Image source: Getty Images.

What

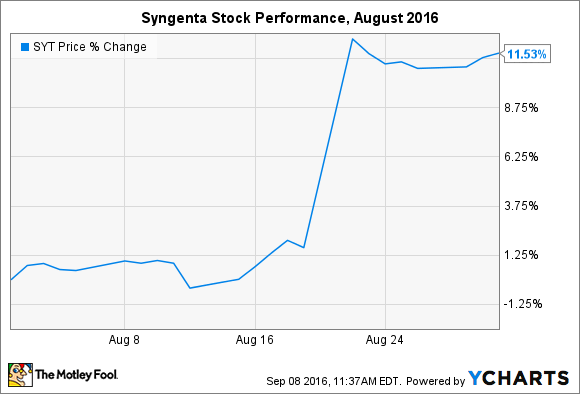

Shares of Swiss agrochemical company Syngenta (NYSE: SYT) rose 11.5% last month after the Committee on Foreign Investment in the United States (or CFIUS) cleared the way for its previously agreed-to $ 43 billion acquisition by ChemChina.

So what

It may seem odd that a merger-acquisition between a Chinese company and a Swiss company needs to get any approval whatsoever from a panel in the United States, but Syngenta’s presence in the lower 48 allows CFIUS to reject takeovers — or erect serious obstacles to them — in the name of national security. Investors were nervous over the decision, especially considering CFIUS had recently rejected much smaller deals involving Chinese electronics companies. As such, prior to the announcement, Syngenta was trading at a market cap of just $ 37 billion — 16% lower than the acquisition price. Its market cap shot up to about $ 41 billion after the announcement.

It’s worth noting that CFIUS has never raised objections to a deal in the food or agricultural sector, apparently taking the stance that America has an ample supply of food. While nothing ominous stands out about the Syngenta-ChemChina deal, investors shouldn’t get comfortable with the panel’s historical voting record within the industry: Natural security is in fact an integral part of national security. For current investors, however, the United States no longer poses a threat to the acquisition.

The same cannot be said for Europe, which is still mulling over the implications of the proposed acquisition. The good news is that ChemChina remains patient, and has once again extended its deadline for the offer. It expects to close the acquisition by the end of 2016.

Now what

Investors have to be happy about recent events. Now, regulators in the European Union pose the last remaining obstacle before the acquisition can be completed — and they may be a little more unpredictable than you think.

Luckily for investors, this is pretty simple. If you own shares, then you should take no action and patiently wait for the acquisition to close, whether that occurs as planned at the end of this year or after other potential conditions are met. But if you’re an investor without a position in Syngenta, then you should stay on the sidelines. Nearly all of the upside — which is capped at $ 43 billion — is already factored into shares.

A secret billion-dollar stock opportunity

The world’s biggest tech company forgot to show you something, but a few Wall Street analysts and the Fool didn’t miss a beat: There’s a small company that’s powering their brand-new gadgets and the coming revolution in technology. And we think its stock price has nearly unlimited room to run for early in-the-know investors! To be one of them, just click here .

Maxx Chatsko has no position in any stocks mentioned. Follow him on Twitter to keep up with developments in the engineered biology field.

The Motley Fool has no position in any of the stocks mentioned. Try any of our Foolish newsletter services free for 30 days . We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy .

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

Plantations International