Scalper1 News

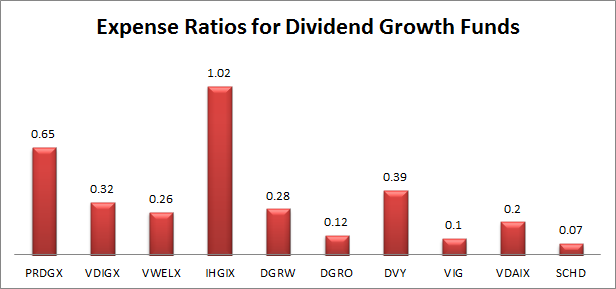

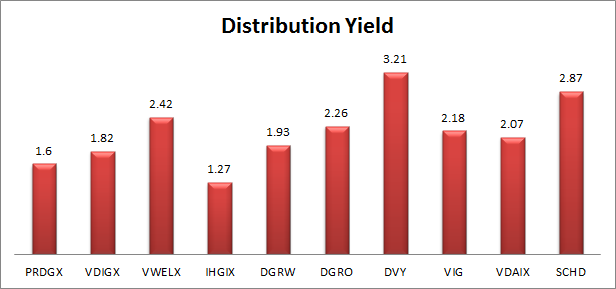

Summary SCHD feels like it doesn’t get much coverage in the dividend investing world, but it is one of the best ETFs in the space. SCHD offers the lowest expense ratio and the one of the better distribution yields. When I was browsing a list by Morningstar, I noticed they were not very interested in the expense ratios or the distribution yields. A few charts showing expense ratios and dividend yields may help you analyze which ones would make sense for you. It seems like the Schwab U.S. Dividend Equity ETF (NYSEARCA: SCHD ) is never in the news. That isn’t a bad thing, but is interesting when I look at some of the ETFs that are getting mentioned by big companies. I recently ran across an article on Morningstar that left me a little curious. The author, apparently speaking for Morningstar, was giving their take on “Our Favorite Dividend Growth Funds and ETFs.” She is a director of personal finance and the author of a book on how to succeed when investing in mutual funds . If anyone should understand the importance of low expense ratios and high distribution yields, she would have the background for it. Of course, I don’t know her and have no grudge, but I was hoping for higher quality when Morningstar decided to publish it. The article included the following funds: T. Rowe Price Dividend Growth Fund (MUTF: PRDGX ) Vanguard Dividend Growth Fund (MUTF: VDIGX ) Vanguard Wellington Fund (MUTF: VWELX ) Hartford Dividend and Growth Fund (MUTF: IHGIX ) WisdomTree U.S. Dividend Growth ETF (NASDAQ: DGRW ) iShares Core Dividend Growth ETF (NYSEARCA: DGRO ) iShares Select Dividend ETF (NYSEARCA: DVY ) Vanguard Dividend Appreciation ETF (NYSEARCA: VIG ) Vanguard Dividend Appreciation Index Fund (MUTF: VDAIX ) It did not include SCHD, which I think should have been one of the top contenders. Let’s talk about the things that actually matter when comparing ETFs with similar investing goals. Remember that this is a discussion of dividend funds, so allocations may be different but there should be quite a bit of overlap. Expense Ratios The expense ratios on an ETF (or mutual fund) are one of the very first things an investor should consider. When I’m considering funds for my portfolio a high expense ratio is pretty much an automatic rejection. When buying an ETF you are making the assumption that the market is reasonably efficient and that your best bet for limiting your risk and finding success is to diversify your investments. If you don’t believe that to at least some extent then there is no reason to invest in either unless it was a requirement of an attractive retirement plan. The point is simple. Expense ratios literally eat your investment. The only reason to pay the expense ratio rather than to buy the individual stocks is for the benefit of being able to buy them all at once with less work and fewer transaction charges. Some investors may be willing to pay a high premium to acquire the most talented that is running “the best” fund. However, the premise that an individual investor can determine which manager will be most successful without ever meeting the manager is absurd. I’m not a believer in the market being perfectly efficient. I cover small cap mREITs and the price movements I’ve seen have convinced me that the small cap companies in the sector are anything but indicative of an efficient market. That is precisely the reason I choose to focus so much of my analysis on a small corner of the market. When a market is small it is expected to have significantly more opportunities for superior analysis because there are fewer experts in the field searching for a market failure. How often were expense ratios mentioned? Only once in identifying one of the reasons VIG was a top choice. The actual expense ratios were not stated for any of the funds. Since those expense ratios matter, I built a chart to display them: As you might guess, I’m fairly partial to SCHD and VIG as my choices for the best dividend growth funds. Distribution Yield Even though the market regularly moves up, many investors find themselves significantly underperforming the S&P 500. One major reason that actual realized returns for investors frequently underperform the market (besides expense ratios) is that as a group investors are terrible at knowing when to buy and sell. If investors as a group regularly understood when to sell, the market would be absurdly stable and herd mentalities would be avoided. I’m not giving myself some kind of self-serving analyst credit there either. Analysts aren’t good at calling the bottom or the top of the markets either. When it comes to winning by market timing, the best solution is to not play the game. Focus on buying ETFs but not selling them. If an investor is simply using a buy and hold strategy for the core of their portfolio the worst they can do is buy at a market top. One of the reasons for using a dividend growth portfolio is that the investor can hopefully live off the dividends eventually. Being able to do that encourages them to avoid selling their shares when the market crashes. I don’t know when the next crash will happen, but I’m fairly confident that most of us will live to see it. The last thing I would want is to be selling off the portfolio during the crash. This is a human error. It is not something intrinsic to the stocks or the ETF that holds them. It is a human mistake that panic leads to a sell off. Being able to live off the dividends prevents that mistake. Living off the dividends requires a stronger distribution yield. The distribution yields were mentioned zero times in the article on Morningstar, but I think they are very important for encouraging good investor decisions. Here is a chart of the expense ratios: Conclusion SCHD has the lowest expense ratio and the second highest distribution ratio. How can anyone skip past SCHD when consider dividend growth ETF investments? On the other hand, IHGIX had a very high expense ratio (over 1%) and a low distribution yield. That does not automatically make it a terrible investment, but it would concern me and certainly deserves to be mentioned when the stock is being suggested as one of the “favorites” for the dividend growth space. When I looked at the prospectus I noticed there were some fairly hefty charges on buying into the fund as well including a very nice dealer commission. No thanks, IHGIX is clearly not for me. For the investors that want to pick a dividend growth ETF, it would be wise to start with determining precisely what you want out of the fund. I always start with low costs. That means a low expense ratios and a preference for free to trade. If you’re convinced that you can handle selling small amounts off to create your own dividend yield without buying into a full scale panic, then distribution yield won’t be as important. I don’t think that dividend stocks are inherently better, but I think many investors would benefit by being protected from themselves. Perhaps the question should be, if an investor does not find dividend growth stocks superior and does not mind selling off portions of their portfolio, why would they be searching for a dividend growth ETF in the first place? Disclosure: I/we have no positions in any stocks mentioned, but may initiate a long position in SCHD over the next 72 hours. (More…) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. Additional disclosure: Information in this article represents the opinion of the analyst. All statements are represented as opinions, rather than facts, and should not be construed as advice to buy or sell a security. Ratings of “outperform” and “underperform” reflect the analyst’s estimation of a divergence between the market value for a security and the price that would be appropriate given the potential for risks and returns relative to other securities. The analyst does not know your particular objectives for returns or constraints upon investing. All investors are encouraged to do their own research before making any investment decision. Information is regularly obtained from Yahoo Finance, Google Finance, and SEC Database. If Yahoo, Google, or the SEC database contained faulty or old information it could be incorporated into my analysis. Scalper1 News

Summary SCHD feels like it doesn’t get much coverage in the dividend investing world, but it is one of the best ETFs in the space. SCHD offers the lowest expense ratio and the one of the better distribution yields. When I was browsing a list by Morningstar, I noticed they were not very interested in the expense ratios or the distribution yields. A few charts showing expense ratios and dividend yields may help you analyze which ones would make sense for you. It seems like the Schwab U.S. Dividend Equity ETF (NYSEARCA: SCHD ) is never in the news. That isn’t a bad thing, but is interesting when I look at some of the ETFs that are getting mentioned by big companies. I recently ran across an article on Morningstar that left me a little curious. The author, apparently speaking for Morningstar, was giving their take on “Our Favorite Dividend Growth Funds and ETFs.” She is a director of personal finance and the author of a book on how to succeed when investing in mutual funds . If anyone should understand the importance of low expense ratios and high distribution yields, she would have the background for it. Of course, I don’t know her and have no grudge, but I was hoping for higher quality when Morningstar decided to publish it. The article included the following funds: T. Rowe Price Dividend Growth Fund (MUTF: PRDGX ) Vanguard Dividend Growth Fund (MUTF: VDIGX ) Vanguard Wellington Fund (MUTF: VWELX ) Hartford Dividend and Growth Fund (MUTF: IHGIX ) WisdomTree U.S. Dividend Growth ETF (NASDAQ: DGRW ) iShares Core Dividend Growth ETF (NYSEARCA: DGRO ) iShares Select Dividend ETF (NYSEARCA: DVY ) Vanguard Dividend Appreciation ETF (NYSEARCA: VIG ) Vanguard Dividend Appreciation Index Fund (MUTF: VDAIX ) It did not include SCHD, which I think should have been one of the top contenders. Let’s talk about the things that actually matter when comparing ETFs with similar investing goals. Remember that this is a discussion of dividend funds, so allocations may be different but there should be quite a bit of overlap. Expense Ratios The expense ratios on an ETF (or mutual fund) are one of the very first things an investor should consider. When I’m considering funds for my portfolio a high expense ratio is pretty much an automatic rejection. When buying an ETF you are making the assumption that the market is reasonably efficient and that your best bet for limiting your risk and finding success is to diversify your investments. If you don’t believe that to at least some extent then there is no reason to invest in either unless it was a requirement of an attractive retirement plan. The point is simple. Expense ratios literally eat your investment. The only reason to pay the expense ratio rather than to buy the individual stocks is for the benefit of being able to buy them all at once with less work and fewer transaction charges. Some investors may be willing to pay a high premium to acquire the most talented that is running “the best” fund. However, the premise that an individual investor can determine which manager will be most successful without ever meeting the manager is absurd. I’m not a believer in the market being perfectly efficient. I cover small cap mREITs and the price movements I’ve seen have convinced me that the small cap companies in the sector are anything but indicative of an efficient market. That is precisely the reason I choose to focus so much of my analysis on a small corner of the market. When a market is small it is expected to have significantly more opportunities for superior analysis because there are fewer experts in the field searching for a market failure. How often were expense ratios mentioned? Only once in identifying one of the reasons VIG was a top choice. The actual expense ratios were not stated for any of the funds. Since those expense ratios matter, I built a chart to display them: As you might guess, I’m fairly partial to SCHD and VIG as my choices for the best dividend growth funds. Distribution Yield Even though the market regularly moves up, many investors find themselves significantly underperforming the S&P 500. One major reason that actual realized returns for investors frequently underperform the market (besides expense ratios) is that as a group investors are terrible at knowing when to buy and sell. If investors as a group regularly understood when to sell, the market would be absurdly stable and herd mentalities would be avoided. I’m not giving myself some kind of self-serving analyst credit there either. Analysts aren’t good at calling the bottom or the top of the markets either. When it comes to winning by market timing, the best solution is to not play the game. Focus on buying ETFs but not selling them. If an investor is simply using a buy and hold strategy for the core of their portfolio the worst they can do is buy at a market top. One of the reasons for using a dividend growth portfolio is that the investor can hopefully live off the dividends eventually. Being able to do that encourages them to avoid selling their shares when the market crashes. I don’t know when the next crash will happen, but I’m fairly confident that most of us will live to see it. The last thing I would want is to be selling off the portfolio during the crash. This is a human error. It is not something intrinsic to the stocks or the ETF that holds them. It is a human mistake that panic leads to a sell off. Being able to live off the dividends prevents that mistake. Living off the dividends requires a stronger distribution yield. The distribution yields were mentioned zero times in the article on Morningstar, but I think they are very important for encouraging good investor decisions. Here is a chart of the expense ratios: Conclusion SCHD has the lowest expense ratio and the second highest distribution ratio. How can anyone skip past SCHD when consider dividend growth ETF investments? On the other hand, IHGIX had a very high expense ratio (over 1%) and a low distribution yield. That does not automatically make it a terrible investment, but it would concern me and certainly deserves to be mentioned when the stock is being suggested as one of the “favorites” for the dividend growth space. When I looked at the prospectus I noticed there were some fairly hefty charges on buying into the fund as well including a very nice dealer commission. No thanks, IHGIX is clearly not for me. For the investors that want to pick a dividend growth ETF, it would be wise to start with determining precisely what you want out of the fund. I always start with low costs. That means a low expense ratios and a preference for free to trade. If you’re convinced that you can handle selling small amounts off to create your own dividend yield without buying into a full scale panic, then distribution yield won’t be as important. I don’t think that dividend stocks are inherently better, but I think many investors would benefit by being protected from themselves. Perhaps the question should be, if an investor does not find dividend growth stocks superior and does not mind selling off portions of their portfolio, why would they be searching for a dividend growth ETF in the first place? Disclosure: I/we have no positions in any stocks mentioned, but may initiate a long position in SCHD over the next 72 hours. (More…) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. Additional disclosure: Information in this article represents the opinion of the analyst. All statements are represented as opinions, rather than facts, and should not be construed as advice to buy or sell a security. Ratings of “outperform” and “underperform” reflect the analyst’s estimation of a divergence between the market value for a security and the price that would be appropriate given the potential for risks and returns relative to other securities. The analyst does not know your particular objectives for returns or constraints upon investing. All investors are encouraged to do their own research before making any investment decision. Information is regularly obtained from Yahoo Finance, Google Finance, and SEC Database. If Yahoo, Google, or the SEC database contained faulty or old information it could be incorporated into my analysis. Scalper1 News

Scalper1 News