Scalper1 News

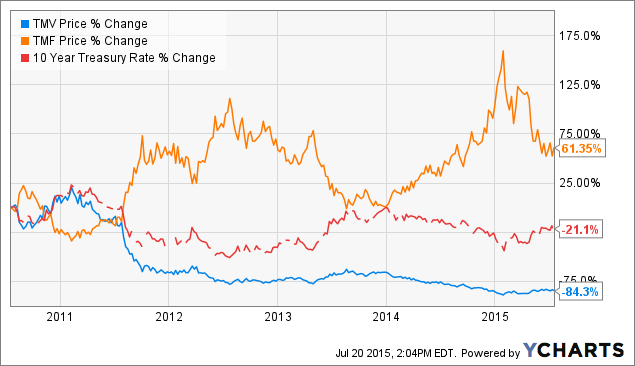

Summary I believe interest rates will increase in the long term. Investors ought to consider options for capitalizing on rising interest rates. TMV is a high risk high reward option for investors who want to hedge their portfolio against rising rates. Introduction I’ve written extensively about how Interest rates are going to rise , and what this means for the individual investor’s long term objectives. I won’t harp on anymore about rising interest rates. If you want to learn more, click on the links above. I’ve covered equity and alternative investment options for capitalizing on an interest rate hike. The majority of those suggestions were stocks, ETFs, and ETNs that benefit conservative or moderately risk averse investors. Today I will make the case, for what I believe to be, the most aggressive inverse leverage tool on the market. Leveraged ETFs give investors increased exposure and ideal results in trending markets. If Interest rates trend upwards, bond prices will decrease and treasury indexes will lose out. Inverse Treasury bond ETFs, however, will make significant returns. For those who strongly believe interest rates will rise significantly, the Direxion Daily 20+ Year Treasury Bear 3x Shares ETF (NYSEARCA: TMV ) has the potential to make the highest percentage returns. TMV Analysis TMV is a treasury bear ETF designed to track a 3X inverse multiple to its underlying index. TMV’s counterpart is the Direxion Daily 30-Year Treasury Bull 3x Shares ETF (NYSEARCA: TMF ). Both ETF’s ought to only be utilized by investors who understand leverage risk, and intend to actively manage their investments. – The Direxion Fact Sheet There is a veritable laundry list of risks associated with leveraged ETFs (particularly 3X ETFs), but when leveraged ETFs are used wisely they come with potentially attractive returns. TMV is designed to track daily results 3X, so long term results may not be as accurate. TMV has a net expense ratio of 0.90% for the pleasure of ownership. Its WAC is 3.52% and average maturity is 26.8 years. Interestingly 62.40% of the indexes bond maturities are 27-30 year bonds. While 20+ Year Treasuries do not perfectly track interest rates (using 10-Year Treasury notes as a base), their is certainly a strong correlation. Rising Rates Rates have hovered around all time lows for over half a decade now due to Fed policies post financial panic in 2008. Rates can only go up, and 10-Year rates are a good measure of rate increases. It is likely that this year , rates will increase (albeit probably marginally). Beaten down inverse treasury ETFs provide direct exposure to these indexes, which provide an opportunity for conditional capitalization in the mid to long term. Inverse Leverage Options There are three big players when it comes to attaining inverse leverage to increasing rates. There is the ProShares Short 20+ Year Treasury ETF (NYSEARCA: TBF ), the ProShares UltraShort 20+ Year Treasury ETF (NYSEARCA: TBT ), and TMV. TBT is valuable for its high market capitalization, and high volume. TBF is slightly less risk, though still a good long term option for conservative investors. TMV, on the other hand, is for those who want to aggressively capitalize on rising rates. Each come with their own risks and rewards It’s fairly apparent that Treasury rates have allowed for suboptimal returns. When rates increase, however returns perform above expectation. To show this let me compare the long term returns of TMV, 10-year rates, and TMF ((Bull)). While this is merely a visual example, it is beneficial for understanding the potential returns. Conclusion There are several inversely leveraged Treasury ETFs on the market that allow investors to capitalize on rising rates. Aggressive investors should consider TMV in the long term because if rates rise, TMV stands to make significant returns. TMV is a fairly inexpensive leveraged ETF that comes with high volume, high AUM, wide recognition, and remarkable long term potential. Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More…) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. Scalper1 News

Summary I believe interest rates will increase in the long term. Investors ought to consider options for capitalizing on rising interest rates. TMV is a high risk high reward option for investors who want to hedge their portfolio against rising rates. Introduction I’ve written extensively about how Interest rates are going to rise , and what this means for the individual investor’s long term objectives. I won’t harp on anymore about rising interest rates. If you want to learn more, click on the links above. I’ve covered equity and alternative investment options for capitalizing on an interest rate hike. The majority of those suggestions were stocks, ETFs, and ETNs that benefit conservative or moderately risk averse investors. Today I will make the case, for what I believe to be, the most aggressive inverse leverage tool on the market. Leveraged ETFs give investors increased exposure and ideal results in trending markets. If Interest rates trend upwards, bond prices will decrease and treasury indexes will lose out. Inverse Treasury bond ETFs, however, will make significant returns. For those who strongly believe interest rates will rise significantly, the Direxion Daily 20+ Year Treasury Bear 3x Shares ETF (NYSEARCA: TMV ) has the potential to make the highest percentage returns. TMV Analysis TMV is a treasury bear ETF designed to track a 3X inverse multiple to its underlying index. TMV’s counterpart is the Direxion Daily 30-Year Treasury Bull 3x Shares ETF (NYSEARCA: TMF ). Both ETF’s ought to only be utilized by investors who understand leverage risk, and intend to actively manage their investments. – The Direxion Fact Sheet There is a veritable laundry list of risks associated with leveraged ETFs (particularly 3X ETFs), but when leveraged ETFs are used wisely they come with potentially attractive returns. TMV is designed to track daily results 3X, so long term results may not be as accurate. TMV has a net expense ratio of 0.90% for the pleasure of ownership. Its WAC is 3.52% and average maturity is 26.8 years. Interestingly 62.40% of the indexes bond maturities are 27-30 year bonds. While 20+ Year Treasuries do not perfectly track interest rates (using 10-Year Treasury notes as a base), their is certainly a strong correlation. Rising Rates Rates have hovered around all time lows for over half a decade now due to Fed policies post financial panic in 2008. Rates can only go up, and 10-Year rates are a good measure of rate increases. It is likely that this year , rates will increase (albeit probably marginally). Beaten down inverse treasury ETFs provide direct exposure to these indexes, which provide an opportunity for conditional capitalization in the mid to long term. Inverse Leverage Options There are three big players when it comes to attaining inverse leverage to increasing rates. There is the ProShares Short 20+ Year Treasury ETF (NYSEARCA: TBF ), the ProShares UltraShort 20+ Year Treasury ETF (NYSEARCA: TBT ), and TMV. TBT is valuable for its high market capitalization, and high volume. TBF is slightly less risk, though still a good long term option for conservative investors. TMV, on the other hand, is for those who want to aggressively capitalize on rising rates. Each come with their own risks and rewards It’s fairly apparent that Treasury rates have allowed for suboptimal returns. When rates increase, however returns perform above expectation. To show this let me compare the long term returns of TMV, 10-year rates, and TMF ((Bull)). While this is merely a visual example, it is beneficial for understanding the potential returns. Conclusion There are several inversely leveraged Treasury ETFs on the market that allow investors to capitalize on rising rates. Aggressive investors should consider TMV in the long term because if rates rise, TMV stands to make significant returns. TMV is a fairly inexpensive leveraged ETF that comes with high volume, high AUM, wide recognition, and remarkable long term potential. Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More…) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. Scalper1 News

Scalper1 News