Scalper1 News

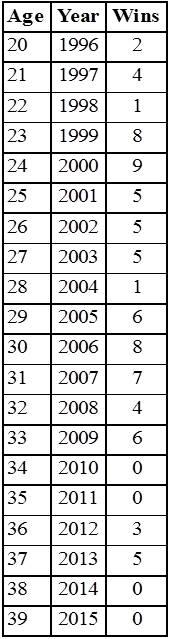

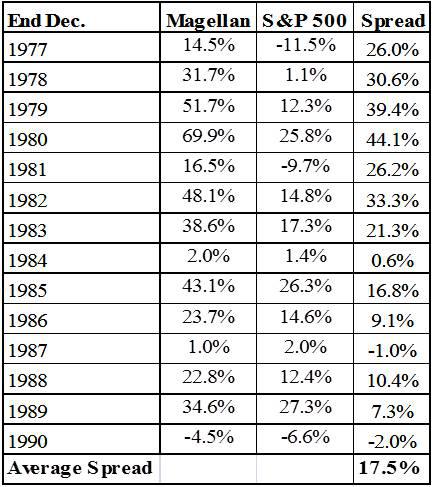

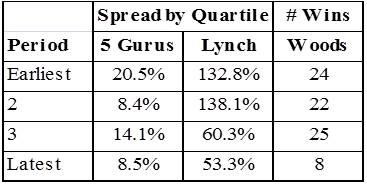

Summary What do golf and investing have in common? The great performers have their ups and downs. These ups and downs of golfer Woods are compared with those of two investment gurus. Elliott R. Morss ©All Rights Reserved February 2015 Introduction Watching Tiger Woods get an 82, the worst score of his career at the Waste Management Phoenix Open on January 30th, I was reminded of other “greats” who have lost their touch. In particular, I thought of some of the great investors, like Graham, Lynch, Zweig, Greenblatt, O’Shaughnessy, and Buffet. 1 The investment performance of these gurus was truly remarkable, but like Tiger, they also have had their ups and downs. In what follows, I look at their records, Tiger’s records, along with what John Reese of Validea has been able to do using a computer model simulation of certain investment gurus’ strategies to pick stocks. Tiger Woods Woods has won 83 professional tournaments. He holds the record for most consecutive weeks at No. 1 (281), and the most total number of weeks (683). Since 1997, he has spent over twelve years atop the Official World Golf Ranking, and has been the number one player for all 52 weeks a record eight times. Few would argue that in his prime, Tiger was the most dominating and best player that ever lived. But since 2009, due to a series of physical ailments and personal problems, he has won only 10 tournaments and none of the Majors. Table 1 gives Tiger’s professional tournament wins by years. Table 1. – Tiger’s Wins Tiger is now 39 years old. Jack Nicklaus has won 3 more majors with his last win at 46. The usual question is whether Woods will be able to catch up to Nicklaus. It is striking how Tiger’s performance has fallen off… Peter Lynch I am a true believer in the random walk theory of stock prices , i.e., most information about individual stocks is reflected in their prices almost immediately. That suggests that unless you have information others do not have, picking stocks is a pretty random business. And this makes what Peter Lynch did at the helm of Fidelity’s Magellan Fund (MUTF: FMAGX ) even more impressive. As Table 2 indicates, Lynch did much better than the S&P 500 (^GSPC) in all but 2 years. Table 2. – Magellan Fund Performance The “Spread” (difference between (^GSPC) and the S&P 500 is indeed impressive. It means that on average if the S&P 500 gained 5%, Magellan gained 22.5%! And note that even in the two years the S&P 500 outperformed Lynch, the spread was very small. John Reese – The “5 Gurus” Reese has a degree in computer science from the Massachusetts Institute of Technology. He became intrigued with investment gurus and developed a computer program to simulate the stock picks of selected gurus. And since 2003, he has recorded the picks of the ” Top Five Gurus ” in a 10-stock portfolio that contains the top 2 ranked stocks from each of these guru investors. The top 5 gurus are selected based on their historical risk-adjusted performance. While the 5 guru’s performance (Table 3) is not as impressive as Lynch’s, it is nevertheless quite amazing. It means that on average if the S&P gained 5%, the 5 Guru Portfolio gained 17.9%! Table 3. – Performance of Reese’s “Top Five Gurus” Comparing Woods with the Investors Is there any reason to expect a comparison of Woods playing golf and gurus picking stocks as meaningful? I think so. Both activities are intensely mental. And in both activities, there is a danger of overthinking and becoming more “technical”. Because the length and time of the three differ, Table 4 breaks them down by period quartiles (earliest years to most recent years). And one commonality is quite apparent – the performance of all declined from their earliest years. And while it is true that getting older leads to reductions in physical performance, Woods is not old enough to justify such a decline. Table 4. – Comparing Investors with Golfer Woods On overthinking and getting more technical, Reese’s system should not be affected since his stocks are picked by a computer model. And in comparison to Lynch, the decline in Reese’s 5 Guru Model is not as significant as Lynch’s. The Future Of course, the Lynch career is over. But how about Woods and Reese? Woods is showing all the signs of overthinking and trying to get his “touch” back in technical fixes. Reese? Hard to say. So far in 2015, his “5 Guru” portfolio is down 2.7%, while the S&P is down 2.0%. Reese has just launched an ETF – the Validea Market Legends ETF (NASDAQ: VALX ). It gives investors an opportunity to invest in accordance to Reese’s modeling of gurus. While the “5 Guru” model takes the leading 2 stocks from the leading gurus, VALX takes 10 of these guru strategies and combines them together in a 100-stock portfolio. So far this year, VALX is down 2.2%. Because of Reese’s past performance, VALX and the “5 Gurus” bear watching… 1 For more on these investment gurus, see John Reese and Jack Forehand’s book, The Guru Investor: How to Beat the Market Using History’s Best Investment Strategies . Disclosure: The author has no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More…) The author wrote this article themselves, and it expresses their own opinions. The author is not receiving compensation for it. The author has no business relationship with any company whose stock is mentioned in this article. Scalper1 News

Summary What do golf and investing have in common? The great performers have their ups and downs. These ups and downs of golfer Woods are compared with those of two investment gurus. Elliott R. Morss ©All Rights Reserved February 2015 Introduction Watching Tiger Woods get an 82, the worst score of his career at the Waste Management Phoenix Open on January 30th, I was reminded of other “greats” who have lost their touch. In particular, I thought of some of the great investors, like Graham, Lynch, Zweig, Greenblatt, O’Shaughnessy, and Buffet. 1 The investment performance of these gurus was truly remarkable, but like Tiger, they also have had their ups and downs. In what follows, I look at their records, Tiger’s records, along with what John Reese of Validea has been able to do using a computer model simulation of certain investment gurus’ strategies to pick stocks. Tiger Woods Woods has won 83 professional tournaments. He holds the record for most consecutive weeks at No. 1 (281), and the most total number of weeks (683). Since 1997, he has spent over twelve years atop the Official World Golf Ranking, and has been the number one player for all 52 weeks a record eight times. Few would argue that in his prime, Tiger was the most dominating and best player that ever lived. But since 2009, due to a series of physical ailments and personal problems, he has won only 10 tournaments and none of the Majors. Table 1 gives Tiger’s professional tournament wins by years. Table 1. – Tiger’s Wins Tiger is now 39 years old. Jack Nicklaus has won 3 more majors with his last win at 46. The usual question is whether Woods will be able to catch up to Nicklaus. It is striking how Tiger’s performance has fallen off… Peter Lynch I am a true believer in the random walk theory of stock prices , i.e., most information about individual stocks is reflected in their prices almost immediately. That suggests that unless you have information others do not have, picking stocks is a pretty random business. And this makes what Peter Lynch did at the helm of Fidelity’s Magellan Fund (MUTF: FMAGX ) even more impressive. As Table 2 indicates, Lynch did much better than the S&P 500 (^GSPC) in all but 2 years. Table 2. – Magellan Fund Performance The “Spread” (difference between (^GSPC) and the S&P 500 is indeed impressive. It means that on average if the S&P 500 gained 5%, Magellan gained 22.5%! And note that even in the two years the S&P 500 outperformed Lynch, the spread was very small. John Reese – The “5 Gurus” Reese has a degree in computer science from the Massachusetts Institute of Technology. He became intrigued with investment gurus and developed a computer program to simulate the stock picks of selected gurus. And since 2003, he has recorded the picks of the ” Top Five Gurus ” in a 10-stock portfolio that contains the top 2 ranked stocks from each of these guru investors. The top 5 gurus are selected based on their historical risk-adjusted performance. While the 5 guru’s performance (Table 3) is not as impressive as Lynch’s, it is nevertheless quite amazing. It means that on average if the S&P gained 5%, the 5 Guru Portfolio gained 17.9%! Table 3. – Performance of Reese’s “Top Five Gurus” Comparing Woods with the Investors Is there any reason to expect a comparison of Woods playing golf and gurus picking stocks as meaningful? I think so. Both activities are intensely mental. And in both activities, there is a danger of overthinking and becoming more “technical”. Because the length and time of the three differ, Table 4 breaks them down by period quartiles (earliest years to most recent years). And one commonality is quite apparent – the performance of all declined from their earliest years. And while it is true that getting older leads to reductions in physical performance, Woods is not old enough to justify such a decline. Table 4. – Comparing Investors with Golfer Woods On overthinking and getting more technical, Reese’s system should not be affected since his stocks are picked by a computer model. And in comparison to Lynch, the decline in Reese’s 5 Guru Model is not as significant as Lynch’s. The Future Of course, the Lynch career is over. But how about Woods and Reese? Woods is showing all the signs of overthinking and trying to get his “touch” back in technical fixes. Reese? Hard to say. So far in 2015, his “5 Guru” portfolio is down 2.7%, while the S&P is down 2.0%. Reese has just launched an ETF – the Validea Market Legends ETF (NASDAQ: VALX ). It gives investors an opportunity to invest in accordance to Reese’s modeling of gurus. While the “5 Guru” model takes the leading 2 stocks from the leading gurus, VALX takes 10 of these guru strategies and combines them together in a 100-stock portfolio. So far this year, VALX is down 2.2%. Because of Reese’s past performance, VALX and the “5 Gurus” bear watching… 1 For more on these investment gurus, see John Reese and Jack Forehand’s book, The Guru Investor: How to Beat the Market Using History’s Best Investment Strategies . Disclosure: The author has no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More…) The author wrote this article themselves, and it expresses their own opinions. The author is not receiving compensation for it. The author has no business relationship with any company whose stock is mentioned in this article. Scalper1 News

Scalper1 News