< div i.d.= "articleText" legibility =" 74.695760598504" > Examining the markets getting on worst since noontime Thursday, contributes from Materials firms are actually underperforming various other markets, presenting a 1.0% loss. Within that group, Freeport-McMoran Copper & & Gold (Sign: FCX) as well as CF Industries Holdings Inc (Symbol: CF) are two from the day’s laggards, showing a loss from 6.2% as well as 3.8%, respectively. With the < a href=" https://www.etfchannel.com/type/etfs-with-most-volume/" rel =" nofollow "> high volume ETFs, one ETF carefully subsequent products inventories is the Products Select Market SPDR ETF (Symbol: XLB), which is down 0.7% on the day, and also up 11.16% year-to-date. Freeport-McMoran Copper & & Gold, at the same time, is actually up 60.41% year-to-date, as well as CF Industries Holdings Inc, is down 25.26% year-to-date. Mixed, FCX and CF produce up approximately 4.1% from the hiddening holdings of XLB.

The next worst carrying out field is actually the Financial market, showing a 0.8% reduction. With huge Monetary inventories, Affiliated Managers Group Inc. (Icon: AMG) and also Lincoln National Corp. (Symbol: LNC) are the most distinctive, presenting a loss from 3.0% and also 2.7%, respectively. One ETF very closely tracking Monetary stocks is actually the Financial Select Industry SPDR ETF (< a href =" http://www.nasdaq.com/symbol/xlf" > XLF), which is down 0.7 %in midday investing, as well as down 1.08% on a year-to-date basis. Affiliated Managers Group Inc., in the meantime, is actually up 3.76% year-to-date, and also Lincoln National Corp., is actually down 10.64% year-to-date. Combined, AMG and LNC comprise approximately 0.7% of the rooting holdings of XLF.

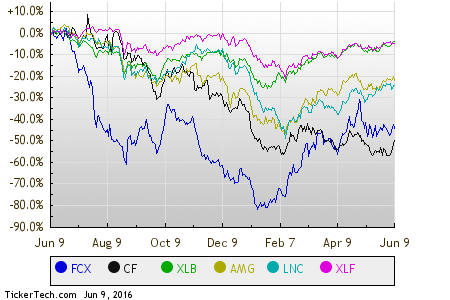

Reviewing these inventories and ETFs on a trailing twelve month basis, listed below is a relative stock rate performance chart, with each of the symbols received a different colour as tagged in the legend basically:  < img course=" articleImgLg" alt=" Stock Options Stations" src =" https://www.scalper1.com/wp-content/uploads/2016/06/11465497078.png"/ > Listed below is actually a snapshot of how the S&P 500 parts within the different industries are getting on in afternoon investing on Thursday. As you can easily view, two fields mindful the day, while 7 industries are down.

< img course=" articleImgLg" alt=" Stock Options Stations" src =" https://www.scalper1.com/wp-content/uploads/2016/06/11465497078.png"/ > Listed below is actually a snapshot of how the S&P 500 parts within the different industries are getting on in afternoon investing on Thursday. As you can easily view, two fields mindful the day, while 7 industries are down.

| < table | border= “0” legibility=” 1 | |

|---|---|---|

| ” > | < tr bgcolor= | |

| ” #F 2F2F2″ > Sector% Improvement Utilities< td align=" right" > +0.4% | ||

| Customer Products< td align=" right" > +0.2% | ||

| Medical care< td align=" & right" > | -0.2% | |

| < tr readability=" 2" > Modern technology & Communications< td align=" right | ” > | -0.3% |

| Commercial< td align=" right" > -0.3% | ||

| Power< td align=" right" > -0.4% | ||

| Services< td align=" right" > -0.7% |

Most recent Contents Plantations International