its full-year guidance to $4.75 per share, much below the previous expectation of $4.90-$5.00 a share and the current Zacks Consensus Estimate of $4.77. The Zacks Consensus Estimate has declined 21 cents over the past 7 days. Weak 2015 Guidance Further, the company expects 2015 earnings to grow slightly less than its long-term growth target of 9-13% due to increased pension costs and currency headwinds. The Zacks Consensus Estimate currently represents growth of 7.85% for this year. Market Impact The news has spread bearishness not only on this package delivery giant but also on the broad space. UPS shares dropped as much as 10% on Friday after this bearish announcement and are down nearly 11.7% over the past three days. Its major rival FedEx (NYSE: FDX ) fell 4.1% over the past three sessions. The sluggish trading has also been felt in the ETF world as both the transport ETFs – the iShares Dow Jones Transportation Average Fund (NYSEARCA: IYT ) and the SPDR S&P Transportation ETF (NYSEARCA: XTN ) – lost 2.3% and 1.2%, respectively, in the same period. What Lies Ahead? Despite the slide and UPS’ sluggish outlook, investors shouldn’t completely write off transportation ETFs from their holdings. This is because the funds have spread out exposure to a number of firms in various types of industries like railroads, airline and low cost trucking suggesting that the space can easily counter shocks from some of the industry’s biggest components. In fact, IYT puts about 47% in railroads while airfreight & logistics makes up for nearly 27% share. Meanwhile, XTN is heavily exposed to trucking and airlines as these make up roughly 62% of the total while air freight & logistics accounts for 21% share. In terms of individual holdings, the iShares product is heavily concentrated on the top firm – FedEx – at 11.65% while UPS takes the fourth spot at 6.71%. On the other hand, State Street fund uses an equal weight methodology for each security. While IYT is more popular and liquid among the two, XTN is cheap by 8 bps. Further, FedEx reaffirmed its EPS guidance of $8.50-$9.00 for fiscal 2015 on the heels of UPS’ warnings. The midpoint is well above the Zacks Consensus Estimate of $8.94, indicating sound business for the transport ETFs. If these were not enough, cheap fuel will provide a big-time boost to transport earnings growth. This has already started to reflect in the latest earnings results as earnings for the transport sector reported so far is up 20.6% with a beat ratio of 57.1% and median surprise of 3.3%. Scalper1 News

Scalper1 News