Scalper1 News

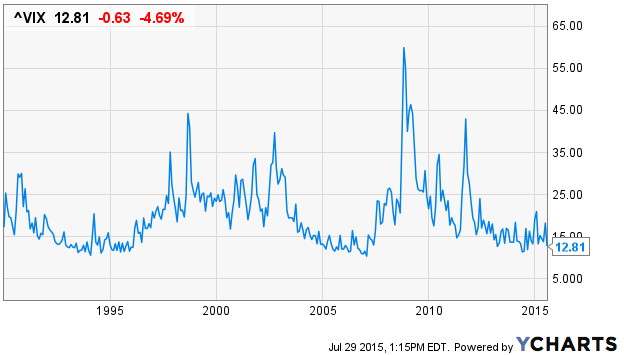

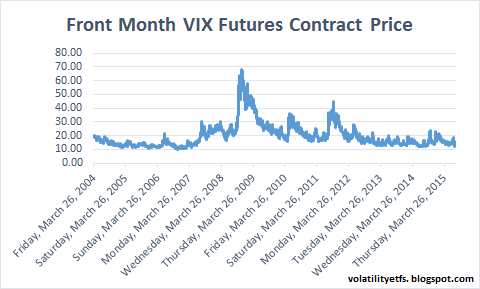

Summary Context is often forgotten by VIX traders. There are two main types of volatility events. I use three main factors to determine the best reward for the risk. In this piece we will try to examine a barometer for the VIX, so to speak. In the past, many of you have had questions about timing. How do I know when to short the VIX? When should I exit my position? My response to these questions are usually the same; you have to think for yourself. I understand that answer probably isn’t what you are looking for. However, each event in the VIX is different and there isn’t a standard answer to that question. In back testing the VIX futures, no one single strategy or exact parameter would be profitable 100% of the time. They could exist, but for reasonable returns, I haven’t found them yet. The contango and backwardation strategy, which is posted here on Seeking Alpha (click on my articles from the author page), comes the closest to being a decent strategy and being quite profitable over time. Context is the number one thing, in my opinion, that VIX investors overlook most when deciding on timing. For example, if I claimed to be a psychic, and people believed that I was, and posted that the ProShares Ultra VIX Short-Term Futures ETF (NYSEARCA: UVXY ) would reach $100 per share in six months, you would immediately have people jump on the bandwagon to purchase it. What was the context of this prediction? Was it before or after another reverse split? The context of the prediction would determine whether it was profitable or not. Since we are not psychic we must rely on other intuitions. We have limited data available on the VIX Index and even less data on the VIX futures. We have data available for the VIX futures going back to 2004 and the VIX Index going back to 1990. Are you familiar with this data? Do you understand the context? If not it would be wise to go back and research the market events that caused each of the spikes you see below. Let’s start by viewing the data: Front month VIX futures contract since 2004: Chart created by Nathan Buehler using data from The Intelligent Investor Blog . Two different types of events Before we get into our analyses we need to differentiate between different types of VIX events. Political: Political events tend to be short lived. Think of a tornado. Confined to a small path and usually does a lot of damage in a short period of time. Political events don’t tend to significantly move the mean of the VIX over larger periods of time. Recent examples: Government shutdown Debt ceiling Greece exit Flight MH17 Economic: Economic events tend to be widespread and drawn-out. Think of a hurricane. Larger area of damage over a larger period of time. Negative economic events tend to move the mean of the VIX higher over larger periods of time. Recent examples: Recession of 2008 – Financial crisis Recessionary fears of 2011 – Global growth fears Both: In rare cases political and economic events can happen together. Most often these are usually acts of war or more recently terrorism. For example; September 11th, 2001, you had an act of terrorism (which I would define as political) that in turn negatively affected the entire economy. How to use types of events in your timing decisions By analyzing the type of event, you can more accurately predict how far the VIX will spike. For example, during the government shutdown and debt ceiling debates, neither side really wanted to inflict harm on the economy. However, they wanted to appear strong, make demands, and then kick the can down the road. This was a trivial event that only took a vote to end. These are your most profitable shorting opportunities as volatility will quickly subside, assuming positive economics, after it is over. Economic events always require a bit of patience. If the VIX were to move from 13 to 20 in the next few weeks, you would immediately get people calling for a short in the VIX. What is the context of the event? Is it economic or is it political? What is the expected time frame for resolution? The result could be economic and the next move in the VIX could be to 26. Sometimes the best answer is to wait and see. If you miss the first 10% decline in the VIX, that is completely okay. It is better than being stuck with a 20% gain in the VIX while being short. Risk vs. Reward Every trade I make, which is 2-5 trades per year in volatility, must meet certain reward objectives for the risk. I look at three main things. Political or Economic: we discussed this above. How far futures could enter backwardation; Backwardation represents your holding cost associated with the short position. Up to 20% and your holding costs are manageable if you expect a swift resolution to the problem. If futures move beyond 20% backwardation you begin to experience heavier compounding of the underlying long volatility product, especially leveraged products like UVXY. By using the contango and backwardation strategy, in my Seeking Alpha library, you could potentially avoid backwardation all together. However, you do lose some reward by reducing your risk. Level of the VIX: Obviously if the VIX is at 40 I might have a more aggressive strategy than if the VIX was at 22. The higher the VIX the higher the potential reward when betting on its decline. This also ties into the backwardation levels. If UVXY had already gained 500% during a recession, theoretically speaking, it really limits its further gain to a maximum of around 100%. By using the high level of the VIX and taking into account your backwardation costs, you can plan a highly probable and profitable trade. Conclusion Context during a rise/spike in volatility is everything. By realizing and taking into account the boundaries and possible outcomes of the event, you can more accurately predict the timing and size of your short position. For more information on how to short the VIX, please view my library of articles. I hope you have found this helpful and that it answered some of your questions on timing. As I stated before, every event will be different and require an independent analysis. Current VIX futures are trading at the lower end of their respective range and this makes shorting UVXY too risky for the amount of reward possible. As most of you know I am a school teacher and I am gearing up for the new school year. I have had a great summer tweeting, chatting, talking, messaging, and blogging with you. Most of my analyses will end until next summer but I will still post articles when profitable conditions present themselves. I hope to make time for at least one analysis per month, but I can’t make any promises during the school year. The best way to keep in touch is to follow me here on Seeking Alpha, connect with me on social media, and subscribe to my blog for breaking news and supplements to my Seeking Alpha page. You can find all of those links here on my Seeking Alpha author page. I hope you have a great and profitable end to 2015! Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More…) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. Scalper1 News

Summary Context is often forgotten by VIX traders. There are two main types of volatility events. I use three main factors to determine the best reward for the risk. In this piece we will try to examine a barometer for the VIX, so to speak. In the past, many of you have had questions about timing. How do I know when to short the VIX? When should I exit my position? My response to these questions are usually the same; you have to think for yourself. I understand that answer probably isn’t what you are looking for. However, each event in the VIX is different and there isn’t a standard answer to that question. In back testing the VIX futures, no one single strategy or exact parameter would be profitable 100% of the time. They could exist, but for reasonable returns, I haven’t found them yet. The contango and backwardation strategy, which is posted here on Seeking Alpha (click on my articles from the author page), comes the closest to being a decent strategy and being quite profitable over time. Context is the number one thing, in my opinion, that VIX investors overlook most when deciding on timing. For example, if I claimed to be a psychic, and people believed that I was, and posted that the ProShares Ultra VIX Short-Term Futures ETF (NYSEARCA: UVXY ) would reach $100 per share in six months, you would immediately have people jump on the bandwagon to purchase it. What was the context of this prediction? Was it before or after another reverse split? The context of the prediction would determine whether it was profitable or not. Since we are not psychic we must rely on other intuitions. We have limited data available on the VIX Index and even less data on the VIX futures. We have data available for the VIX futures going back to 2004 and the VIX Index going back to 1990. Are you familiar with this data? Do you understand the context? If not it would be wise to go back and research the market events that caused each of the spikes you see below. Let’s start by viewing the data: Front month VIX futures contract since 2004: Chart created by Nathan Buehler using data from The Intelligent Investor Blog . Two different types of events Before we get into our analyses we need to differentiate between different types of VIX events. Political: Political events tend to be short lived. Think of a tornado. Confined to a small path and usually does a lot of damage in a short period of time. Political events don’t tend to significantly move the mean of the VIX over larger periods of time. Recent examples: Government shutdown Debt ceiling Greece exit Flight MH17 Economic: Economic events tend to be widespread and drawn-out. Think of a hurricane. Larger area of damage over a larger period of time. Negative economic events tend to move the mean of the VIX higher over larger periods of time. Recent examples: Recession of 2008 – Financial crisis Recessionary fears of 2011 – Global growth fears Both: In rare cases political and economic events can happen together. Most often these are usually acts of war or more recently terrorism. For example; September 11th, 2001, you had an act of terrorism (which I would define as political) that in turn negatively affected the entire economy. How to use types of events in your timing decisions By analyzing the type of event, you can more accurately predict how far the VIX will spike. For example, during the government shutdown and debt ceiling debates, neither side really wanted to inflict harm on the economy. However, they wanted to appear strong, make demands, and then kick the can down the road. This was a trivial event that only took a vote to end. These are your most profitable shorting opportunities as volatility will quickly subside, assuming positive economics, after it is over. Economic events always require a bit of patience. If the VIX were to move from 13 to 20 in the next few weeks, you would immediately get people calling for a short in the VIX. What is the context of the event? Is it economic or is it political? What is the expected time frame for resolution? The result could be economic and the next move in the VIX could be to 26. Sometimes the best answer is to wait and see. If you miss the first 10% decline in the VIX, that is completely okay. It is better than being stuck with a 20% gain in the VIX while being short. Risk vs. Reward Every trade I make, which is 2-5 trades per year in volatility, must meet certain reward objectives for the risk. I look at three main things. Political or Economic: we discussed this above. How far futures could enter backwardation; Backwardation represents your holding cost associated with the short position. Up to 20% and your holding costs are manageable if you expect a swift resolution to the problem. If futures move beyond 20% backwardation you begin to experience heavier compounding of the underlying long volatility product, especially leveraged products like UVXY. By using the contango and backwardation strategy, in my Seeking Alpha library, you could potentially avoid backwardation all together. However, you do lose some reward by reducing your risk. Level of the VIX: Obviously if the VIX is at 40 I might have a more aggressive strategy than if the VIX was at 22. The higher the VIX the higher the potential reward when betting on its decline. This also ties into the backwardation levels. If UVXY had already gained 500% during a recession, theoretically speaking, it really limits its further gain to a maximum of around 100%. By using the high level of the VIX and taking into account your backwardation costs, you can plan a highly probable and profitable trade. Conclusion Context during a rise/spike in volatility is everything. By realizing and taking into account the boundaries and possible outcomes of the event, you can more accurately predict the timing and size of your short position. For more information on how to short the VIX, please view my library of articles. I hope you have found this helpful and that it answered some of your questions on timing. As I stated before, every event will be different and require an independent analysis. Current VIX futures are trading at the lower end of their respective range and this makes shorting UVXY too risky for the amount of reward possible. As most of you know I am a school teacher and I am gearing up for the new school year. I have had a great summer tweeting, chatting, talking, messaging, and blogging with you. Most of my analyses will end until next summer but I will still post articles when profitable conditions present themselves. I hope to make time for at least one analysis per month, but I can’t make any promises during the school year. The best way to keep in touch is to follow me here on Seeking Alpha, connect with me on social media, and subscribe to my blog for breaking news and supplements to my Seeking Alpha page. You can find all of those links here on my Seeking Alpha author page. I hope you have a great and profitable end to 2015! Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More…) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. Scalper1 News

Scalper1 News