Scalper1 News

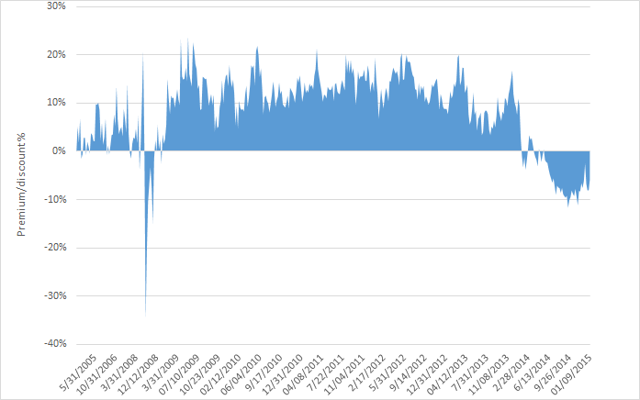

Summary Energy stocks have fallen in the past several months due to volatility in the price of oil. Midstream MLPs involved with the transportation or storage of fuels offer lower, but more stable distributions. This article presents a number of reasons why investors should consider TYG for exposure to the midstream MLP space. Introduction What will the price of oil be in three months time? If you think I know the answer to that question, I have a prime real estate in the Bahamas to sell you. What is known is that energy MLPs have done rather poorly recently. As a readers of my ” Buy-the-Dip High-Yield ” portfolio would know, buying on the dips allows you to lock in higher yields and grasp the potential for capital appreciation. Upstream (also known as E&P) MLPs have fallen the hardest in recent months, with bellwethers such as Line Energy (NASDAQ: LINE ) plunging by about two-thirds. While their yields are the highest, upstream MLPs also carry more risk due to their acute sensitivity to the price of oil. I considered buying upstream-containing MLP funds (see my previous articles on YMLP , MLPJ and MLPY ) to mitigate this risk, but ultimately decided that the entire sector was too volatile at this time. In comparison, midstream MLPs, which are involved with the transportation (via pipeline, rail, barge, oil tanker or truck) and storage of crude or refined petroleum products, tend to offer lower but more stable distributions. Tortoise Energy Infrastructure Corporation Upon consideration of the various midstream MLP ETFs, ETNs and CEFs on the market, I ultimately decided on purchasing Tortoise Energy Infrastructure Corporation (NYSE: TYG ). My reasons for buying TYG can be broken down into three reasons: 1. Long track record of (out)performance As described in my recent article , TYG has over 10 years of track record performance. Among MLP CEFs, only Kayne Anderson MLP Investment Company (NYSE: KYN ) has a similarly long history. Over the last three years, when the benchmark Alerian MLP ETF (NYSEARCA: AMLP ) became available, TYG has returned 17.83% annualized (by NAV), compared to 14.51% for KYN and 8.87% for AMLP. After accounting for its 25.29% leverage, TYG returned 14.23%, which is still higher than AMLP. The following graph shows the total return percentages of TYG, KYN and AMLP over the past few years. Note that the graph shows price return rather than NAV return. TYG Total Return Price data by YCharts As mentioned in the previous article, KYN actually had a better price return compared to TYG over the last few years, whereas TYG had a better NAV return. I believe that NAV return is a better reflection of performance compared to price return, since the value of a CEF is ultimately based on its NAV. Unfortunately YCharts does not have a ability to chart NAV total return. 2. Historically large discount As mentioned many times in my previous articles, mean reversion of premium/discount values is an effective strategy to add an extra bit of performance to your CEF holdings. Basically, the strategy entails buying CEFs when their discount exceeds their historical average, allowing you to profit from mean reversion as the discount narrows. TYG currently trades at a discount of -5.80%. The following chart shows the premium/discount for TYG (graph constructed from data supplied by Tortoise Capital Advisors ). (click to enlarge) We can see that for most of its 10-year history, apart from a brief spurt in 2008 and during the last year, TYG has traded at a persistent premium. The following table shows the average premium/discount values for TYG over various time periods (premium/discount data are from CEFConnect except for the 10-year time period which was manually calculated). Time Premium/discount Current -5.80% 1-year -4.97% 3-year 5.99% 5-year 9.02% 10-year 8.48% Therefore, we can see that TYG has a very large discount relative to its 3-year, 5-year and 10-year averages, indicating that now would be a good time to consider buying this fund for midstream MLP exposure. We also note that TYG had recently fallen to as low as -10% discount in September of last year, which would have been an even better time to buy the fund. 3. Reasonable expense ratio TYG charges a management fee of 1.62%* (according to CEFConnect). This seems high, but once you factor in the benchmark AMLP’s 0.85% expense ratio and the 25.29% leverage of the fund, you are really only paying 0.44% more for the active management of TYG. This compares favorably to KYN, which charges 1.12% for “active expense” (see my previous article for how this was calculated). *Excludes interest expenses and deferred tax liabilities. Given the significant outperformance of TYG vis-a-vis the benchmark over the last few years, I consider the management fee well worth it. 4. Possible downside protection Note: I’m not a tax expert so please take the following with a grain of salt. MLP CEFs (or ETFs) structured as corporations accrue deferred tax liabilities over the years, which will act as a drag on NAV (compared to an ETN) when the underlying constituents are advancing. Conversely, in a falling market an MLP CEF/ETF should fall less than an MLP ETN because the CEF/ETF will be able to accrue a deferred tax asset, or to decrease its deferred tax liability. George Spritzer’s [CFA] excellent article explains the benefit of a deferred tax liability: Another interesting feature of deferred tax liabilities is that they provide some cushion on the downside if there were a major correction in the MLP sector. This would cause a decrease in the deferred tax liabilities, which translates into less of a penalty when the regular unadjusted NAV is computed. Moreover, Mr. Spritzer estimates that the true discount for TYG is even higher (around 36%) once the deferred tax liabilities are accounted for. Indeed, if the CEF managers are using tax minimization strategies to boost the NAV return of the CEF over the benchmark AMLP, which is subject to the same tax drag as the CEFs but is passively managed, then that is even more the reason to pay for active management. To see the deferred tax liability in action, consider the price action of AMLP (an ETF) relative to JP Morgan Alerian MLP (NYSEARCA: AMJ ) (an ETN) over the last five days, a period where oil-related stocks took another punch to the stomach. AMLP and AMJ are both passive benchmarks that track similar indices but the outperformance of AMLP on the downside is probably due to its accrued deferred tax liabilities. TYG did even better, though part of this could have been due to fluctuations in premium/discount values. TYG Price data by YCharts Therefore, my investing in an MLP CEF (or ETF) over ETN that has accrued deferred tax liabilities, you gain some downside protection. Summary This article presents several reasons why investors looking to gain exposure to the midstream MLP space should consider TYG. Due to overall volatility in the energy sector, I would recommend that investors slowly dollar-cost average their way into this fund instead of buying the whole amount in one go. Scalper1 News

Summary Energy stocks have fallen in the past several months due to volatility in the price of oil. Midstream MLPs involved with the transportation or storage of fuels offer lower, but more stable distributions. This article presents a number of reasons why investors should consider TYG for exposure to the midstream MLP space. Introduction What will the price of oil be in three months time? If you think I know the answer to that question, I have a prime real estate in the Bahamas to sell you. What is known is that energy MLPs have done rather poorly recently. As a readers of my ” Buy-the-Dip High-Yield ” portfolio would know, buying on the dips allows you to lock in higher yields and grasp the potential for capital appreciation. Upstream (also known as E&P) MLPs have fallen the hardest in recent months, with bellwethers such as Line Energy (NASDAQ: LINE ) plunging by about two-thirds. While their yields are the highest, upstream MLPs also carry more risk due to their acute sensitivity to the price of oil. I considered buying upstream-containing MLP funds (see my previous articles on YMLP , MLPJ and MLPY ) to mitigate this risk, but ultimately decided that the entire sector was too volatile at this time. In comparison, midstream MLPs, which are involved with the transportation (via pipeline, rail, barge, oil tanker or truck) and storage of crude or refined petroleum products, tend to offer lower but more stable distributions. Tortoise Energy Infrastructure Corporation Upon consideration of the various midstream MLP ETFs, ETNs and CEFs on the market, I ultimately decided on purchasing Tortoise Energy Infrastructure Corporation (NYSE: TYG ). My reasons for buying TYG can be broken down into three reasons: 1. Long track record of (out)performance As described in my recent article , TYG has over 10 years of track record performance. Among MLP CEFs, only Kayne Anderson MLP Investment Company (NYSE: KYN ) has a similarly long history. Over the last three years, when the benchmark Alerian MLP ETF (NYSEARCA: AMLP ) became available, TYG has returned 17.83% annualized (by NAV), compared to 14.51% for KYN and 8.87% for AMLP. After accounting for its 25.29% leverage, TYG returned 14.23%, which is still higher than AMLP. The following graph shows the total return percentages of TYG, KYN and AMLP over the past few years. Note that the graph shows price return rather than NAV return. TYG Total Return Price data by YCharts As mentioned in the previous article, KYN actually had a better price return compared to TYG over the last few years, whereas TYG had a better NAV return. I believe that NAV return is a better reflection of performance compared to price return, since the value of a CEF is ultimately based on its NAV. Unfortunately YCharts does not have a ability to chart NAV total return. 2. Historically large discount As mentioned many times in my previous articles, mean reversion of premium/discount values is an effective strategy to add an extra bit of performance to your CEF holdings. Basically, the strategy entails buying CEFs when their discount exceeds their historical average, allowing you to profit from mean reversion as the discount narrows. TYG currently trades at a discount of -5.80%. The following chart shows the premium/discount for TYG (graph constructed from data supplied by Tortoise Capital Advisors ). (click to enlarge) We can see that for most of its 10-year history, apart from a brief spurt in 2008 and during the last year, TYG has traded at a persistent premium. The following table shows the average premium/discount values for TYG over various time periods (premium/discount data are from CEFConnect except for the 10-year time period which was manually calculated). Time Premium/discount Current -5.80% 1-year -4.97% 3-year 5.99% 5-year 9.02% 10-year 8.48% Therefore, we can see that TYG has a very large discount relative to its 3-year, 5-year and 10-year averages, indicating that now would be a good time to consider buying this fund for midstream MLP exposure. We also note that TYG had recently fallen to as low as -10% discount in September of last year, which would have been an even better time to buy the fund. 3. Reasonable expense ratio TYG charges a management fee of 1.62%* (according to CEFConnect). This seems high, but once you factor in the benchmark AMLP’s 0.85% expense ratio and the 25.29% leverage of the fund, you are really only paying 0.44% more for the active management of TYG. This compares favorably to KYN, which charges 1.12% for “active expense” (see my previous article for how this was calculated). *Excludes interest expenses and deferred tax liabilities. Given the significant outperformance of TYG vis-a-vis the benchmark over the last few years, I consider the management fee well worth it. 4. Possible downside protection Note: I’m not a tax expert so please take the following with a grain of salt. MLP CEFs (or ETFs) structured as corporations accrue deferred tax liabilities over the years, which will act as a drag on NAV (compared to an ETN) when the underlying constituents are advancing. Conversely, in a falling market an MLP CEF/ETF should fall less than an MLP ETN because the CEF/ETF will be able to accrue a deferred tax asset, or to decrease its deferred tax liability. George Spritzer’s [CFA] excellent article explains the benefit of a deferred tax liability: Another interesting feature of deferred tax liabilities is that they provide some cushion on the downside if there were a major correction in the MLP sector. This would cause a decrease in the deferred tax liabilities, which translates into less of a penalty when the regular unadjusted NAV is computed. Moreover, Mr. Spritzer estimates that the true discount for TYG is even higher (around 36%) once the deferred tax liabilities are accounted for. Indeed, if the CEF managers are using tax minimization strategies to boost the NAV return of the CEF over the benchmark AMLP, which is subject to the same tax drag as the CEFs but is passively managed, then that is even more the reason to pay for active management. To see the deferred tax liability in action, consider the price action of AMLP (an ETF) relative to JP Morgan Alerian MLP (NYSEARCA: AMJ ) (an ETN) over the last five days, a period where oil-related stocks took another punch to the stomach. AMLP and AMJ are both passive benchmarks that track similar indices but the outperformance of AMLP on the downside is probably due to its accrued deferred tax liabilities. TYG did even better, though part of this could have been due to fluctuations in premium/discount values. TYG Price data by YCharts Therefore, my investing in an MLP CEF (or ETF) over ETN that has accrued deferred tax liabilities, you gain some downside protection. Summary This article presents several reasons why investors looking to gain exposure to the midstream MLP space should consider TYG. Due to overall volatility in the energy sector, I would recommend that investors slowly dollar-cost average their way into this fund instead of buying the whole amount in one go. Scalper1 News

Scalper1 News