Scalper1 News

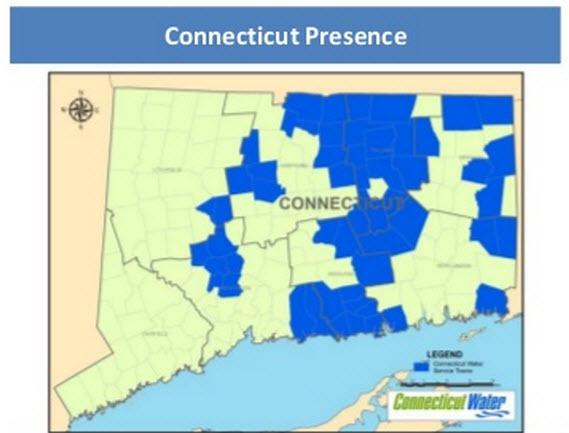

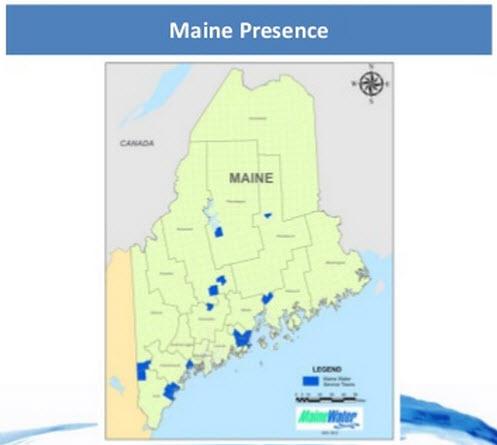

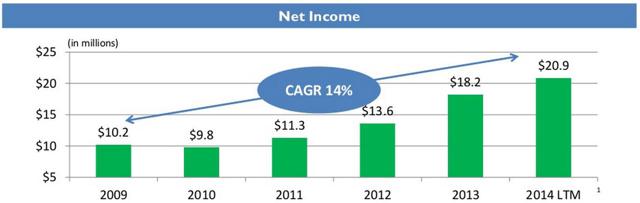

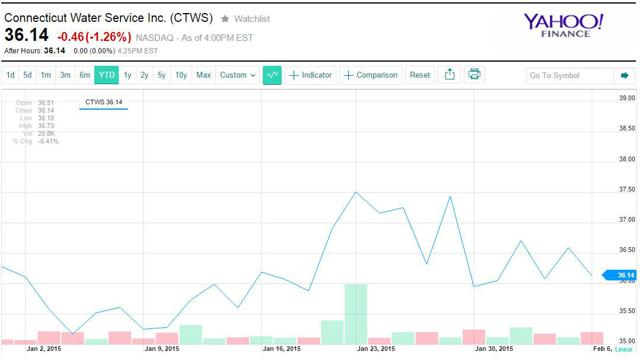

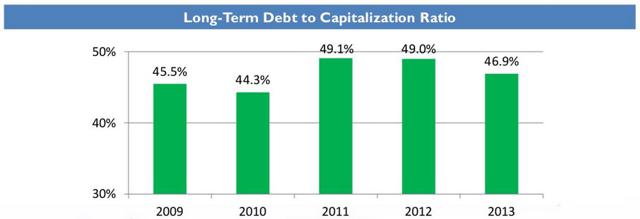

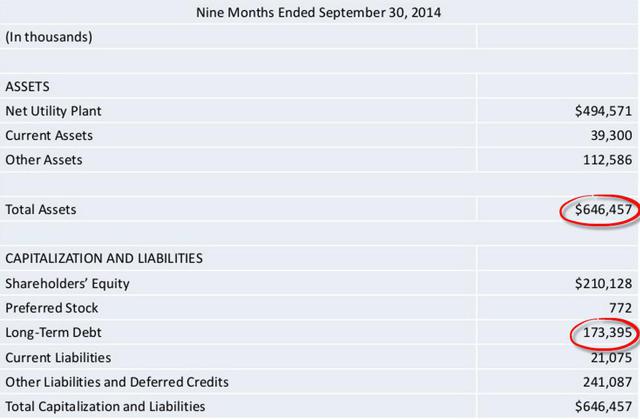

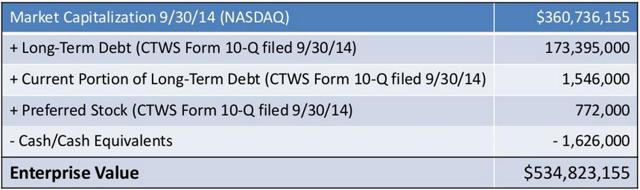

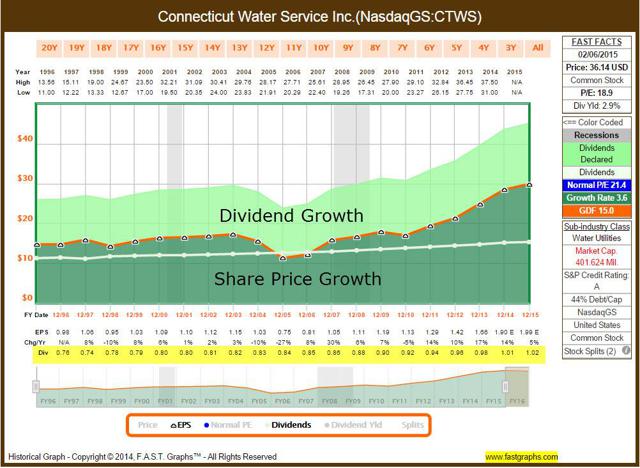

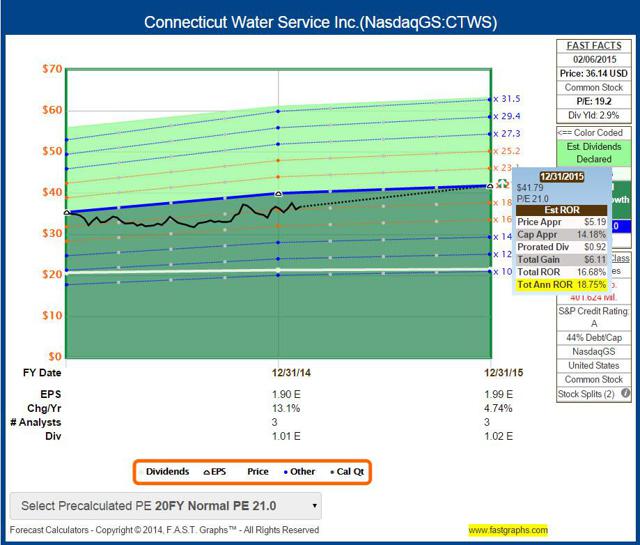

Summary Today I am going to stay on the Monopoly board and discuss a close cousin to REITs, Utilities. I see strong correlations to real estate and utilities – they both deliver essential services measured by a long runway for demand. There’s a reason utilities are on the Monopoly board… you can’t win the game by owning just real estate. Many of you know me as a real estate analyst, and while around 90% of my research is in the REIT sector, I occasionally drift outside of my circle of competence into other asset sectors. Today, I am going to stay on the Monopoly board, though, and discuss a close cousin to REITs, Utilities. You see, I need to diversify my holdings into other dividend-paying stocks, and while I’m attracted to the short and mid-term forecast for US real estate, I know it’s important not to hold all of my eggs in one basket. In addition, I see strong correlations to real estate and utilities – they both deliver essential services measured by a long runway for demand. Arguably, utilities are much more stable over the long term, as the asset class is generally consider to be the lowest-risk compared with the overall stock market. Don’t worry. I will continue my “day job” of analyzing REITs, but I wanted to write this article for two purposes: (1) I wanted to tell you about a stock I recently added to my portfolio; and (2) I wanted to provide you with the research on this selection. I recognize that the long-term capital appreciation is limited with my new stock selection; however, my reasons for the pick will be summarized below. All About Connecticut Water Connecticut Water Service, Inc. (NASDAQ: CTWS ) was founded in 1956, and is headquartered in Clinton, Connecticut. The company serves nearly 125,500 customers, which is around 400,000 people, in 56 towns in Connecticut and Maine. Around 93% of the company’s net income is attributable to regulated operations, and there are two subsidiaries: Connecticut Water Company and Maine Water Company. Around 90% of the company’s business is residential, and the business has over 2,100 miles of pipeline. Here’s a snapshot of the company’s geographic representation in Connecticut (around $297 million in revenue as of 9/30/14): Also, more recently, Connecticut Water has extended operations in Maine, where the company generated around $51 million in revenue (as of 9-30-14): Since 2012, Connecticut Water acquired around 32,000 new customers (36% growth) through investments in Aqua Maine and Biddeford & Saco Water Company. Over the last 25 years, the company has purchased 60 total water systems (40 of these over the last 7 years). The water market is highly fragmented, as the company estimates that there are over 800 separate water systems and 300 wastewater operations, making the Connecticut and Maine ripe markets for consolidation. An Incredibly Stable Dividend Alternative As I side, I focus on REITs, but I know it’s also important to maintain a diversified investment portfolio. Consequently, I decided to pursue limited exposure in the Utilities sector. I currently own Consolidated Edison (NYSE: ED ), and I have been closely monitoring Duke Energy (NYSE: DUK ) and Piedmont Natural Gas (NYSE: PNY ), both in my backyard (I live in South Carolina). Last week, I attended the World MoneyShow in Orlando, and I listened to Connecticut Water’s CEO Eric Thornburg explain his company’s business model. One of the primary attractions to his company’s business model (as he explained) is the powerful earnings platform. For example, take a look at the company’s more recent revenue history: (click to enlarge) Now compare the above-referenced income history with the earnings per share history: (click to enlarge) Perhaps the most impressive trend is the company’s dividend history – Connecticut Water has paid 234 consecutive quarterly dividends without interruption or reduction. Even more impressive than that, the company has increased its dividend payment for over 45 years in a row. (click to enlarge) Small Cap, Big Credit Rating Connecticut Water is a small-cap utility with a market cap of around $400 million. Here’s a snapshot of the company’s year-over-year trading history: (click to enlarge) As of January 2015, it is rated A by Standard & Poor’s, and as illustrated below, the company has a well-balanced debt-to-equity ratio (with no near-term debt maturities): (click to enlarge) The company has assets of around $646 million and debt of around $173 million. Here’s a snapshot of its balance sheet: (click to enlarge) Enterprise Value is around $534 million: (click to enlarge) I’m Turning on the Spigot Connecticut Water offers a compelling opportunity for investing in a conservative growth stock with a proven track record for executing accretive acquisitions. This selection is seemingly more conservative than most of the other stocks that I write about; however, I am targeting a regionally focused utility that offers diversification and scale. I was equally impressed with the management team (with an average of 25 years of utility experience), and especially the insight provided by the CEO at the World MoneyShow last week. He fielded several questions from the audience, and tactfully responded with well-articulated “sleep well at night” commentary. As evidenced by the F.A.S.T. Graph below, Connecticut Water’s historical earnings performance meets my criteria for quality: (click to enlarge) Now, let’s look at F.A.S.T. Graph’s forecasting chart (below). As you can see, the shares are trading at $36.14 (with a P/E multiple of 19.2x). Assuming a target of 21x P/E at year-end 2015, the shares could grow by ~14% (to $41.79), translating to an annualized total return of 18.75%. Of course, I have to remember that the potential for long-term share price appreciation is limited with utilities stocks. I much more confident in the dividend growth – a record that is unblemished due to the high-quality balance sheet and sound dividend payout ratio (of 59%). (click to enlarge) In closing, I know that utilities stocks tend to hold up better in falling markets, since investors are usually in less of a rush to sell their lower-risk investments when the broader environment curdles. Accordingly, remember that utilities are more risky than most asset classes within the bond market, but they are generally seen as being lower-risk compared to the overall stock market. There’s a reason utilities are on the Monopoly board… you can’t win the game by owning just real estate. The secret is to invest in a broad portfolio of dividend-paying stocks. Connecticut Water is sound utility selection that should provide me with very predictable dividend income, and by reinvesting all of the dividends, I expect to “sleep well at night”. (Remember: Connecticut Water is a small-cap stock, so investors should limit exposure). For more information on Connecticut Water’s DRIP program, click HERE . (click to enlarge) Forbes Real Estate Investor : For more information, check out my newsletter HERE . Sources : Yahoo Finance, F.A.ST. Graphs, and CTWS Investor Presentation. Disclaimer: This article is intended to provide information to interested parties. As I have no knowledge of individual investor circumstances, goals, and/or portfolio concentration or diversification, readers are expected to complete their own due diligence before purchasing any stocks mentioned or recommended. Disclosure: The author is long O, DLR, VTR, HTA, STAG, CSG, GPT, ROIC, HCN, OHI, LXP, KIM, WPC, DOC, UDF, EXR, MYCC, BX, TCO, ED, CTWS. (More…) The author wrote this article themselves, and it expresses their own opinions. The author is not receiving compensation for it (other than from Seeking Alpha). The author has no business relationship with any company whose stock is mentioned in this article. Scalper1 News

Summary Today I am going to stay on the Monopoly board and discuss a close cousin to REITs, Utilities. I see strong correlations to real estate and utilities – they both deliver essential services measured by a long runway for demand. There’s a reason utilities are on the Monopoly board… you can’t win the game by owning just real estate. Many of you know me as a real estate analyst, and while around 90% of my research is in the REIT sector, I occasionally drift outside of my circle of competence into other asset sectors. Today, I am going to stay on the Monopoly board, though, and discuss a close cousin to REITs, Utilities. You see, I need to diversify my holdings into other dividend-paying stocks, and while I’m attracted to the short and mid-term forecast for US real estate, I know it’s important not to hold all of my eggs in one basket. In addition, I see strong correlations to real estate and utilities – they both deliver essential services measured by a long runway for demand. Arguably, utilities are much more stable over the long term, as the asset class is generally consider to be the lowest-risk compared with the overall stock market. Don’t worry. I will continue my “day job” of analyzing REITs, but I wanted to write this article for two purposes: (1) I wanted to tell you about a stock I recently added to my portfolio; and (2) I wanted to provide you with the research on this selection. I recognize that the long-term capital appreciation is limited with my new stock selection; however, my reasons for the pick will be summarized below. All About Connecticut Water Connecticut Water Service, Inc. (NASDAQ: CTWS ) was founded in 1956, and is headquartered in Clinton, Connecticut. The company serves nearly 125,500 customers, which is around 400,000 people, in 56 towns in Connecticut and Maine. Around 93% of the company’s net income is attributable to regulated operations, and there are two subsidiaries: Connecticut Water Company and Maine Water Company. Around 90% of the company’s business is residential, and the business has over 2,100 miles of pipeline. Here’s a snapshot of the company’s geographic representation in Connecticut (around $297 million in revenue as of 9/30/14): Also, more recently, Connecticut Water has extended operations in Maine, where the company generated around $51 million in revenue (as of 9-30-14): Since 2012, Connecticut Water acquired around 32,000 new customers (36% growth) through investments in Aqua Maine and Biddeford & Saco Water Company. Over the last 25 years, the company has purchased 60 total water systems (40 of these over the last 7 years). The water market is highly fragmented, as the company estimates that there are over 800 separate water systems and 300 wastewater operations, making the Connecticut and Maine ripe markets for consolidation. An Incredibly Stable Dividend Alternative As I side, I focus on REITs, but I know it’s also important to maintain a diversified investment portfolio. Consequently, I decided to pursue limited exposure in the Utilities sector. I currently own Consolidated Edison (NYSE: ED ), and I have been closely monitoring Duke Energy (NYSE: DUK ) and Piedmont Natural Gas (NYSE: PNY ), both in my backyard (I live in South Carolina). Last week, I attended the World MoneyShow in Orlando, and I listened to Connecticut Water’s CEO Eric Thornburg explain his company’s business model. One of the primary attractions to his company’s business model (as he explained) is the powerful earnings platform. For example, take a look at the company’s more recent revenue history: (click to enlarge) Now compare the above-referenced income history with the earnings per share history: (click to enlarge) Perhaps the most impressive trend is the company’s dividend history – Connecticut Water has paid 234 consecutive quarterly dividends without interruption or reduction. Even more impressive than that, the company has increased its dividend payment for over 45 years in a row. (click to enlarge) Small Cap, Big Credit Rating Connecticut Water is a small-cap utility with a market cap of around $400 million. Here’s a snapshot of the company’s year-over-year trading history: (click to enlarge) As of January 2015, it is rated A by Standard & Poor’s, and as illustrated below, the company has a well-balanced debt-to-equity ratio (with no near-term debt maturities): (click to enlarge) The company has assets of around $646 million and debt of around $173 million. Here’s a snapshot of its balance sheet: (click to enlarge) Enterprise Value is around $534 million: (click to enlarge) I’m Turning on the Spigot Connecticut Water offers a compelling opportunity for investing in a conservative growth stock with a proven track record for executing accretive acquisitions. This selection is seemingly more conservative than most of the other stocks that I write about; however, I am targeting a regionally focused utility that offers diversification and scale. I was equally impressed with the management team (with an average of 25 years of utility experience), and especially the insight provided by the CEO at the World MoneyShow last week. He fielded several questions from the audience, and tactfully responded with well-articulated “sleep well at night” commentary. As evidenced by the F.A.S.T. Graph below, Connecticut Water’s historical earnings performance meets my criteria for quality: (click to enlarge) Now, let’s look at F.A.S.T. Graph’s forecasting chart (below). As you can see, the shares are trading at $36.14 (with a P/E multiple of 19.2x). Assuming a target of 21x P/E at year-end 2015, the shares could grow by ~14% (to $41.79), translating to an annualized total return of 18.75%. Of course, I have to remember that the potential for long-term share price appreciation is limited with utilities stocks. I much more confident in the dividend growth – a record that is unblemished due to the high-quality balance sheet and sound dividend payout ratio (of 59%). (click to enlarge) In closing, I know that utilities stocks tend to hold up better in falling markets, since investors are usually in less of a rush to sell their lower-risk investments when the broader environment curdles. Accordingly, remember that utilities are more risky than most asset classes within the bond market, but they are generally seen as being lower-risk compared to the overall stock market. There’s a reason utilities are on the Monopoly board… you can’t win the game by owning just real estate. The secret is to invest in a broad portfolio of dividend-paying stocks. Connecticut Water is sound utility selection that should provide me with very predictable dividend income, and by reinvesting all of the dividends, I expect to “sleep well at night”. (Remember: Connecticut Water is a small-cap stock, so investors should limit exposure). For more information on Connecticut Water’s DRIP program, click HERE . (click to enlarge) Forbes Real Estate Investor : For more information, check out my newsletter HERE . Sources : Yahoo Finance, F.A.ST. Graphs, and CTWS Investor Presentation. Disclaimer: This article is intended to provide information to interested parties. As I have no knowledge of individual investor circumstances, goals, and/or portfolio concentration or diversification, readers are expected to complete their own due diligence before purchasing any stocks mentioned or recommended. Disclosure: The author is long O, DLR, VTR, HTA, STAG, CSG, GPT, ROIC, HCN, OHI, LXP, KIM, WPC, DOC, UDF, EXR, MYCC, BX, TCO, ED, CTWS. (More…) The author wrote this article themselves, and it expresses their own opinions. The author is not receiving compensation for it (other than from Seeking Alpha). The author has no business relationship with any company whose stock is mentioned in this article. Scalper1 News

Scalper1 News