Scalper1 News

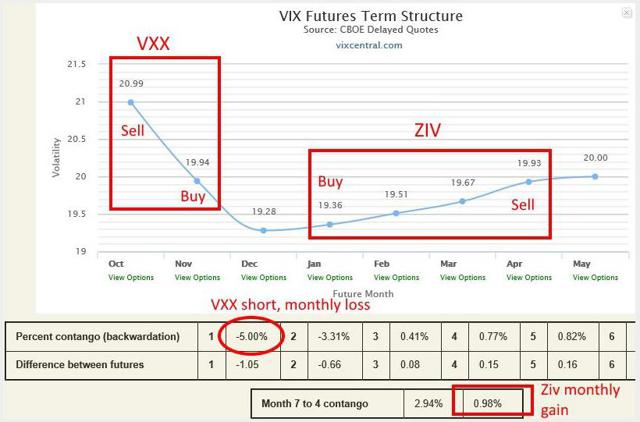

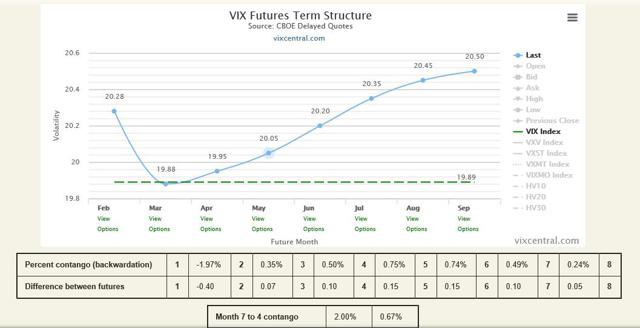

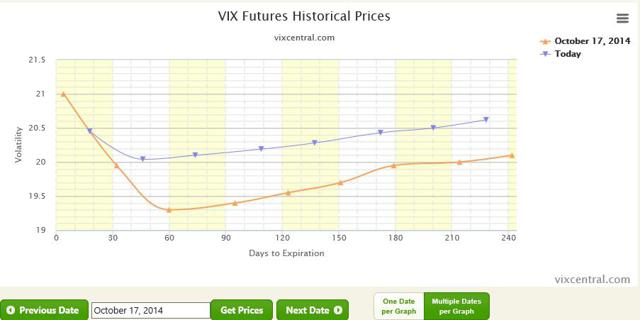

I last recommend ZIV at 39 in October. That trade worked out nicely. ZIV is back at 39 and is again an attractive buy here. I last discussed the VelocityShares Daily Inverse VIX Medium-Term Futures ETF (NASDAQ: ZIV ) in mid-October, calling it a buy to take advantage of excessive market negativity surrounding the potential for an Ebola outbreak in the United States along with uncertainty in the Middle East. ZIV proceeded to rise from 39 to 46 in a straight-line, offering near 20% gains for nimble traders. It’s time to go back to the well as ZIV is again offering a reasonable entry-point. New concerns have shaken the stock market, with pressures from plunging oil prices and earnings misses causing new waves of volatility. Again, like in October, the near-term part of the VIX futures curve finds itself in contango, meaning that it is a bit troublesome to short the iPath S&P 500 VIX ST Futures ETN (NYSEARCA: VXX ) directly. If the VIX futures curve stays where it is currently, VXX will rise gradually just from enjoying the backwardation the market is in. As you can see in the graphic shown later in this article, VXX benefits roughly 2% a month if the futures curve stays as is, which isn’t a huge headwind to the short trade, but it is a deterrent for sure. When you combine that with the cost of borrowing VXX to short, in addition to considering that short VXX has much more risk than long ZIV (since VXX tends to rally far more quickly than ZIV drops), again I’d be preferential to a long ZIV position than a short VXX position here to profit from the excessive volatility priced into the market at the moment. ZIV is an attractive long as the broader market continues to enjoy support around 1990 on the S&P 500 index (NYSEARCA: SPY ). While the market has suffered a few bumps over the past month, economic conditions remain generally favorable and the Fed doesn’t seem inclined to raise interest rates particularly quickly. Fears over Europe have plagued the market since at least 2011 and are unlikely to hold any more merit this time around. Oil prices are a potential hazard, as the energy sector has suffered severe losses, however the benefits of cheaper energy provide sufficient positive feedback to other sectors that the overall impact on the market appears to be contained. Since I last discussed ZIV, the instrument enjoyed a quick 20% rally and then has gradually slid back down to where it traded previously. With this past week’s volatility, ZIV took a nice dive, and now finds itself back at 39, where we dealt with it previously. It’s firmly back in the buy zone, and conditions are equally favorable in comparison to our last entry. I’ve reproduced the chart from our October ZIV buy at 39, with the futures curve today, ZIV also at 39. There’s one positive and one negative, and on the whole it works out to be a wash in my view. (Charts from Vixcentral.com) VIX futures October 17th, 2014: (click to enlarge) VIX futures now (as of 1pm ET Friday): (click to enlarge) On the one hand, ZIV was gaining 1% a month purely from contango. It was buying January futures at 19.36 and selling at 19.93, which produces a 3% gain on each roll. Divide by 3 (since it holds the contracts for 3 months), and you get a percent a month, or more than a 12% compounded annual return if volatility is flat and it just reaps the contango harvest. Now, however, the contango yield has fallen to roughly 0.6% a month, or a bit over 7% annualized, which is a good tailwind to the trade, but not as strong as previously. VIX futures in comparison, October 18th, 2014 versus now: (click to enlarge) However, note that the whole term structure has moved upward. Before ZIV was buying futures at 19.36 and selling at 19.93, now it is buying at 20.05 and selling at 20.45. Thus, ZIV, which is perpetually shorting VIX futures contracts, now has a notably better cost basis for its short positions. This is the beauty of ZIV as a longer-term investment or long-biased trading vehicle: ZIV’s net asset value consistently rises even as the market bounces around; returning to and then deviating again from the mean. What does this mean practically? ZIV is again at 39, where it was in October. However, ZIV’s cost basis for its short positions has now improved by 5%. Should the VIX futures head back to where they were in October, in the low-19s, ZIV would now make a 5% capital gain, moving higher to 41 per share. This before any benefits from contango. While ZIV is priced the same as during the October dip, the VIX curve is higher than before, now offering more potential upside for ZIV on a market normalization to calmer conditions. If VIX settles down in similar fashion to how it did in October, ZIV would reach 48 on this next upswing, taking it almost 25% higher and back to near 52-week highs. Taking a longer-term view of ZIV’s chart, ZIV gradually rises something along the order of 1% a month (what it earns on average from contango) while it swings upward and downward around the trend-line as the market fluctuates. ZIV’s next sustained push higher should take it above 50, as it is overdue for a new high when the market gets over its near-term crisis of confidence. The risk to the trade would be if the market has topped. At some point the bull market will end, and ZIV will no longer be an easy buy on dips. At that point we’ll have to watch the VIX structure closely to see if ZIV stays in contango or not. Should it go into backwardation, like VXX, we’d have to reconsider the viability of the trade. As it is, I don’t think the bull market has ended yet. And alternatively, short VXX will work out better than long ZIV if you are convinced that the market immediately calms down from here. In October, the panic subsided quickly, and shorting VXX did produce a better percentage gain than ZIV. This could happen again if the S&P 500 quickly moves back to its highs. As I’m not convinced this is going to happen, I’d rather take the much more conservative ZIV trade, which offers high probability of 20% near-term upside with limited downside. Disclosure: The author is long ZIV. (More…) The author wrote this article themselves, and it expresses their own opinions. The author is not receiving compensation for it (other than from Seeking Alpha). The author has no business relationship with any company whose stock is mentioned in this article. Scalper1 News

I last recommend ZIV at 39 in October. That trade worked out nicely. ZIV is back at 39 and is again an attractive buy here. I last discussed the VelocityShares Daily Inverse VIX Medium-Term Futures ETF (NASDAQ: ZIV ) in mid-October, calling it a buy to take advantage of excessive market negativity surrounding the potential for an Ebola outbreak in the United States along with uncertainty in the Middle East. ZIV proceeded to rise from 39 to 46 in a straight-line, offering near 20% gains for nimble traders. It’s time to go back to the well as ZIV is again offering a reasonable entry-point. New concerns have shaken the stock market, with pressures from plunging oil prices and earnings misses causing new waves of volatility. Again, like in October, the near-term part of the VIX futures curve finds itself in contango, meaning that it is a bit troublesome to short the iPath S&P 500 VIX ST Futures ETN (NYSEARCA: VXX ) directly. If the VIX futures curve stays where it is currently, VXX will rise gradually just from enjoying the backwardation the market is in. As you can see in the graphic shown later in this article, VXX benefits roughly 2% a month if the futures curve stays as is, which isn’t a huge headwind to the short trade, but it is a deterrent for sure. When you combine that with the cost of borrowing VXX to short, in addition to considering that short VXX has much more risk than long ZIV (since VXX tends to rally far more quickly than ZIV drops), again I’d be preferential to a long ZIV position than a short VXX position here to profit from the excessive volatility priced into the market at the moment. ZIV is an attractive long as the broader market continues to enjoy support around 1990 on the S&P 500 index (NYSEARCA: SPY ). While the market has suffered a few bumps over the past month, economic conditions remain generally favorable and the Fed doesn’t seem inclined to raise interest rates particularly quickly. Fears over Europe have plagued the market since at least 2011 and are unlikely to hold any more merit this time around. Oil prices are a potential hazard, as the energy sector has suffered severe losses, however the benefits of cheaper energy provide sufficient positive feedback to other sectors that the overall impact on the market appears to be contained. Since I last discussed ZIV, the instrument enjoyed a quick 20% rally and then has gradually slid back down to where it traded previously. With this past week’s volatility, ZIV took a nice dive, and now finds itself back at 39, where we dealt with it previously. It’s firmly back in the buy zone, and conditions are equally favorable in comparison to our last entry. I’ve reproduced the chart from our October ZIV buy at 39, with the futures curve today, ZIV also at 39. There’s one positive and one negative, and on the whole it works out to be a wash in my view. (Charts from Vixcentral.com) VIX futures October 17th, 2014: (click to enlarge) VIX futures now (as of 1pm ET Friday): (click to enlarge) On the one hand, ZIV was gaining 1% a month purely from contango. It was buying January futures at 19.36 and selling at 19.93, which produces a 3% gain on each roll. Divide by 3 (since it holds the contracts for 3 months), and you get a percent a month, or more than a 12% compounded annual return if volatility is flat and it just reaps the contango harvest. Now, however, the contango yield has fallen to roughly 0.6% a month, or a bit over 7% annualized, which is a good tailwind to the trade, but not as strong as previously. VIX futures in comparison, October 18th, 2014 versus now: (click to enlarge) However, note that the whole term structure has moved upward. Before ZIV was buying futures at 19.36 and selling at 19.93, now it is buying at 20.05 and selling at 20.45. Thus, ZIV, which is perpetually shorting VIX futures contracts, now has a notably better cost basis for its short positions. This is the beauty of ZIV as a longer-term investment or long-biased trading vehicle: ZIV’s net asset value consistently rises even as the market bounces around; returning to and then deviating again from the mean. What does this mean practically? ZIV is again at 39, where it was in October. However, ZIV’s cost basis for its short positions has now improved by 5%. Should the VIX futures head back to where they were in October, in the low-19s, ZIV would now make a 5% capital gain, moving higher to 41 per share. This before any benefits from contango. While ZIV is priced the same as during the October dip, the VIX curve is higher than before, now offering more potential upside for ZIV on a market normalization to calmer conditions. If VIX settles down in similar fashion to how it did in October, ZIV would reach 48 on this next upswing, taking it almost 25% higher and back to near 52-week highs. Taking a longer-term view of ZIV’s chart, ZIV gradually rises something along the order of 1% a month (what it earns on average from contango) while it swings upward and downward around the trend-line as the market fluctuates. ZIV’s next sustained push higher should take it above 50, as it is overdue for a new high when the market gets over its near-term crisis of confidence. The risk to the trade would be if the market has topped. At some point the bull market will end, and ZIV will no longer be an easy buy on dips. At that point we’ll have to watch the VIX structure closely to see if ZIV stays in contango or not. Should it go into backwardation, like VXX, we’d have to reconsider the viability of the trade. As it is, I don’t think the bull market has ended yet. And alternatively, short VXX will work out better than long ZIV if you are convinced that the market immediately calms down from here. In October, the panic subsided quickly, and shorting VXX did produce a better percentage gain than ZIV. This could happen again if the S&P 500 quickly moves back to its highs. As I’m not convinced this is going to happen, I’d rather take the much more conservative ZIV trade, which offers high probability of 20% near-term upside with limited downside. Disclosure: The author is long ZIV. (More…) The author wrote this article themselves, and it expresses their own opinions. The author is not receiving compensation for it (other than from Seeking Alpha). The author has no business relationship with any company whose stock is mentioned in this article. Scalper1 News

Scalper1 News