Scalper1 News

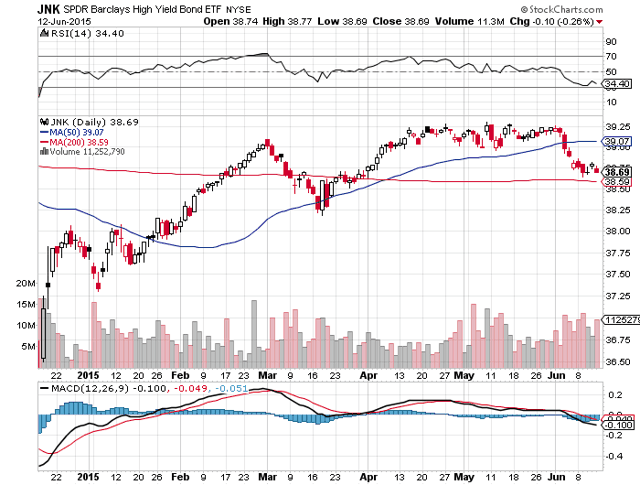

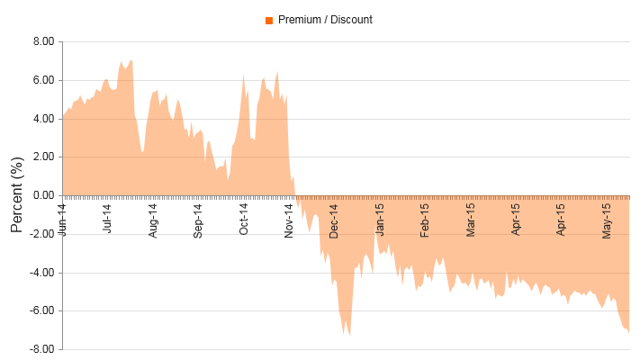

“Taper tantrums” in the credit markets are giving investors another ideal buying opportunity with junk bonds. The “smart money” remains bullish on junk bonds for 2015. Junk bond ETF’s make sense, but bargains and higher yields are possible with closed end funds that trade at a discount. My favorite closed end fund trades for a 7% discount to net asset value, it yields 9.5%, and it pays shareholders every month. Here we go again, the markets are having another “taper tantrum” and that has caused some selling pressure in junk bonds. We have seen pullbacks in the junk bond sector many times in the past few years and each one has been a great buying opportunity. This recent sell-off appears to be another golden opportunity to buy high-yielding assets from investors who are either uninformed or just plain overly focused with short-term thinking. Let’s take a look at the chart of a popular junk bond ETF below: (click to enlarge) As the chart above shows, the SPDR Barclays High Yield Bond ETF (NYSEARCA: JNK ) is now trading near the 200-day moving average of $38.59, which is a potentially strong support level. At this level, the potential downside risk could be limited and that makes this an even more attractive buying opportunity. Furthermore, there are other good reasons to be buying junk bonds now: The market has been so overly focused on this potential rate hike that it seems like many investors are acting very irrational over the fear of any rate hike. However, a closer look reveals that there is really nothing to fear, because like just about everything in this economic “recovery”, any rate hike is likely to be very minimal. One analyst in a recent Washington Post article describes the potential rate hike as being “bupkis” or “absolutely nothing” in terms of the size. The article states: “I don’t expect that they’ll do more than a quarter point,” said Ed Yardeni, president and chief investment strategist of his own advisory firm Yardeni Research. ” Bupkis as we say in New York,” he added, using a Yiddish word that has come to mean ‘absolutely nothing’ in English. “I think they’ll do the bare minimum,” he added, “for credibility sake. To show they can. They haven’t had any practice.” He predicted that the Fed’s action will be described as “one and done.” The reality is that the stock market and high yield bonds could rally as soon as the “rate hike” takes place as the certainty of this event could calm irrational investor fears and allow the market participants to realize that even after a quarter point hike, stocks and high yield bonds are still the only game in town. All this hand-wringing over a quarter point hike is irrational because it is nowhere near enough to make savings accounts, money market accounts or CD’s, a competitive asset class when compared to dividend stocks or high yield bonds. It appears that the “smart money” sees this and that is why firms like Goldman Sachs (NYSE: GS ) are bullish on junk bonds for 2015 . Another long-term positive factor is that the European Central Bank’s new bond buying program is creating more demand for high yield assets. A recent Bloomberg article , states that the European Central Bank’s bond buying program (quantitative easing) is pushing yields below zero on nearly $1.7 trillion worth of debt and that is also creating more demand for high yield assets. Furthermore, the fact that interest rates can move up a little (ok, barely) is a bullish sign for the overall economy. A stronger economy means that junk bond default rates could decrease and credit ratings could increase thereby making the bonds more valuable and lower risk. I believe it makes sense for investors to accumulate shares in JNK but there is another way to get an even higher yield and a bargain…… and that is to consider closed end funds, or CEF’s, which can trade for a discount to net asset value. In this sector, my favorite closed end fund is the Pioneer Diversified High Income Trust (NYSEMKT: HNW ). This is a CEF which primarily invests in high yielding bonds. For numerous reasons, this remains one of my favorite ways to invest in junk bonds: It is well diversified, it trades at a discount to net asset value, it pays a dividend every month, the payout appears secure, plus it yields 9.5%. The Pioneer Diversified High Income Trust has around 432 holdings which indicates it is well diversified. This fund has an average duration of just 3.02 years, which means that duration risk is very low and that is another reason why this fund is very attractive. The Pioneer Diversified High Income Trust has average earnings per share of more than 16 cents per month . This means the monthly payout of 13.5 cents per months appears very solid. (click to enlarge) The chart above shows that the share price is now a bargain at just about $17, because the net asset value (as of June 11, 2015) is $18.32. The current share price represents a discount of about 7% below net asset value. That is a large discount and it is one that has not historically lasted for long as rebounds have typically quickly followed these types of pullbacks. I believe that the market is overly focused on a “bupkis” rate increase and that means investors will once again be looking to buy high yield assets. A quarter point increase is not enough to make the generous 9.5% yield that the Pioneer Diversified High Income Trust any less attractive to most investors who desire income. The 7% discount to net asset value makes it a real bargain. Plus, with the generous yield, and with the dividend payout being made to investors every month, this closed end fund is like a gift that keeps on giving. Here are some key points for the Pioneer Diversified High Income Trust: Current share price: $17.10 The 52 week range is $16.43 to $21.63 Annual dividend: $1.62 per share (or 13.5 cents per month), which yields about 9.5% Here are some key points for SPDR Barclays Capital High Yield Bond: Current share price: $38.69 The 52 week range is $37.26 to $41.82 Annual dividend: about $2.40 or (20 cents monthly) per share which yields 6% Data is sourced from Yahoo Finance. No guarantees or representations are made. Hawkinvest is not a registered investment advisor and does not provide specific investment advice. The information is for informational purposes only. You should always consult a financial advisor. Disclosure: The author is long JNK, HNW. (More…) The author wrote this article themselves, and it expresses their own opinions. The author is not receiving compensation for it (other than from Seeking Alpha). The author has no business relationship with any company whose stock is mentioned in this article. Scalper1 News

“Taper tantrums” in the credit markets are giving investors another ideal buying opportunity with junk bonds. The “smart money” remains bullish on junk bonds for 2015. Junk bond ETF’s make sense, but bargains and higher yields are possible with closed end funds that trade at a discount. My favorite closed end fund trades for a 7% discount to net asset value, it yields 9.5%, and it pays shareholders every month. Here we go again, the markets are having another “taper tantrum” and that has caused some selling pressure in junk bonds. We have seen pullbacks in the junk bond sector many times in the past few years and each one has been a great buying opportunity. This recent sell-off appears to be another golden opportunity to buy high-yielding assets from investors who are either uninformed or just plain overly focused with short-term thinking. Let’s take a look at the chart of a popular junk bond ETF below: (click to enlarge) As the chart above shows, the SPDR Barclays High Yield Bond ETF (NYSEARCA: JNK ) is now trading near the 200-day moving average of $38.59, which is a potentially strong support level. At this level, the potential downside risk could be limited and that makes this an even more attractive buying opportunity. Furthermore, there are other good reasons to be buying junk bonds now: The market has been so overly focused on this potential rate hike that it seems like many investors are acting very irrational over the fear of any rate hike. However, a closer look reveals that there is really nothing to fear, because like just about everything in this economic “recovery”, any rate hike is likely to be very minimal. One analyst in a recent Washington Post article describes the potential rate hike as being “bupkis” or “absolutely nothing” in terms of the size. The article states: “I don’t expect that they’ll do more than a quarter point,” said Ed Yardeni, president and chief investment strategist of his own advisory firm Yardeni Research. ” Bupkis as we say in New York,” he added, using a Yiddish word that has come to mean ‘absolutely nothing’ in English. “I think they’ll do the bare minimum,” he added, “for credibility sake. To show they can. They haven’t had any practice.” He predicted that the Fed’s action will be described as “one and done.” The reality is that the stock market and high yield bonds could rally as soon as the “rate hike” takes place as the certainty of this event could calm irrational investor fears and allow the market participants to realize that even after a quarter point hike, stocks and high yield bonds are still the only game in town. All this hand-wringing over a quarter point hike is irrational because it is nowhere near enough to make savings accounts, money market accounts or CD’s, a competitive asset class when compared to dividend stocks or high yield bonds. It appears that the “smart money” sees this and that is why firms like Goldman Sachs (NYSE: GS ) are bullish on junk bonds for 2015 . Another long-term positive factor is that the European Central Bank’s new bond buying program is creating more demand for high yield assets. A recent Bloomberg article , states that the European Central Bank’s bond buying program (quantitative easing) is pushing yields below zero on nearly $1.7 trillion worth of debt and that is also creating more demand for high yield assets. Furthermore, the fact that interest rates can move up a little (ok, barely) is a bullish sign for the overall economy. A stronger economy means that junk bond default rates could decrease and credit ratings could increase thereby making the bonds more valuable and lower risk. I believe it makes sense for investors to accumulate shares in JNK but there is another way to get an even higher yield and a bargain…… and that is to consider closed end funds, or CEF’s, which can trade for a discount to net asset value. In this sector, my favorite closed end fund is the Pioneer Diversified High Income Trust (NYSEMKT: HNW ). This is a CEF which primarily invests in high yielding bonds. For numerous reasons, this remains one of my favorite ways to invest in junk bonds: It is well diversified, it trades at a discount to net asset value, it pays a dividend every month, the payout appears secure, plus it yields 9.5%. The Pioneer Diversified High Income Trust has around 432 holdings which indicates it is well diversified. This fund has an average duration of just 3.02 years, which means that duration risk is very low and that is another reason why this fund is very attractive. The Pioneer Diversified High Income Trust has average earnings per share of more than 16 cents per month . This means the monthly payout of 13.5 cents per months appears very solid. (click to enlarge) The chart above shows that the share price is now a bargain at just about $17, because the net asset value (as of June 11, 2015) is $18.32. The current share price represents a discount of about 7% below net asset value. That is a large discount and it is one that has not historically lasted for long as rebounds have typically quickly followed these types of pullbacks. I believe that the market is overly focused on a “bupkis” rate increase and that means investors will once again be looking to buy high yield assets. A quarter point increase is not enough to make the generous 9.5% yield that the Pioneer Diversified High Income Trust any less attractive to most investors who desire income. The 7% discount to net asset value makes it a real bargain. Plus, with the generous yield, and with the dividend payout being made to investors every month, this closed end fund is like a gift that keeps on giving. Here are some key points for the Pioneer Diversified High Income Trust: Current share price: $17.10 The 52 week range is $16.43 to $21.63 Annual dividend: $1.62 per share (or 13.5 cents per month), which yields about 9.5% Here are some key points for SPDR Barclays Capital High Yield Bond: Current share price: $38.69 The 52 week range is $37.26 to $41.82 Annual dividend: about $2.40 or (20 cents monthly) per share which yields 6% Data is sourced from Yahoo Finance. No guarantees or representations are made. Hawkinvest is not a registered investment advisor and does not provide specific investment advice. The information is for informational purposes only. You should always consult a financial advisor. Disclosure: The author is long JNK, HNW. (More…) The author wrote this article themselves, and it expresses their own opinions. The author is not receiving compensation for it (other than from Seeking Alpha). The author has no business relationship with any company whose stock is mentioned in this article. Scalper1 News

Scalper1 News