Scalper1 News

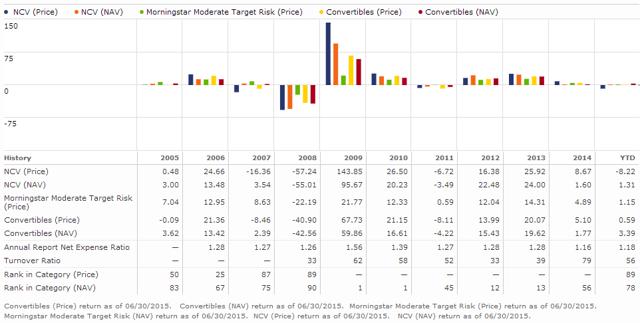

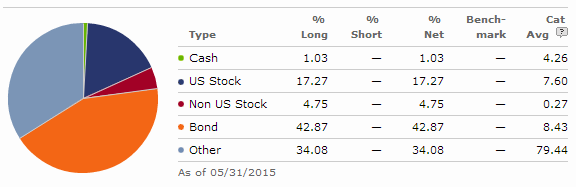

Summary For the first time in three years, NCV has traded at a discount to trading price, and this prompted the need for a review of the fund. Since my last NCV/NCZ primer (NCZ/NCV Primer), both NCV/NCZ have maintained their monthly distributions and investors have collected approximately 18% in dividend income. NCV remains a great investment vehicle for yield hungry investors with a healthy debt maturity and sector mix. The markets have been nothing close to stable for the last few weeks and this has led to the broader investment community to lose focus on their investment objectives and strategies (I mean both retail and institutional investors). For the first time in three years, the AllianzGI Convertible & Income Fund (NYSE: NCV ) has traded at a discount to trading price, and this prompted the need for a review of the fund. First off, this isn’t the first time it has happened (the price to trade below the net asset value). NCV has dipped below it’s net asset value several times historically in similar fashions – generally in response to drastic market events (in this case it’s Greece’s and Puerto Rico’s debt default scares). When the markets edge lower, like they have in the last three weeks, and many investment vehicles are impacted due to this concern, I refer to it as ” headline risk ” and without a question, the current headline risk with Greece is not good, but it isn’t going to be THAT bad for the global economy. Investors should remember/realize what exactly is at play here. In this case, it is a country defaulting/postponing/determining how to payoff debt to an entity that is unlevered and does not contain counter party risk (IMF, Germany, European Union, all other creditors). Investors, and the rest of the investment community, should realize that Greece’s headline risk is fairly isolated from investment vehicles like NCV (and the AllianzGI Convertible Fund II (NYSE: NCZ )), which trade and are meant to be benchmarked against convertible bond indices. Therefore, I felt it is time to refocus closed end fund investors back on to NCV, where global macro headline risk should not dictate the performance of convertible funds of U.S. denominated equities. Since my last NCV/NCZ primer ( NCZ/NCV Primer ), both NCV/NCZ have maintained their monthly distributions and investors have collected approximately 18% in dividend income and have been able to book 22% of returns assuming dividends were reinvested. To review the fund’s strategy, NCV invests in short to medium term convertible bonds of companies based in the United States mainly and they achieve a 12% distribution rate by levering their assets by around 33% at all times to benefit from the increased investment, and generate the high monthly distributions of approximately 13% (based on recent price levels). NCV achieves these returns in two main forms: Direct investment into convertible debt via underwritings and secondary market trading. Intra-day trading based on market opportunities to capture mispriced debt events. The downside of NCV’s strategy is that it can face liquidity constraints for some of its debt and may take on the wrong positions which will impact NAV, but difficult to compute on the market price front, making the performance of the current investments fairly difficult to transcribe. NCV Market Price vs. Net Asset Value Price Chart – NCV trades at a healthy premium to the funds net asset value price and for the right reasons… Yield demand. Source: Morningstar As shown above, NCV has consistently traded above its Net Asset Value, and this is largely due to the fact that NCV pays out a substantial dividend compared to other closed end funds. Since NCV consistently yields a monthly 12% (13% at current trading prices), investors made up of both retail and institutional distinctions have found that a 12% distribution rate is very attractive considering it can be a long term investment and executed by a reputable investment manager, Allianz. Investors do not mind paying a slight premium on the fund for the return of an above average distribution rate. NCV Annual Returns vs. Convertible Bond Benchmarks – NCV sell-off is a market overreaction (click to enlarge) Source: Morningstar Above, NCV’s trading price is compared to its convertible benchmark and based on the above chart, YTD 2015 is one of the first times where you see a divergence of NCV’s share price vs. convertible benchmark prices, outlining this investment opportunity. Generally, NCV has been able to beat this index by maintaining an active investment portfolio of convertible debt, granting positioning options the convertible bond index does not benefit from (since it is a passively tracked index). NCV Asset Allocation – The majority of the assets are in Convertible debt, which is concentrated in the United States and far from Europe Source: Morningstar To highlight why I wanted to publish this article, above is a pie chart of NCV’s asset allocation, of which is made up of 75%+ U.S. denominated debt and far from European risk. Just for clarification, the above chart is from Morningstar.com and Morningstar’s asset allocation for closed end funds is automated, confusing investors slightly since convertible debt can be identified as either “bonds” or “other” for various securities. In this case, the bonds and other categories are the convertible debt categories. NCV Bond Maturity Breakdown – With medium-term debt making up the majority of the investment portfolio, AllianzGI portfolio managers can maintain the portfolio mix for long-term investors… (click to enlarge) Source: Morningstar NCV Distributions – Investors should not see the distribution mix change, with focus to remain in distributing income to investors long term. Source: Morningstar Finally, I wanted to highlight several other factors that can help investors refocus on NCV. First, the income distributions are almost completely made up of convertible debt income funds and therefore gives investors the stability of payments since the bulk of the payouts are not driven by intra-day trading bets/performance/strategies, unlike other closed end funds. Second, the recent market price drop can be tied to the headline risk I mentioned/discussed earlier and the fact that NCV holds a portion of U.S. stock holdings in its portfolio, capturing some of the downside that the broader markets have locked onto. Third, investors who originally invested in NCV remain yield hungry and the closed end fund substitutions aren’t really here (there are only a few closed end funds that focus on convertible bonds and simultaneously yield 12% to investors). In my view, the price drop will be corrected back upward after investors have had time to digest the headline risk from Europe and broader market underperformance. NCV remains a great investment vehicle for yield hungry investors with a healthy debt maturity and sector mix, and investors should not mistaken the recent global economic issues with a closed end fund investing in convertible bonds. Disclosure: I am/we are long NCV, NCZ. (More…) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. Scalper1 News

Summary For the first time in three years, NCV has traded at a discount to trading price, and this prompted the need for a review of the fund. Since my last NCV/NCZ primer (NCZ/NCV Primer), both NCV/NCZ have maintained their monthly distributions and investors have collected approximately 18% in dividend income. NCV remains a great investment vehicle for yield hungry investors with a healthy debt maturity and sector mix. The markets have been nothing close to stable for the last few weeks and this has led to the broader investment community to lose focus on their investment objectives and strategies (I mean both retail and institutional investors). For the first time in three years, the AllianzGI Convertible & Income Fund (NYSE: NCV ) has traded at a discount to trading price, and this prompted the need for a review of the fund. First off, this isn’t the first time it has happened (the price to trade below the net asset value). NCV has dipped below it’s net asset value several times historically in similar fashions – generally in response to drastic market events (in this case it’s Greece’s and Puerto Rico’s debt default scares). When the markets edge lower, like they have in the last three weeks, and many investment vehicles are impacted due to this concern, I refer to it as ” headline risk ” and without a question, the current headline risk with Greece is not good, but it isn’t going to be THAT bad for the global economy. Investors should remember/realize what exactly is at play here. In this case, it is a country defaulting/postponing/determining how to payoff debt to an entity that is unlevered and does not contain counter party risk (IMF, Germany, European Union, all other creditors). Investors, and the rest of the investment community, should realize that Greece’s headline risk is fairly isolated from investment vehicles like NCV (and the AllianzGI Convertible Fund II (NYSE: NCZ )), which trade and are meant to be benchmarked against convertible bond indices. Therefore, I felt it is time to refocus closed end fund investors back on to NCV, where global macro headline risk should not dictate the performance of convertible funds of U.S. denominated equities. Since my last NCV/NCZ primer ( NCZ/NCV Primer ), both NCV/NCZ have maintained their monthly distributions and investors have collected approximately 18% in dividend income and have been able to book 22% of returns assuming dividends were reinvested. To review the fund’s strategy, NCV invests in short to medium term convertible bonds of companies based in the United States mainly and they achieve a 12% distribution rate by levering their assets by around 33% at all times to benefit from the increased investment, and generate the high monthly distributions of approximately 13% (based on recent price levels). NCV achieves these returns in two main forms: Direct investment into convertible debt via underwritings and secondary market trading. Intra-day trading based on market opportunities to capture mispriced debt events. The downside of NCV’s strategy is that it can face liquidity constraints for some of its debt and may take on the wrong positions which will impact NAV, but difficult to compute on the market price front, making the performance of the current investments fairly difficult to transcribe. NCV Market Price vs. Net Asset Value Price Chart – NCV trades at a healthy premium to the funds net asset value price and for the right reasons… Yield demand. Source: Morningstar As shown above, NCV has consistently traded above its Net Asset Value, and this is largely due to the fact that NCV pays out a substantial dividend compared to other closed end funds. Since NCV consistently yields a monthly 12% (13% at current trading prices), investors made up of both retail and institutional distinctions have found that a 12% distribution rate is very attractive considering it can be a long term investment and executed by a reputable investment manager, Allianz. Investors do not mind paying a slight premium on the fund for the return of an above average distribution rate. NCV Annual Returns vs. Convertible Bond Benchmarks – NCV sell-off is a market overreaction (click to enlarge) Source: Morningstar Above, NCV’s trading price is compared to its convertible benchmark and based on the above chart, YTD 2015 is one of the first times where you see a divergence of NCV’s share price vs. convertible benchmark prices, outlining this investment opportunity. Generally, NCV has been able to beat this index by maintaining an active investment portfolio of convertible debt, granting positioning options the convertible bond index does not benefit from (since it is a passively tracked index). NCV Asset Allocation – The majority of the assets are in Convertible debt, which is concentrated in the United States and far from Europe Source: Morningstar To highlight why I wanted to publish this article, above is a pie chart of NCV’s asset allocation, of which is made up of 75%+ U.S. denominated debt and far from European risk. Just for clarification, the above chart is from Morningstar.com and Morningstar’s asset allocation for closed end funds is automated, confusing investors slightly since convertible debt can be identified as either “bonds” or “other” for various securities. In this case, the bonds and other categories are the convertible debt categories. NCV Bond Maturity Breakdown – With medium-term debt making up the majority of the investment portfolio, AllianzGI portfolio managers can maintain the portfolio mix for long-term investors… (click to enlarge) Source: Morningstar NCV Distributions – Investors should not see the distribution mix change, with focus to remain in distributing income to investors long term. Source: Morningstar Finally, I wanted to highlight several other factors that can help investors refocus on NCV. First, the income distributions are almost completely made up of convertible debt income funds and therefore gives investors the stability of payments since the bulk of the payouts are not driven by intra-day trading bets/performance/strategies, unlike other closed end funds. Second, the recent market price drop can be tied to the headline risk I mentioned/discussed earlier and the fact that NCV holds a portion of U.S. stock holdings in its portfolio, capturing some of the downside that the broader markets have locked onto. Third, investors who originally invested in NCV remain yield hungry and the closed end fund substitutions aren’t really here (there are only a few closed end funds that focus on convertible bonds and simultaneously yield 12% to investors). In my view, the price drop will be corrected back upward after investors have had time to digest the headline risk from Europe and broader market underperformance. NCV remains a great investment vehicle for yield hungry investors with a healthy debt maturity and sector mix, and investors should not mistaken the recent global economic issues with a closed end fund investing in convertible bonds. Disclosure: I am/we are long NCV, NCZ. (More…) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. Scalper1 News

Scalper1 News