Scalper1 News

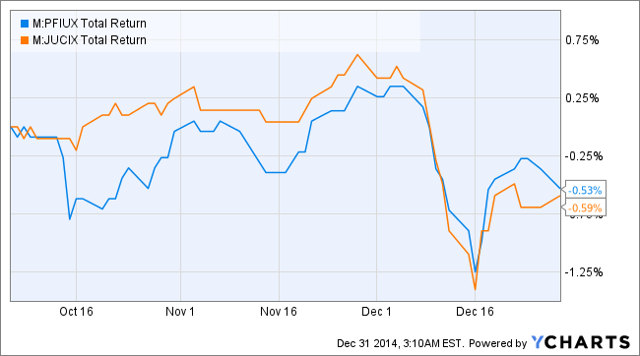

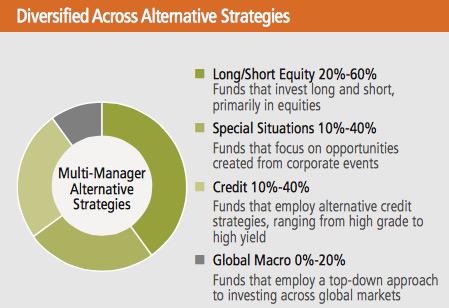

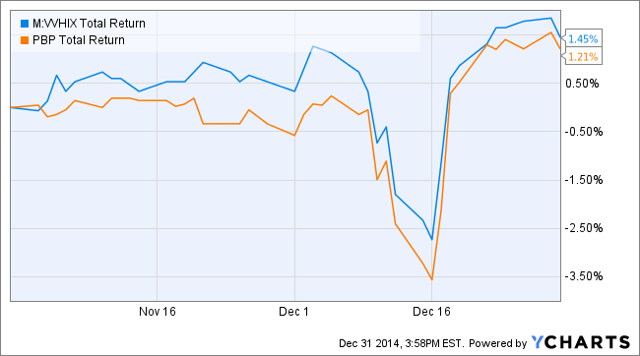

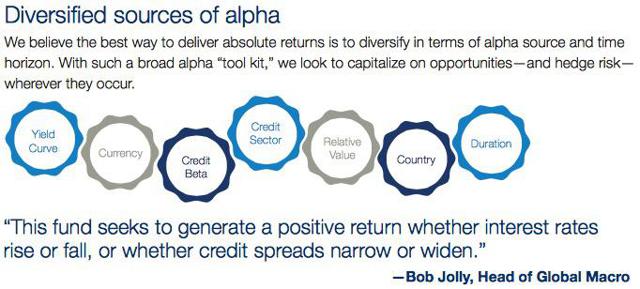

With a never ending expectation of rising rates in 2014, investors flocked to alternative fixed income funds in the first three quarters of the year, and finally slowed the migration from traditional fixed income in the fourth quarter as rate rise fears subsided. Nevertheless, three of the top ten funds on this year’s list are alternative fixed income funds, in addition to both of the Honorable Mention funds. Multi-alternative funds take up the #3, #4, #5 and #6 spots on the list as many investors look to make a single allocation to a diversified alternatives fund in their first allocation to the category. Long/short funds round out the remainder of the top 10 spots – not surprising given the extended run in the equity market from its low point in 2009 and the concern that the bull might be nearing the end of its journey. While the list includes mostly large investment management firms, there are two boutique firms that make the top 10: Clark Capital Management, advisor to the #8 ranked Navigator Tactical Fixed Income Fund, and V2 Capital, advisor to the #9 ranked V2 Hedged Equity Fund. GMO and Dreyfus are the only two firms with more than one fund on the 2014 list (each have two). The list also includes one hedge fund conversion, which is the V2 Hedged Equity Fund. Hedge fund conversions were a trend that picked up steam in 2014 and will likely continue on into 2015 as hedge fund managers with unfilled capacity and limited institutional distribution look to capitalize on the flows into liquid alternatives. In addition, for strategies that have liquid underlying assets, a mutual fund structure can be a more attractive investment vehicle for both retail and institutional investors due to the lower barriers to investing in a mutual fund vehicle. We anticipate that 2015 will bring some changes to the liquid alternatives landscape as the markets unfold in ways that will certainly be different from recent years past. Until then, have a safe and Happy New Year! The List – 2014’s Largest Liquid Alternative Fund Launches 1. GMO Debt Opportunities Fund (MUTF: GMODX ) Total assets: $1.8 billion; Ticker: GMODX; Inception date: 2/11/2014; Category: Nontraditional Bond; Fund link . GMO comes in at #1 and #3 in 2014, however the firm uses mutual funds for a significant portion of its institutional investment allocations. While this particular fund can invest in nearly any type of debt instrument, and can use leverage and derivatives to gain both long and short exposure, it is nearly entirely allocated to asset-backed securities. In addition, the fund has a $300 million investment minimum – clearly off limits to the average retail investor. 2. Janus Global Unconstrained Bond Fund (MUTF: JUCAX ) Total assets: $1.2 billion; Ticker: JUCAX; Inception date: 5/27/2014; Category: Nontraditional Bond; Fund link . Due to the good fortune of landing Bill Gross as the portfolio manager for this fund, assets have jumped by more than $1 billion in short order and has put the fund among the top fund launches of 2014. The unconstrained bond fund competes head to head with Gross’s former colleagues at PIMCO and their unconstrained bond fund, which lost $6 billion of assets in the three months ending November 30. From inception of Bill Gross taking the reins on the Janus fund on October 5 to December 29, the head to head competition between the two unconstrained bond funds is nearly dead even: (click to enlarge) 3. GMO Special Opportunities Fund (MUTF: GSOFX ) Total assets: $796 million; Ticker: GSOFX; Inception date: 7/28/2014; Category: Multi-Alternative; Fund link . This is another of GMO’s institutional funds (see #1 above) and is an unconstrained, long/short, multi-asset, global go-anywhere fund that has an investment objective of “positive total returns.” And just like its sister fund above, it has a $300 million investment minimum, so if you do want to invest you will need to contact GMO directly and be ready to cut a large check. 4. Blackstone Alternative Multi-Strategy Fund (MUTF: BXMIX ) Total assets: $763 million; Ticker: BXMIX; Inception date: 6/16/2014; Category: Multi-Alternative; Fund link . After inking a deal in 2013 to be one of two exclusive alternative mutual fund providers for Fidelity’s private client business, and raising more than $1 billion in doing so, Blackstone came back to the well in 2014 with a more widely available multi-alternative fund that provides investors with exposure to 17 managers across 7 different investment styles including long/short equity, global macro, long/short credit, multi-strategy and market neutral. We will keep an eye on Blackstone in 2015 to see if they leverage their $2 billion of alternative mutual fund assets and recent distribution partnership with Columbia (see #11 below) to introduce new funds into the market. 5. AllianceBernstein Multi-Manager Alternative Strategies Fund (MUTF: ALATX ) Total assets: $395 million; Ticker: ALATX; Inception date: 7/31/2014; Category: Multi-Alternative; Fund link . Leveraging both its internal portfolio management capabilities and its 2010 purchase of SunAmerica’s alternative asset management business, AllianceBernstein has built a very solid alternative mutual fund lineup, and continued the expansion of their fund range in 2014 with the launch of this fund and two long/short funds. The Multi-Manager Alternative Strategies Fund is run by Marc Gamsin and Greg Outcalt, both of whom were part of the SunAmerica acquisition. The fund allocates currently to 11 external managers across long/short equity, special situations, global macro and credit oriented strategies, as noted in the below graphic from the fund’s 9/30/14 fact sheet: 6. Dreyfus Alternative Diversifier Strategies Fund (MUTF: DRNAX ) Total assets: $386 million; Ticker: DRNAX; Inception date: 3/31/2014; Category: Multi-Alternative; Fund link . Dreyfus picks up the #6 and #7 spots with its two new funds backed by the distribution power of not only the Dreyfus platform but also its parent organization, BNY Mellon. The Dreyfus Alternative Diversifier Strategies Fund invests in other alternative mutual funds, including Dreyfus funds, and provides investors with exposure to a range of strategies including long/short equity, managed futures, commodities, real estate and real assets. 7. Dreyfus Select Managers Long/Short Fund (MUTF: DBNAX ) Total assets:$299 million; Ticker: DBNAX; Inception date: 3/31/2014; Category: Long/Short Equity; Fund link . This new Dreyfus fund is sub-advised by affiliate EACM Advisors who allocates the fund’s assets to underlying assets managers in the long/short equity, event driven and short selling space. While not a pure long/short equity fund in the traditional sense, it does maintain a low beta to the market and provides investors with multiple sources of alpha from equity-driven managers. Since inception of the fund, EACM Advisors has not been shy about making changes to the underlying fund manager lineup, having hired three new managers and terminating one. 8. Navigator Tactical Fixed Income Fund (MUTF: NTBAX ) Total assets: $283 million; Ticker: NTBAX; Inception date: 3/27/2014; Category: Nontraditional Bond; Fund link . This is one of two funds on this year’s top 10 list to be offered by a boutique investment firm. Clark Capital Management, the advisor to the fund, currently offers four alternative mutual funds, with this fund and the Navigator Sentry Managed Volatility Fund being the firm’s newest (both launched on 3/27/14). The fund tactically allocates assets among different sectors of the fixed income market with a primary focus on high yield, corporates and government bonds, and will hedge the portfolio when deemed appropriate to avoid credit and/or interest rate risk. 9. V2 Hedged Equity Fund (MUTF: VVHIX ) Total assets: $246 million; Ticker: VVHIX; Inception date: 10/31/2014; Category: Long/Short Equity; Fund link . This new fund from V2 Capital is the second fund on the list from a boutique asset manager and is also a conversion from a hedge fund. The fund combines an actively managed, concentrated portfolio of 30-50 stocks with a short portfolio of customized S&P 500 index options. The stocks represent the managers’ “best ideas” generated through fundamental, bottom-up research; while the short option positions are intended to generate income and provide a hedge on the portfolio’s equity exposure. Not your ordinary covered call portfolio! The fund has outperformed the passively managed PowerShares S&P 500 Buy-Write ETF (ticker: PBP ) over the short time period from inception to 12/30/14: (click to enlarge) 10. Deutsche Strategic Equity Long/Short Fund (MUTF: DSLAX ) Total assets: $194 million; Ticker: DSLAX; Inception date: 5/15/2014; Category: Long/Short Equity; Fund link . Deutsche slips into the #10 spot on the list with this multi-manager long/short fund and reeled in Leon Cooperman of Omega Advisors as one of its sub-advisors. The fund currently allocates to two domestic equity long/short managers (Omega and Atlantic Investment Management) and two global long/short equity managers (Chilton Investment Company and Lazard Asset Management). Net long exposure of the fund is expected to range between 20% and 80% of the fund’s net assets. Honorable Mention Given that two of the above funds are restricted to institutional investors (the two GMO funds at #1 and #3), we have included two Honorable Mentions, which are the #11 and #12 funds on the list of top asset raises during the year: 11. Columbia Mortgage Opportunities Fund (MUTF: CLMAX ) Total assets: $165 million; Ticker: CLMAX; Inception date: 4/30/2014; Category: Nontraditional Bond; Fund link . Columbia stepped up its alternatives game this year with the hiring of Bill Landes and the establishment of a partnership with Blackstone to distribute Blackstone-managed alternative mutual funds. While this new fund was launched before all the fanfare that occurred later in the year, it does fit nicely in a more broadly build out stable of alternative funds. The Columbia Mortgage Opportunities Fund looks to tactically allocate between various sectors of the mortgage-related securities market, and can use derivatives, leverage and shorting to manage exposures. 12. Schroder Global Strategic Bond Fund (MUTF: SGBVX ) Total assets: $118 million; Ticker: SGBVX; Inception date: 6/23/14; Category: Nontraditional Bond; Fund link . Schroders rounds out the list by leveraging its global fixed income capabilities to bring a global unconstrained bond fund to the market. The fund is able to invest across a wide variety of global fixed income instruments, and can use derivatives and shorting to gain exposures to specific segments of the fixed income market or hedge existing exposures. The following graphic from the fund’s overview document sums up the opportunity set: (click to enlarge) Note: Total assets reflected above for each fund are based on fund assets for all share classes of each fund on December 29, 2014 based on information from Morningstar and each fund’s website. Scalper1 News

With a never ending expectation of rising rates in 2014, investors flocked to alternative fixed income funds in the first three quarters of the year, and finally slowed the migration from traditional fixed income in the fourth quarter as rate rise fears subsided. Nevertheless, three of the top ten funds on this year’s list are alternative fixed income funds, in addition to both of the Honorable Mention funds. Multi-alternative funds take up the #3, #4, #5 and #6 spots on the list as many investors look to make a single allocation to a diversified alternatives fund in their first allocation to the category. Long/short funds round out the remainder of the top 10 spots – not surprising given the extended run in the equity market from its low point in 2009 and the concern that the bull might be nearing the end of its journey. While the list includes mostly large investment management firms, there are two boutique firms that make the top 10: Clark Capital Management, advisor to the #8 ranked Navigator Tactical Fixed Income Fund, and V2 Capital, advisor to the #9 ranked V2 Hedged Equity Fund. GMO and Dreyfus are the only two firms with more than one fund on the 2014 list (each have two). The list also includes one hedge fund conversion, which is the V2 Hedged Equity Fund. Hedge fund conversions were a trend that picked up steam in 2014 and will likely continue on into 2015 as hedge fund managers with unfilled capacity and limited institutional distribution look to capitalize on the flows into liquid alternatives. In addition, for strategies that have liquid underlying assets, a mutual fund structure can be a more attractive investment vehicle for both retail and institutional investors due to the lower barriers to investing in a mutual fund vehicle. We anticipate that 2015 will bring some changes to the liquid alternatives landscape as the markets unfold in ways that will certainly be different from recent years past. Until then, have a safe and Happy New Year! The List – 2014’s Largest Liquid Alternative Fund Launches 1. GMO Debt Opportunities Fund (MUTF: GMODX ) Total assets: $1.8 billion; Ticker: GMODX; Inception date: 2/11/2014; Category: Nontraditional Bond; Fund link . GMO comes in at #1 and #3 in 2014, however the firm uses mutual funds for a significant portion of its institutional investment allocations. While this particular fund can invest in nearly any type of debt instrument, and can use leverage and derivatives to gain both long and short exposure, it is nearly entirely allocated to asset-backed securities. In addition, the fund has a $300 million investment minimum – clearly off limits to the average retail investor. 2. Janus Global Unconstrained Bond Fund (MUTF: JUCAX ) Total assets: $1.2 billion; Ticker: JUCAX; Inception date: 5/27/2014; Category: Nontraditional Bond; Fund link . Due to the good fortune of landing Bill Gross as the portfolio manager for this fund, assets have jumped by more than $1 billion in short order and has put the fund among the top fund launches of 2014. The unconstrained bond fund competes head to head with Gross’s former colleagues at PIMCO and their unconstrained bond fund, which lost $6 billion of assets in the three months ending November 30. From inception of Bill Gross taking the reins on the Janus fund on October 5 to December 29, the head to head competition between the two unconstrained bond funds is nearly dead even: (click to enlarge) 3. GMO Special Opportunities Fund (MUTF: GSOFX ) Total assets: $796 million; Ticker: GSOFX; Inception date: 7/28/2014; Category: Multi-Alternative; Fund link . This is another of GMO’s institutional funds (see #1 above) and is an unconstrained, long/short, multi-asset, global go-anywhere fund that has an investment objective of “positive total returns.” And just like its sister fund above, it has a $300 million investment minimum, so if you do want to invest you will need to contact GMO directly and be ready to cut a large check. 4. Blackstone Alternative Multi-Strategy Fund (MUTF: BXMIX ) Total assets: $763 million; Ticker: BXMIX; Inception date: 6/16/2014; Category: Multi-Alternative; Fund link . After inking a deal in 2013 to be one of two exclusive alternative mutual fund providers for Fidelity’s private client business, and raising more than $1 billion in doing so, Blackstone came back to the well in 2014 with a more widely available multi-alternative fund that provides investors with exposure to 17 managers across 7 different investment styles including long/short equity, global macro, long/short credit, multi-strategy and market neutral. We will keep an eye on Blackstone in 2015 to see if they leverage their $2 billion of alternative mutual fund assets and recent distribution partnership with Columbia (see #11 below) to introduce new funds into the market. 5. AllianceBernstein Multi-Manager Alternative Strategies Fund (MUTF: ALATX ) Total assets: $395 million; Ticker: ALATX; Inception date: 7/31/2014; Category: Multi-Alternative; Fund link . Leveraging both its internal portfolio management capabilities and its 2010 purchase of SunAmerica’s alternative asset management business, AllianceBernstein has built a very solid alternative mutual fund lineup, and continued the expansion of their fund range in 2014 with the launch of this fund and two long/short funds. The Multi-Manager Alternative Strategies Fund is run by Marc Gamsin and Greg Outcalt, both of whom were part of the SunAmerica acquisition. The fund allocates currently to 11 external managers across long/short equity, special situations, global macro and credit oriented strategies, as noted in the below graphic from the fund’s 9/30/14 fact sheet: 6. Dreyfus Alternative Diversifier Strategies Fund (MUTF: DRNAX ) Total assets: $386 million; Ticker: DRNAX; Inception date: 3/31/2014; Category: Multi-Alternative; Fund link . Dreyfus picks up the #6 and #7 spots with its two new funds backed by the distribution power of not only the Dreyfus platform but also its parent organization, BNY Mellon. The Dreyfus Alternative Diversifier Strategies Fund invests in other alternative mutual funds, including Dreyfus funds, and provides investors with exposure to a range of strategies including long/short equity, managed futures, commodities, real estate and real assets. 7. Dreyfus Select Managers Long/Short Fund (MUTF: DBNAX ) Total assets:$299 million; Ticker: DBNAX; Inception date: 3/31/2014; Category: Long/Short Equity; Fund link . This new Dreyfus fund is sub-advised by affiliate EACM Advisors who allocates the fund’s assets to underlying assets managers in the long/short equity, event driven and short selling space. While not a pure long/short equity fund in the traditional sense, it does maintain a low beta to the market and provides investors with multiple sources of alpha from equity-driven managers. Since inception of the fund, EACM Advisors has not been shy about making changes to the underlying fund manager lineup, having hired three new managers and terminating one. 8. Navigator Tactical Fixed Income Fund (MUTF: NTBAX ) Total assets: $283 million; Ticker: NTBAX; Inception date: 3/27/2014; Category: Nontraditional Bond; Fund link . This is one of two funds on this year’s top 10 list to be offered by a boutique investment firm. Clark Capital Management, the advisor to the fund, currently offers four alternative mutual funds, with this fund and the Navigator Sentry Managed Volatility Fund being the firm’s newest (both launched on 3/27/14). The fund tactically allocates assets among different sectors of the fixed income market with a primary focus on high yield, corporates and government bonds, and will hedge the portfolio when deemed appropriate to avoid credit and/or interest rate risk. 9. V2 Hedged Equity Fund (MUTF: VVHIX ) Total assets: $246 million; Ticker: VVHIX; Inception date: 10/31/2014; Category: Long/Short Equity; Fund link . This new fund from V2 Capital is the second fund on the list from a boutique asset manager and is also a conversion from a hedge fund. The fund combines an actively managed, concentrated portfolio of 30-50 stocks with a short portfolio of customized S&P 500 index options. The stocks represent the managers’ “best ideas” generated through fundamental, bottom-up research; while the short option positions are intended to generate income and provide a hedge on the portfolio’s equity exposure. Not your ordinary covered call portfolio! The fund has outperformed the passively managed PowerShares S&P 500 Buy-Write ETF (ticker: PBP ) over the short time period from inception to 12/30/14: (click to enlarge) 10. Deutsche Strategic Equity Long/Short Fund (MUTF: DSLAX ) Total assets: $194 million; Ticker: DSLAX; Inception date: 5/15/2014; Category: Long/Short Equity; Fund link . Deutsche slips into the #10 spot on the list with this multi-manager long/short fund and reeled in Leon Cooperman of Omega Advisors as one of its sub-advisors. The fund currently allocates to two domestic equity long/short managers (Omega and Atlantic Investment Management) and two global long/short equity managers (Chilton Investment Company and Lazard Asset Management). Net long exposure of the fund is expected to range between 20% and 80% of the fund’s net assets. Honorable Mention Given that two of the above funds are restricted to institutional investors (the two GMO funds at #1 and #3), we have included two Honorable Mentions, which are the #11 and #12 funds on the list of top asset raises during the year: 11. Columbia Mortgage Opportunities Fund (MUTF: CLMAX ) Total assets: $165 million; Ticker: CLMAX; Inception date: 4/30/2014; Category: Nontraditional Bond; Fund link . Columbia stepped up its alternatives game this year with the hiring of Bill Landes and the establishment of a partnership with Blackstone to distribute Blackstone-managed alternative mutual funds. While this new fund was launched before all the fanfare that occurred later in the year, it does fit nicely in a more broadly build out stable of alternative funds. The Columbia Mortgage Opportunities Fund looks to tactically allocate between various sectors of the mortgage-related securities market, and can use derivatives, leverage and shorting to manage exposures. 12. Schroder Global Strategic Bond Fund (MUTF: SGBVX ) Total assets: $118 million; Ticker: SGBVX; Inception date: 6/23/14; Category: Nontraditional Bond; Fund link . Schroders rounds out the list by leveraging its global fixed income capabilities to bring a global unconstrained bond fund to the market. The fund is able to invest across a wide variety of global fixed income instruments, and can use derivatives and shorting to gain exposures to specific segments of the fixed income market or hedge existing exposures. The following graphic from the fund’s overview document sums up the opportunity set: (click to enlarge) Note: Total assets reflected above for each fund are based on fund assets for all share classes of each fund on December 29, 2014 based on information from Morningstar and each fund’s website. Scalper1 News

Scalper1 News