Scalper1 News

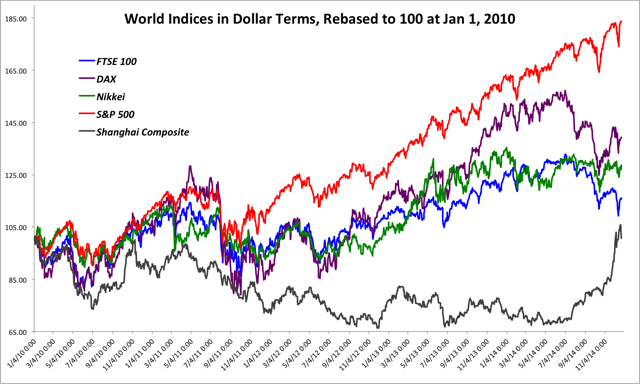

Summary US markets have performed better than any other major market in the last 5 years. Value investors are casting their gaze over international equities. However, it is important to be cognizant of the risks involved in shopping overseas. After 3 years of strong returns for the S&P 500 many value investors are casting their gaze over international markets, where gains have been more modest and valuations look more reasonable. The gain in the dollar versus other currencies has made the divergence even starker, as the chart here shows: (click to enlarge) Source: StockViews Research European markets look attractive due to cheaper valuations, while Asian markets offer some exciting growth opportunities. However, investing in international markets, particularly emerging ones, can be fraught with danger and there are a number of issues that require careful consideration. There was a time in the 1990s when investing in emerging markets was practically a sackable offence in the fund management industry. EM investing is much more in vogue now, although a healthy dose of skepticism is just as necessary. Attitude to Shareholders We often take it for granted that management will maximize value for shareholders over all else. Sometimes they focus excessively on the short-term and sometimes management gets power hungry, but the abuse of power is kept in check by strong corporate governance and pressure from shareholders. A culture of “working for shareholders” doesn’t always exist in other parts of the world. Management tends to be more entrenched, and will often prioritize their own personal ambition over the company. Shareholder activism is simply not a feature of most markets and corporate governance may be weaker. Often management will know to “make the right noises” to shareholders, but the reality does not always match up with the rhetoric. Sometimes they don’t even bother to hide their true intentions. At one meeting I had with an Eastern European bank CFO, when I asked about strategy he thumped his fist on the desk as he said “We aim to be…BIG”. Particular issues exist where a company is still part-owned by the state or is dominated by a founding family. In these cases, management may view the company with a very different perspective to shareholders – as an extension of state power or as a local employment provider. Wendelin Wiedeking, CEO of Porsche ( OTCPK:POAHY ), said in an interview: “Yes, of course we have heard of shareholder value. But that does not change the fact that we put customers first, then workers, then business partners, suppliers and dealers, and then shareholders” In some cases the longer-term focus of a family-run company can be an advantage. Most of the time, after all, the interests of multiple stakeholders are aligned. However the investor needs to get into these situations with eyes open and an understanding of management attitude – too often shareholders “cry foul” after the event, when they should have known better from the start. Disclosure of Information Equity markets are more mature in the US than other parts of the world. Over the past 100 years, disclosure has improved and adherence to US GAAP is strong. Companies often go beyond the minimum requirements and public information is freely available on the web. Elsewhere this culture is not so ingrained. There may be little disclosure beyond the statutory minimum and little effort to explain the key drivers. An industrial analyst I knew was once visiting Russia and asked the management why information was so lacking on the company, an unsatisfactory situation given his firm now owned 1% of the share base. When pressed, the CEO answered ” You have 1% of shares, I give you 1% of the information! ” State Interference For most industries in the US, it is accepted that the profits of a company belong to its shareholders. You can reasonably expect that a company will go about its business without (excessive) interference from the state. Unfortunately elsewhere many companies are subject to capricious tax regimes and even confiscation. These risks are not always obvious, since it is not a problem until it becomes one. State interference is particularly a danger where a company relies on physical assets that cannot be moved overseas (such as a mining or oil company), or when a company operates in a highly-regulated industry. In other cases (particularly in construction) a company may rely heavily on contracts from the state. Some companies, like Gazprom ( OTCQX:GZPFY ) in Russia, are so intertwined with the state it is not clear exactly what you are buying when you become a shareholder. Liquidity The US markets are the deepest and most liquid equity markets in the world. Many investors assume it is the same when they invest in foreign equities. While volumes may look strong in an up market, this can change quite rapidly into a down cycle. Combined with movements in the currency, this often leads to quite sharp declines in the stock price. Of course, the long-term investor can turn this to an advantage since a liquidity crunch can create some great buying opportunities (though patience may be required). Returns versus Growth Many investors are attracted to emerging markets by the prospect of growth. However it’s a rookie mistake to equate GDP growth with growth in the stock market. Despite 7-8% GDP growth in China over the last five years, the Shanghai Composite is the worst performing index of our five indices over five years. Some companies that are not attuned to shareholder value may chase growth regardless of returns. When a company tries to grow rapidly without addressing return on capital, this destroys value (see this StockViews Campus Video for an explanation). Investors should always be alert for these kind of situations and not be seduced by a simple promise of “higher growth”. Conclusion Of course all the risk factors listed here are generalizations. There are plenty of outstanding international companies with a deep sense of responsibility to shareholders who are pro-active about disclosure. Even where these risks do exist, you should do what you would with any investment – seek to understand the risk and factor it into what you’re prepared to pay. You will be following in the footsteps of a number of seasoned investors who have made such investments in recent years, including Buffett [POSCO (NYSE: PKX )], Peltz [Danone ( OTCQX:DANOY )] and Einhorn (Greek Banks). Scalper1 News

Summary US markets have performed better than any other major market in the last 5 years. Value investors are casting their gaze over international equities. However, it is important to be cognizant of the risks involved in shopping overseas. After 3 years of strong returns for the S&P 500 many value investors are casting their gaze over international markets, where gains have been more modest and valuations look more reasonable. The gain in the dollar versus other currencies has made the divergence even starker, as the chart here shows: (click to enlarge) Source: StockViews Research European markets look attractive due to cheaper valuations, while Asian markets offer some exciting growth opportunities. However, investing in international markets, particularly emerging ones, can be fraught with danger and there are a number of issues that require careful consideration. There was a time in the 1990s when investing in emerging markets was practically a sackable offence in the fund management industry. EM investing is much more in vogue now, although a healthy dose of skepticism is just as necessary. Attitude to Shareholders We often take it for granted that management will maximize value for shareholders over all else. Sometimes they focus excessively on the short-term and sometimes management gets power hungry, but the abuse of power is kept in check by strong corporate governance and pressure from shareholders. A culture of “working for shareholders” doesn’t always exist in other parts of the world. Management tends to be more entrenched, and will often prioritize their own personal ambition over the company. Shareholder activism is simply not a feature of most markets and corporate governance may be weaker. Often management will know to “make the right noises” to shareholders, but the reality does not always match up with the rhetoric. Sometimes they don’t even bother to hide their true intentions. At one meeting I had with an Eastern European bank CFO, when I asked about strategy he thumped his fist on the desk as he said “We aim to be…BIG”. Particular issues exist where a company is still part-owned by the state or is dominated by a founding family. In these cases, management may view the company with a very different perspective to shareholders – as an extension of state power or as a local employment provider. Wendelin Wiedeking, CEO of Porsche ( OTCPK:POAHY ), said in an interview: “Yes, of course we have heard of shareholder value. But that does not change the fact that we put customers first, then workers, then business partners, suppliers and dealers, and then shareholders” In some cases the longer-term focus of a family-run company can be an advantage. Most of the time, after all, the interests of multiple stakeholders are aligned. However the investor needs to get into these situations with eyes open and an understanding of management attitude – too often shareholders “cry foul” after the event, when they should have known better from the start. Disclosure of Information Equity markets are more mature in the US than other parts of the world. Over the past 100 years, disclosure has improved and adherence to US GAAP is strong. Companies often go beyond the minimum requirements and public information is freely available on the web. Elsewhere this culture is not so ingrained. There may be little disclosure beyond the statutory minimum and little effort to explain the key drivers. An industrial analyst I knew was once visiting Russia and asked the management why information was so lacking on the company, an unsatisfactory situation given his firm now owned 1% of the share base. When pressed, the CEO answered ” You have 1% of shares, I give you 1% of the information! ” State Interference For most industries in the US, it is accepted that the profits of a company belong to its shareholders. You can reasonably expect that a company will go about its business without (excessive) interference from the state. Unfortunately elsewhere many companies are subject to capricious tax regimes and even confiscation. These risks are not always obvious, since it is not a problem until it becomes one. State interference is particularly a danger where a company relies on physical assets that cannot be moved overseas (such as a mining or oil company), or when a company operates in a highly-regulated industry. In other cases (particularly in construction) a company may rely heavily on contracts from the state. Some companies, like Gazprom ( OTCQX:GZPFY ) in Russia, are so intertwined with the state it is not clear exactly what you are buying when you become a shareholder. Liquidity The US markets are the deepest and most liquid equity markets in the world. Many investors assume it is the same when they invest in foreign equities. While volumes may look strong in an up market, this can change quite rapidly into a down cycle. Combined with movements in the currency, this often leads to quite sharp declines in the stock price. Of course, the long-term investor can turn this to an advantage since a liquidity crunch can create some great buying opportunities (though patience may be required). Returns versus Growth Many investors are attracted to emerging markets by the prospect of growth. However it’s a rookie mistake to equate GDP growth with growth in the stock market. Despite 7-8% GDP growth in China over the last five years, the Shanghai Composite is the worst performing index of our five indices over five years. Some companies that are not attuned to shareholder value may chase growth regardless of returns. When a company tries to grow rapidly without addressing return on capital, this destroys value (see this StockViews Campus Video for an explanation). Investors should always be alert for these kind of situations and not be seduced by a simple promise of “higher growth”. Conclusion Of course all the risk factors listed here are generalizations. There are plenty of outstanding international companies with a deep sense of responsibility to shareholders who are pro-active about disclosure. Even where these risks do exist, you should do what you would with any investment – seek to understand the risk and factor it into what you’re prepared to pay. You will be following in the footsteps of a number of seasoned investors who have made such investments in recent years, including Buffett [POSCO (NYSE: PKX )], Peltz [Danone ( OTCQX:DANOY )] and Einhorn (Greek Banks). Scalper1 News

Scalper1 News